Pattern Stock

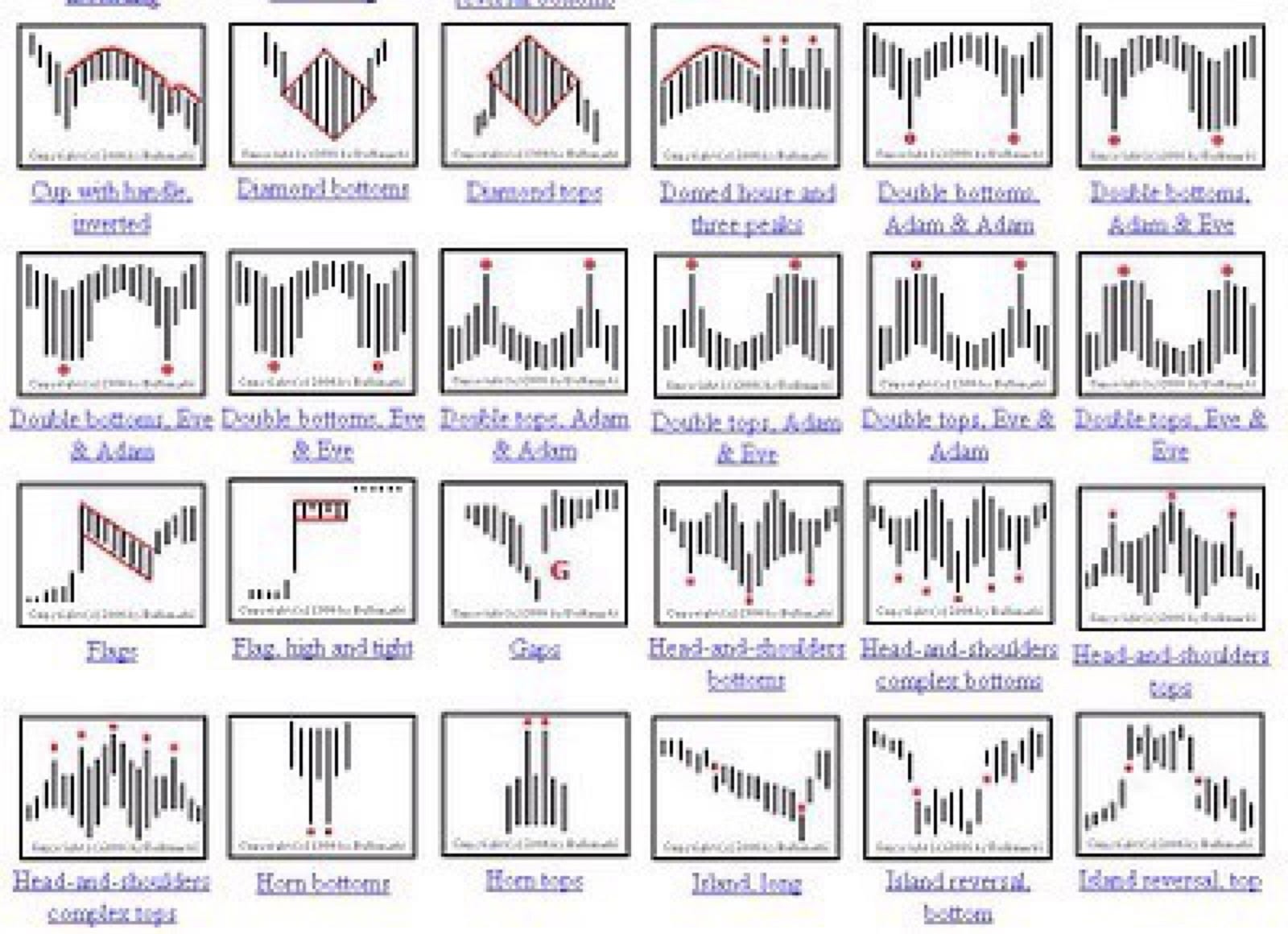

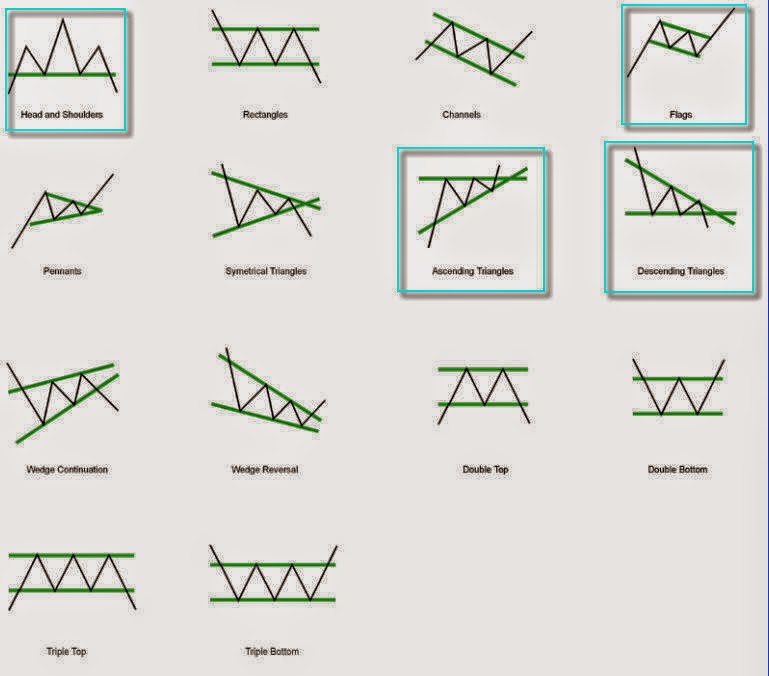

Pattern Stock - Web published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. Corn) should be on your list of agriculture etfs to buy. Web 12 reliable & profitable chart patterns. They are a fundamental technical analysis technique that helps traders use past price actions as a guide for potential future market movements. Trading by chart patterns is based on the premise that once a chart forms a pattern the short term. The patterns are identified using a series of trendlines or curves. Such reversals can often signal the beginning of a. 10 dependable stock chart patterns for technical analysis. There are tons of chart patterns. Web stock chart patterns are the next best thing. We believe it is one of the strongest leading indicators that also builds within it the best risk model available. Web published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. This development comes as mcdonald’s. We call these chart patterns and traders like you use. Web 12 reliable & profitable chart patterns. Why stock chart patterns are important If you can recognize patterns well enough, it can be like seeing the future. Web published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. Stocks do one of three things — trend. Understanding those patterns is an important part of becoming a successful trader. An inverse head and shoulders stock chart pattern has an 89% success rate for a reversal of an existing downtrend. There are tons of chart patterns. A $10,000 investment in paypal at its peak would now be worth about $2,080. There are several types of chart patterns such. Web chart patterns provide a visual representation of the battle between buyers and sellers so you see if a market is trending higher, lower, or moving sideways. Patterns such as ‘head and shoulders,’ ‘double top,’ and ‘triple bottom’ signal potential market reversals, while ‘bull flag,’ ‘bear flag,’ and ‘pennants’ indicate the continuation of current trends. Web 12 reliable & profitable. Web stock chart patterns are lines and shapes drawn onto price charts in order to help predict forthcoming price actions, such as breakouts and reversals. Whatever the stock’s doing, patterns form. Web what are stock chart patterns? Web the fed is in a holding pattern. Such reversals can often signal the beginning of a. Web what are stock chart patterns? Web this indicates a strong and consistent upward trend for the company's stock. This development comes as mcdonald’s. They are a fundamental technical analysis technique that helps traders use past price actions as a guide for potential future market movements. Chart patterns are unique formations within a price chart used by technical analysts in. Web stock chart patterns are lines and shapes drawn onto price charts in order to help predict forthcoming price actions, such as breakouts and reversals. Most can be divided into two broad categories—reversal and continuation patterns. Chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices, commodities, and cryptocurrency. The patterns are identified using a series of trendlines or curves. Web stock chart patterns are the next best thing. Technical analysts and chartists seek to identify patterns. The data can be intraday, daily, weekly or monthly and the patterns can be as short as one day or as long as many years. Stock chart patterns provide distinct signals on. The patterns are identified using a series of trendlines or curves. Stock chart patterns provide distinct signals on where the price of an asset may go in the future based on previous movements. We believe it is one of the strongest leading indicators that also builds within it the best risk model available. Web this indicates a strong and consistent. If you can recognize patterns well enough, it can be like seeing the future. Gaps and outside reversals may form in one trading session, while broadening tops and dormant bottoms may require many months to form. Web a pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period.. Web teucrium corn fund (corn) if you’re bullish on corn futures in particular due to el nino, then the teucrium corn fund (nysearca: What are stock chart patterns. Understanding those patterns is an important part of becoming a successful trader. Most can be divided into two broad categories—reversal and continuation patterns. A $10,000 investment in paypal at its peak would now be worth about $2,080. 10 dependable stock chart patterns for technical analysis. Chart patterns are unique formations within a price chart used by technical analysts in stock trading (as well as stock indices, commodities, and cryptocurrency trading ). Web chart pattern is a term of technical analysis used to analyze a stock's price action according to the shape its price chart creates. Stock chart patterns (or crypto chart patterns) help traders gain insight into potential price trends, whether up or down. Primary use of chart patterns. Web stock chart patterns are the next best thing. Knowing this can help you make your buy and sell decisions. Web what is a stock chart pattern? Web stock trading patterns are important tools used by traders to predict future price movements based on historical price action and volume indicators. There are tons of chart patterns. They are identifiable patterns in trading based on past price movements that produce trendlines revealing possible future moves.

Analyzing Stock Chart Patterns and What They Mean Stock chart

How to read candlestick patterns What every investor needs to know

Chart Patterns All Things Stocks Medium

Triangle Chart Patterns Complete Guide for Day Traders

![Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim](https://www.tradingsim.com/hubfs/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

13 Stock Chart Patterns That You Can’t Afford To

Triangle Chart Patterns Complete Guide for Day Traders

Understanding Stock chart Patterns Part II Sharetisfy

The 2 Best Chart Patterns For Trading Ehelpify Stock Market For Vrogue

.png)

Mastering Trading Our Ultimate Chart Patterns Cheat Sheet

Patterns Such As ‘Head And Shoulders,’ ‘Double Top,’ And ‘Triple Bottom’ Signal Potential Market Reversals, While ‘Bull Flag,’ ‘Bear Flag,’ And ‘Pennants’ Indicate The Continuation Of Current Trends.

Each Has A Proven Success Rate Of Over 85%, With An Average Gain Of 43%.

Whatever The Stock’s Doing, Patterns Form.

Patterns Help You Decode And Detect Current And Future Price Action As Well As What Levels Would Be Better For Lower Risk Entries And Risk Off Exits.

Related Post: