Pattern Bat

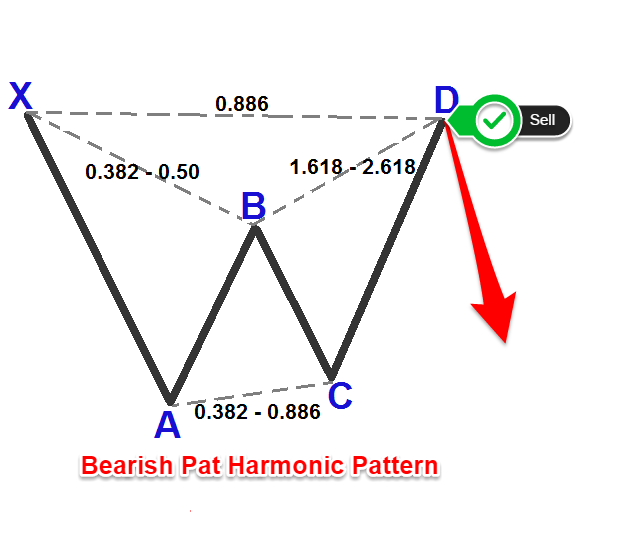

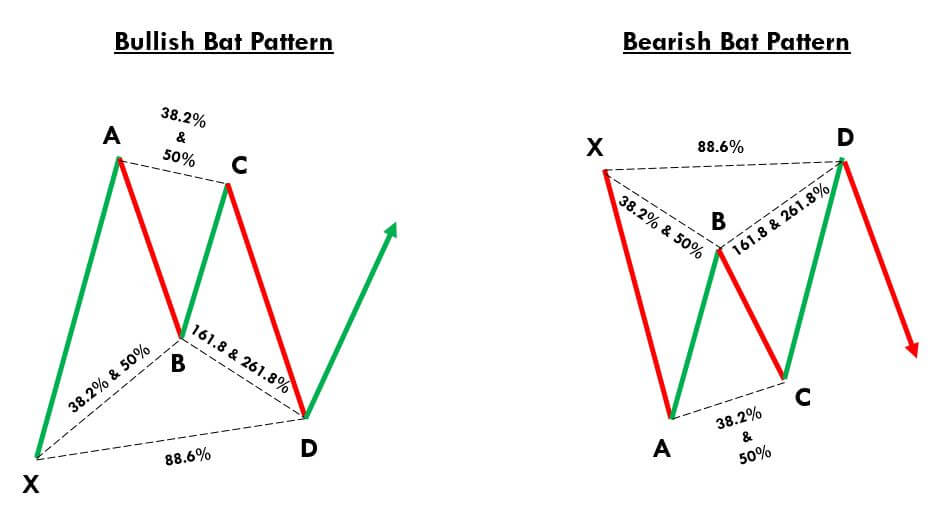

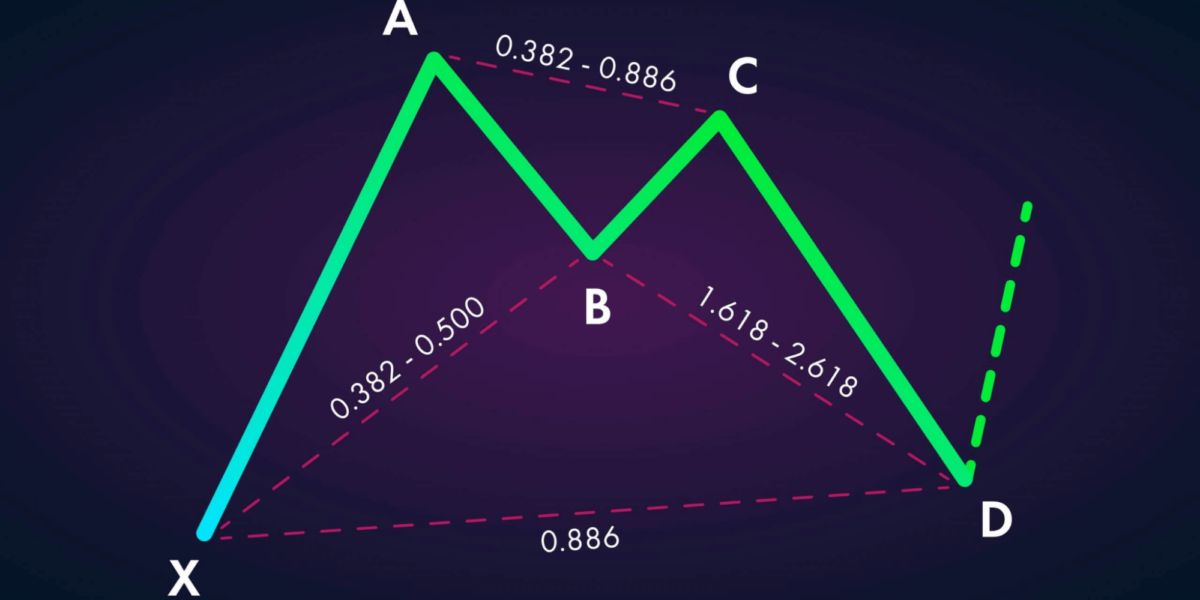

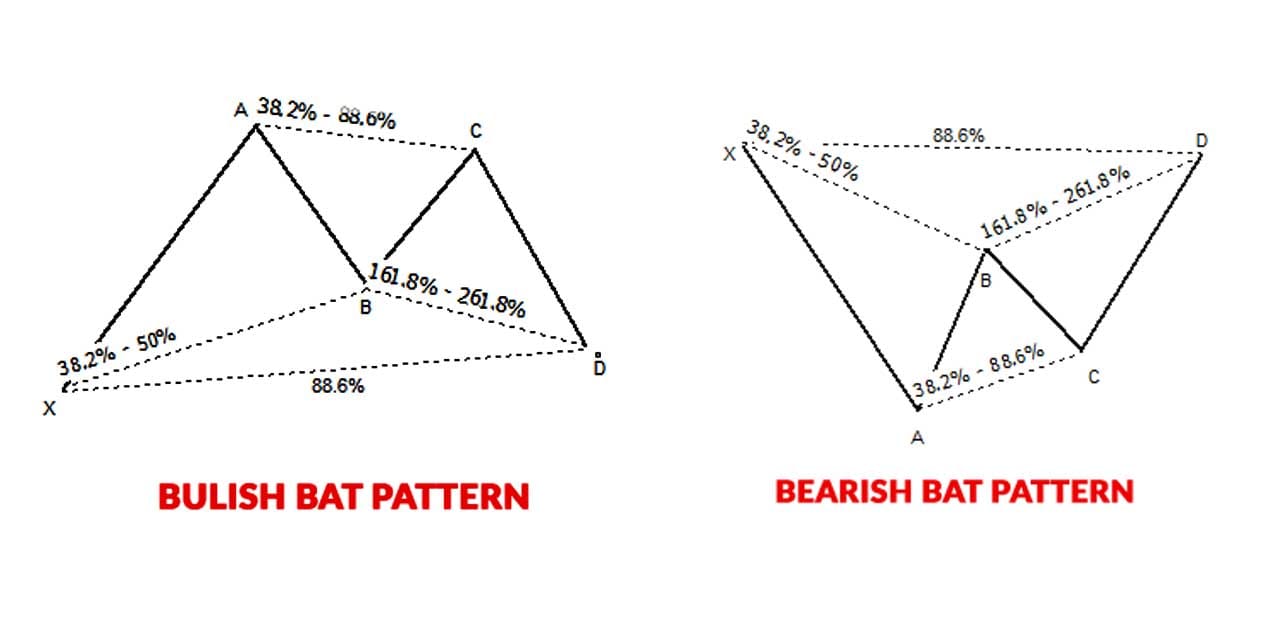

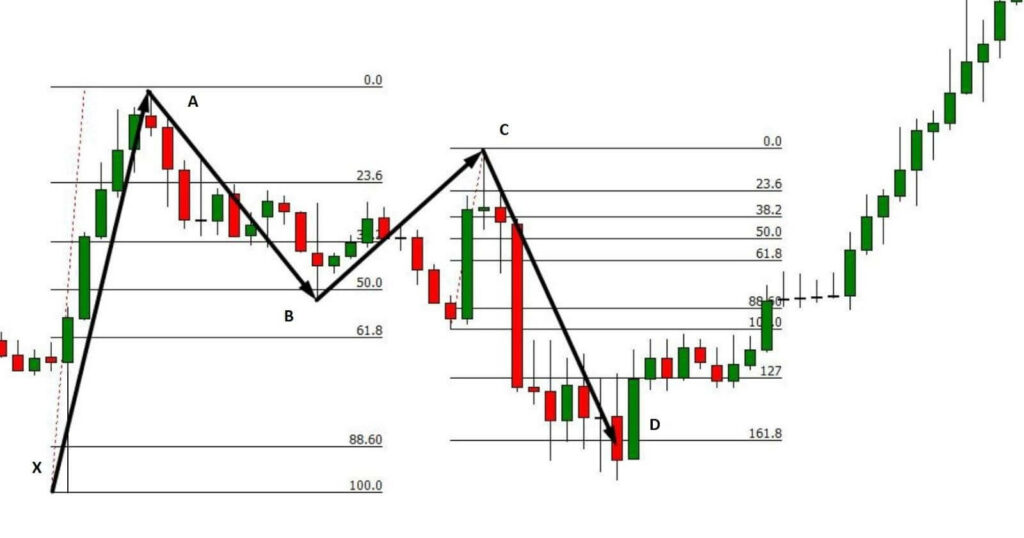

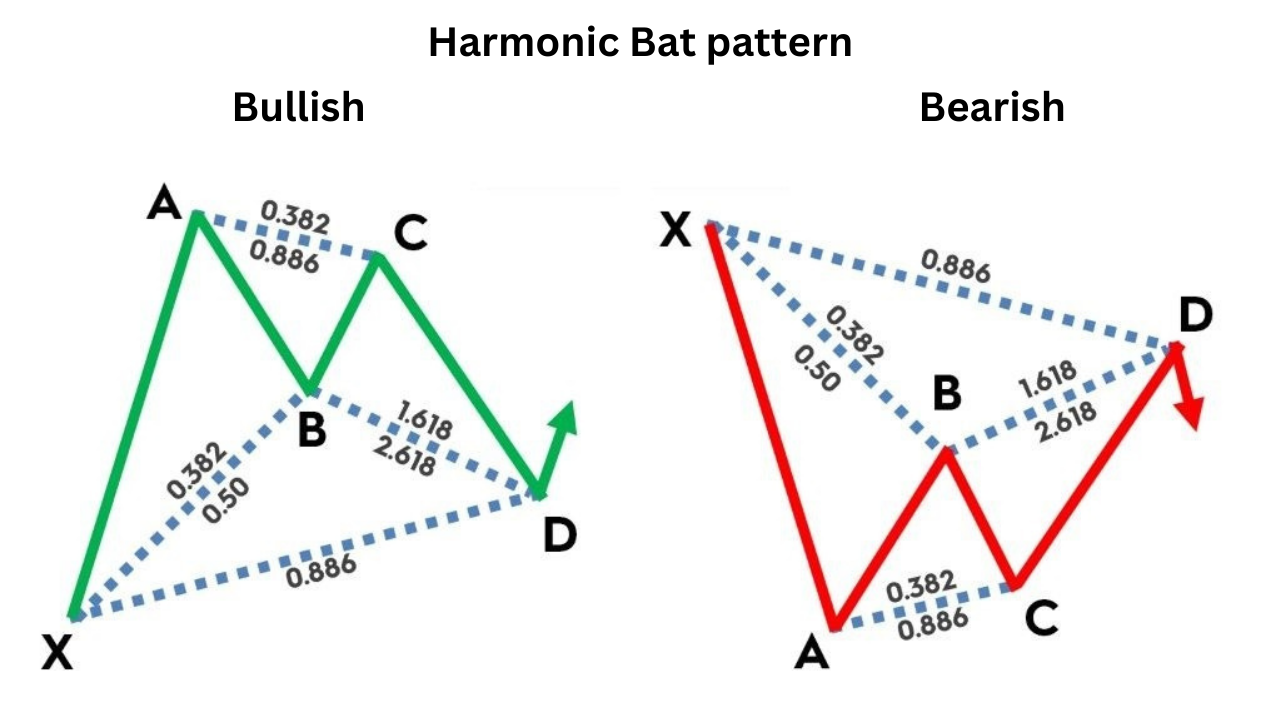

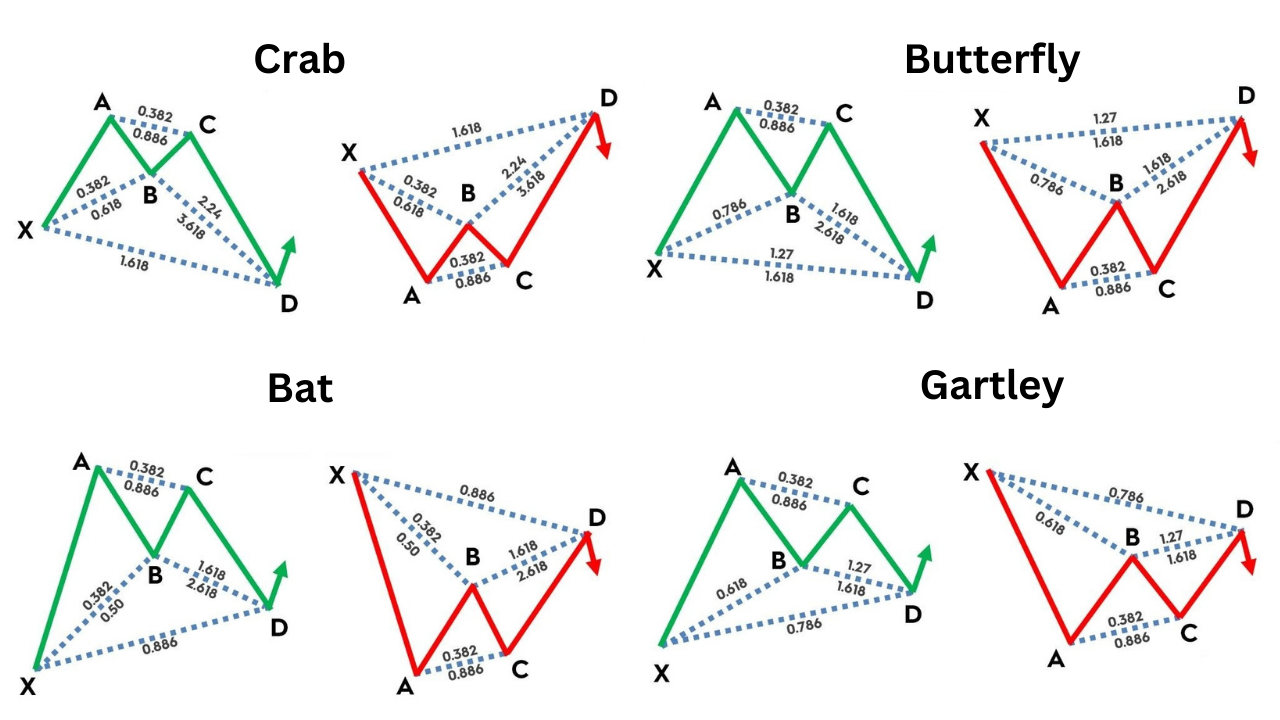

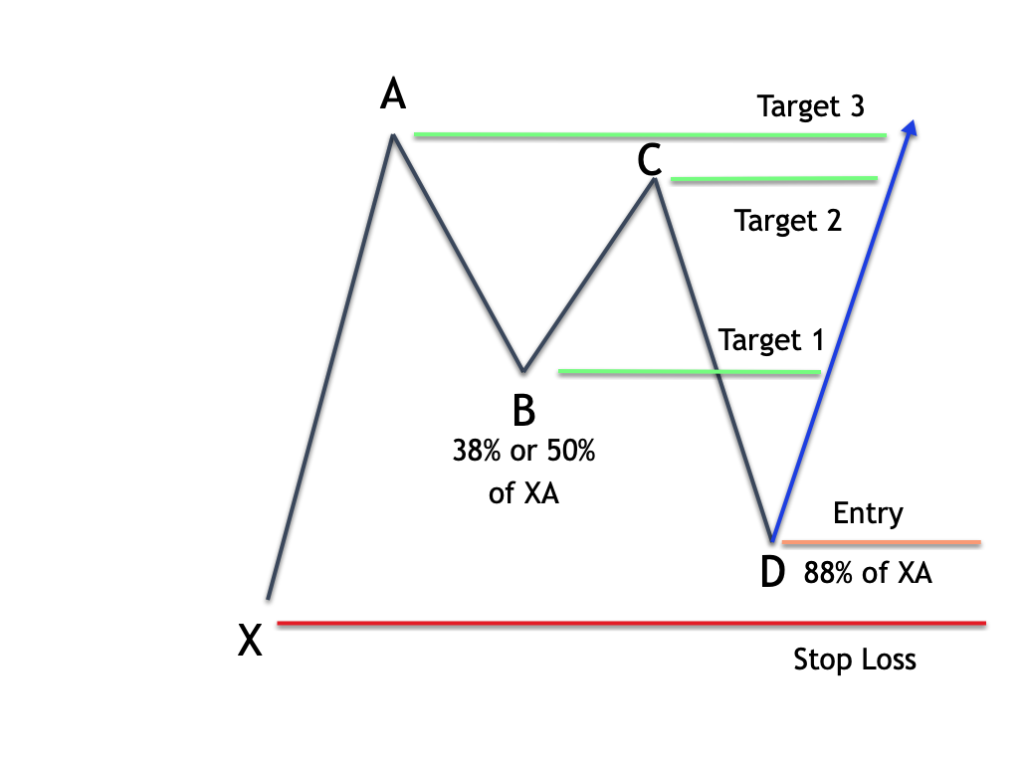

Pattern Bat - B point at a less than a 0.618 retracement of xa, preferably a distinct 50% or 38.2% retracement. The bat harmonic pattern follows different fibonacci ratios. And, in a bearish bat, c can retrace. For a valid bat, b should retrace between 38% and 50% of the first move from x to a. Scott carney, who first recognized the bat pattern, suggests that a 50% retracement at b is the best signal. Web the harmonic bat pattern teaches traders how to trade the bat pattern and begin earning money with a new exciting approach to technical analysis. Free crochet bat amigurumi pattern. The bat pattern is a retracement and continuation pattern that occurs when a trend temporarily reverses its direction but then. The next thing for the bat pattern to be satisfied is the fibonacci retracement of at least 0.382 and a maximum of 0.50. It is the first leg drawn from the first swing's low to the second swing's high and vice versa. The ab wave is a 38.2% or 50.0% retracement of the xa wave. The criteria for identifying the bat pattern are as follows: Web the bat pattern™, is a precise harmonic pattern™ discovered by scott carney in 2001. The bat pattern is a retracement and continuation pattern that occurs when a trend temporarily reverses its direction but then. Let’s have. The disadvantages of using harmonic bat patterns. It is the first leg drawn from the first swing's low to the second swing's high and vice versa. The figure above shows a nice reaction after prices reached 88.6%. Unless fibonacci retracement and extension levels are met. Identified by scott carney in 2001, the bat pattern is made up of precise elements. •d point need to be in the rage of bc projection. The b point retracement must be less than a 0.618, preferably a 0.50 or 0.382 of the xa leg. The market strategy of the pattern is part of the harmonic trading patterns system of trading. However, the ab leg should never go below the 0.618 level. Web the bat. Web the bat pattern, is a precise harmonic pattern discovered by scott carney in 2001 the pattern incorporates the 0.886xa retracement, as the defining element in the potential reversal zone (prz). And, in a bearish bat, c can retrace. The bat pattern is a retracement and continuation pattern that occurs when a trend temporarily reverses its direction but then. Web. Let’s have a look at the parameters of a bat pattern: Developed by scott carney in 2001, the bat is considered one of the most accurate harmonic patterns by some traders. As the bat shape denotes, the pattern needs to retrace the ab leg and go. Web bat patterns also offer another advantage in that there is tighter stop loss. Developed by scott carney in 2001, the bat is considered one of the most accurate harmonic patterns by some traders. The xa wave is a normal price swing in the upward or downward direction. Typically, the best structures employ a 50 percent retracement at the midpoint. The ab wave is a 38.2% or 50.0% retracement of the xa wave. He. Web the harmonic bat pattern teaches traders how to trade the bat pattern and begin earning money with a new exciting approach to technical analysis. However, the ab leg should never go below the 0.618 level. The bat harmonic pattern follows different fibonacci ratios. Web a proper bat pattern needs to fulfill the below criteria. Web bat pattern rules are: However, the ab leg should never go below the 0.618 level. The disadvantages of using harmonic bat patterns. It has specific fibonacci measurements for each point within its structure and it is important to note that d is not a point, but rather a zone in which price is likely to reverse, called the potential reversal zone (prz). The criteria. And bc projection must be at least 1.618 and maximum 2.618. Web the bat pattern is a variation of the harmonic pattern gartley pattern. Typically, the best structures employ a 50 percent retracement at the midpoint. Developed by scott carney in 2001, the bat is considered one of the most accurate harmonic patterns by some traders. The bc wave can. In its bullish version, the first leg appears when the price sharply increases from point x to point a. 0.382 or 0.50 fibonacci retracement of the xa length, c: The figure above shows a nice reaction after prices reached 88.6%. The bat utilizes a minimum 1.618bc projection. The key difference between the bat harmonic pattern and other harmonic patterns is. B point at a less than a 0.618 retracement of xa, preferably a distinct 50% or 38.2% retracement. The bc wave can be either a 38.2% or 88.6% retracement of the ab wave. However, the ab leg should never go below the 0.618 level. Unless fibonacci retracement and extension levels are met. Developed by scott carney in 2001, the bat is considered one of the most accurate harmonic patterns by some traders. 0.382 or 0.50 fibonacci retracement of the xa length, c: He wrote about the pattern in his series of books, entitled harmonic trading. Web the bat pattern requires some very specific rules that be followed strictly to be considered valid. One of the key ways to differentiate a bat structure from a cypher pattern is the b point which, if it doesn’t go beyond the 50% fibonacci retracement of the xa leg then it’s a bat, otherwise it can turn into a cypher structure. In a bullish bat, c can retrace up to 88% of ab, but it shouldn’t break higher than point a. The pattern incorporates the 0.886xa retracement, as the defining element in the potential reversal zone (prz). Just as it is with many harmonic patterns, there is a bullish and a bearish version of the bat pattern. It has specific fibonacci measurements for each point within its structure and it is important to note that d is not a point, but rather a zone in which price is likely to reverse, called the potential reversal zone (prz). The bat utilizes a minimum 1.618bc projection. It was discovered by scott carney in 2001 and is one of the four most common and popular harmonic chart patterns. The ab wave is a 38.2% or 50.0% retracement of the xa wave.

How to Trad The Harmonic Bat Pattern Forex Chart Strategy Forex Pops

Harmonic Chart Bat Pattern Forex Strategy Indicator Mt4 Trading Charts

Bat Pattern in Forex Trading A Complete Guide • FX Tech Lab

Harmonic Pattern Bat How To Trade The Bat Pattern

How to Trade the Bat Harmonic Pattern (Trading Strategy)

Bat Pattern Bat Harmonic Pattern Trading Strategy Bat Harmonic

Bat Pattern in Forex Trading A Complete Guide • FX Tech Lab

How to Trade with the Harmonic Bat Pattern Market Pulse

How to Trade with the Harmonic Bat Pattern Market Pulse

Tips For Trading The Harmonic Bat Pattern Forex Training Group

Web Bat Pattern Rules Are:

•D Point Need To Be In The Rage Of Bc Projection.

In Its Bullish Version, The First Leg Appears When The Price Sharply Increases From Point X To Point A.

Web The Bullish Bat Pattern Is Similar To The Cypher Harmonic Pattern But It Follows Different Fibonacci Ratios.

Related Post: