Most Accurate Candlestick Patterns

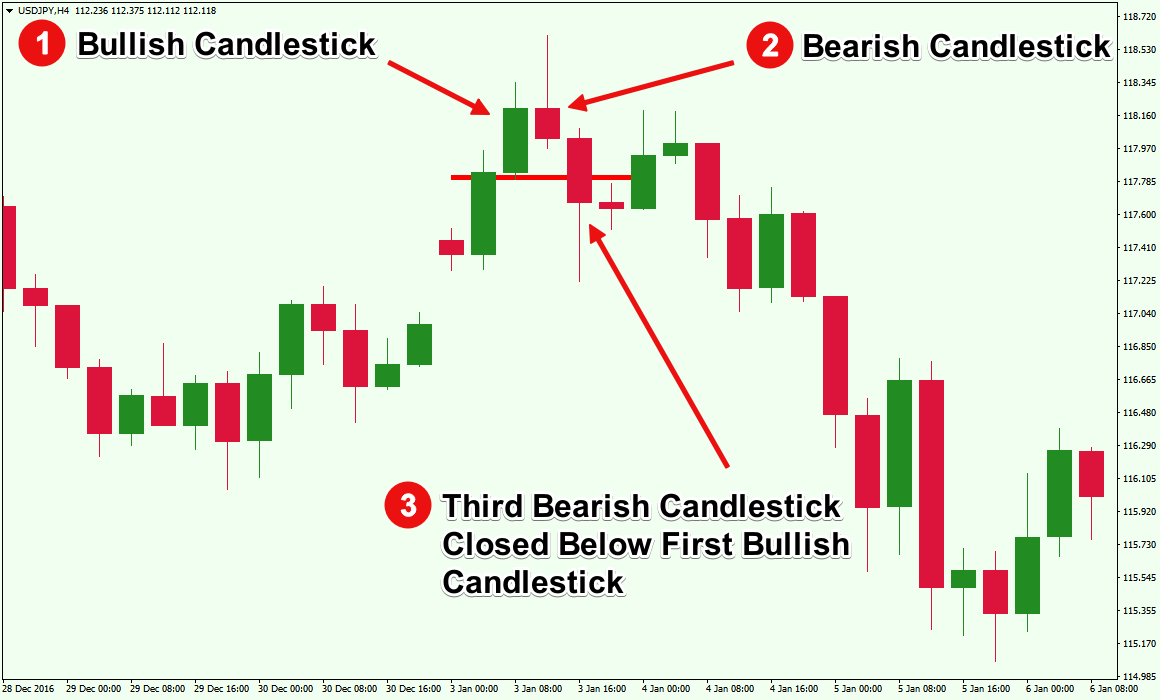

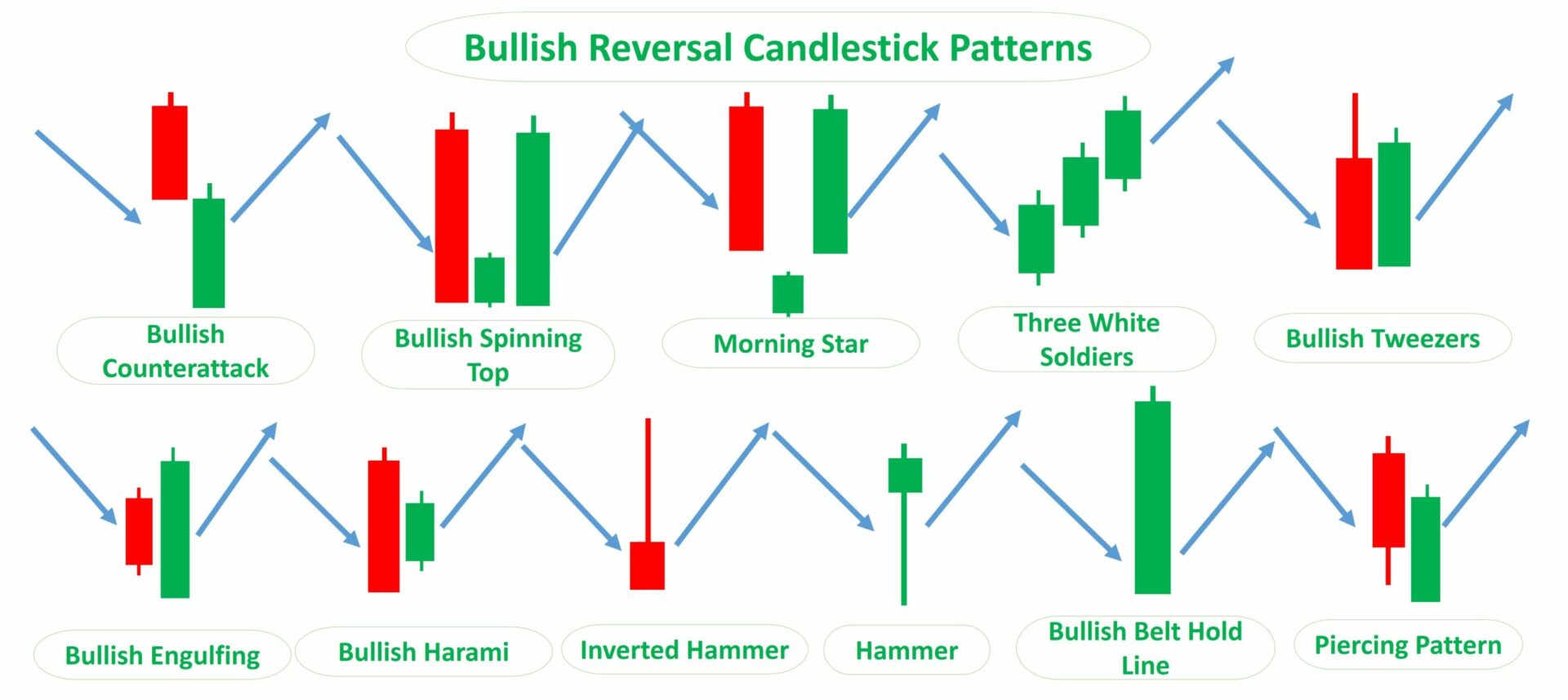

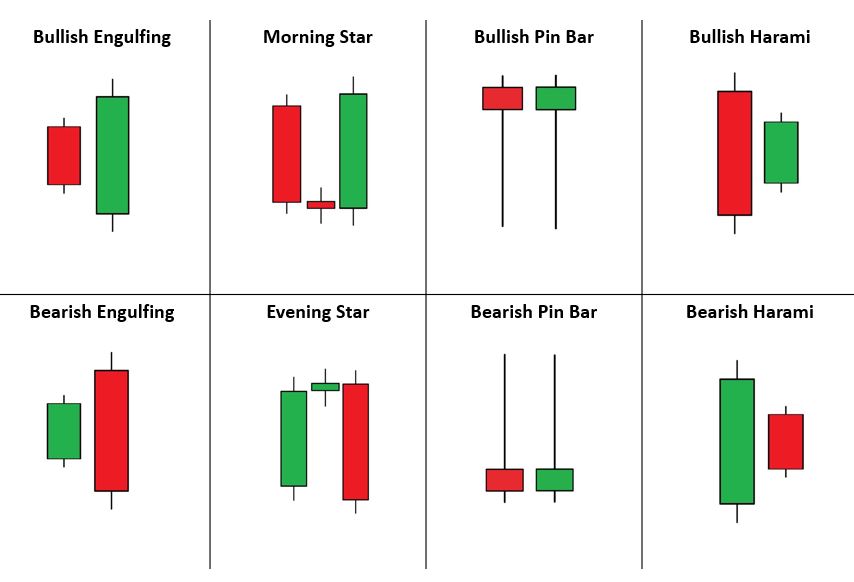

Most Accurate Candlestick Patterns - As you’ll soon find out, different candlestick patterns work in different markets. For a complete list of bullish (and bearish) reversal patterns, see greg morris' book, candlestick charting explained. Introduction to 35 candlestick patterns. Used as a bullish signal, it has a 60% success rate and an average win of 4.2%, based on 588 years of data. Candlestick patterns are visual representations of price movements within a specific. But second, and perhaps most importantly, it occurs very frequently in the markets, making it a highly tradable pattern. Chart candles, or candlestick charts, are a type of financial chart used to describe price movements of an asset, usually over time. The inverted hammer has a 60% success rate, followed by the bearish marubozu (56.1%), gravestone doji (57%), and. These patterns emerge from the open, high, low, and close prices of a security within a given period and are crucial for making informed trading decisions. A candlestick chart is a method of displaying the historical price movement of an asset over time. For a complete list of bullish (and bearish) reversal patterns, see greg morris' book, candlestick charting explained. A small candle with a small body follows, before a strong candle in the direction opposite to the previous trend occurs. Top 10 candlestick patterns traders should know. Invesco db commodity index tracking fund historical. As technical analysis has become more and more. Chart candles, or candlestick charts, are a type of financial chart used to describe price movements of an asset, usually over time. Top 10 candlestick patterns traders should know. Each candlestick represents a certain period, depending on the time frame selected by the trader. Web the best candlestick patterns. Used as a bullish signal, it has a 60% success rate. Web get my guide. Web morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. A candlestick chart is a method of displaying the historical price movement of an asset over time. If you are familiar with the bearish “hanging man”, you’ll notice that the hammer looks very similar. Candlestick. Candlestick patterns are like building blocks in understanding how the stock market behaves and how prices might change. Three advancing white soldiers (aws) final tip. The ultimate guide to candlestick patterns. These patterns emerge from the open, high, low, and close prices of a security within a given period and are crucial for making informed trading decisions. Candlestick patterns are. This is because each market has its own personality. Shop best sellersshop our huge selectiondeals of the dayfast shipping However, there are other commonly used and important single candlestick patterns you must consider in trading. Take a look at the historical performance of the stock market vs. Candlestick patterns are like building blocks in understanding how the stock market behaves. Web morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. A candlestick chart is a method of displaying the historical price movement of an asset over time. Web some of the most popular candlestick patterns include the hammer, three white soldiers and spinning top. These patterns emerge from the. This article will focus on the other six patterns. Three advancing white soldiers (aws) final tip. Learn how to use candlestick charts to predict price direction and identify reversal patterns. Chart candles, or candlestick charts, are a type of financial chart used to describe price movements of an asset, usually over time. Top 10 candlestick patterns traders should know. This article will focus on the other six patterns. Take a look at the historical performance of the stock market vs. The context is a steady or oversold downtrend. However, there are other commonly used and important single candlestick patterns you must consider in trading. As you’ll soon find out, different candlestick patterns work in different markets. A small candle with a small body follows, before a strong candle in the direction opposite to the previous trend occurs. However, there are other commonly used and important single candlestick patterns you must consider in trading. Used as a bullish signal, it has a 60% success rate and an average win of 4.2%, based on 588 years of data.. Blog technical analysis the ultimate guide to candlestick patterns. The inverted hammer has a 60% success rate, followed by the bearish marubozu (56.1%), gravestone doji (57%), and. However, there are other commonly used and important single candlestick patterns you must consider in trading. This article will focus on the other six patterns. Our research identified the best candestick patterns based. The ultimate guide to candlestick patterns. How to read candlestick patterns for trading. Top 10 candlestick patterns traders should know. Candlestick patterns are key indicators on financial charts, offering insights into market sentiment and price movements. 25, 2023 11 min read. First, it has a 68% accuracy rate; Blog technical analysis the ultimate guide to candlestick patterns. Knowing about these patterns can really help you make smarter decisions when trading. Web the evening star and morning star are two of the most common candlestick patterns in forex to trade reversals. Predicting candlesticks is crucial for anticipating market trends and making informed investment decisions. Three advancing white soldiers (aws) final tip. They start with a candle in the direction of a trend. Interpretability is essential to understand the rationale behind model predictions, particularly in complex financial environments. Our research identified the best candestick patterns based on 58,680 test trades. But as the saying goes, context is everything. Web the best candlestick patterns.![Candlestick Patterns The Definitive Guide [UPDATED 2022]](https://www.alphaexcapital.com/wp-content/uploads/2020/04/Bullish-Harami-Candlestick-Patterns-Example-by-Alphaex-Capital-1030x1030.png)

Candlestick Patterns The Definitive Guide [UPDATED 2022]

.png)

4 Powerful Candlestick Patterns Every Trader Should Know

BEST Candlestick Patterns for Intraday Trading (Scalping & Day Trading

10 Mostused Candlestick Patterns Explained in 5 minutes YouTube

Most Reliable Candlestick Pattern

3 Most Reliable Candlestick Chart Patterns Investor Scene Riset

Candlestick Patterns The Definitive Guide (2021)

Top Reversal Candlestick Patterns

Top 4 Candlestick Patterns With The Highest Probability In Olymp Trade

The Most Reliable Candlestick Patterns You Must Know

See Examples Of Doji, Engulfing Lines, Hammer, Hanging Man, And Aba…

However, There Are Other Commonly Used And Important Single Candlestick Patterns You Must Consider In Trading.

Hammer Candlesticks Patterns Explained & Reliability Tested.

Web Over Time, Groups Of Daily Candlesticks Fall Into Recognizable Patterns With Descriptive Names Like Three White Soldiers, Dark Cloud Cover, Hammer, Morning Star, And Abandoned Baby, To Name.

Related Post: