Multi Candlestick Patterns

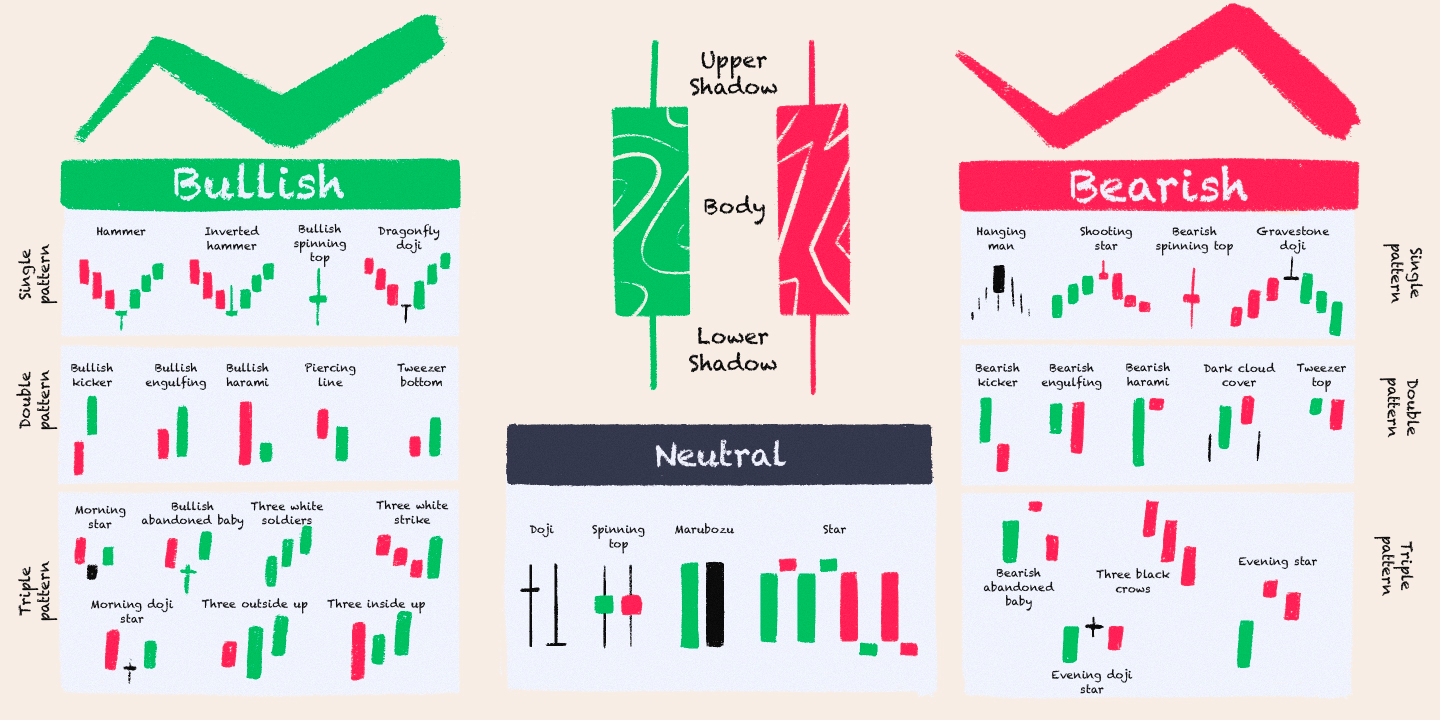

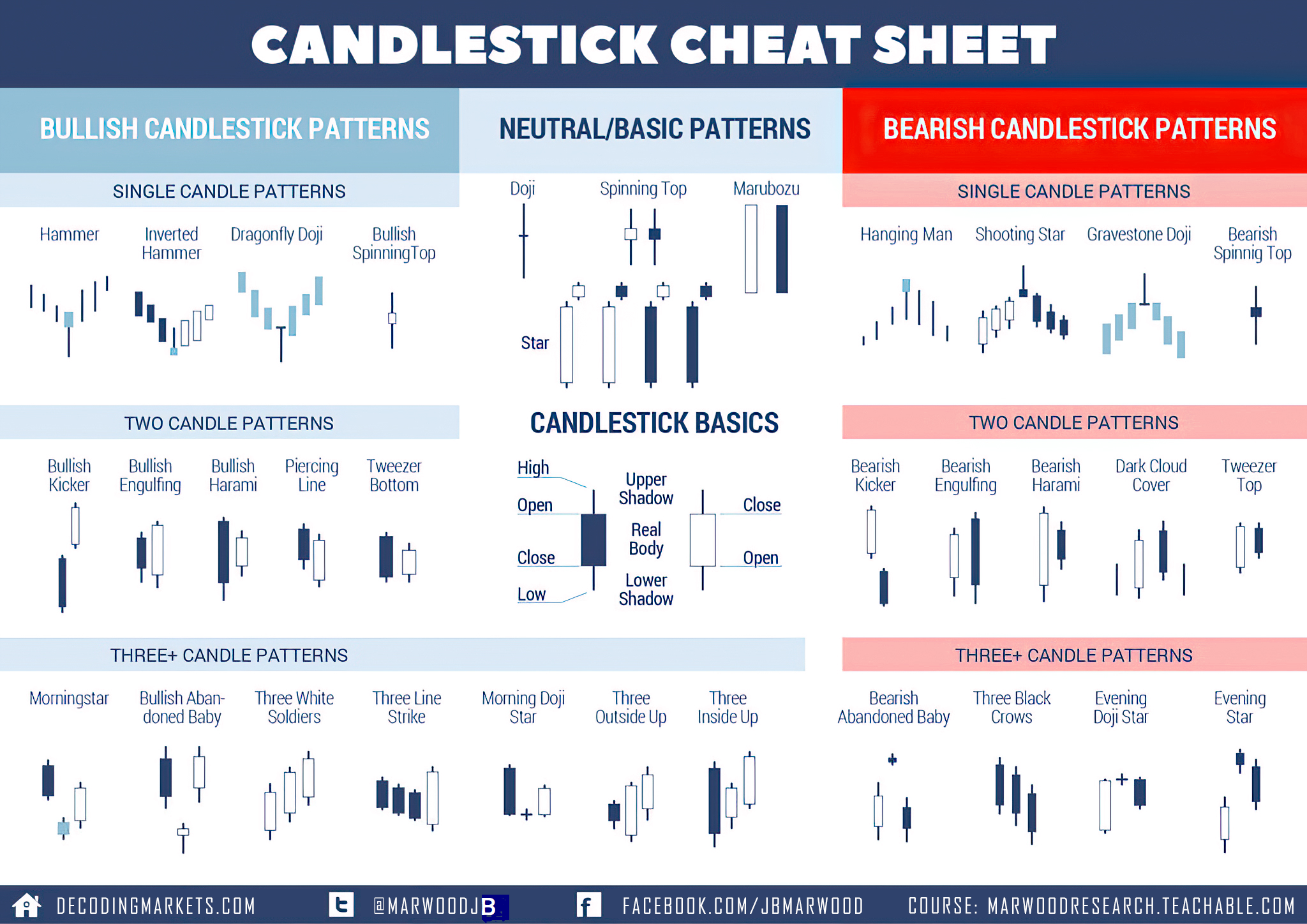

Multi Candlestick Patterns - It is made of 3 candlesticks, the first being a bearish candle, the second a doji and the third being a bullish candle. The hammer is a bullish reversal pattern, which signals that a. This means the trading opportunity evolves over a minimum of 2 trading. Web learn how to identify and trade the island reversal, kicker, hook reversal and three gap advanced candlestick patterns. Bullish closing marubozu candlestick pattern. Where one candle overtakes another, signaling a shift in market sentiment. My analysis, research and testing stems from 25 years of trading experience and my financial technician certification with the international federation of technical. Candlestick patterns can be made up of one candle or multiple candlesticks. Web what are thestrat candlestick patterns? Web each candlestick pattern has a distinct name and a traditional trading strategy. The bullish engulfing pattern evolves over two trading days. ☆ research you can trust ☆. Dive into the intricacies and variations of engulfing patterns to. Web in the previous video, we looked at single candlestick patterns. Bullish and bearish candlesticks [9:17 minutes] more candlestick patterns. Let’s look at a single candle pattern named the bullish closing marubozu. P2’s blue candle completely engulfs p1’s red. Candlestick patterns can be made up of one candle or multiple candlesticks. The body of the bullish doji lies completely outside that of the surrounding candles, indicating market indecision. The second candle must be small compared to the others, like a. The body of the bullish doji lies completely outside that of the surrounding candles, indicating market indecision. The second candle must be small compared to the others, like a doji or a spinning top. The first candle shows the continuation of the downtrend. They can also form reversal or continuation patterns. In a single candlestick pattern, the trader needed just. However, when analyzing multiple candlestick patterns, the trader needs 2 or sometimes 3 candlesticks to identify a trading opportunity. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. The first candle shows the continuation of the downtrend. In this lesson, we cover how to. This can be either a continuation or reversal pattern. Web the tower pattern is a trend reversal pattern that consists of at least four candlesticks. The second candle must be small compared to the others, like a doji or a spinning top. Dive into the intricacies and variations of engulfing patterns to. Web each candlestick pattern has a distinct name and a traditional trading strategy. It appears at the. Here are five of the main patterns: The first candle shows the continuation of the downtrend. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. In this lesson, we cover how to. Web this is a candlestick pattern search indicator that informs you when any candlestick pattern occurs in any time frame with its. They can also form reversal or continuation patterns. This means the trading opportunity evolves over a minimum of 2 trading. We have quantified and backtested the following 75 candlestick patterns: This is known as the evening doji star pattern. The morning star is a multiple candlestick chart pattern that is formed after a downtrend indicating a bullish reversal. Gaps (a general term used to indicate both. A doji star at an uptrend can be a signal of a top being formed. ☆ research you can trust ☆. The hammer is a bullish reversal pattern, which signals that a. Ideally, the body of the second candle shouldn’t overlap with the bodies of the other two candles. Day one is called p1, and day two is called p2. Here are five of the main patterns: Web the tower pattern is a trend reversal pattern that consists of at least four candlesticks. Engulfing pattern, piercing pattern & dark cloud cover patternin t. After much investigation, i have come to the conclusion that the parents of all candlestick patterns. The hammer or the inverted hammer. The bullish engulfing pattern evolves over two trading days. (study the chart below) a doji star in a downtrend can be a signal for a bottom being formed. Candlestick patterns can be made up of one candle or multiple candlesticks. The body of the bullish doji lies completely outside that of the surrounding candles,. The second candle must be small compared to the others, like a doji or a spinning top. Multiple candlestick patterns (part 3) the morning star and the evening star are the last two candlestick patterns we will be studying. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. It appears at the bottom end of a downtrend. This can be either a continuation or reversal pattern. The engulfing patterns (bullish engulfing pattern and bearish engulfing patterns), the piercing pattern, the dark cloud cover, the harami pattern (bullish harami & bearish harami), the candles gaps, the morning star, the evening star, three. Web what are thestrat candlestick patterns? ☆ research you can trust ☆. Day one is called p1, and day two is called p2. After much investigation, i have come to the conclusion that the parents of all candlestick patterns are , pin bar candlestick, and engulf candlestick, and through these two any other confirmations. The third candle must be bullish. However, when analyzing multiple candlestick patterns, the trader needs 2 or sometimes 3 candlesticks to identify a trading opportunity. A doji star at an uptrend can be a signal of a top being formed. The hammer is a bullish reversal pattern, which signals that a. Here are some of the most popular candlestick charts, explained:

Multiple Candlestick Patterns How to Identify Them? Espresso Bootcamp

![Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim](https://www.tradingsim.com/hubfs/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

How to read candlestick patterns What every investor needs to know

Candlestick Patterns The Definitive Guide New Trader U

Candlestick patterns cheat sheet Artofit

Understanding Candlesticks Multi Candle Patterns Trade Brains

![Candlestick Patterns The Definitive Guide [UPDATED 2022]](https://www.alphaexcapital.com/wp-content/uploads/2020/04/Bullish-Harami-Candlestick-Patterns-Example-by-Alphaex-Capital-1030x1030.png)

Candlestick Patterns The Definitive Guide [UPDATED 2022]

.png)

4 Powerful Candlestick Patterns Every Trader Should Know

Candlestick Patterns The Definitive Guide (2021)

What Are Candlestick Patterns? Understanding Candlesticks Basics

Web Multiple Candlestick Patterns Evolve Over Two Or More Trading Days.

The Body Of The Bullish Doji Lies Completely Outside That Of The Surrounding Candles, Indicating Market Indecision.

Where One Candle Overtakes Another, Signaling A Shift In Market Sentiment.

Web Here Is A List Of Multi Candlesticks Patterns We Will Be Having A Discussion On In This Chapter:

Related Post: