On Neck Breakout Candlestick Pattern

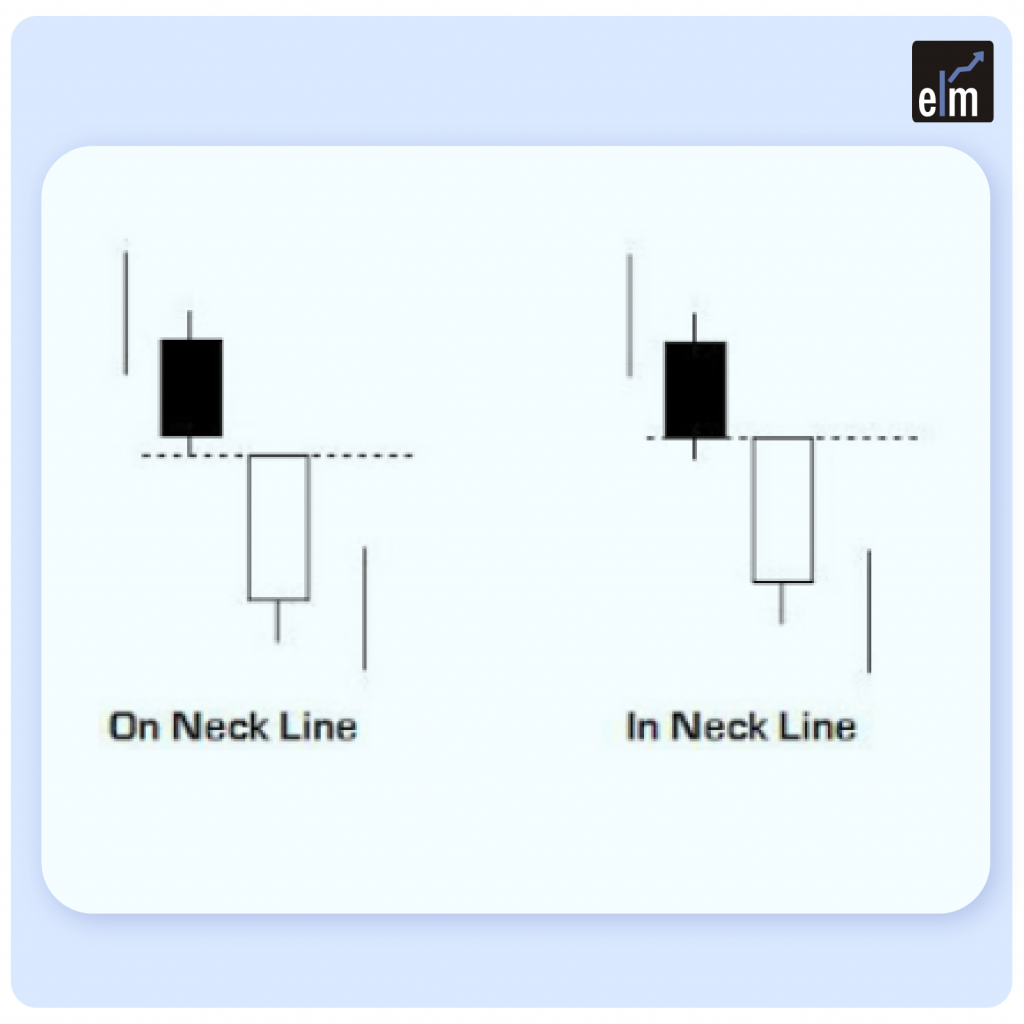

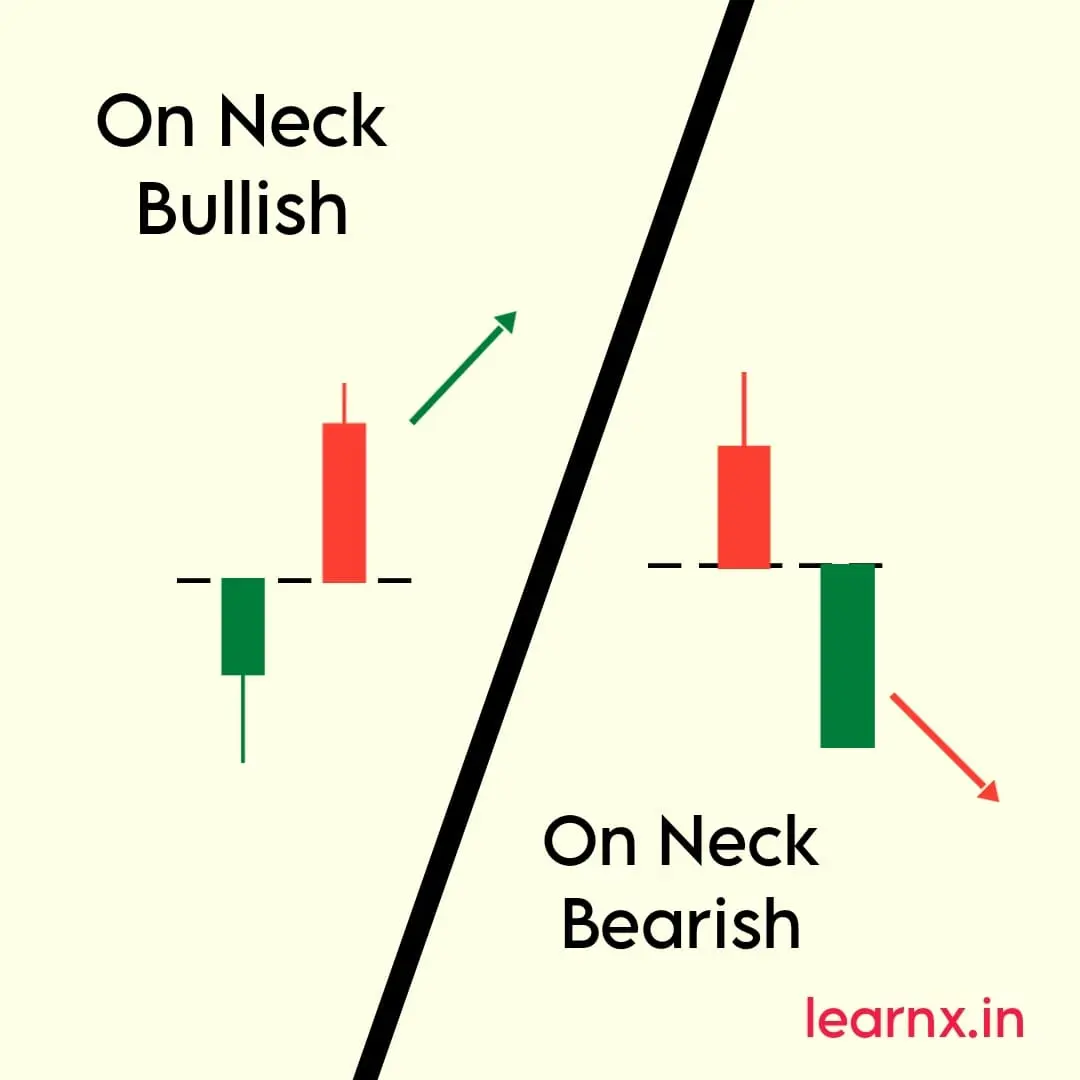

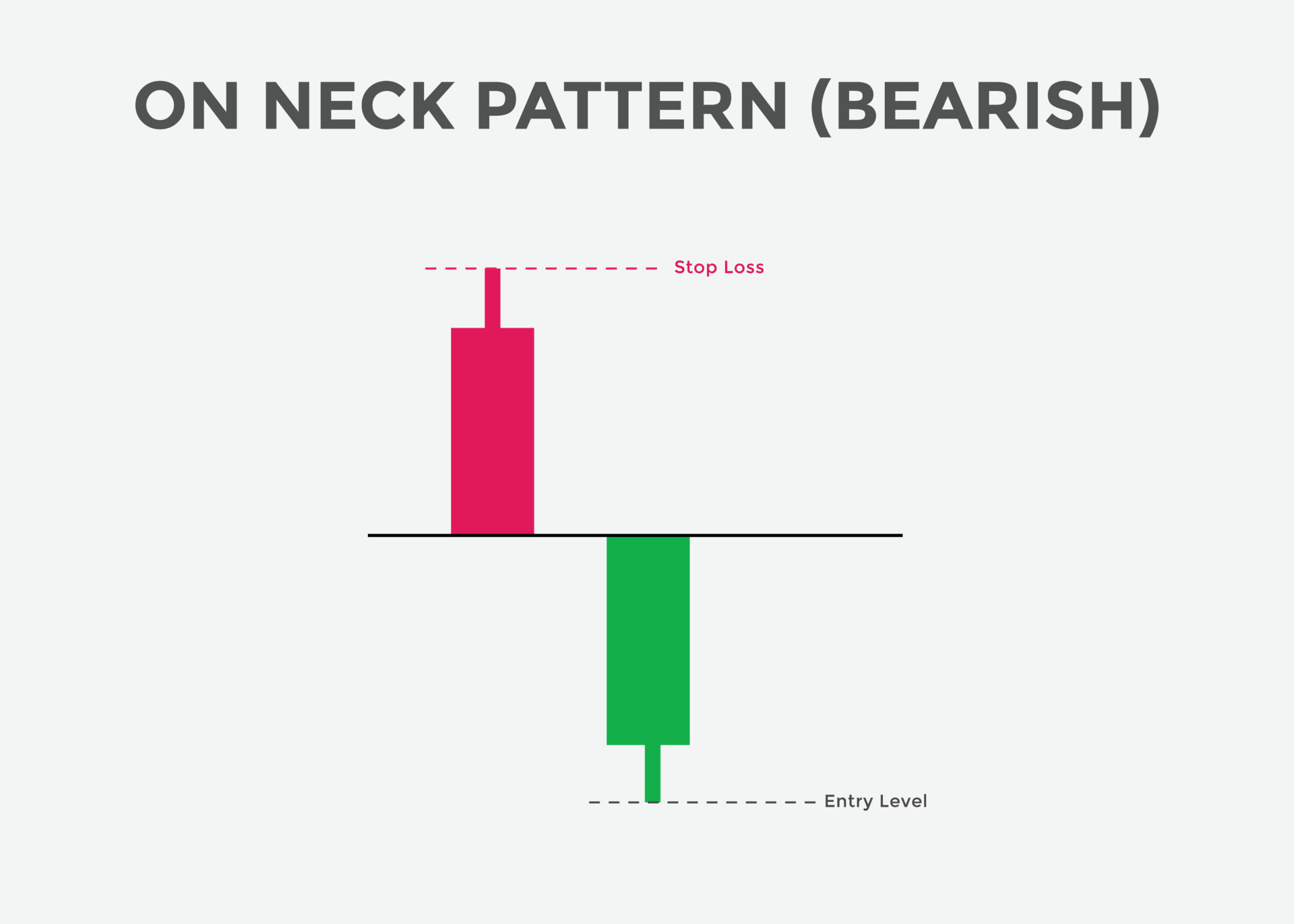

On Neck Breakout Candlestick Pattern - Web daily on necklie pattern. Web studying the on neck candlestick pattern shows its detailed importance in technical trading, giving traders a way to understand if downtrends will keep going. Consolidation pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap,. Scanner guide scan examples feedback. In downtrend, it consists of a black candlestick followed by. Web the on neck candlestick pattern is a two line candle with a downward price trend leading to it. The on neck pattern occurs when a long real bodied down candle is followed by a smaller real bodied up candle that gapsdown on the open but then closes near the prior candle's close. In an on neck pattern, the first candle is bearish and the second one is bullish. Web the on neck candlestick pattern is a bearish continuation pattern found in financial markets, typically observed on a candlestick chart. Reversal rate, frequency, and overall performance),. Scanner guide scan examples feedback. Web the on neck candlestick pattern is a two line candle with a downward price trend leading to it. Reversal rate, frequency, and overall performance),. Web candlestick patterns are graphic representations of the actions between supply and demand in the prices of shares or commodities. In an on neck pattern, the first candle is bearish. Web the on neck candlestick pattern is a bearish continuation pattern found in financial markets, typically observed on a candlestick chart. This pattern is based on the fact of impulsive and retracement. Web breakout candlestick patterns occur when the price of a security moves beyond a specific resistance or support level with increased volume. The on neck pattern occurs when a. Web candlestick patterns are graphic representations of the actions between supply and demand in the prices of shares or commodities. Web daily on necklie pattern. Web studying the on neck candlestick pattern shows its detailed importance in technical trading, giving traders a way to understand if downtrends will keep going. In downtrend, it consists of a black candlestick followed by.. Reversal rate, frequency, and overall performance),. The on neck pattern occurs when a long real bodied down candle is followed by a smaller real bodied up candle that gapsdown on the open but then closes near the prior candle's close. A tall black candle is the first to appear followed by a white candle. Web breakout candlestick patterns occur when the. The pattern is called a neckline because the two closing prices are the same (or almost the same) across the two candles,. In downtrend, it consists of a black candlestick followed by. Web the on neck pattern occurs after a downtrend when a long real bodied bearish candle is followed by a smaller real bodied bullish candle which gaps down. In an on neck pattern, the first candle is bearish and the second one is bullish. This pattern is based on the fact of impulsive and retracement. Web the on neck candlestick is a continuation pattern that is also bearish. Web the on neck pattern occurs after a downtrend when a long real bodied bearish candle is followed by a. Scanner guide scan examples feedback. Web candlestick patterns are graphic representations of the actions between supply and demand in the prices of shares or commodities. Web the on neck candlestick is a continuation pattern that is also bearish. Web daily on necklie pattern. In an on neck pattern, the first candle is bearish and the second one is bullish. Web studying the on neck candlestick pattern shows its detailed importance in technical trading, giving traders a way to understand if downtrends will keep going. Web candlestick patterns are graphic representations of the actions between supply and demand in the prices of shares or commodities. In an on neck pattern, the first candle is bearish and the second one is. The pattern is called a neckline because the two closing prices are the same (or almost the same) across the two candles,. Web the on neck candlestick pattern is a bearish continuation pattern found in financial markets, typically observed on a candlestick chart. Web the on neck candlestick pattern is a two line candle with a downward price trend leading. A tall black candle is the first to appear followed by a white candle. The pattern is called a neckline because the two closing prices are the same (or almost the same) across the two candles,. Consolidation pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap,. This pattern is. Web breakout candlestick patterns occur when the price of a security moves beyond a specific resistance or support level with increased volume. A tall black candle is the first to appear followed by a white candle. Reversal rate, frequency, and overall performance),. Web the on neck candlestick is a continuation pattern that is also bearish. The pattern is called a neckline because the two closing prices are the same (or almost the same) across the two candles,. This pattern consists of two. Web the on neck candlestick pattern is a two line candle with a downward price trend leading to it. Web daily on necklie pattern. Consolidation pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap,. In an on neck pattern, the first candle is bearish and the second one is bullish. Web candlestick patterns are graphic representations of the actions between supply and demand in the prices of shares or commodities. Web the on neck pattern occurs after a downtrend when a long real bodied bearish candle is followed by a smaller real bodied bullish candle which gaps down on. Scanner guide scan examples feedback. The on neck pattern occurs when a long real bodied down candle is followed by a smaller real bodied up candle that gapsdown on the open but then closes near the prior candle's close. This pattern is based on the fact of impulsive and retracement.

What Is OnNeck Candlestick Pattern With Examples ELM

On Neck Pattern How to identify the Neckline Candlestick Pattern

Share Breakout On neck candlestick chart pattern YouTube

66671.jpg)

FREE Guide To Candlestick Patterns Learn Top 28 Patterns

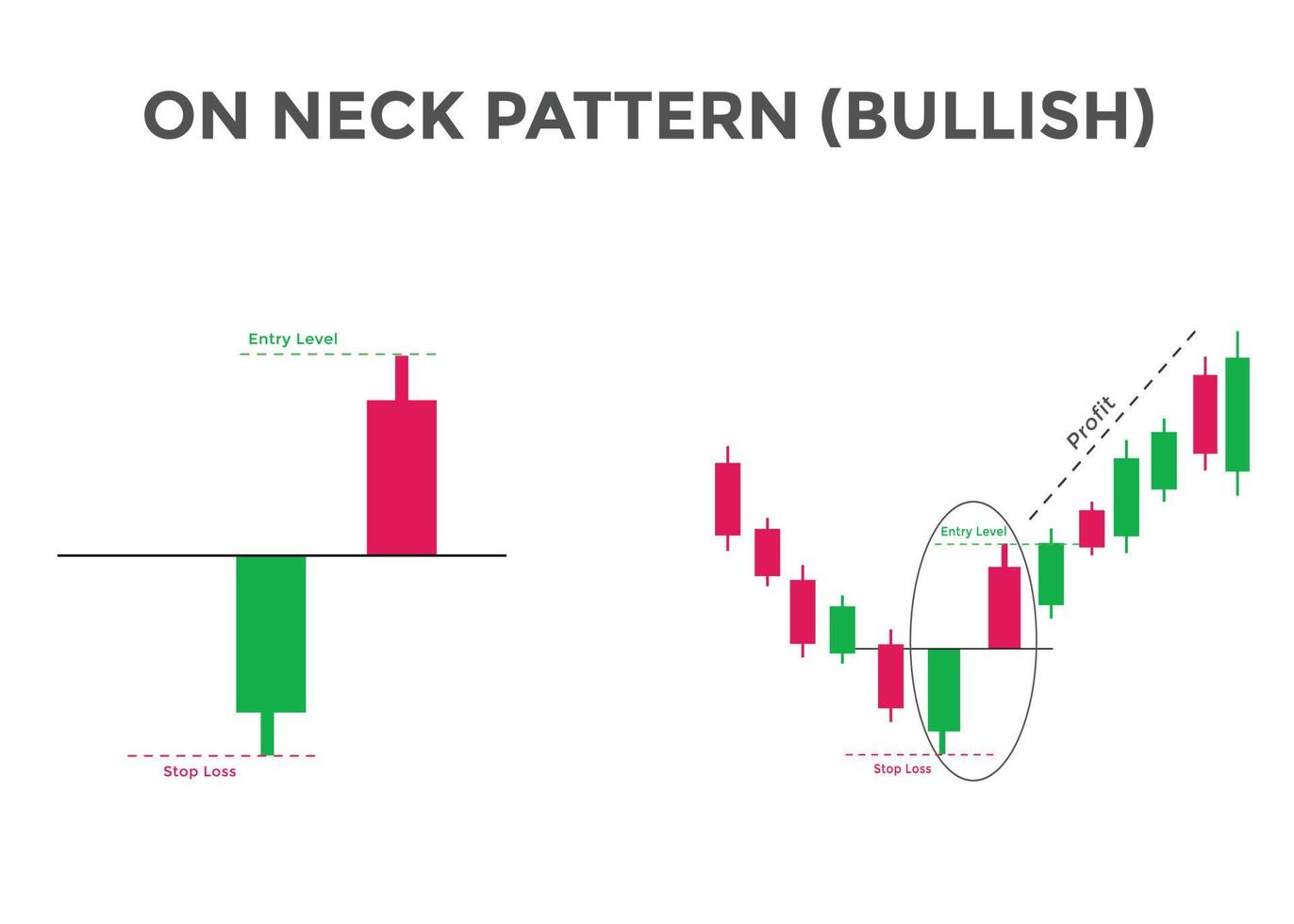

On neck bullish candlestick chart pattern. Candlestick chart Pattern

What Is OnNeck Candlestick Pattern With Examples ELM

Candlestick Patterns The Complete Guide LearnX

On neck pattern bearish candlestick chart. Candlestick chart Pattern

Best Chart and Candlestick patterns that work!

What Is OnNeck Candlestick Pattern With Examples ELM

Scanner Guide Scan Examples Feedback.

In Downtrend, It Consists Of A Black Candlestick Followed By.

Web Studying The On Neck Candlestick Pattern Shows Its Detailed Importance In Technical Trading, Giving Traders A Way To Understand If Downtrends Will Keep Going.

Web The On Neck Candlestick Pattern Is A Bearish Continuation Pattern Found In Financial Markets, Typically Observed On A Candlestick Chart.

Related Post: