Morning Star Pattern Stocks

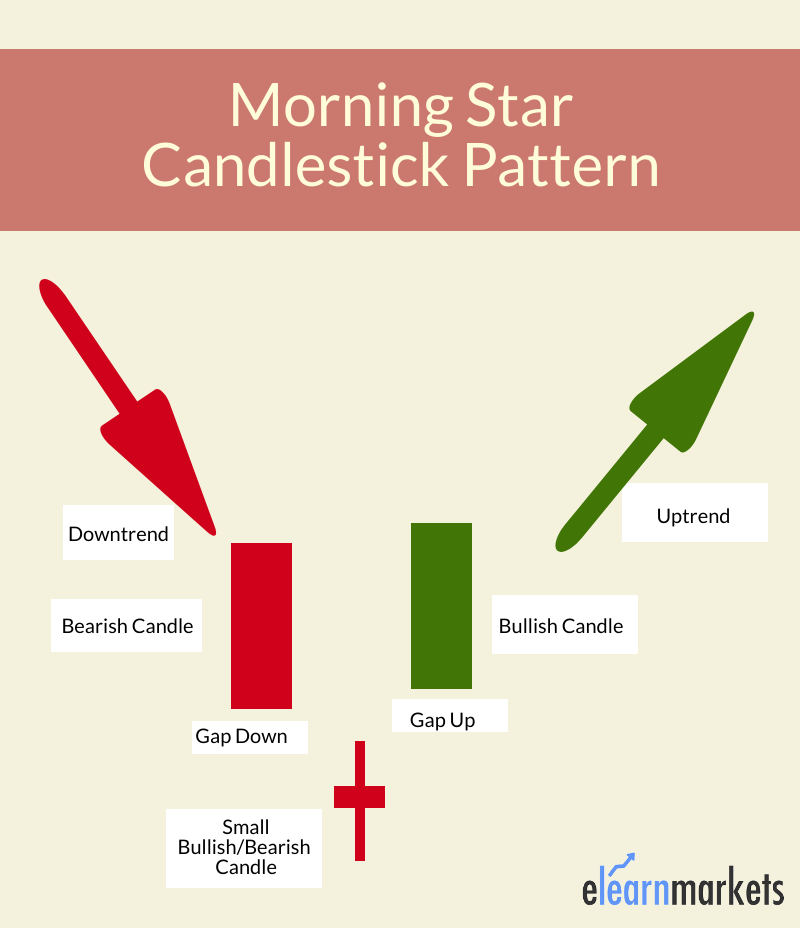

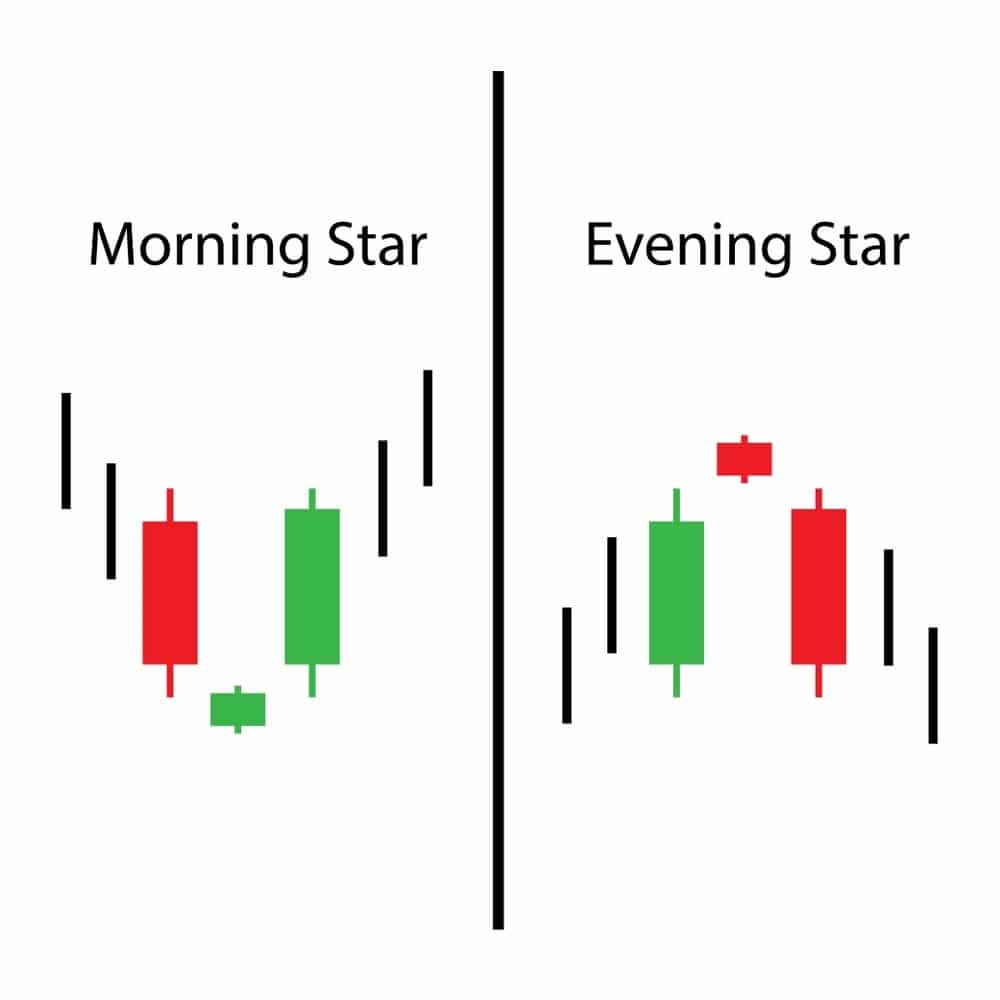

Morning Star Pattern Stocks - Then we have a third white candlestick whose closing is well into the first session’s black body. Vanguard total stock market etf vti. The pattern has three candles: Web the morning star candlestick pattern is a common bullish pattern used by price action traders. Scanner guide scan examples feedback. Traders watch for the formation of a morning star and then seek confirmation that a reversal is indeed occurring. Unlike the historical morningstar rating for funds (or “star rating”), the. One pattern that has proven to be highly effective in identifying potential reversals and profit. It tends to be more dependable in longer timeframes like daily or weekly charts, where each candlestick reflects a wider range of trading data and reduces the ‘noise’ common in shorter time frames. Vanguard s&p 500 etf voo. The bullish reversal pattern consists of the following three candlesticks: It is composed of a black candlestick followed by a short candlestick, which characteristically gaps down to form a star. The second candle is a small one that opens and closes below the first candle, creating a gap. The following day a tall white candle signals the reversal of the. The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning star index. Traders watch for the formation of a morning star and then seek confirmation that a reversal is indeed occurring. A two candle signal, indicating a radical change in investor. The morning star consists of three candlesticks with the middle candlestick forming a star. The bullish reversal pattern consists of the following three candlesticks: The morning star is a bullish reversal pattern that forms following a downward trend and indicates a reversal in the previous price trend. It is a pattern in a similar class to the other formations like. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. This one is in a downward price trend when the stock creates a tall black candle. Fact checked by lucien bechard. Morning star candlestick is a triple candlestick pattern that indicated bullish reversal. Web 7 min read. This pattern is composed of three candlesticks, with the first one being a tall bearish candle. One pattern that has proven to be highly effective in identifying potential reversals and profit. The first candlestick drops with a gap down, followed by the third candlestick, which is followed by a gap up to the third and final candlestick of the morning. If you use japanese candlestick charting techniques, you might be surprised to learn the data shows traditional morning star trading strategies only work in the crypto markets. A closing white marubozu formed at a high trading volume indicates the strength of the bulls, however, they still have to break a resistance set up. Vanguard s&p 500 etf voo. Fact checked. This pattern is composed of three candlesticks, with the first one being a tall bearish candle. The bulls control the stock, and the price moved back above a trendline. It is composed of a black candlestick followed by a short candlestick, which characteristically gaps down to form a star. After a long red body, we see a downside gap to. Web a morning star candlestick pattern is a reversal pattern that forms after a downtrend. Scanner guide scan examples feedback. It is formed at the bottom of a downtrend and it gives us a warning sign that the ongoing downtrend is going to reverse. Scanner guide scan examples feedback. Web the morning star candlestick appears circled in red on the. However, its reliability varies across timeframes. Fact checked by lucien bechard. Vanguard total stock market etf vti. The bulls control the stock, and the price moved back above a trendline. Web a morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. A closing white marubozu formed at a high trading volume indicates the strength of the bulls, however, they still have to break a resistance set up. Web the morning star candlestick pattern is a common bullish pattern used by price action traders. The evening star pattern is a signal of a potential top in the market. The pattern begins with. Traders watch for the formation of a morning star and then seek confirmation that a reversal is indeed occurring. It warns of weakness in a downtrend that could potentially lead to a trend reversal. Web the morning star candlestick pattern is a common bullish pattern used by price action traders. Unlike the historical morningstar rating for funds (or “star rating”), the. It is aptly called a morning star because it appears just before the sun rises (in the form of higher prices). The morning star is a bullish reversal pattern that forms following a downward trend and indicates a reversal in the previous price trend. Web the morning star pattern is versatile, effective in different markets such as stocks and forex. After a long red body, we see a downside gap to a small real body. After a long red body, we see a downside gap to a small real body. This pattern is composed of three candlesticks, with the first one being a tall bearish candle. Fact checked by lucien bechard. Web 7 min read. Web the ‘morning star’ candlestick pattern is effective in a downward trending market and signals bullish trend reversal on the charts. Web the morning star candlestick pattern is a price action analysis tool used to identify potential trend reversals on the price charts. A two candle signal, indicating a radical change in investor sentiment towards the bullish side. Web the morning star candlestick pattern is a signal of a potential bottom in the market.

What Is Morning Star Candlestick Pattern? How To Use In Trading How

What Is Morning Star Candlestick? Formation & Uses ELM

How To Trade Blog Morning Star Candlestick Pattern How To Trade and

Morning Star Pattern A Guide to Trading This Bullish Reversal Pattern

What Is Morning Star Candlestick Pattern? How To Use In Trading How

What Is Morning Star Candlestick Pattern? How To Use In Trading How

A Tutorial On The Morning Star Candlestick Pattern Forex Training Group

RAVIN 5th Candlestick pattern /Morning Star Candlestick Pattern

What Is Morning Star Candlestick Pattern? How To Use In Trading How

:max_bytes(150000):strip_icc()/dotdash_Final_Morning_Star_Definition_Jun_2020-01-a6d5241bc649403aa86f394d5a2430a7.jpg)

Morning Star Pattern A Guide to Trading This Bullish Reversal Pattern

Bullish Reversal Pattern In Which A Stock Which Had A Long White Body A 2 Days Ago, Then Opened Lower With A Doji A Day Ago And Finally Closed Above The Previous Day.

One Pattern That Has Proven To Be Highly Effective In Identifying Potential Reversals And Profit.

Morning Star Patterns Are Bullish Reversal Patterns.

Web The Morning Star Candlestick Pattern Is A Signal Of A Potential Bottom In The Market.

Related Post: