Megaphone Chart Pattern

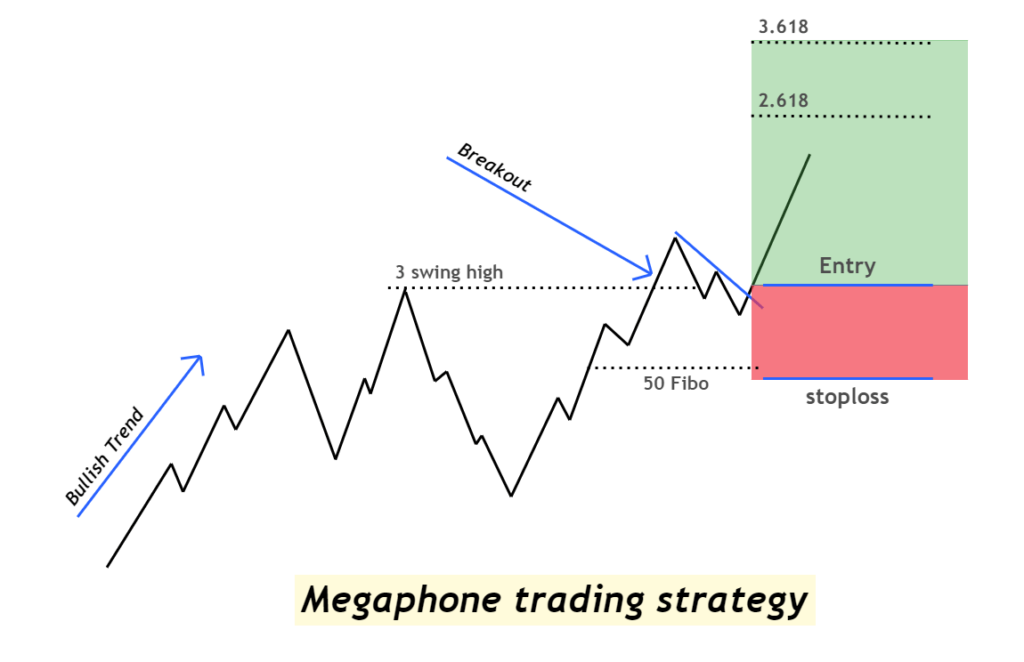

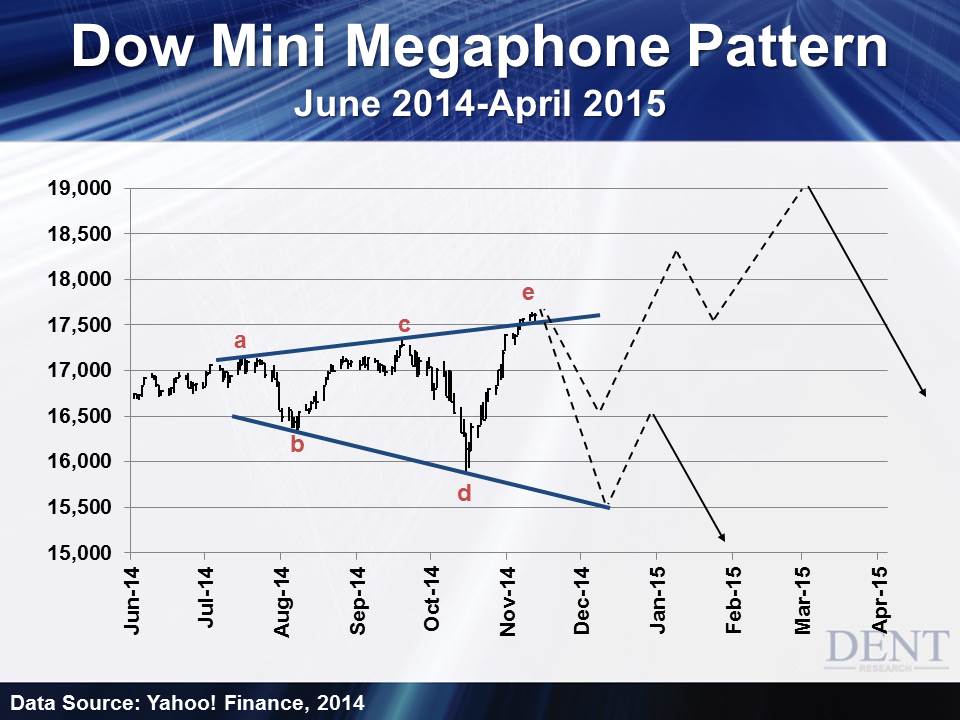

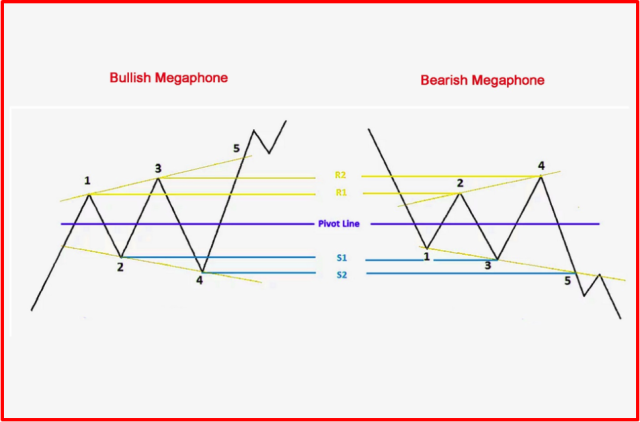

Megaphone Chart Pattern - The bullish pattern is confirmed when, usually on the third upswing, prices break above the prior high but fail to fall below this level again. Given the pattern's tendency for pullbacks, it's best. As prices rise, buyers are. It occurs at the top or bottom of the market. It is diagrammed as two diverging trend lines, one rising and one falling. Web a broadening top is a unique chart pattern resembling a reverse triangle or megaphone that signals significant volatility and disagreement between bullish and bearish investors. Though often seen as bearish due to its volatility and uncertainty, its historical performance makes it ambiguous. Web the megaphone pattern is a price action trading pattern that gets formed due to increasing volatility in prices. It consists of two trend lines diverging from each other in opposite directions. Web a megaphone pattern is a chart pattern that occurs when the price movement becomes volatile. The price targets in a megaphone breakout pattern are computed using the fibonacci ratio of the pattern height (vertical distance) added from the breakout levels. It is represented by two lines, one ascending and one descending, that diverge from each other. A megaphone pattern occurs in a stock chart when there are at least two higher highs and lower lows.. Web the pattern can get displayed as a bullish or bearish megaphone chart pattern. A pattern that occurs during high volatility, when a security shows great movement with little direction. To simplify, the megaphone pattern occurs in most instances when the market is very volatile and the general market orientation is unclear. Web a megaphone pattern is a chart pattern. A pattern that occurs during high volatility, when a security shows great movement with little direction. Web research shows that the most reliable chart patterns are the head and shoulders, with an 89% success rate, the double bottom (88%), and the triple bottom and descending triangle (87%). It consists of two diverging trendlines, where the highs are getting higher, and. Given the pattern's tendency for pullbacks, it's best. Web a megaphone pattern in trading is a chart pattern that occurs when price movement becomes volatile. It is diagrammed as two diverging trend lines, one rising and one falling. It is most commonly seen at market tops or. The opposite of a bullish megaphone top is called a megaphone bottom. To identify a megaphone pattern,. This pattern typically appears after a significant increase or decrease in security prices. Though often seen as bearish due to its volatility and uncertainty, its historical performance makes it ambiguous. The greater the time frame is the better. Web the rare megaphone bottom—a.k.a. It is represented by two lines, one ascending and one descending, that diverge from each other. It is characterized by a series of at least two higher highs and two lower lows. Therefore, investors must watch how prices react at lower and upper channels to make investment decisions. The opposite of a bullish megaphone top is called a megaphone bottom.. This pattern typically occurs during times of high market volatility when traders are uncertain about the market’s direction. Web the megaphone pattern is characterized by a series of higher highs and lower lows, which is a marked expansion in volatility: Web a megaphone pattern in trading is a chart pattern that occurs when price movement becomes volatile. It depicts a. This pattern is useful for technical analysis as it helps traders predict possible future price movements. Web a broadening top is a unique chart pattern resembling a reverse triangle or megaphone that signals significant volatility and disagreement between bullish and bearish investors. It depicts a situation in which bears and bulls are fighting over a specific stock market direction. With. Normally this pattern is visible when the market is at its top or bottom. Web price targets in megaphone trading patterns. This pattern is useful for technical analysis as it helps traders predict possible future price movements. It is characterized by a series of at least two higher highs and two lower lows. Web megaphone pattern is a pattern which. With a wider mouth than its top, the pattern symbolizes the unpredictable market movements and increased volatility about. It is represented by two lines, one ascending and one descending, that diverge from each other. Web the megaphone pattern can be both bullish, and bearish chart patterns. Web the megaphone chart pattern describes the normal state of the market. For example,. This pattern is useful for technical analysis as it helps traders predict possible future price movements. This pattern is famous for its “broadening formation,” the price action also warns. It consists of two diverging trendlines, where the highs are getting higher, and the lows are getting lower, creating a. It is most commonly seen at market tops or. Web megaphone pattern is a pattern which consists of minimum two higher highs and two lower lows. Web the megaphone chart pattern describes the normal state of the market. A bullish phase starts when the price goes up a channel, while a bearish phase starts if it goes down the channel. To simplify, the megaphone pattern occurs in most instances when the market is very volatile and the general market orientation is unclear. Web the rare megaphone bottom—a.k.a. The bullish pattern is confirmed when, usually on the third upswing, prices break above the prior high but fail to fall below this level again. Web the megaphone pattern can be both bullish, and bearish chart patterns. It depicts a situation in which bears and bulls are fighting over a specific stock market direction. Therefore, investors must watch how prices react at lower and upper channels to make investment decisions. Web price targets in megaphone trading patterns. With a wider mouth than its top, the pattern symbolizes the unpredictable market movements and increased volatility about. The price targets in a megaphone breakout pattern are computed using the fibonacci ratio of the pattern height (vertical distance) added from the breakout levels.

Megaphone Pattern The Art of Trading like a Professional

Megaphone Pattern The Art of Trading like a Professional

Megaphone Pattern The Art of Trading like a Professional

Bearish and Bullish Megaphone pattern A Complete Guide ForexBee

Megaphone Chart Pattern Explained! (Technical Analysis Trading Stocks

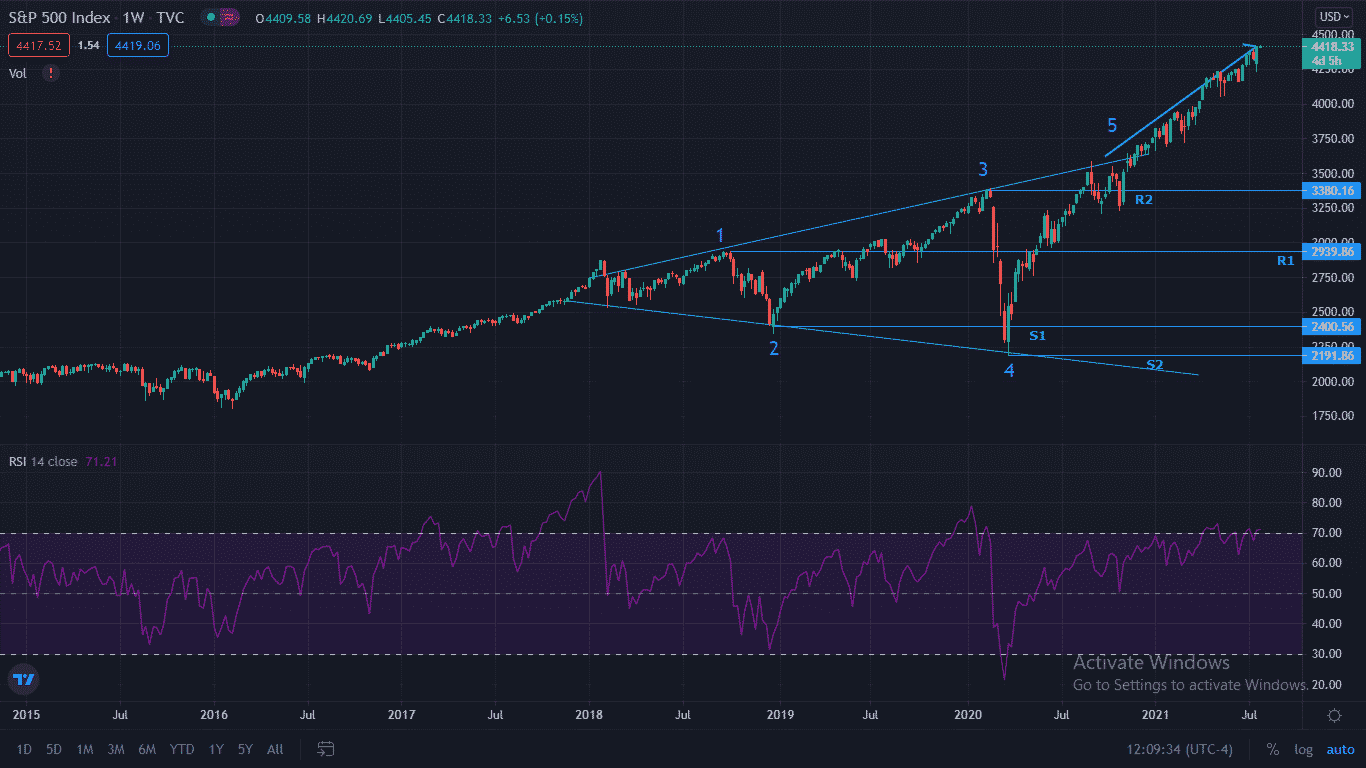

HOW TO TRADE Video Lesson Megaphone Pattern Wave Count 21 March

Hot To Use Megaphone Chart Pattern Trading Strategy YouTube

Megaphone Trading Strategy The Forex Geek

Megaphone Pattern A Complete Expert's Guide 2023 • Dumb Little Man

What is the Megaphone Pattern? How To Trade It.

Web Megaphone Pattern In Technical Analysis Chart Trading Bullish And Bearish Explanation With Guide!👉Get My Technical Analysis Course Here:

This Pattern Typically Occurs During Times Of High Market Volatility When Traders Are Uncertain About The Market’s Direction.

Web A Broadening Top Is A Unique Chart Pattern Resembling A Reverse Triangle Or Megaphone That Signals Significant Volatility And Disagreement Between Bullish And Bearish Investors.

This Pattern Typically Appears After A Significant Increase Or Decrease In Security Prices.

Related Post: