Morning Start Pattern

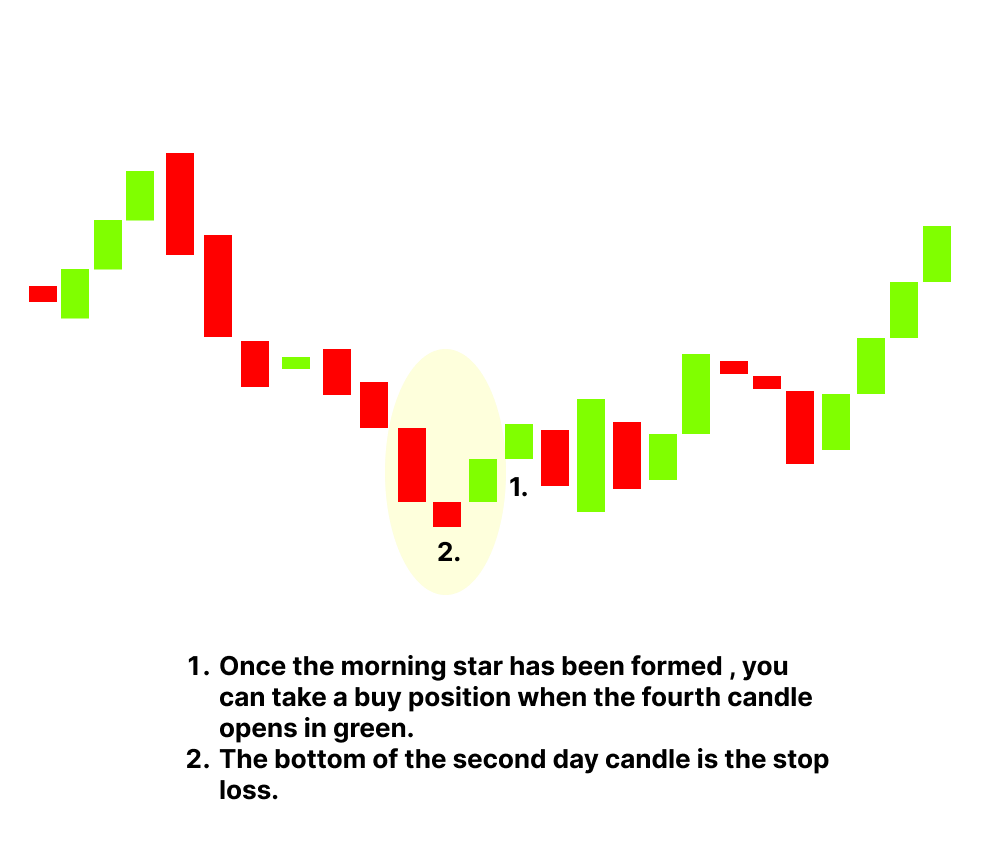

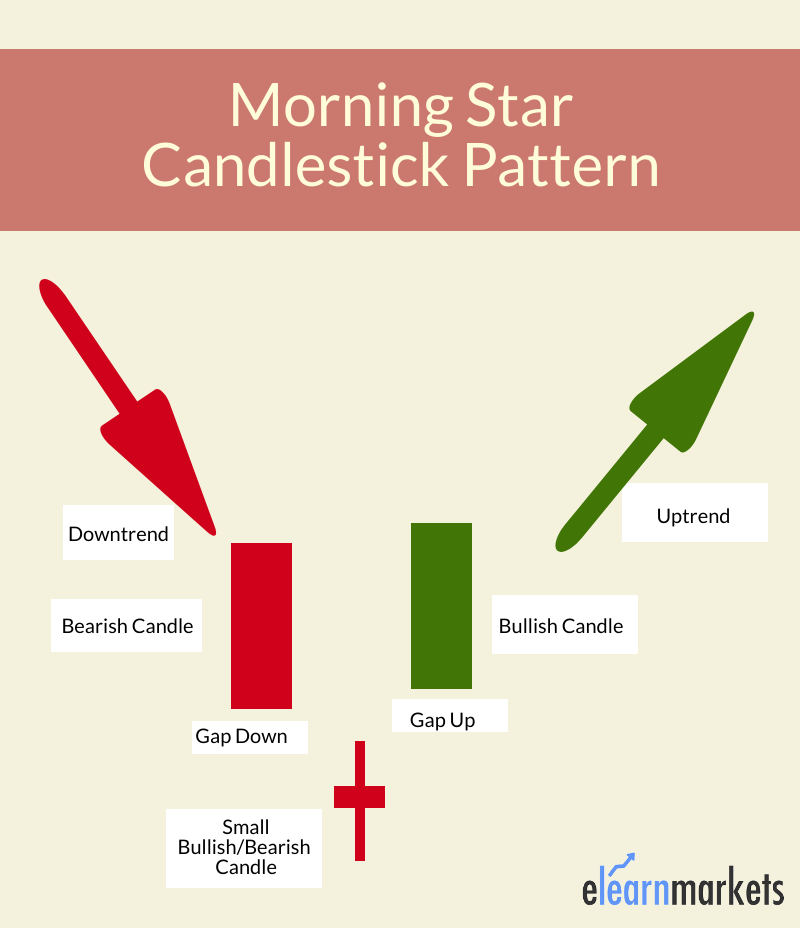

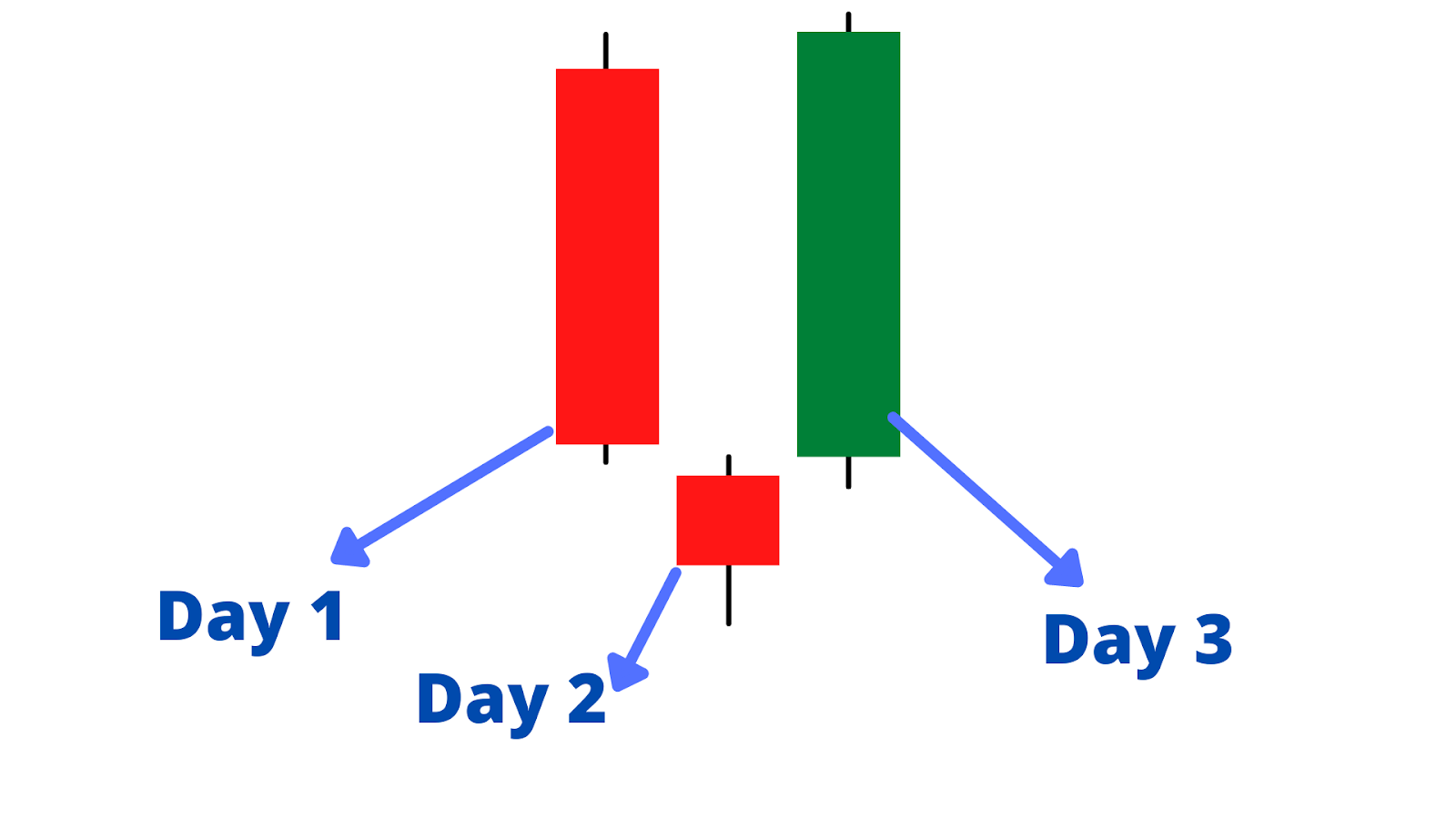

Morning Start Pattern - It reveals a slowing down of downward momentum before a large. It is a pattern in a similar class to the other formations like doji, hanging man, hammer, and evening star that we have looked at before. Web the morning star pattern is considered a strong indication of a potential bullish price reversal. It typically occurs at the end of a downtrend and signals a potential trend reversal. The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. Four elements to consider for a morning star formation. The first candle is bearish and followed by a doji that gaps down. It is a bullish reversal pattern. Web a morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. This powerful pattern, often spotted at the trough of a downward trend, can alert traders to a possible trend reversal, opening the door for bullish market opportunities. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. The first candle is bearish and followed by a doji that gaps down. Web we will have mainly cloudy skies today, with rain possible at times throughout the day, with rain chances really increasing in the evening and overnight hours. It. Web the morning star is a bullish reversal pattern that occurs at the bottom of a downtrend. It consists of a bearish candlestick followed by a doji star and then a strong bullish candle. Does not need to form with gaps, but can. Its formation consists of three candles in a specific sequence, symbolizing a shift from bearish to bullish. Wednesday and thursday turn nice. The morning star pattern is a visual representation of a shift in market sentiment from bearish to bullish. The following day a tall white candle signals the reversal of the downtrend when its body gaps above the star's body. 5/5 (110k reviews) Web the morning star [1] is a pattern seen in a candlestick chart,. If this pattern forms at the top of an uptrend, it may signal a reversal to the downside if it's at previous resistance levels. Web we will have mainly cloudy skies today, with rain possible at times throughout the day, with rain chances really increasing in the evening and overnight hours. It occurs at the base of a downtrend and. Long black candle, black candle, black marubozu, opening black marubozu, closing black marubozu. Web the morning star pattern is a bullish reversal pattern that consists of three candlesticks. This pattern is widely used by traders and analysts to predict future price movements. Web the morning star pattern is a series of three candlesticks on a market’s chart that indicate an. Trump leads president biden in five crucial battleground states, a new set of polls shows, as a yearning for change and discontent over the economy and the war in gaza among young, black. The pattern got the name because just like the planet mercury, which is the star of early morning i.e. Combining the morning star with technical indicators like. Web the morning star candlestick appears circled in red on the daily scale. If this pattern forms at the top of an uptrend, it may signal a reversal to the downside if it's at previous resistance levels. Trump leads president biden in five crucial battleground states, a new set of polls shows, as a yearning for change and discontent over. May 13, 2024 | last updated. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. It typically occurs at the end of a downtrend and signals a potential trend reversal. However, we will see a lull in the active pattern for your thursday evening. Wasn't the only. May 13, 2024 | last updated. This pattern indicates a trend reversal from down to up. This means if this pattern gets formed at the bottom of the downtrend, then it reverses the trend to up. Web we will have mainly cloudy skies today, with rain possible at times throughout the day, with rain chances really increasing in the evening. A morning star forms following a downward trend and it. Sunday should dry back out. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. This means if this pattern gets formed at the bottom of the downtrend, then it reverses the trend to up. Morning star is a bullish candlestick. Web table of contents. However, we will see a lull in the active pattern for your thursday evening. The stormy pattern returns friday and saturday. The following day a tall white candle signals the reversal of the downtrend when its body gaps above the star's body. The first candle is bearish and followed by a doji that gaps down. The pattern consists of a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. Morning star is a bullish candlestick pattern. If you have midday brunch plans, the. Web the morning star pattern is a bullish reversal pattern that consists of three candlesticks. It consists of a bearish candlestick followed by a doji star and then a strong bullish candle. The morning star pattern is a visual representation of a shift in market sentiment from bearish to bullish. Web we will have mainly cloudy skies today, with rain possible at times throughout the day, with rain chances really increasing in the evening and overnight hours. Check out the latest details below. Combining the morning star with technical indicators like bollinger bands and rsi can enhance its reliability. Sunday should dry back out. This pattern is widely used by traders and analysts to predict future price movements.

How To Trade Blog Morning Star Candlestick Pattern How To Trade and

Morning Star Candlestick Pattern Meaning, Definition & Examples

What Is Morning Star Candlestick? Formation & Uses ELM

Morning Star Pattern How to Identify a Bullish Reversal in Crypto

What Is Morning Star Candlestick Pattern? How To Use In Trading How

What Is Morning Star Candlestick Pattern? How To Use In Trading How

What Is Morning Star Candlestick Pattern? How To Use In Trading How

Morning Star Pattern A Guide to Trading This Bullish Reversal Pattern

What Is Morning Star Candlestick Pattern? How To Use In Trading How

Morning Star Candlestick Pattern definition and guide

Shop Our Huge Selectionshop Best Sellersfast Shippingdeals Of The Day

May 13, 2024 | Last Updated.

A Morning Star Forms Following A Downward Trend And It.

Web The Morning Star Is A Bullish Reversal Pattern That Occurs At The Bottom Of A Downtrend.

Related Post: