Non Profit Organization Receipt Template

Non Profit Organization Receipt Template - Keep accurate records and tax purposes. Web donation receipt templates. Web page 1 of 3. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web posted on january 17, 2023 by ryan duffy. Web use these nonprofit donation receipt letter templates for the different types of donations your nonprofit receives: Nonprofit donation receipts are both a legal requirement and an important part of nurturing your supporters. A donation can be in the form of cash or property. We will populate it automatically with all the necessary donation details and organization info. Why do you need a donation receipt? Nonprofit receipts are given to the donor when he donates to a nonprofit organization. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. We will populate it automatically with all the necessary donation details and organization info. A nonprofit receipt template is a helpful. Nonprofit donation receipts are both a legal requirement and an important part of nurturing your supporters. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Web donation receipt email & letter templates for your nonprofit. Clear and consistent nonprofit donation receipts help build. 6 free templates | instrumentl. A donation can be in the form of cash or property. Both parties are required to use donation receipts to prove that they’ve either donated cash. Best for tracking donor behavior with data insights: The organization should also fill in their. A donation can be in the form of cash or property. The last thing you want is to spend your time dealing with legal trouble. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Statement that no goods or services were provided by. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Nonprofit donation receipts are both a legal requirement and an important part of nurturing your supporters. Web page 1 of 3. Web the written acknowledgment required to substantiate a charitable contribution of $250 or. Web to help you write the best automatic donation receipt for your nonprofit, i’ve compiled a few great donation receipt examples and a template you can customize for your own receipt: Web a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. These are given when a. Summit assistance dog’s unleash your love donation receipt. Web donation receipt templates. 6 free templates | instrumentl. They’re important for anyone who wants to itemize their charitable giving when tax season rolls. Benefits of an automated donation receipt process. Web this article covers everything you need to know about creating nonprofit donation receipts from a template. These are given when a donor donates to a nonprofit organization. Keep accurate records and tax purposes. One of the most important parts of running a nonprofit is making sure you’re staying compliant with government regulations. They’re important for anyone who wants to. Benefits of a 501c3 donation receipt. Web posted on january 17, 2023 by ryan duffy. Web a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. Web a 501(c)(3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250. The organization should also fill in their. Web to help you write the best automatic donation receipt for your nonprofit, i’ve compiled a few great donation receipt examples and a template you can customize for your own receipt: Summit assistance dog’s unleash your love donation receipt. Best for tracking donor behavior with data insights: Web a 501(c)(3) donation receipt is. Nonprofit donation receipts are both a legal requirement and an important part of nurturing your supporters. Jump to the donation receipt templates. Web donation receipt templates. Web published july 5, 2023 • reading time: Just as people expect a receipt when they purchase an item from a store, your supporters expect a donation receipt when they donate to your nonprofit organization. What are the best donation receipt templates for nonprofits? Web 501 (c) (3) donation receipt template | ultimate guide. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. These are given when a donor donates to a nonprofit organization. Web the written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: A nonprofit receipt template is a helpful document used to create a form of receipt states that a benefactor has been donated a certain value to a beneficiary. We will populate it automatically with all the necessary donation details and organization info. Best for tracking donor behavior with data insights: Best nonprofit crm tool with integrations: Why do you need a donation receipt? Benefits of an automated donation receipt process.

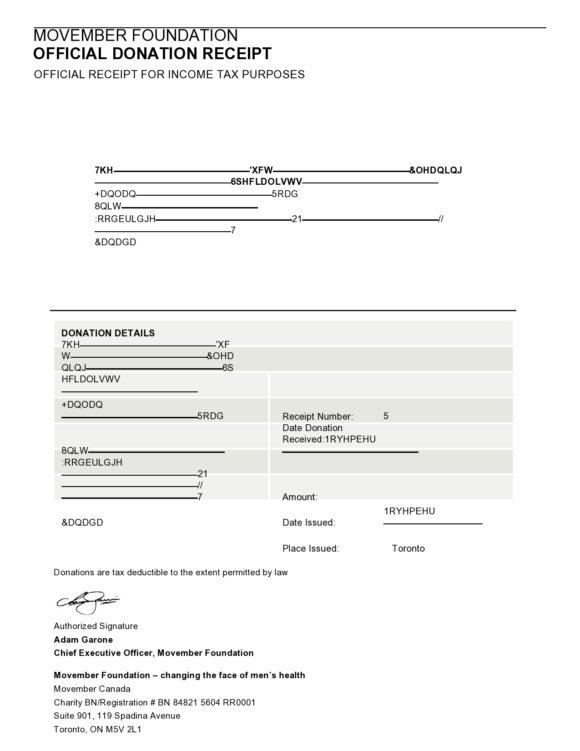

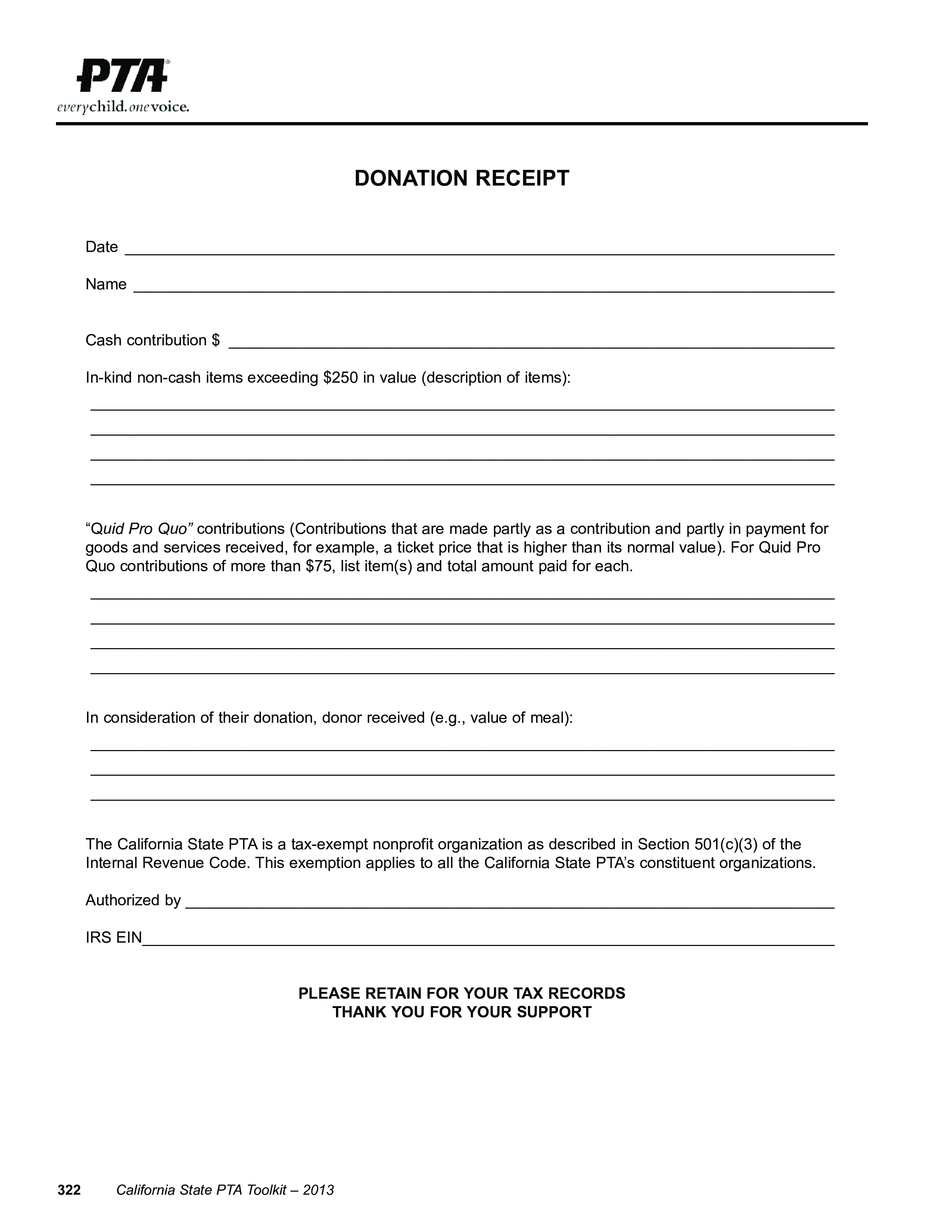

Free Non Profit Donation Receipt Template

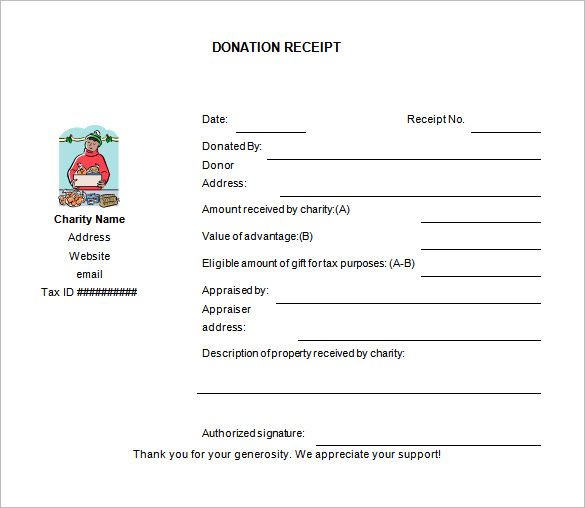

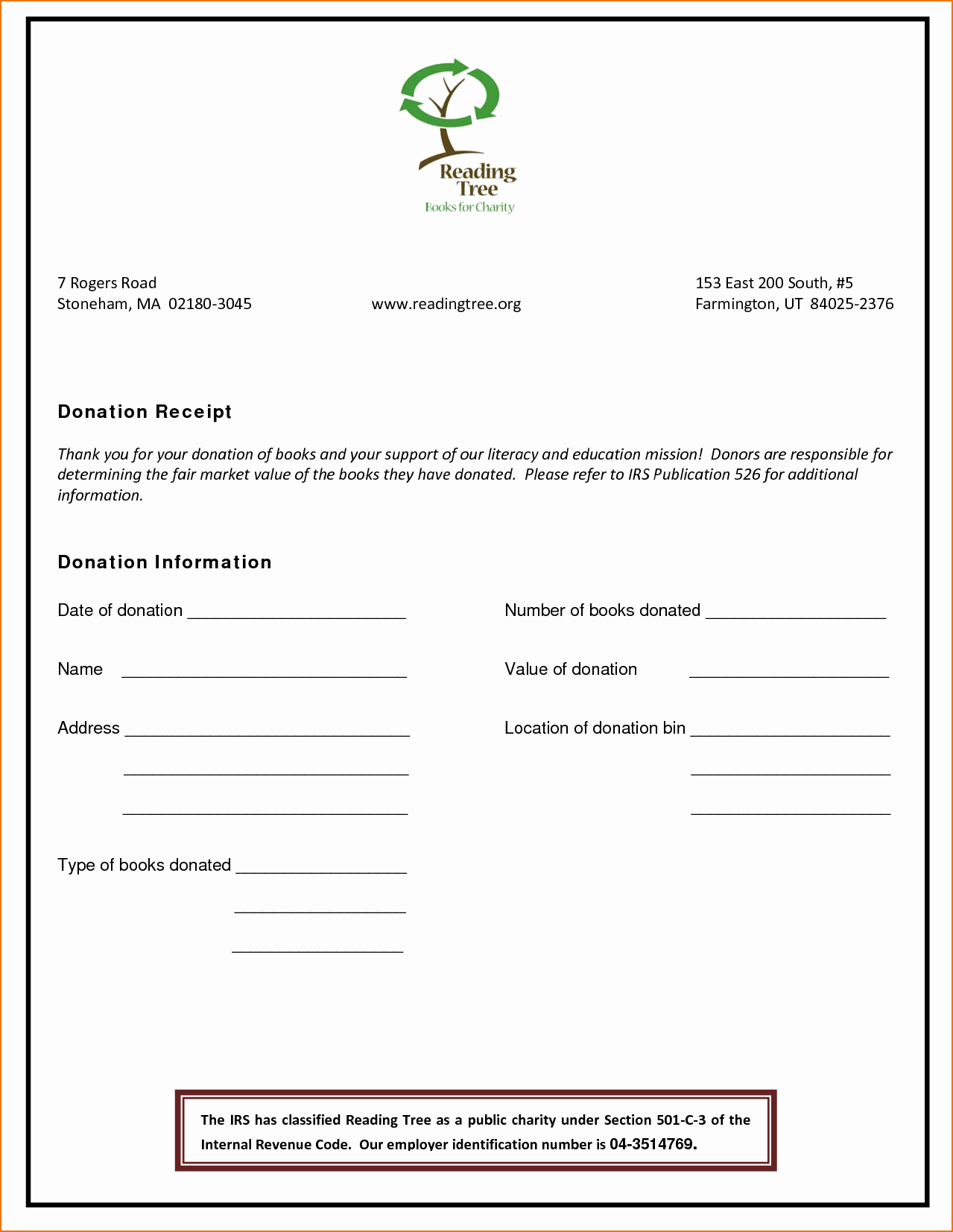

FREE 9+ Sample Fundraiser Receipt Templates in PDF MS Word

Nonprofit Receipt 5+ Examples, Format, Pdf Examples

Non Profit Donation Receipt Templates at

10 Donation Receipt Templates Free Samples, Examples & Format

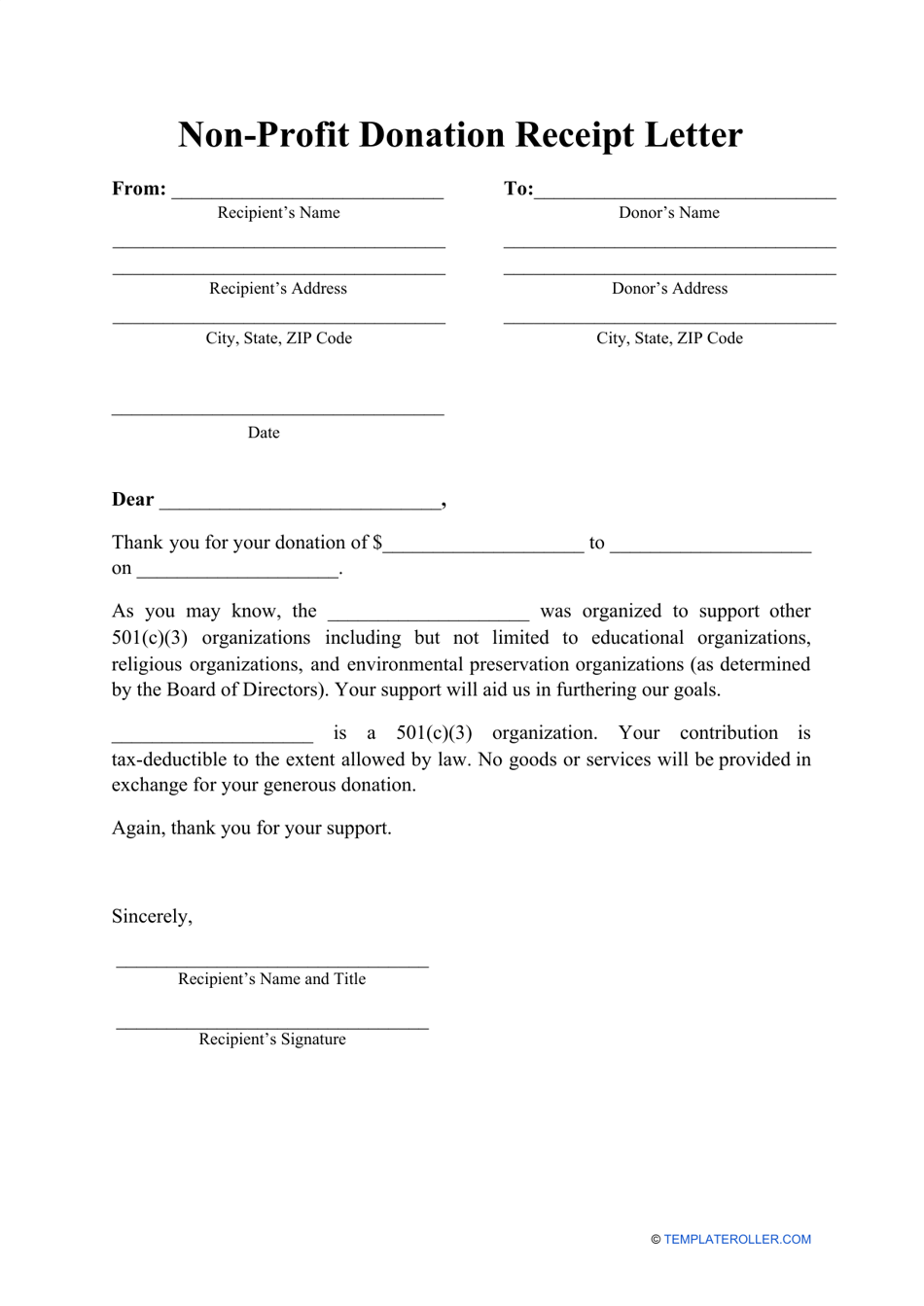

Nonprofit Donation Receipt Letter Template Download Printable PDF

Nonprofit Donation Receipt Template

Non Profit Donation Receipt Template Excel Templates

Sample Non Profit Donation Templates at

50+ FREE Donation Receipt Templates (Word PDF)

Web Posted On January 17, 2023 By Ryan Duffy.

Web Nonprofit Donation Receipt Template:

One Of The Most Important Parts Of Running A Nonprofit Is Making Sure You’re Staying Compliant With Government Regulations.

Both Parties Are Required To Use Donation Receipts To Prove That They’ve Either Donated Cash.

Related Post: