Pattern Trading

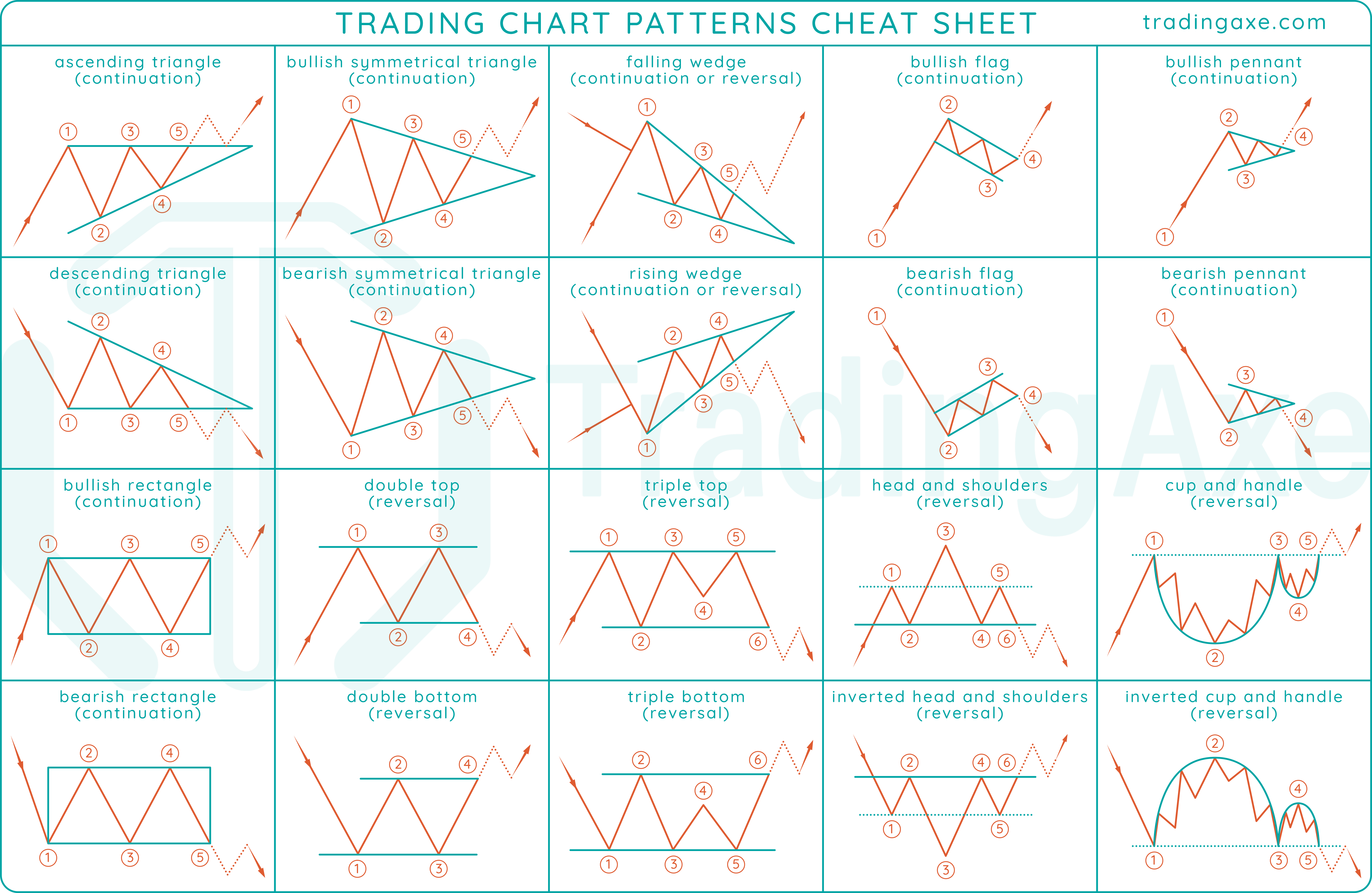

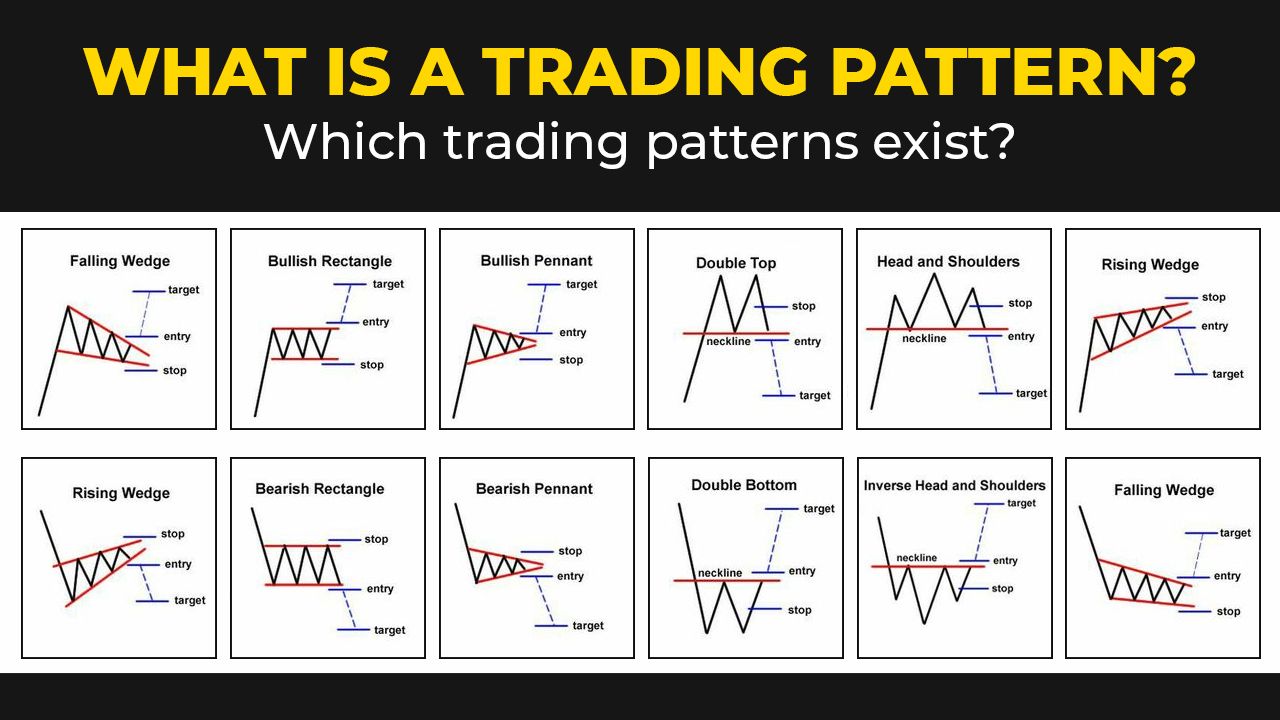

Pattern Trading - Web all types of traders typically use trading patterns to determine when to enter or exit a position, and by many opinions, chart analysis is among the most effective ways to trade financial instruments. Basically, you are using past market data to determine the next price movements. Web learn how to read stock charts and analyze trading chart patterns, including spotting trends, identifying support and resistance, and recognizing market reversals and breakout patterns. It consists of four distinct. They can be identified with the help of trend lines, horizontal lines, and curves. Now, of course, some basic chart patterns are easy to spot. Patterns are the distinctive formations created by the movements of security prices on a. There are dozens of different candlestick patterns with. Watch to learn about the pattern day trading rule, what constitutes a day trade, and how to comply with the rule. Patterns that form on stock charts signal what stocks can do next. Chart patterns form a key part of day trading. There are dozens of different candlestick patterns with. Web a chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past. Web cardano adausd, the 10th largest cryptocurrency by market value, has formed what is. Web a chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past. Web updated may 25, 2022. The patterns are identified using a series of trendlines or curves. Web using charts, technical analysts seek to identify price patterns and market trends in financial. Web the ai algorithms within the platform are trained to detect patterns, recognize market trends, and identify profitable trading opportunities. Chart patterns form a key part of day trading. There are dozens of different candlestick patterns with. Some patterns tell traders they should buy, while others tell them when to sell or hold. Candlestick and other charts produce frequent signals. Basically, you are using past market data to determine the next price movements. There are dozens of different candlestick patterns with. 542k views 2 years ago price action. Web stock trading patterns are important tools used by traders to predict future price movements based on historical price action and volume indicators. It is considered a continuation pattern, indicating that the. Patterns connect trends and are the building blocks of our price charts. Patterns such as ‘head and shoulders,’ ‘double top,’ and ‘triple bottom’ signal potential market reversals, while ‘bull flag,’ ‘bear flag,’ and ‘pennants’ indicate the continuation of current trends. Web the abcd pattern is a prominent technical analysis tool utilized by traders to identify potential price movements in financial. Web a chart pattern strategy is based on recognizable shapes on the price chart created by price movements. The revenues from asia and europe are expected to make up 33.4. The pattern day trading rule explained. Patterns are the distinctive formations created by the movements of security prices on a. Patterns such as ‘head and shoulders,’ ‘double top,’ and ‘triple. Patterns such as ‘head and shoulders,’ ‘double top,’ and ‘triple bottom’ signal potential market reversals, while ‘bull flag,’ ‘bear flag,’ and ‘pennants’ indicate the continuation of current trends. Now, of course, some basic chart patterns are easy to spot. Web zinger key points. Web smart trading starts with technical analysis — that means you must know how to read stock. Web what are chart patterns? Web stock trading patterns are important tools used by traders to predict future price movements based on historical price action and volume indicators. The pattern day trading rule explained. Chart patterns are the basis of technical analysis and require a trader to know exactly what they are looking at, as well as what they are. The revenues from asia and europe are expected to make up 33.4. The pattern day trading rule explained. There are dozens of different candlestick patterns with. Actively trading securities can be exciting, especially when markets are volatile. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Basically, you are using past market data to determine the next price movements. Web chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices, commodities, and cryptocurrency trading ). Chart patterns are the basis of technical analysis and require a trader to know exactly what. The revenues from asia. It consists of four distinct. Web the breakout pattern is a key trading signal in penny stocks, indicating a significant shift in market dynamics and potentially heralding a new trend. Web september 18, 2023 beginner. Web 11 chart patterns for trading. Web a chart pattern strategy is based on recognizable shapes on the price chart created by price movements. They can be identified with the help of trend lines, horizontal lines, and curves. What is it like to trade with schwab? Candlestick patterns are technical trading tools that have been used for centuries to predict price direction. Trader foresees economic data to be a major catalyst for the dogecoin price movement, expecting a $0.22 price target. Patterns such as ‘head and shoulders,’ ‘double top,’ and ‘triple bottom’ signal potential market reversals, while ‘bull flag,’ ‘bear flag,’ and ‘pennants’ indicate the continuation of current trends. Web the abcd pattern is a prominent technical analysis tool utilized by traders to identify potential price movements in financial markets. Web a chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past. Web what are chart patterns? Web using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns. Patterns that form on stock charts signal what stocks can do next. Web a pattern day trader (pdt) is a trader who executes four or more day trades within five business days using the same account.

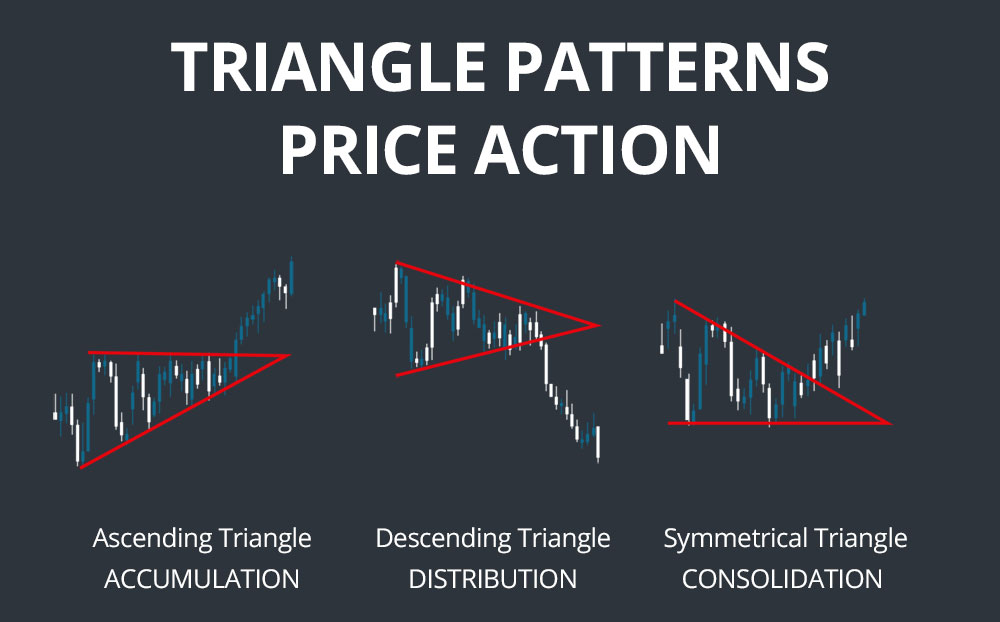

Triangle Chart Patterns Complete Guide for Day Traders

How to Trade Triangle Chart Patterns FX Access

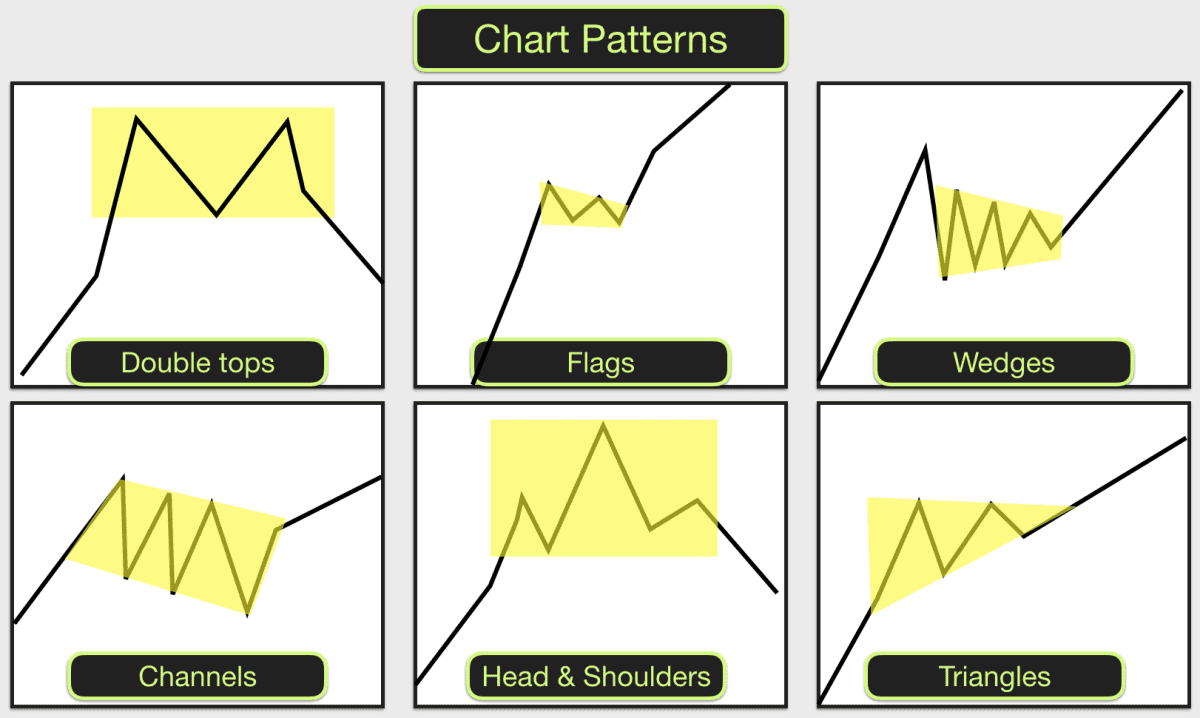

Chart patterns and how to trade them

Trading Chart Patterns Cheat Sheet TradingAxe

Printable Chart Patterns Cheat Sheet

WHAT IS A TRADING PATTERN? WHICH TRADING PATTERNS EXIST? Bikotrading

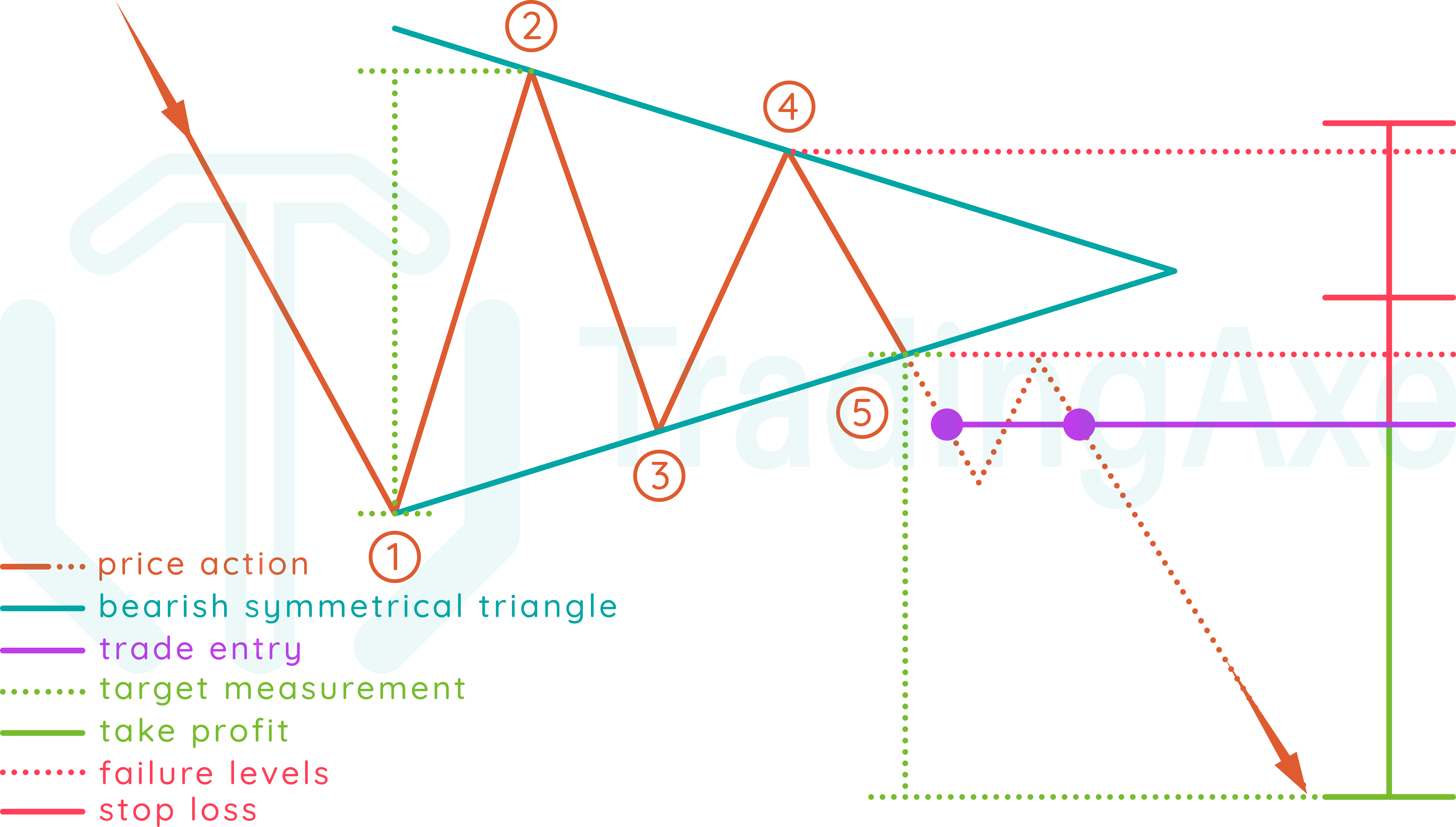

How To Trade Bearish Symmetrical Triangle Chart Pattern TradingAxe

Triangle Pattern Characteristics And How To Trade Effectively How To

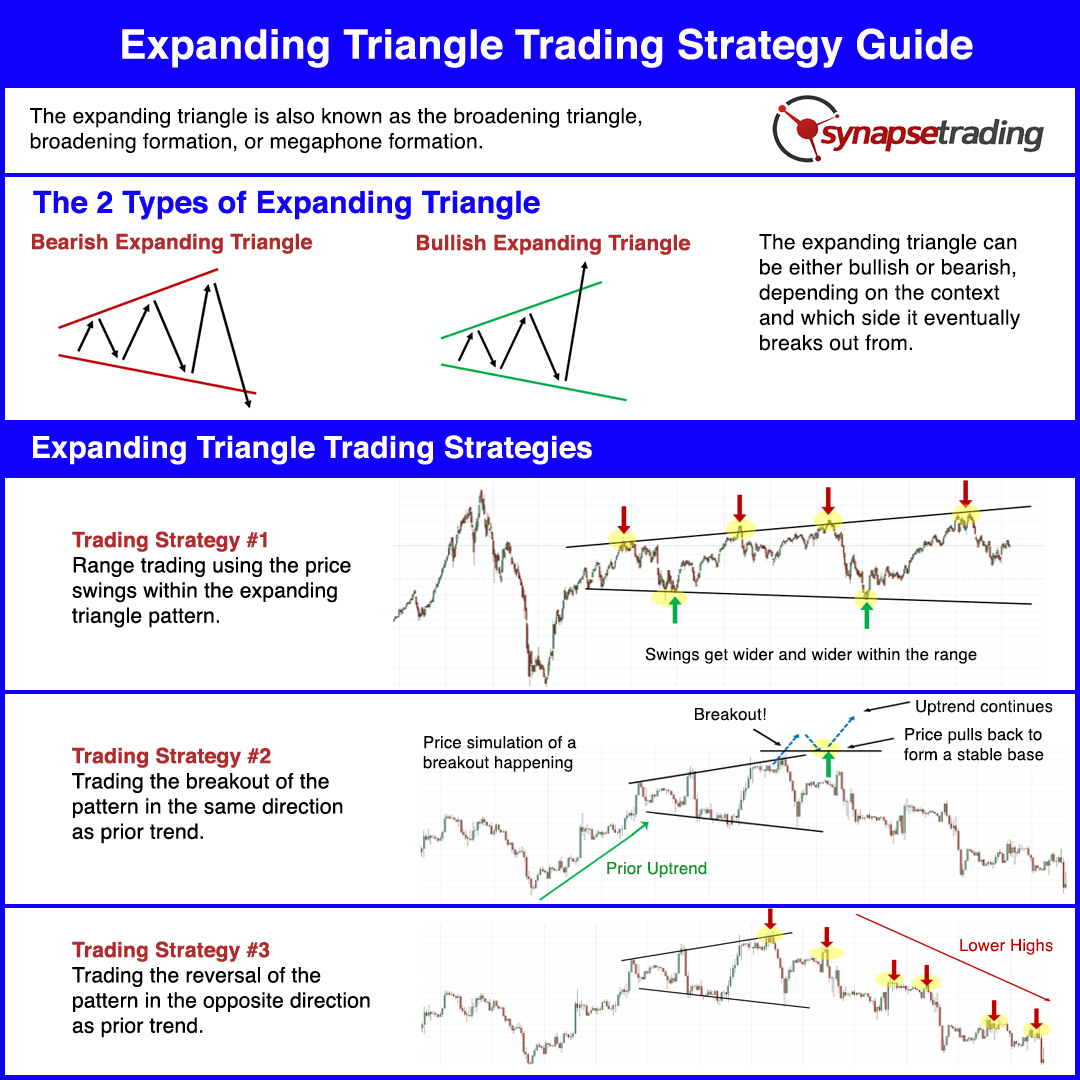

Expanding Triangle Pattern Trading Strategy Guide (Updated 2024

Rectangle Pattern Trading Strategy Guide Updated 2021 Riset

Patterns Are The Distinctive Formations Created By The Movements Of Security Prices On A.

Chart Patterns Form A Key Part Of Day Trading.

Web Updated May 25, 2022.

Web Stock Trading Patterns Are Important Tools Used By Traders To Predict Future Price Movements Based On Historical Price Action And Volume Indicators.

Related Post: