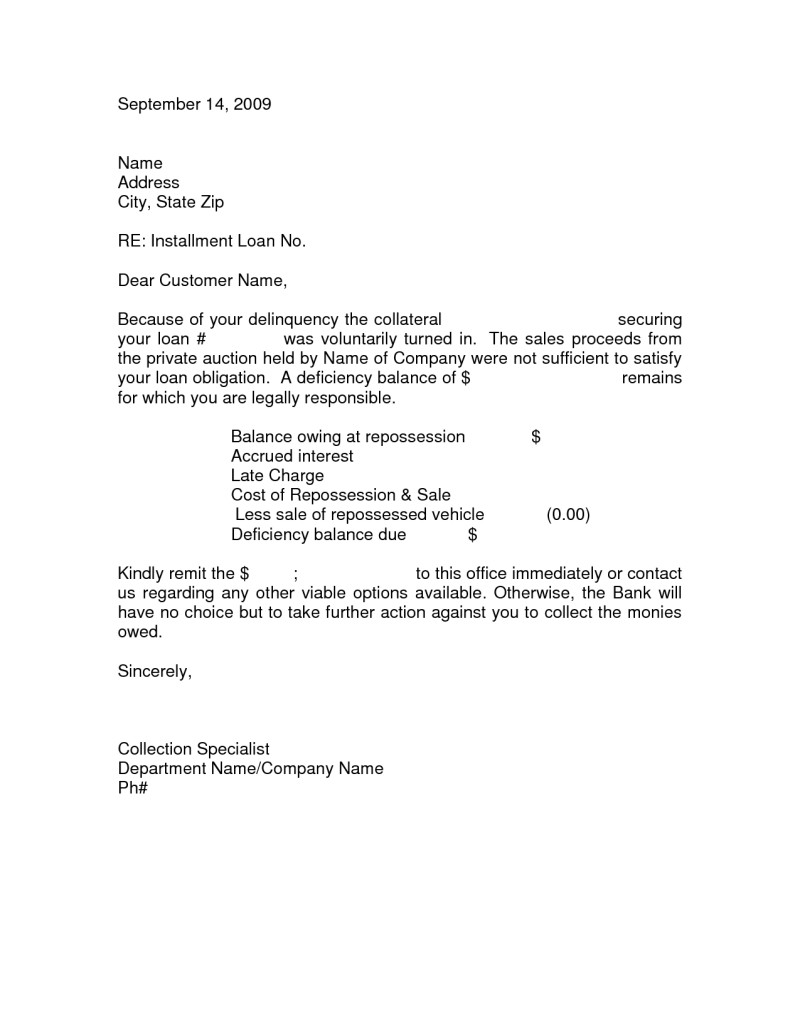

Notice Of Vehicle Repossession Letter Template

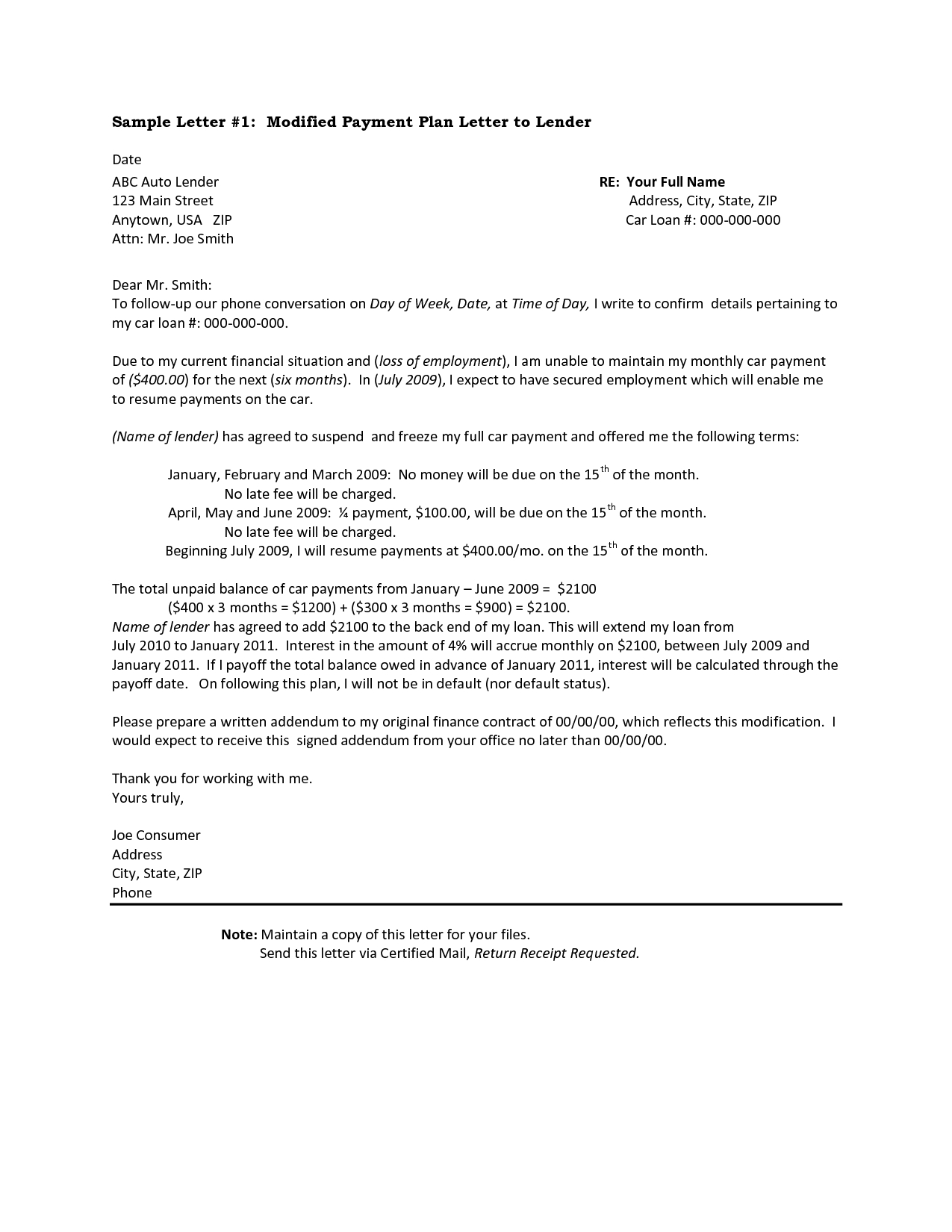

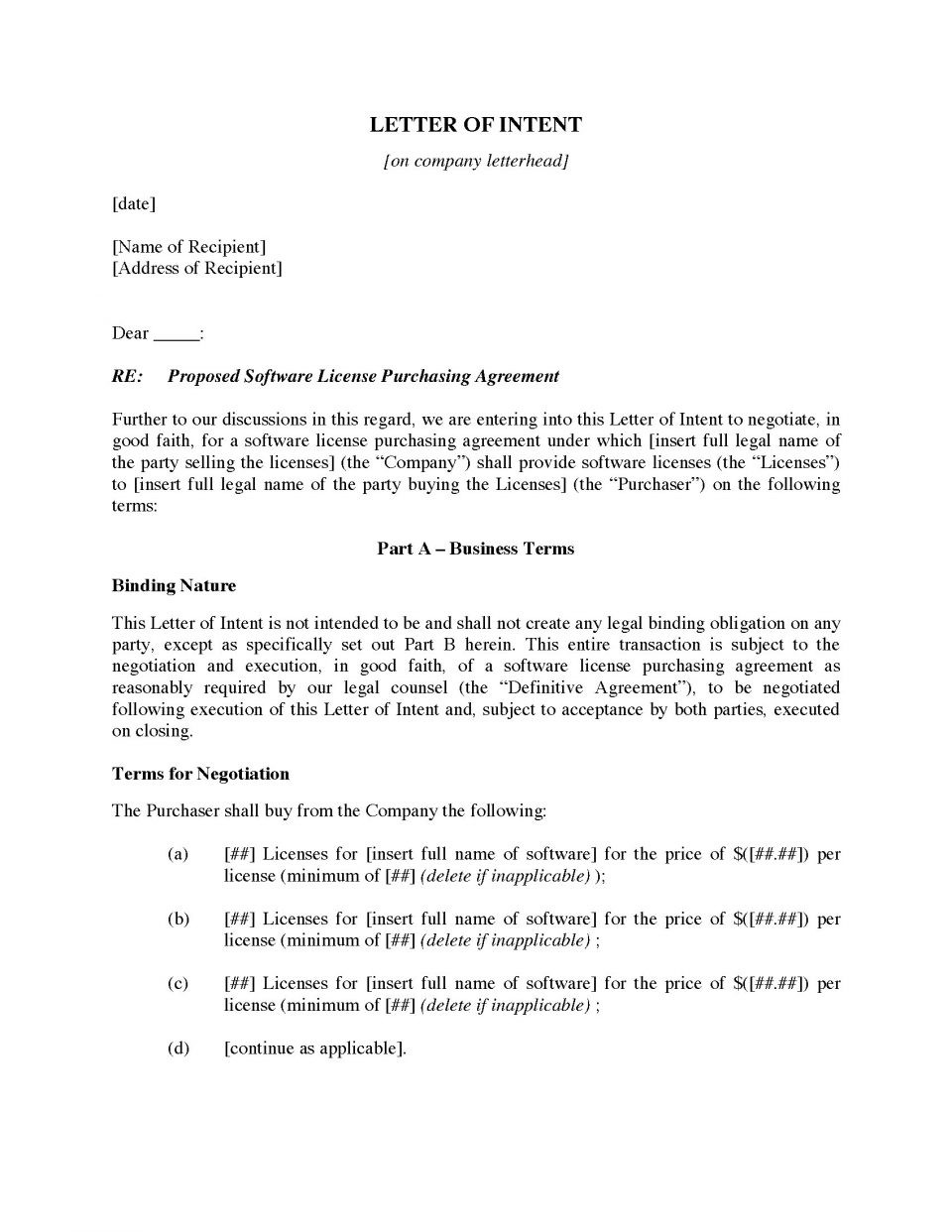

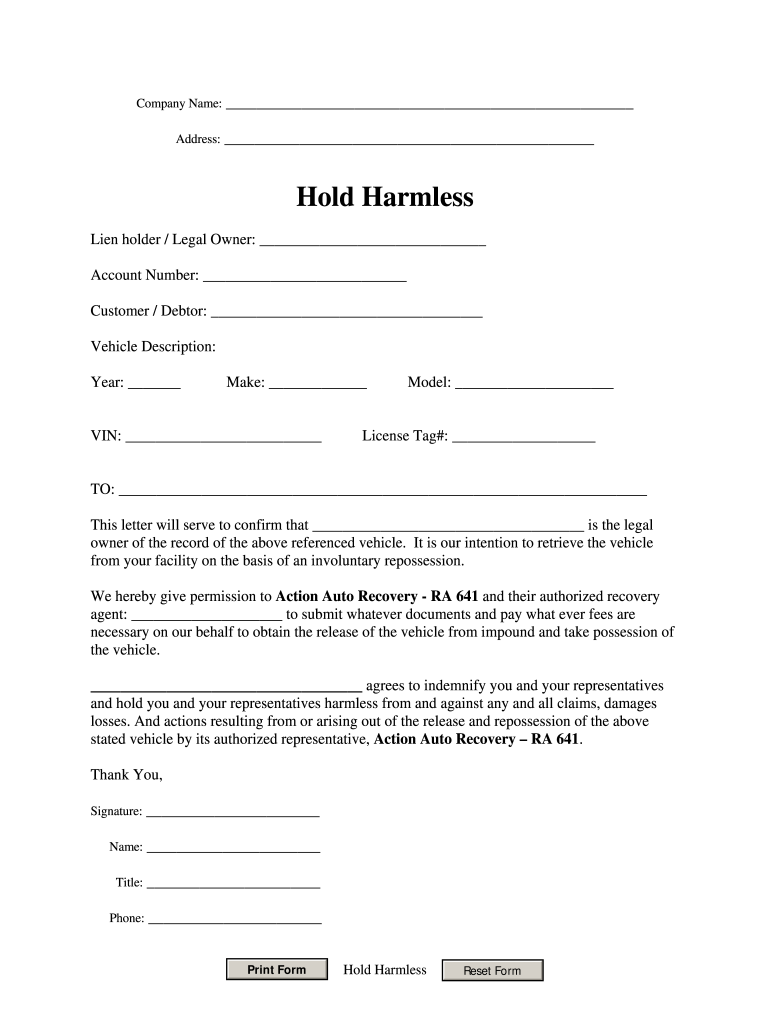

Notice Of Vehicle Repossession Letter Template - Web updated october 12, 2021. All fields are required to be completed. Web repossession guidelines and sample documents. Web if your car has already been repossessed, the lender must send you a notice of your right to redeem the car and a notice of what the lender intends to do with your car. Here’s what to do if you. Web use this sample voluntary repossession letter as a template for your formal voluntary repossession letter. Name of the owner and a statement in bold type at. Web below you'll learn more about car repossession, including: What car repossession is and the process involved; Notices lenders often send when repossessing a car, and; Such a letter is called a repossession letter. If you don’t make your car payments on time, your lender might have the right to take your car without going to court or telling you first. Vehicle and traffic law section 425 requires the repossessor of a motor vehicle or motorcycle to do the following: When a debtor fails to pay. If you do not pay the amount required to redeem. What car repossession is and the process involved; Such a letter is called a repossession letter. Notices lenders often send when repossessing a car, and; Before such a seizure, the lender issues a letter/ notice informing that he is seizing the asset. Such a letter is called a repossession letter. Web by stephanie lane, attorney · case western reserve university school of law. Name of lender address city,. Is the account 10 days or more past due? This form must be completed when a vehicle is repossessed. The letter usually states that the lender has. Is the account 10 days or more past due? Notices lenders often send when repossessing a car, and; First name, middle name, last name complete address city state zip. When a debtor fails to pay the owed money to a lender, the lender has a right to seize the asset that was. The vehicle is being held at: Your rights and the rules the creditor must follow when repossessing a car. Here’s what to do if you. What car repossession is and the process involved; Web for all involuntary repossessions, the lienholder must mail or deliver to the owner a notice of redemption, which must include: Your rights and the rules the creditor must follow when repossessing a car. Web use this sample voluntary repossession letter as a template for your formal voluntary repossession letter. Web request for repossession notices from lender. Here’s what to do if you. Web security interest agreement (california commercial code [com. Here’s what to do if you. If your car loan lender repossesses your vehicle, you're probably not entitled to any notice before. Web if you do not have a notice of repossession, bring a letter written on letterhead and signed by an official of the loan company. Web the notice must advise of (1) the right to reinstatement and redemption. Before such a seizure, the lender issues a letter/ notice informing that he is seizing the asset. If you do not pay the amount required to redeem. When a debtor fails to pay the owed money to a lender, the lender has a right to seize the asset that was kept as collateral. Your rights and the rules the creditor. Web use this sample voluntary repossession letter as a template for your formal voluntary repossession letter. Such a letter is called a repossession letter. Notice prior to repossession of a vehicle. If not, you have to wait until it is before you can. Web below you'll learn more about car repossession, including: Name of the owner and a statement in bold type at. Notices lenders often send when repossessing a car, and; Web below you'll learn more about car repossession, including: Before such a seizure, the lender issues a letter/ notice informing that he is seizing the asset. Here’s what to do if you. This form must be completed when a vehicle is repossessed. Web if you do not have a notice of repossession, bring a letter written on letterhead and signed by an official of the loan company. If you don’t make your car payments on time, your lender might have the right to take your car without going to court or telling you first. The vehicle is being held at: Verify that the vehicle was. Select the applicable “method of repossession” and attach. The letter usually states that the lender has. All fields are required to be completed. When a debtor fails to pay the owed money to a lender, the lender has a right to seize the asset that was kept as collateral. If your car loan lender repossesses your vehicle, you're probably not entitled to any notice before. A customizable template to kickstart your letter writing. The notice must tell you the name and contact information for both the lender (the legal owner of the vehicle) and the repossession agency. Web once you have decided to repossess a debtor’s vehicle, you must deliver a notice of redemption to the debtor that: Web security interest agreement (california commercial code [com. Is the account 10 days or more past due? Web updated october 12, 2021.

Notice Of Vehicle Repossession Letter Template

Car Repossession Letter Template Daisy Blake

Notice Of Vehicle Repossession Letter Template

Vehicle Repossession Letter Template Samples Letter Template Collection

Car Repossession Dispute Letter Template Fill Online, Printable

Car Repossession Letter Template Daisy Blake

Repossession Letter PDF Complete with ease airSlate SignNow

Vehicle Repossession Letter Template Samples Letter Template Collection

Notice Of Repossession Letter Template

LUSERSAMGMT SharedConnieFormsRepossession Form 2 Fill Out and Sign

We Have Repossessed The Above Described Vehicle.

Web Below You'll Learn More About Car Repossession, Including:

Web If Your Car Has Already Been Repossessed, The Lender Must Send You A Notice Of Your Right To Redeem The Car And A Notice Of What The Lender Intends To Do With Your Car.

If You Do Not Pay The Amount Required To Redeem.

Related Post: