Morning Star Chart Pattern

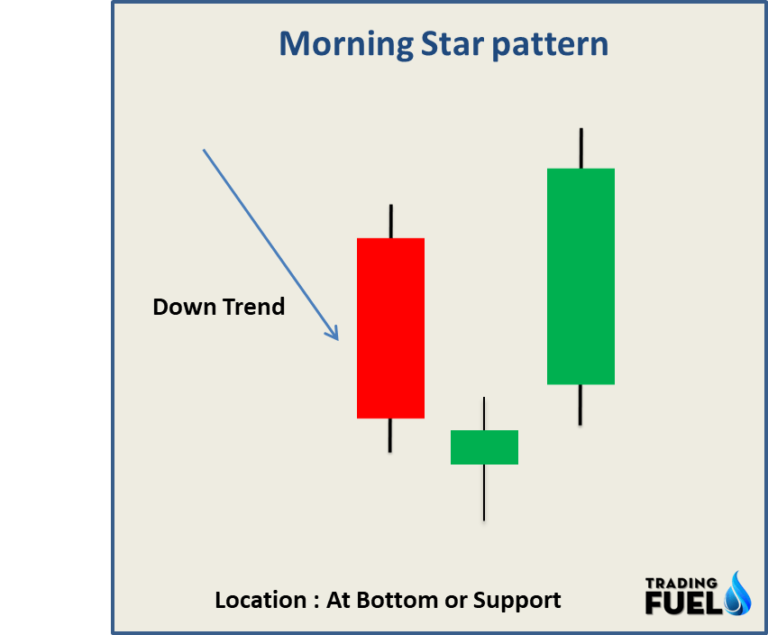

Morning Star Chart Pattern - Web morning star is a bullish candlestick pattern. Morning star candlestick is a triple candlestick pattern that indicated bullish reversal. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. Morning star has three candlestick patterns: The morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. The morning star pattern can be observed in the eur/gbp chart below, where there is an established downtrend leading up to the formation of the. After a long red body, we see a downside gap to a small real body. Morning star patterns are bullish reversal patterns. The pattern begins with a tall red (bearish) candlestick, followed by a smaller red or green candlestick with a short body and long. It is a downtrend reversal pattern. Web the morning star is a candlestick pattern that is comprised of three candles. Web the ‘morning star’ candlestick pattern is effective in a downward trending market and signals bullish trend reversal on the charts. The morning star pattern can be observed in the eur/gbp chart below, where there is an established downtrend leading up to the formation of the.. The morning star pattern can be observed in the eur/gbp chart below, where there is an established downtrend leading up to the formation of the. The significance of the pattern increases if the third day’s opening is below a support area. The pattern is formed by combining 3 consecutive candlesticks. Web updated 27 jul 2022. Web updated april 4, 2024. A morning star pattern appears in a short downtrend, within a support area formed by a rising window a few weeks earlier. Learn about morning star candles. It is a downtrend reversal pattern. Web a morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. Stock passes all of the below. Learn about morning star candles. Web a morning star is a three candle reversal candlestick pattern that forms after a downtrend. Find out why morning star patterns are important in trading, and how forex markets can react. It is considered a reversal pattern that calls for a price increase following a sustained downward trend. Web the morning star is a. The first candlestick is a long bearish candlestick, followed by a small bullish or bearish candlestick, and finally, a long bullish candlestick. Web a morning star is a candlestick pattern commonly used in forex trading to identify a potential bullish reversal in a downtrend. It is a downtrend reversal pattern. The pattern begins with a tall red (bearish) candlestick, followed. It is a downtrend reversal pattern. Web the morning star pattern is a series of three candlesticks on a market’s chart that indicate an upcoming bullish reversal. Web a morning star is a three candle reversal candlestick pattern that forms after a downtrend. Morning star has three candlestick patterns: A closing white marubozu formed at a high trading volume indicates. Find out why morning star patterns are important in trading, and how forex markets can react. This means if this pattern gets formed at the bottom of the downtrend, then it reverses the trend to up. Traders watch for the formation of a morning star and then seek confirmation that a reversal is indeed occurring. A big red candle, a. The morning star appears at the bottom end of a downtrend. The pattern begins with a tall red (bearish) candlestick, followed by a smaller red or green candlestick with a short body and long. Web morning star is a bullish candlestick pattern. Web a morning star is a candlestick pattern commonly used in forex trading to identify a potential bullish. The morning star is a bullish reversal pattern that forms following a downward trend and indicates a reversal in the previous price trend. A morning star pattern appears in a short downtrend, within a support area formed by a rising window a few weeks earlier. Web the morning star is a candlestick pattern that is comprised of three candles. In. This pattern is composed of three candlesticks, with the first one being a tall bearish candle. Web the morning star candlestick pattern is easily recognizable on a chart since it consists of three different candlesticks. A morning star forms following a downward trend and it. The first candle is a bearish candlestick. Web morning star candlestick pattern. Morning star patterns are bullish reversal patterns. Web the ‘morning star’ candlestick pattern is effective in a downward trending market and signals bullish trend reversal on the charts. It is a downtrend reversal pattern. The second candle is a small one that opens and closes below the first candle, creating a gap. The first candle is a bearish candlestick. The morning star is a bullish reversal pattern that forms following a downward trend and indicates a reversal in the previous price trend. A closing white marubozu formed at a high trading volume indicates the strength of the bulls, however, they still have to break a resistance set up. A morning star forms over three periods. Bullish reversal pattern in which a stock which had a long white body a 2 days ago, then opened lower with a doji a day ago and finally closed above the previous day. Web a morning star is a three candle reversal candlestick pattern that forms after a downtrend. The third candle gaps up and finishes as a big, positive candle. This pattern is composed of three candlesticks, with the first one being a tall bearish candle. Learn about morning star candles. Web the morning star is a candlestick pattern that is comprised of three candles. The morning star is a pattern seen in a candlestick chart, a popular type of a chart used by technical analysts to anticipate or predict price action of a security, derivative, or currency over a short period of time. The first candle is bearish and followed by a doji that gaps down.

What Is a Morning Star Candlestick Pattern? Trading Fuel

What Is The Morning Star Candlestick Pattern?

Morning Star Pattern A Guide to Trading This Bullish Reversal Pattern

A Tutorial On The Morning Star Candlestick Pattern Forex Training Group

How To Trade Blog Morning Star Candlestick Pattern How To Trade and

What Is Morning Star Candlestick Pattern? How To Use In Trading How

What Is Morning Star Candlestick Pattern? How To Use In Trading How

![]()

Morning Star Candlestick Pattern Trading Strategy Design Talk

What Is Morning Star Candlestick Pattern? How To Use In Trading How

Morning Star Candlestick Pattern definition and guide

Web Morning Star Is A Bullish Candlestick Pattern.

Fact Checked By Lucien Bechard.

Traders Watch For The Formation Of A Morning Star And Then Seek Confirmation That A Reversal Is Indeed Occurring.

Stock Passes All Of The Below Filters In Cash Segment:

Related Post: