Pattern Day Trader Cash Account

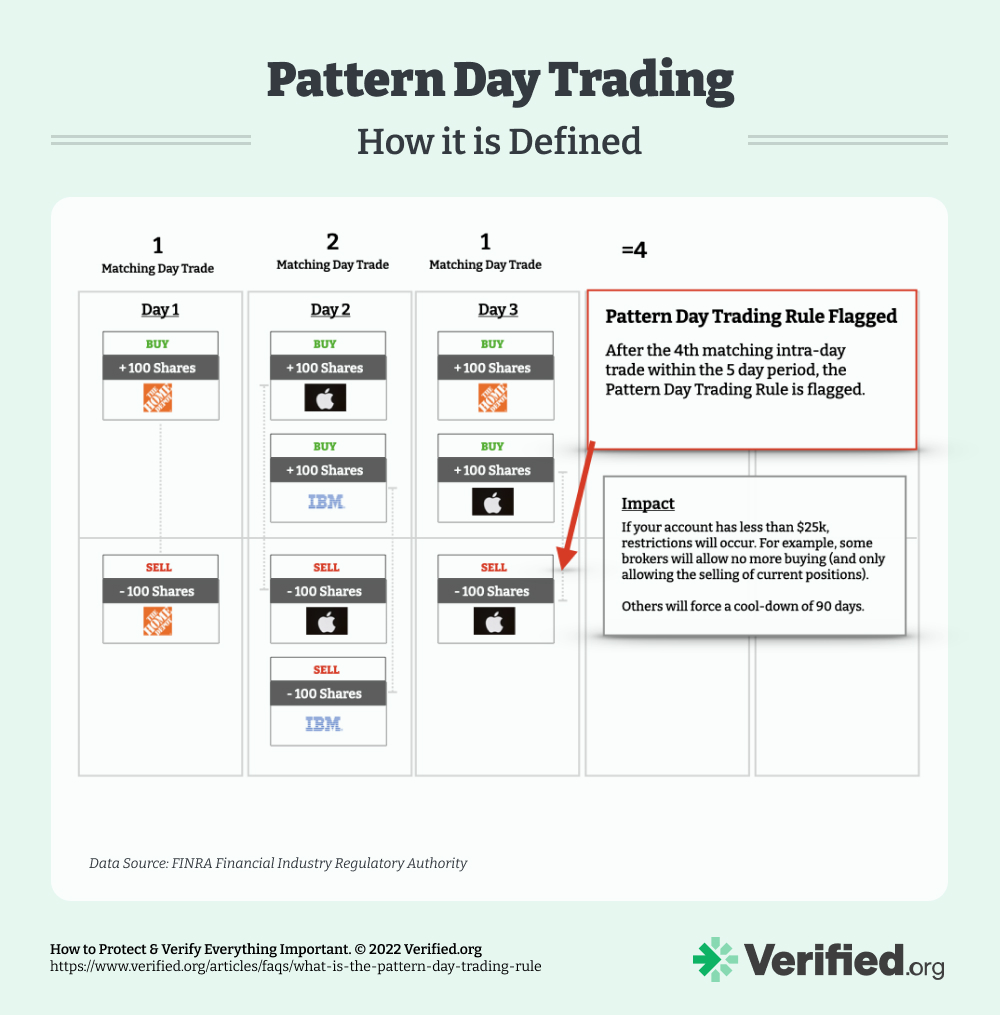

Pattern Day Trader Cash Account - In a cash account, traders can only trade with the funds available without using leverage. Live chatanalysis toolstrading platformwelcome bonus This means you can’t place any day trades until you. This required minimum equity, which. Web day trading in a cash account is the practice of buying and selling financial securities within the same trading day, using only the available cash in the account. Web pattern day trader accounts. What exactly is a day trade? Web a pattern day trader's account must maintain a day trading minimum equity of $25,000 on any day on which day trading occurs. Web finra rules define a pattern day trader as any customer who executes four or more “day trades” within five business days, provided that the number of day trades. Web cash vs margin account. Web day trading in a cash account is the practice of buying and selling financial securities within the same trading day, using only the available cash in the account. It seems like my brokerage a automatically converts your account to margin when you get approved for. Web pattern day trader accounts. What is the pattern day trader rule? Web cash. In a cash account, traders can only trade with the funds available without using leverage. Web pattern day trading rules only apply to margin accounts, right? Web cash vs margin account. It seems like my brokerage a automatically converts your account to margin when you get approved for. Web a pattern day trader designation requires a minimum margin equity plus. What exactly is a day trade? Web if you place your 4th day trade in the 5 trading day window, your investing account will be flagged for pattern day trading. Web finra rules define a pattern day trader as any customer who executes four or more “day trades” within five business days, provided that the number of day trades. Web. In a cash account, traders can only trade with the funds available without using leverage. Web day trading in a cash account is the practice of buying and selling financial securities within the same trading day, using only the available cash in the account. Web the financial industry regulatory authority (finra) defines a pattern day trader as an investor who. What is the pattern day trader rule? Web pattern day trading rules only apply to margin accounts, right? Rollover your 401(k)plan for your retirementlow cost providers It seems like my brokerage a automatically converts your account to margin when you get approved for. Web cash vs margin account. Web no, the pattern day trader rule does not apply to cash accounts. Web in the united states, a pattern day trader is a financial industry regulatory authority (finra) designation for a stock trader who executes four or more day trades in five. Web a pattern day trader designation requires a minimum margin equity plus cash in the amount $25,000. This required minimum equity, which. What exactly is a day trade? It seems like my brokerage a automatically converts your account to margin when you get approved for. How to avoid the pdt rule. Web cash vs margin account. What exactly is a day trade? Web cash vs margin account. Web a pattern day trader designation requires a minimum margin equity plus cash in the amount $25,000 at all times or the account will be issued a day trade minimum equity. Unlike margin accounts, which allow traders to borrow funds, cash accounts limit traders to the. Web if you. Web pattern day traders must maintain minimum equity of $25,000 in their margin account on any day that the customer day trades. Web pattern day trader accounts. How to avoid the pdt rule. Unlike margin accounts, which allow traders to borrow funds, cash accounts limit traders to the. Web a pattern day trader designation requires a minimum margin equity plus. Unlike margin accounts, which allow traders to borrow funds, cash accounts limit traders to the. A day trade is what happens when you. What is the pattern day trader rule? Web day trading in a cash account is the practice of buying and selling financial securities within the same trading day, using only the available cash in the account. Rollover. This required minimum equity, which. Web there are a few simple but strict rules that define pattern day trading. In a cash account, traders can only trade with the funds available without using leverage. Web pattern day traders must maintain minimum equity of $25,000 in their margin account on any day that the customer day trades. It seems like my brokerage a automatically converts your account to margin when you get approved for. Web pattern day trading rules only apply to margin accounts, right? Web if you place your 4th day trade in the 5 trading day window, your investing account will be flagged for pattern day trading. What exactly is a day trade? What is the pattern day trader rule? Rollover your 401(k)plan for your retirementlow cost providers Web day trading in a cash account is the practice of buying and selling financial securities within the same trading day, using only the available cash in the account. Web pattern day trader accounts. Web finra rules define a pattern day trader as any customer who executes four or more “day trades” within five business days, provided that the number of day trades. Web no, the pattern day trader rule does not apply to cash accounts. This means you can’t place any day trades until you. Web a pattern day trader designation requires a minimum margin equity plus cash in the amount $25,000 at all times or the account will be issued a day trade minimum equity.

How To Trade With The Pattern Day Trader (PDT) Rule Pure Power Picks

What is Pattern Day Trader Rule + Tips for Traders

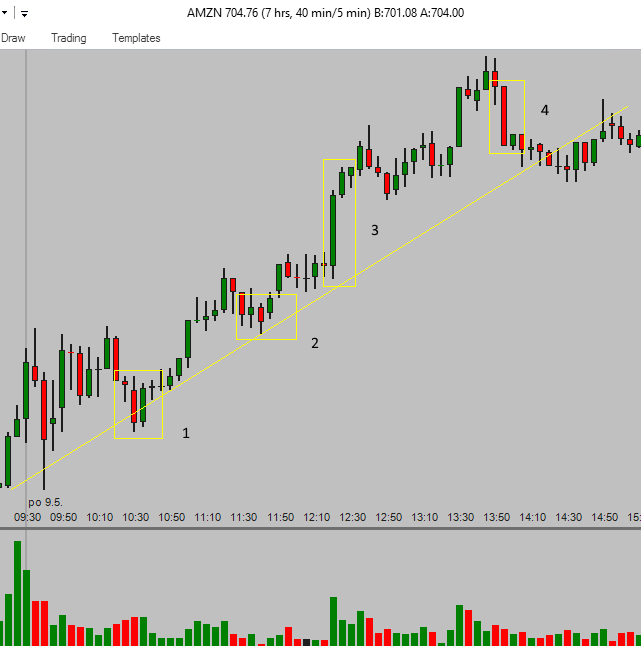

Chart pattern for day trader and with it forex broker spreads compare

:max_bytes(150000):strip_icc()/Patterndaytrader-1af2dcedc8fd4f0bac9a8194f300f26d.jpg)

Pattern Day Trader (PDT) Definition and How It Works

Margin Account vs Cash Account What's Best for You? Warrior Trading

11 Most Important Tips • Pattern Day Trader Rule Workaround • 2022

Pattern Day Trading Rule Explained Traderma

11 Most Important Tips • Pattern Day Trader Rule Workaround • 2022

Pattern Day Trader Rule Definition and Explanation

What is the Pattern Day Trading Rule (& Why it Matters)?

A Day Trade Is What Happens When You.

Web Cash Vs Margin Account.

Web In The United States, A Pattern Day Trader Is A Financial Industry Regulatory Authority (Finra) Designation For A Stock Trader Who Executes Four Or More Day Trades In Five.

Unlike Margin Accounts, Which Allow Traders To Borrow Funds, Cash Accounts Limit Traders To The.

Related Post: