Most Successful Chart Patterns

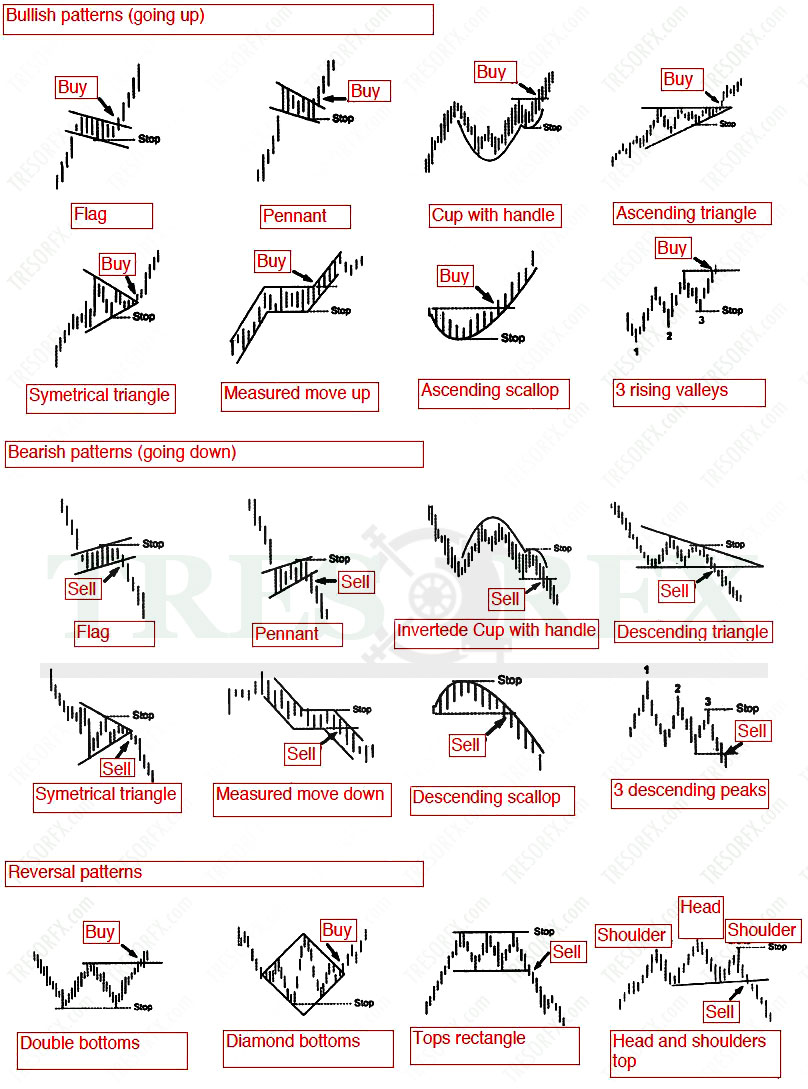

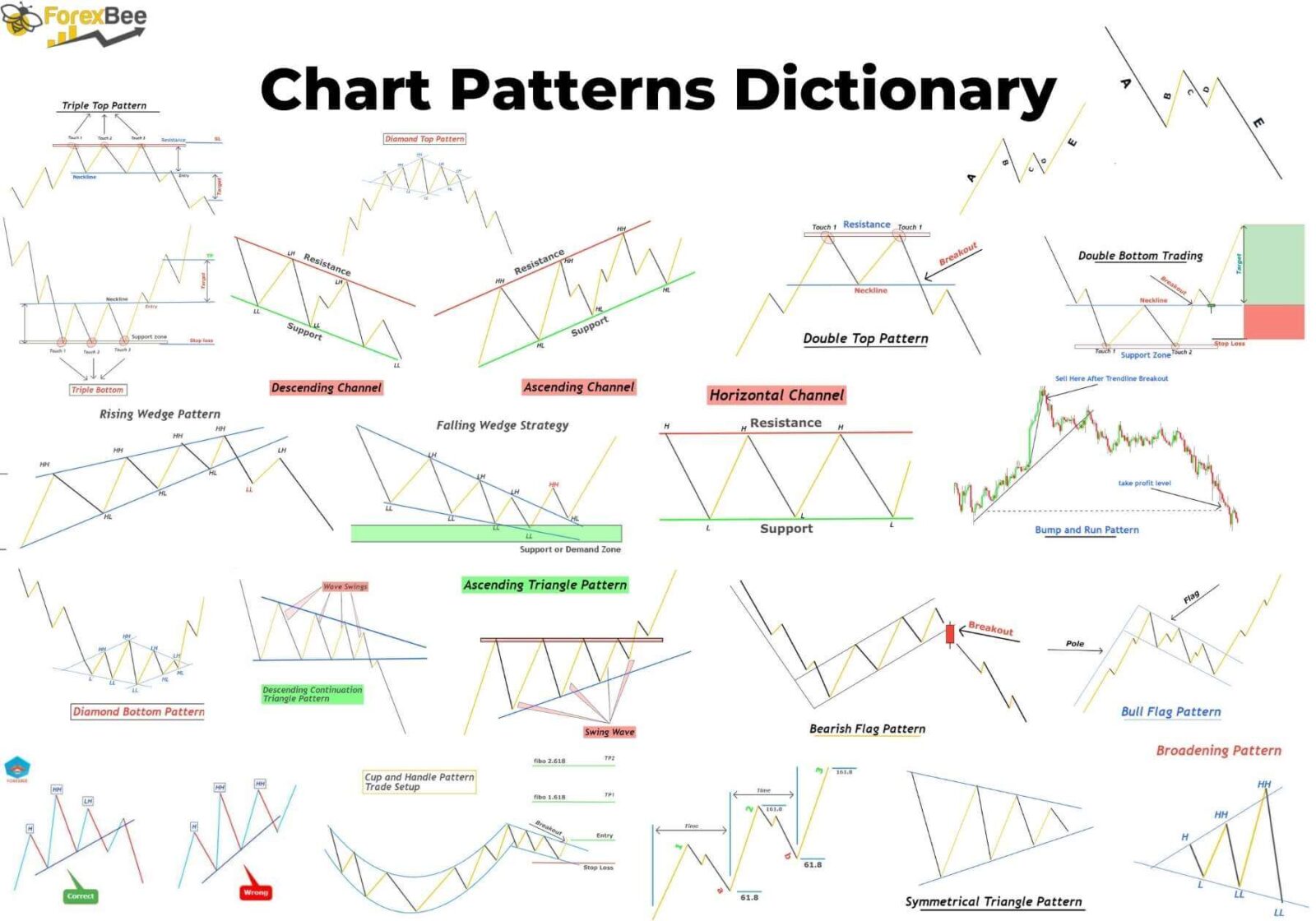

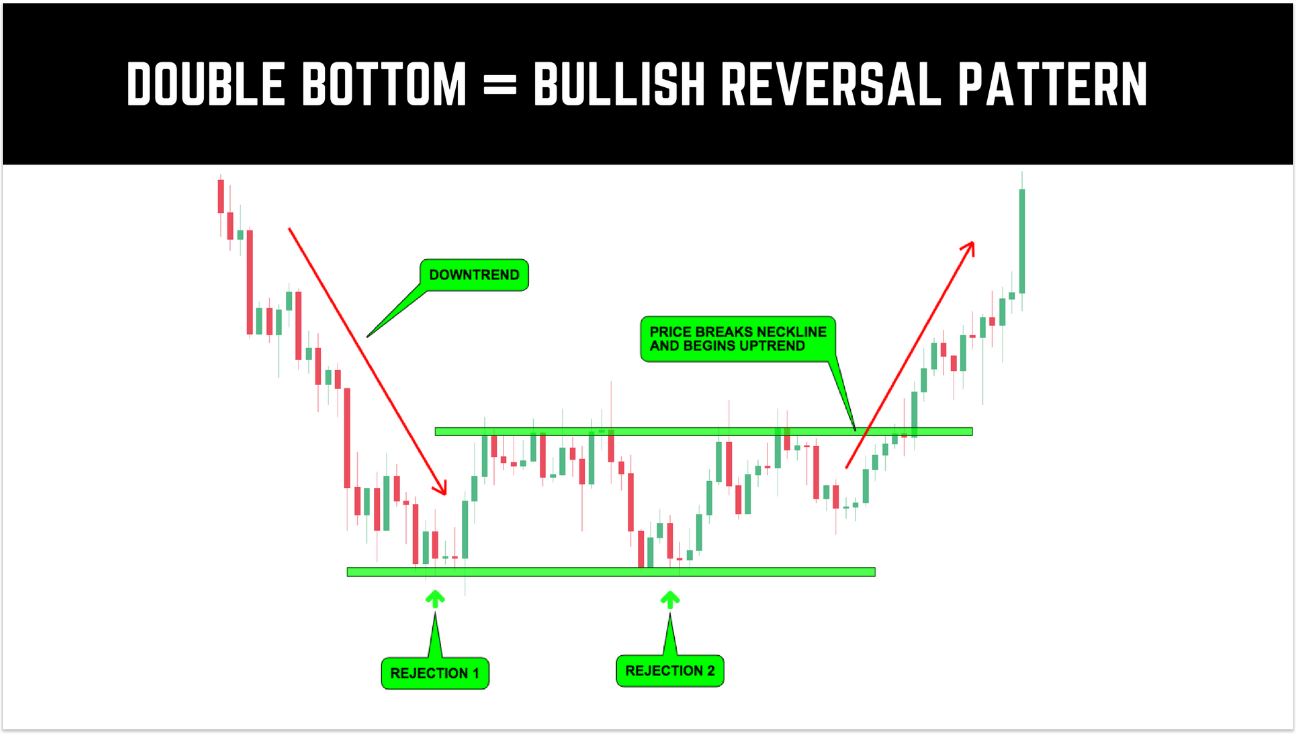

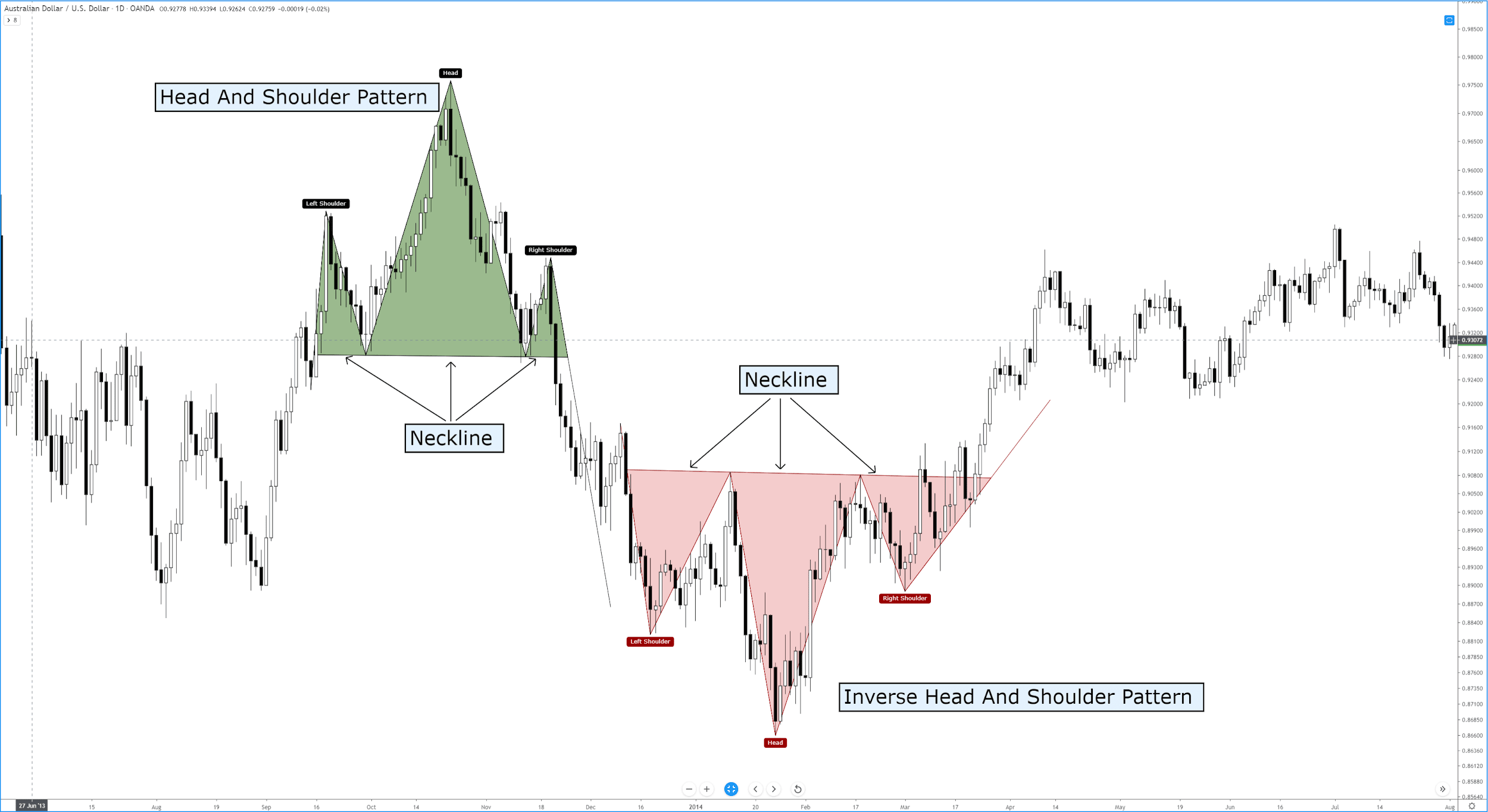

Most Successful Chart Patterns - They are a crucial part of technical analysis because they guide traders on what trades to make. But what is a chart pattern trading strategy? Web head and shoulders pattern: These are traditional chart patterns, harmonic patterns and candlestick patterns (which can only be identified on candlestick charts). For example, price channels and pennants both suggest that the price will continue moving in the same direction as the trend. Published research shows the most reliable and profitable stock chart patterns are the inverse head and shoulders, double bottom, triple bottom, and descending triangle. Web there are three types of chart patterns: Each has a proven success rate of over 85%, with an average gain of 43%. Web 22 december 2023 by steve curran. Web identify the various types of technical indicators including, trend, momentum, volume, and support and resistance. These are traditional chart patterns, harmonic patterns and candlestick patterns (which can only be identified on candlestick charts). For example, price channels and pennants both suggest that the price will continue moving in the same direction as the trend. It’s the one in the training that i referred to as the “world record pattern.” that is, of course, the bull. Web 22 december 2023 by steve curran. Web as we can see, the double bottom is a slightly more effective breakout pattern than the double top, reaching its target 78.55% of the time compared to 75.01%. Web identify the various types of technical indicators including, trend, momentum, volume, and support and resistance. Each type provides valuable insights into market trends. Web there are three key chart patterns used by technical analysis experts. Web there are three types of chart patterns: Web identify the various types of technical indicators including, trend, momentum, volume, and support and resistance. Chart patterns are clear and distinctive chart formation patterns. Each type provides valuable insights into market trends and potential trading opportunities. Do you know that the majority of chart patterns have a win rate of less than 40%? Web triangles are among the most popular chart patterns used in technical analysis since they occur frequently compared to other patterns. They are an integral aspect of technical analysis, especially for discretionary traders. The good thing about these patterns is that they very. Web there are three types of chart patterns: Identifying chart patterns with technical analysis. There is no one ‘best’ chart pattern, because they are all used to highlight different trends in a huge variety of markets. These are traditional chart patterns, harmonic patterns and candlestick patterns (which can only be identified on candlestick charts). Published research shows the most reliable. There is no one ‘best’ chart pattern, because they are all used to highlight different trends in a huge variety of markets. The head and shoulders pattern is considered one of the most reliable chart patterns and is used to identify possible trend reversals. Triple top pattern (77.59%) 3b. With that in mind, we’ll start with the very first chart. Uncovering underutilized and profitable chart patterns. The rectangle top is the. These are traditional chart patterns, harmonic patterns and candlestick patterns (which can only be identified on candlestick charts). At basic, these visual chart formations that repeatedly appear on trading charts are an excellent tool for traders to enter and exit trades with a reasonably high probability of success by. Each has a proven success rate of over 85%, with an average gain of 43%. At basic, these visual chart formations that repeatedly appear on trading charts are an excellent tool for traders to enter and exit trades with a reasonably high probability of success by integrating. Web as we can see, the double bottom is a slightly more effective. Trading strategies and market analysis. Each has a proven success rate of over 85%, with an average gain of 43%. Web by oddmund groette april 7, 2024 technical analysis. Web there are three types of chart patterns: Web what are the most successful chart patterns in trading? Web what are the most successful chart patterns in trading? ☆ research you can trust ☆. Trading strategies and market analysis. Use charts and learn chart patterns through specific examples of important patterns in bar and candlestick charts. There is no one ‘best’ chart pattern, because they are all used to highlight different trends in a huge variety of markets. Web what are the most successful chart patterns in trading? Identifying chart patterns with technical analysis. Web 22 december 2023 by steve curran. With that in mind, we’ll start with the very first chart pattern you must know. The head and shoulders pattern is considered one of the most reliable chart patterns and is used to identify possible trend reversals. These patterns are formed by price movements and provide valuable insights into market trends and potential future price movements. At basic, these visual chart formations that repeatedly appear on trading charts are an excellent tool for traders to enter and exit trades with a reasonably high probability of success by integrating. Mitigating risk and enhancing profitability with chart patterns. For example, price channels and pennants both suggest that the price will continue moving in the same direction as the trend. It’s the one in the training that i referred to as the “world record pattern.” that is, of course, the bull flag pattern. They are a crucial part of technical analysis because they guide traders on what trades to make. Chart patterns are an invaluable tool for traders to navigate the unpredictable market. Web research shows that the most reliable chart patterns are the head and shoulders, with an 89% success rate, the double bottom (88%), and the triple bottom and descending triangle (87%). See our list of essential trading patterns to get your technical analysis started. Some of the most successful chart patterns in trading include the head and shoulders pattern, double top and double bottom patterns, triangle patterns, the cup and handle pattern, and the flag and pennant patterns. Web there are three key chart patterns used by technical analysis experts.:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-02-59df8834491946bcb9588197942fabb6.jpg)

Introduction to Stock Chart Patterns (2022)

Chart Patterns for Successful Trading TRESORFX

Chart Patterns Cheat Sheet [FREE Download], 47 OFF

Most Successful Chart Patterns for Stock Option and Forex Traders

How to Trade Chart Patterns with Target and SL Forex GDP

19 Chart Patterns PDF Guide ForexBee

8 Most Successful Chart Patterns SGX NIFTY

Top 10 Forex Chart Patterns Every Trader Should Know

:max_bytes(150000):strip_icc()/dotdash_Final_Most_Commonly_Used_Forex_Chart_Patterns_Jun_2020-01-a6be7f7fd3124918a519946fead796b8.jpg)

Most Commonly Used Forex Chart Patterns

10 Day Trading Patterns for Beginners Trade180 Technical Indicators

Web There Are Three Types Of Chart Patterns:

But What Is A Chart Pattern Trading Strategy?

Web Many People Think Of Chart Patterns As Bullish Or Bearish But There Are Really Three Main Types Of Chart Pattern Groups:

O'neil Shows 100 Charts Of The.

Related Post: