Pattern Day Trader Rule Cash Account

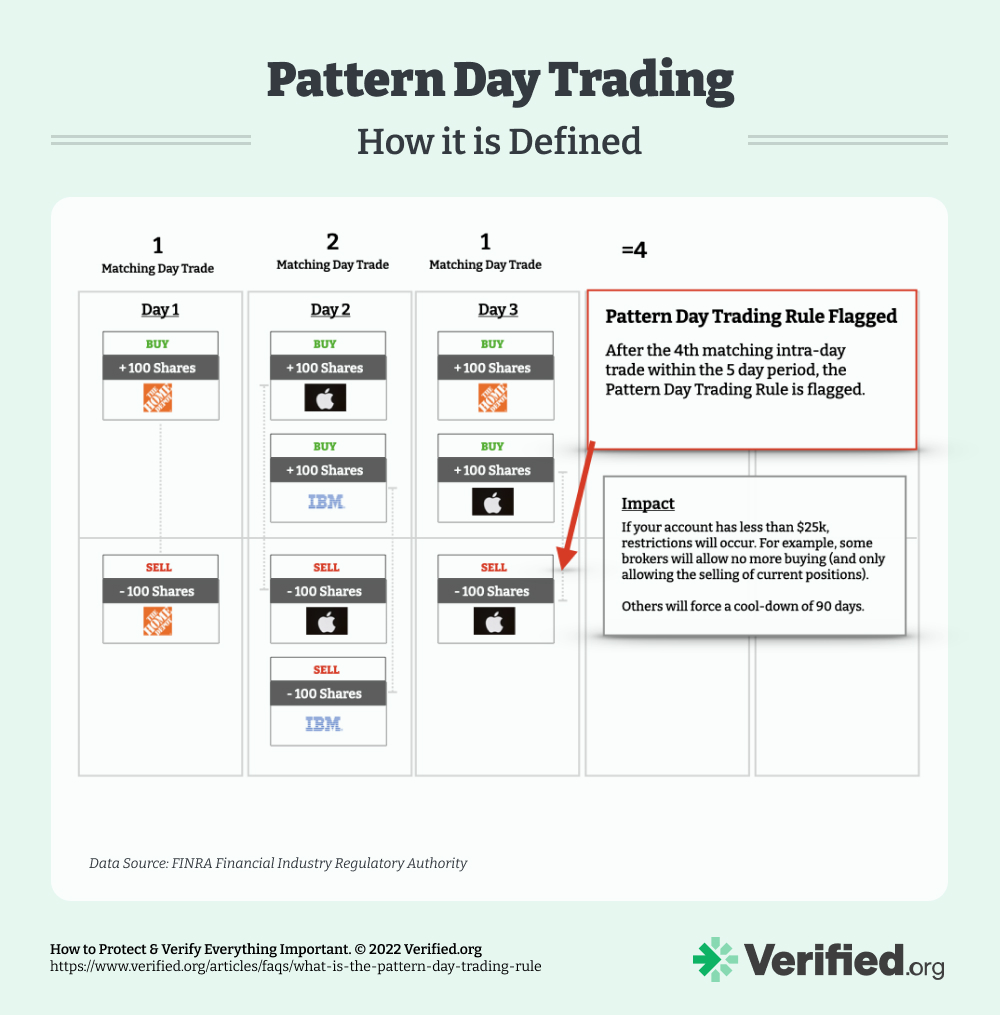

Pattern Day Trader Rule Cash Account - Web under the pdt rule, a day trade is the purchase and sale, or sale and purchase, of the same security in a margin account within a single trading day, sometimes called a round trip. Web 3 min read. So, what is a ‘pattern day trader (pdt)?’. Web the pattern trading rule mandates investors to maintain $25000 in their margin account for four business days. On one side, pdt helps beginners in minimizing their losses. Web the pattern day trader (pdt) rule applies to margin accounts and requires a minimum equity of $25,000 for those who execute four or more day trades within five business days. If your margin account has <25k in it you're gonna need to watch your day trade count. First of all, what is pdt… and the pdt rule? Three months must pass without a day trade for a person so classified to lose the restrictions imposed on them. Last updated 29 nov 2022. First of all, what is pdt… and the pdt rule? The required minimum equity must be in the account prior to any day trading activities. Having restrictions placed on your account because of pattern day trader rules aren’t ideal. If you make more than three day trades in five business days, provided the number of trades is more than 6%. Once you are designated as a pattern day trader, finra requires account holders to maintain at least $25,000 of equity in their account as of the close of every trading day. On the other hand, it limits their ability to perform trades. Forex & cfd tradingprecious metalsopen & transparentexceptional execution As a result, finra advises brokers and brokerage firms to. If your margin account has <25k in it you're gonna need to watch your day trade count. Web under the pdt rule, a day trade is the purchase and sale, or sale and purchase, of the same security in a margin account within a single trading day, sometimes called a round trip. Web switch to a cash account: Having restrictions. If your margin account has <25k in it you're gonna need to watch your day trade count. On one side, pdt helps beginners in minimizing their losses. Once you are designated as a pattern day trader, finra requires account holders to maintain at least $25,000 of equity in their account as of the close of every trading day. The required. On one side, pdt helps beginners in minimizing their losses. Once you are designated as a pattern day trader, finra requires account holders to maintain at least $25,000 of equity in their account as of the close of every trading day. The required minimum equity must be in the account prior to any day trading activities. Web 3 min read.. Yes but you'll still have the account flagged as finra requires pdt tracking for all brokerage accounts. If you make more than three day trades in five business days, provided the number of trades is more than 6% of total trades in your account during this period, you meet the. On one side, pdt helps beginners in minimizing their losses.. The required minimum equity must be in the account prior to any day trading activities. But if you’ve ever wondered ‘does the pdt rule apply to cash accounts?’ we can help with that. Web a pattern day trader's account must maintain a day trading minimum equity of $25,000 on any day on which day trading occurs. Web 3 min read.. Web the pattern day trader (pdt) rule applies to margin accounts and requires a minimum equity of $25,000 for those who execute four or more day trades within five business days. Web the main rule is that in order to engage in pattern day trading you must maintain an equity balance of at least $25,000 in a margin account. Web. If you want to be a more active trader, or occasionally do a little day trading, be sure to keep tabs on all the applicable limits. Yes but you'll still have the account flagged as finra requires pdt tracking for all brokerage accounts. Web the financial industry regulatory authority (finra) defines a pattern day trader as an investor who executes. Having restrictions placed on your account because of pattern day trader rules aren’t ideal. Web the pattern day trader (pdt) rule applies to margin accounts and requires a minimum equity of $25,000 for those who execute four or more day trades within five business days. Pattern day trader (pdt) is a regulatory designation from the financial industry regulatory authority (finra). However, this rule doesn’t apply to cash accounts, which is one reason some traders prefer them. So, what is a ‘pattern day trader (pdt)?’. Forex & cfd tradingprecious metalsopen & transparentexceptional execution Web a pattern day trader's account must maintain a day trading minimum equity of $25,000 on any day on which day trading occurs. If you make more than three day trades in five business days, provided the number of trades is more than 6% of total trades in your account during this period, you meet the. Web pattern day trading restrictions don’t apply to cash accounts, they only apply to margin accounts and ira limited margin accounts. Yes but you'll still have the account flagged as finra requires pdt tracking for all brokerage accounts. First of all, what is pdt… and the pdt rule? Three months must pass without a day trade for a person so classified to lose the restrictions imposed on them. But if you’ve ever wondered ‘does the pdt rule apply to cash accounts?’ we can help with that. Web the main rule is that in order to engage in pattern day trading you must maintain an equity balance of at least $25,000 in a margin account. Web switch to a cash account: If you want to be a more active trader, or occasionally do a little day trading, be sure to keep tabs on all the applicable limits. The required minimum equity must be in the account prior to any day trading activities. Web the financial industry regulatory authority (finra) defines a pattern day trader as an investor who executes four or more day trades within five business days. Web updated 1/11/2024 19 min read.

Pattern Day Trader Rule Definition and Explanation

:max_bytes(150000):strip_icc()/Patterndaytrader-1af2dcedc8fd4f0bac9a8194f300f26d.jpg)

Pattern Day Trader (PDT) Definition and How It Works

Understanding The Pattern Day Trader Rule YouTube

Pattern Day Trader Rule (PDT) Explained Trade Brigade

Pattern Day Trading Rule Day Trading Rule Under 25k

What is Pattern Day Trader Rule + Tips for Traders

How To Trade With The Pattern Day Trader (PDT) Rule Pure Power Picks

What is the Pattern Day Trading Rule (& Why it Matters)?

Pattern Day Trading Rule Explained Traderma

Cash Vs Margin Vs Intraday Pattern Day Trading Explained EZAS

Web The Pattern Day Trader (Pdt) Rule Applies To Margin Accounts And Requires A Minimum Equity Of $25,000 For Those Who Execute Four Or More Day Trades Within Five Business Days.

This Means You Can Trade Stocks, Etps, And Options In A Cash Account Without Worrying About Your Number Of Day Trades.

Having Restrictions Placed On Your Account Because Of Pattern Day Trader Rules Aren’t Ideal.

Pattern Day Trader (Pdt) Is A Regulatory Designation From The Financial Industry Regulatory Authority (Finra) Applied To Traders Who Execute Four Or More Day Trades Within Five Business Days In A Margin Account, Provided These Trades Exceed Six Percent Of Their Total Trading Activity In The Same Period.

Related Post: