Morning Star Pattern

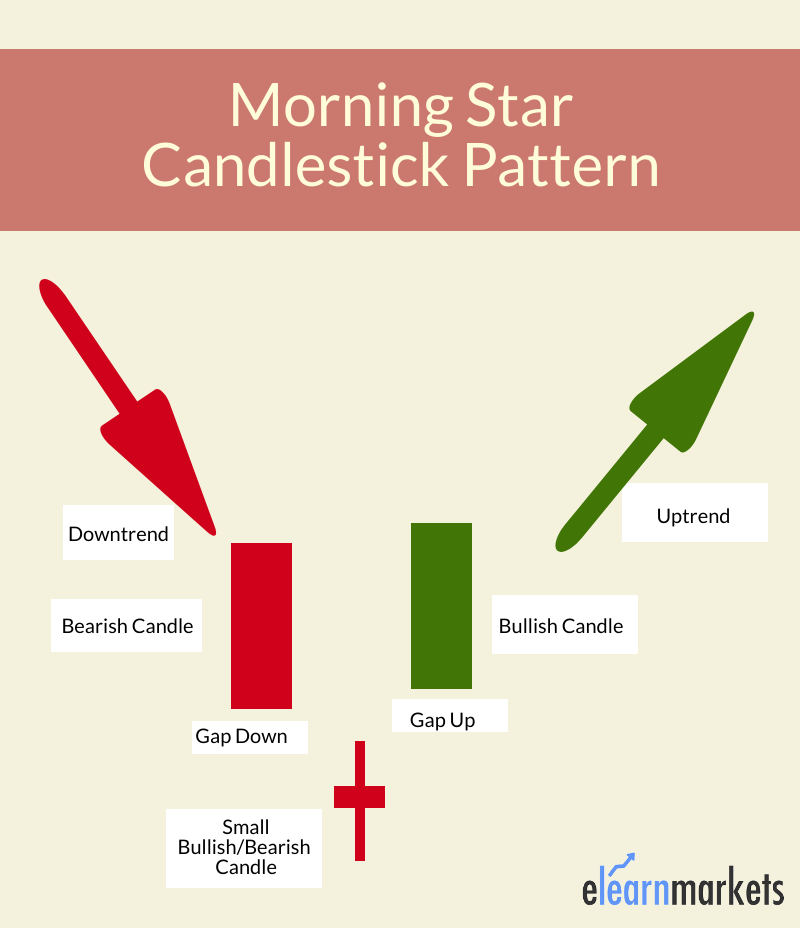

Morning Star Pattern - Web a morning star is a bullish candlestick pattern in a price chart. It consists of three candles and is generally seen as a sign of a potential recovery following a downtrend. Explore amazon devicesread ratings & reviewsfast shippingdeals of the day How reliable is the morning star in forex trading? Exclusive designsfree pattern downloadsnow shipping worldwide If this pattern forms at the top of an uptrend, it may signal a reversal to the downside if it's at previous resistance levels. Web the morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. It occurs at the base of a downtrend and signals a new uptrend may form. How to trade the morning star pattern; How reliable is the morning star in forex trading? Web a morning star is a bullish candlestick pattern in a price chart. It usually emerges in times of market gloom, hinting at a possible shift from bearish to bullish momentum. How to trade the morning star pattern; Web the morning star candlestick pattern is easily recognizable on a chart since. Exclusive designsfree pattern downloadsnow shipping worldwide Explore amazon devicesread ratings & reviewsfast shippingdeals of the day If this pattern forms at the top of an uptrend, it may signal a reversal to the downside if it's at previous resistance levels. How to identify a morning star on forex charts; It occurs at the base of a downtrend and signals a. How to trade the morning star pattern; Web a morning star is a bullish candlestick pattern in a price chart. Web what is a morning star candlestick? It consists of a bearish candle, a short doji that gaps down, and a bullish candle that gaps up, signaling a potential reversal from a bearish to a bullish trend. How to identify. How to identify a morning star on forex charts; If this pattern forms at the top of an uptrend, it may signal a reversal to the downside if it's at previous resistance levels. How to trade the morning star pattern; Exclusive designsfree pattern downloadsnow shipping worldwide It occurs at the base of a downtrend and signals a new uptrend may. It consists of three candles and is generally seen as a sign of a potential recovery following a downtrend. Web the morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. It. It usually emerges in times of market gloom, hinting at a possible shift from bearish to bullish momentum. How reliable is the morning star in forex trading? How to trade the morning star pattern; It occurs at the base of a downtrend and signals a new uptrend may form. The first candlestick drops with a gap down, followed by the. How to identify a morning star on forex charts; It consists of three candles and is generally seen as a sign of a potential recovery following a downtrend. It consists of a bearish candle, a short doji that gaps down, and a bullish candle that gaps up, signaling a potential reversal from a bearish to a bullish trend. If this. Explore amazon devicesread ratings & reviewsfast shippingdeals of the day How to trade the morning star pattern; Exclusive designsfree pattern downloadsnow shipping worldwide How reliable is the morning star in forex trading? It occurs at the base of a downtrend and signals a new uptrend may form. It consists of a bearish candle, a short doji that gaps down, and a bullish candle that gaps up, signaling a potential reversal from a bearish to a bullish trend. It occurs at the base of a downtrend and signals a new uptrend may form. It usually emerges in times of market gloom, hinting at a possible shift from bearish. The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. How reliable is the morning star in forex trading? Web what is a morning star candlestick? It occurs at the base of a downtrend and signals a new uptrend. If this pattern forms at the top of an uptrend, it may signal a reversal to the downside if it's at previous resistance levels. Web the morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. It occurs at the base of a downtrend and signals a new uptrend may form. Web what is a morning star candlestick? It consists of three candles and is generally seen as a sign of a potential recovery following a downtrend. Explore amazon devicesread ratings & reviewsfast shippingdeals of the day Web a morning star is a bullish candlestick pattern in a price chart. It usually emerges in times of market gloom, hinting at a possible shift from bearish to bullish momentum. Exclusive designsfree pattern downloadsnow shipping worldwide Web a morning star pattern is a bullish reversal pattern. How reliable is the morning star in forex trading? Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks.

What Is Morning Star Candlestick Pattern? How To Use In Trading How

Morning Star Candlestick Pattern How To Trade and Win Forex With It

What Is Morning Star Candlestick Pattern? How To Use In Trading How

What Is Morning Star Candlestick? Formation & Uses ELM

What Is Morning Star Candlestick Pattern? How To Use In Trading How

What Is Morning Star Candlestick Pattern? How To Use In Trading How

Morning Star Candlestick Pattern definition and guide

Morning Star Candlestick Pattern How to Identify Perfect Morning Star

Understanding The Morning Star Candlestick Pattern InvestoPower

What Is Morning Star Candlestick Pattern? How To Use In Trading How

How To Identify A Morning Star On Forex Charts;

How To Trade The Morning Star Pattern;

It Consists Of A Bearish Candle, A Short Doji That Gaps Down, And A Bullish Candle That Gaps Up, Signaling A Potential Reversal From A Bearish To A Bullish Trend.

The First Candlestick Drops With A Gap Down, Followed By The Third Candlestick, Which Is Followed By A Gap Up To The Third And Final Candlestick Of The Morning Star Index.

Related Post: