Npv Excel Template

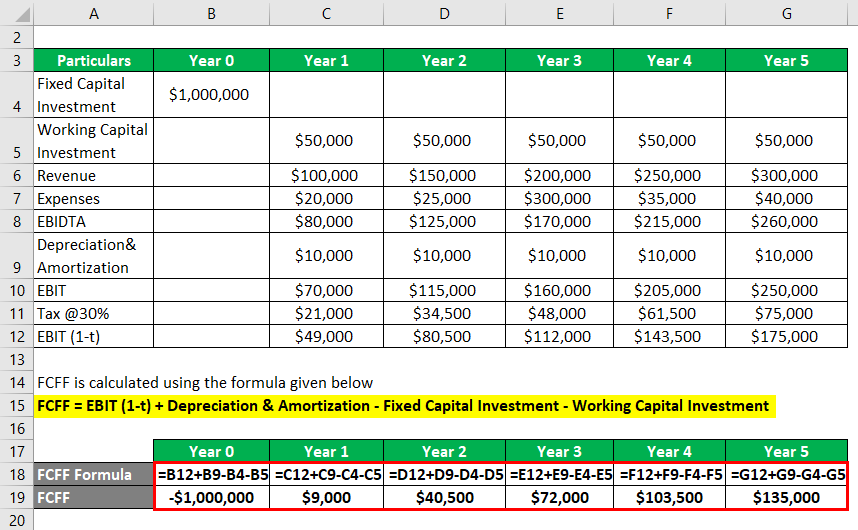

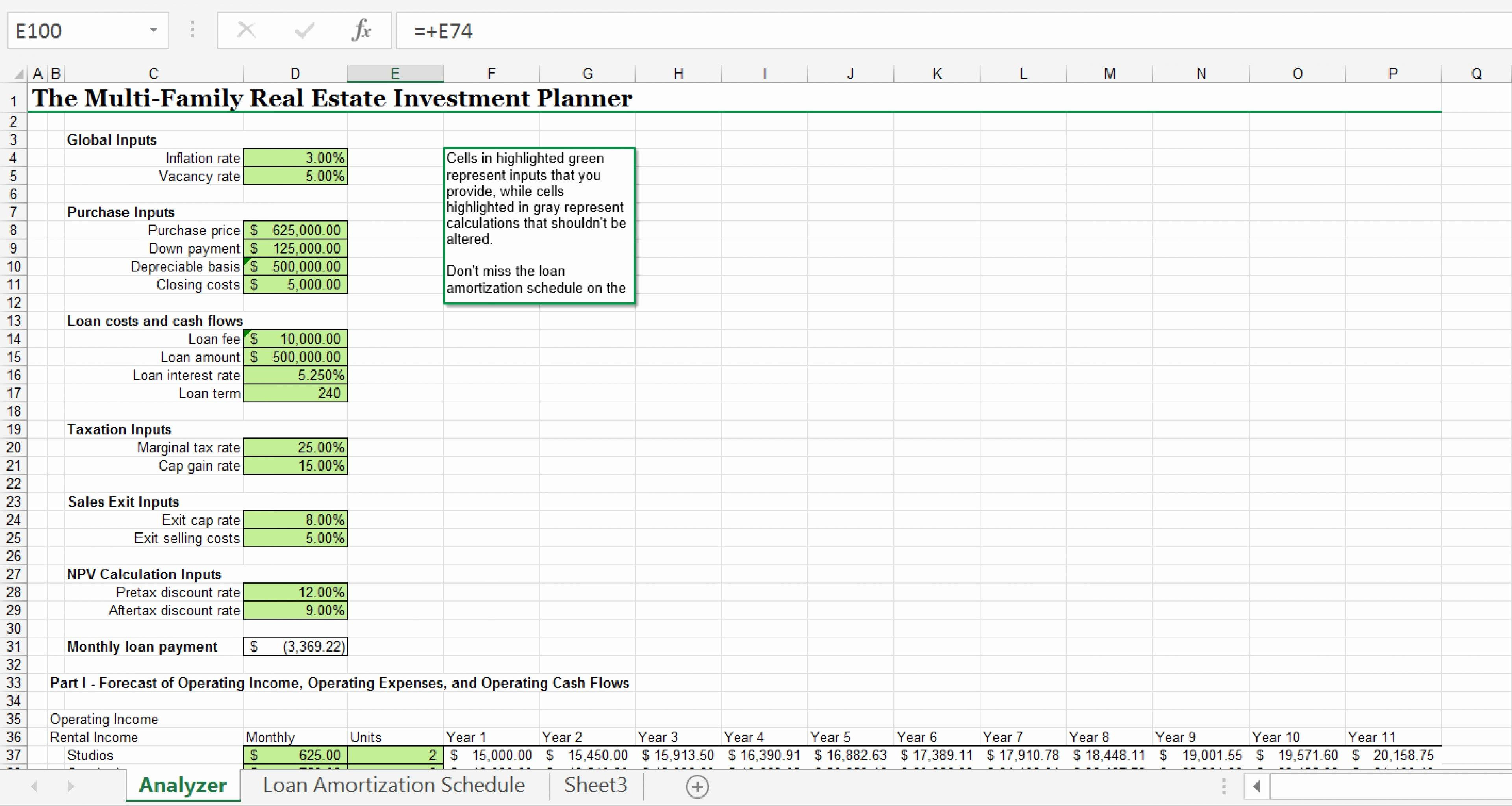

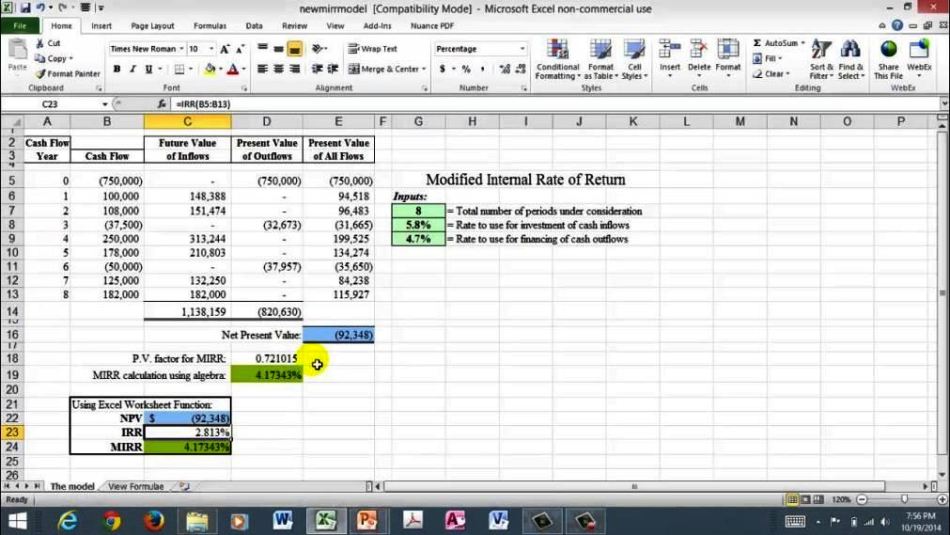

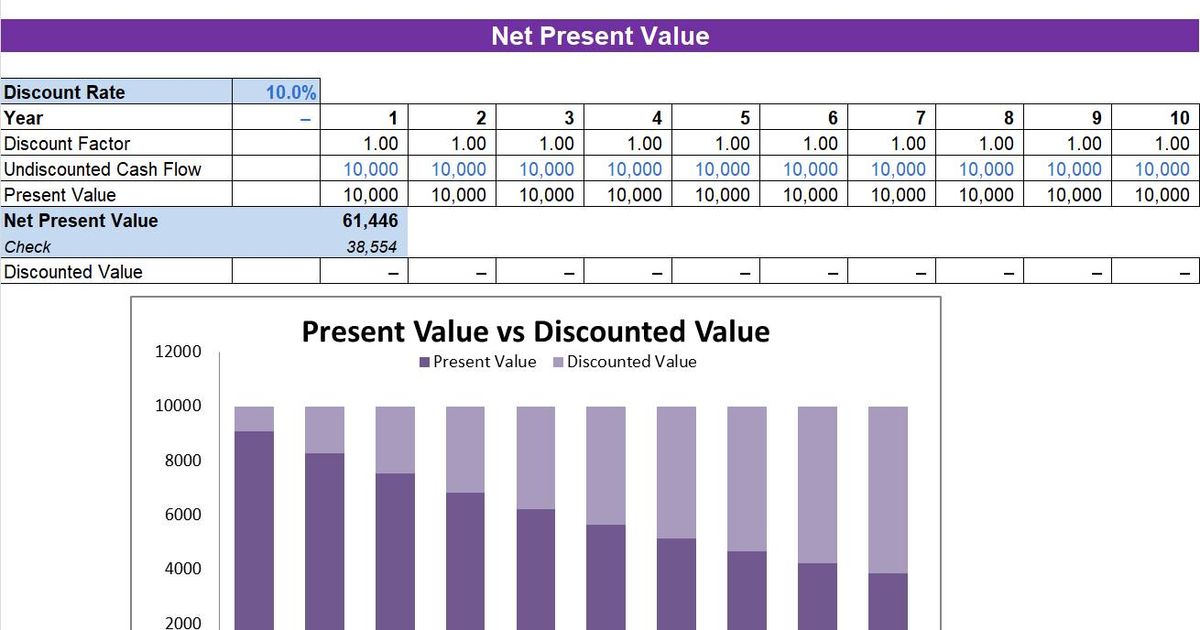

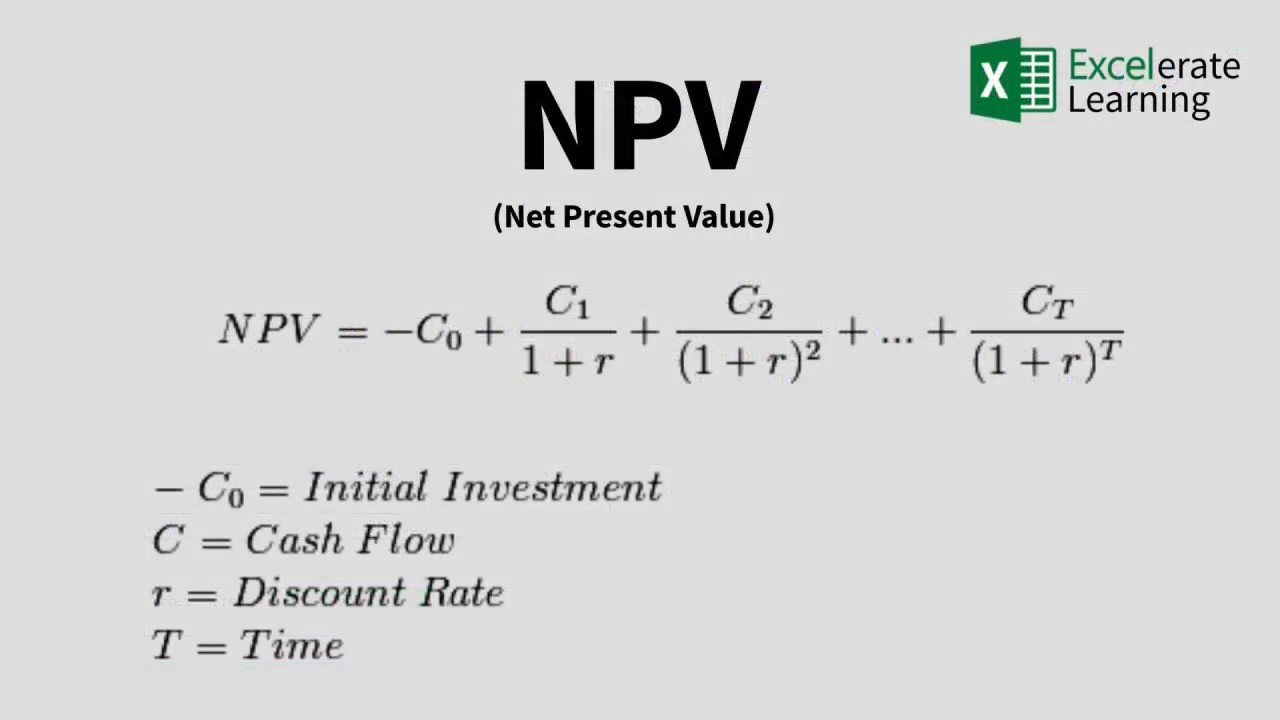

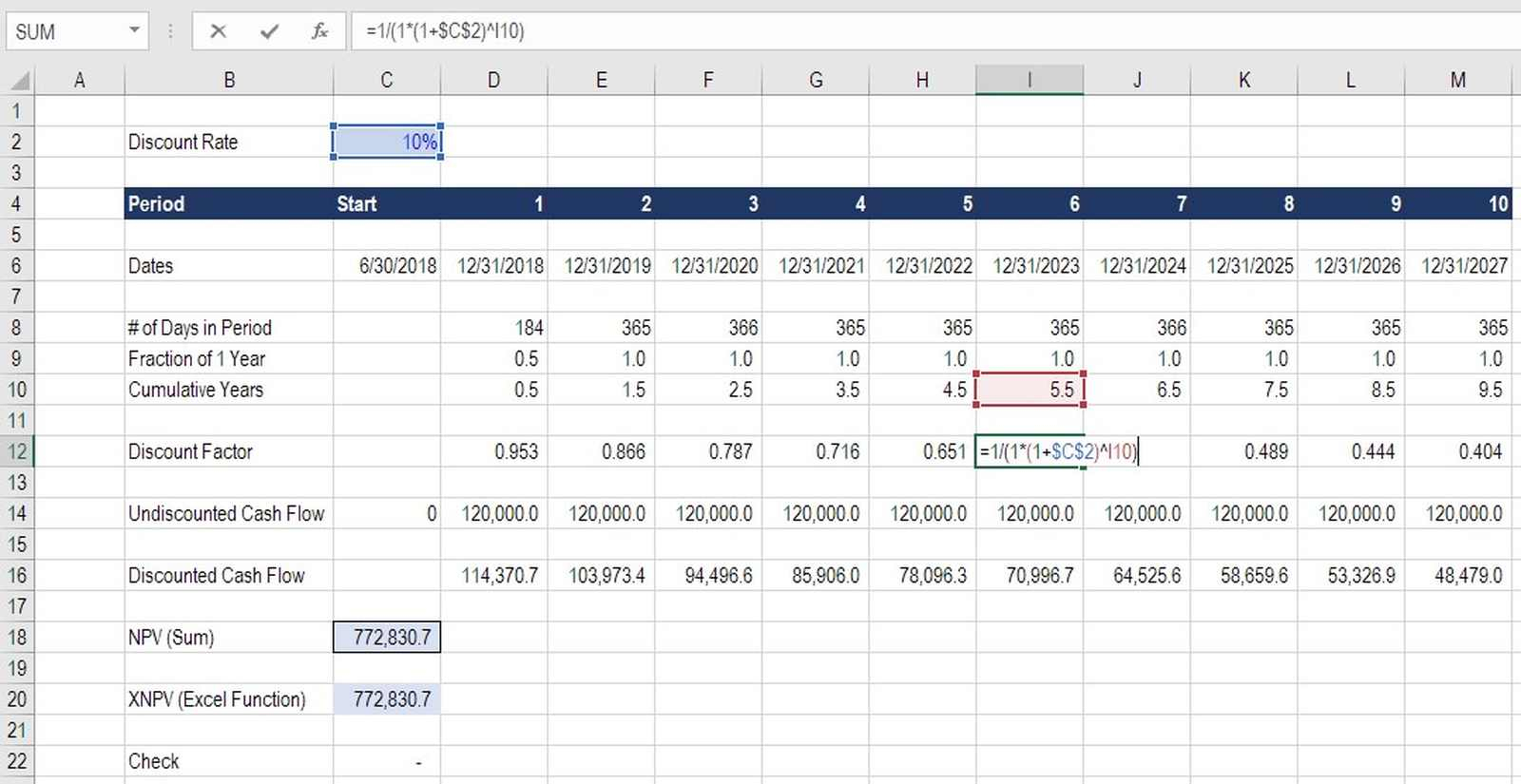

Npv Excel Template - Web table of content. Irr is based on npv. Below this column header you’ll be calculating the net present value. The discount rate, return of. Example for npv calculation in excel. Web net present value means the net value of an investment today. Web 1) the npv calculator worksheet shown in the screenshot above lets you calculate npv and irr for multiple series of cash flows. Calculates the net present value of an investment by using a discount rate. Step 1) create a sheet and set up values: Web how to calculate net present value (npv) npv formula. Web net present value means the net value of an investment today. In this example, we will calculate the npv over a 10 years period. Web net present value (npv) is a method to analyze projects and investments and find out whether these would be profitable or not. Web how to calculate npv using excel. Where n is the number. Web table of content. It is a financial measure to tell if an investment is going to be profitable or if it is worth investing. You can think of it as a special case of npv, where the rate. In this example, we will calculate the npv over a 10 years period. Npv stands for net present value which represents. Web how to calculate net present value (npv) npv formula. Below this column header you’ll be calculating the net present value. Web npv is a financial metric used to evaluate the potential profitability of an investment or project. It is a financial measure to tell if an investment is going to be profitable or if it is worth investing. Calculates. Web how to calculate npv using excel. Irr is based on npv. You can think of it as a special case of npv, where the rate. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Calculates the net present value of an investment by using a discount rate. Web it could be also the annual interest rate. Web this article describes the formula syntax and usage of the npv function in microsoft excel. Web the net present value (npv) is a financial metric used to evaluate the profitability of an investment project by comparing the present value of cash inflows. Npv stands for net present value which represents. Web net present value (npv) is a common financial calculation used to determine the profitability of an investment or project. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Web net present value (npv) excel template helps you calculate the present value of a series of cash flows. Web. Web it could be also the annual interest rate. Web the net present value (npv) is a financial metric used to evaluate the profitability of an investment project by comparing the present value of cash inflows. Net present value can be calculated by hand, although it may. Web net present value (npv) is a common financial calculation used to determine. Calculates the net present value of an investment by using a discount rate. Example for npv calculation in excel. Web net present value means the net value of an investment today. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. Web the formula for npv is: It measures the present value of future cash inflows and outflows,. Npv stands for net present value which represents the difference between the values of the present cash inflows and outflows applying a discount rate. Web table of content. Web net present value (npv) is a common financial calculation used to determine the profitability of an investment or project. Net. Below this column header you’ll be calculating the net present value. Web the net present value (npv) is a financial metric used to evaluate the profitability of an investment project by comparing the present value of cash inflows. The discount rate, return of. It’s widely used in the financial world and is. Web net present value means the net value. Web this net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. You can think of it as a special case of npv, where the rate. Web the net present value (npv) is a financial metric used to evaluate the profitability of an investment project by comparing the present value of cash inflows. What is a good net present value (npv)? Example for npv calculation in excel. Web table of content. Web 1) the npv calculator worksheet shown in the screenshot above lets you calculate npv and irr for multiple series of cash flows. Web the formula for npv is: Web looking for a net present value (npv) excel template? Net present value can be calculated by hand, although it may. It is a financial measure to tell if an investment is going to be profitable or if it is worth investing. Web net present value (npv) is a method to analyze projects and investments and find out whether these would be profitable or not. Web it could be also the annual interest rate. Below this column header you’ll be calculating the net present value. Net present value (npv) is the value of all future. Web net present value (npv) is a common financial calculation used to determine the profitability of an investment or project.

Net Present Value Formula Examples With Excel Template Images

Npv Excel Spreadsheet Template —

Excel Npv Template

How To Compute The Npv In Excel Haiper

Net Present Value (NPV) Excel Template Calculate NPV with Ease

How to Calculate Net Present Value in Excel + Template YouTube

Net Present Value Calculator Excel Templates

Npv Excel Spreadsheet Template Spreadsheet Downloa Npv Excel

NPV IRR Calculator Excel Template IRR Excel Spreadsheet

Professional Net Present Value Calculator Excel Template Excel Tmp

Use This Free Excel Template To Easily Calculate The Npv.

Web Net Present Value (Npv) Excel Template Helps You Calculate The Present Value Of A Series Of Cash Flows.

Web This Article Describes The Formula Syntax And Usage Of The Npv Function In Microsoft Excel.

Irr Is Based On Npv.

Related Post: