M Stock Pattern

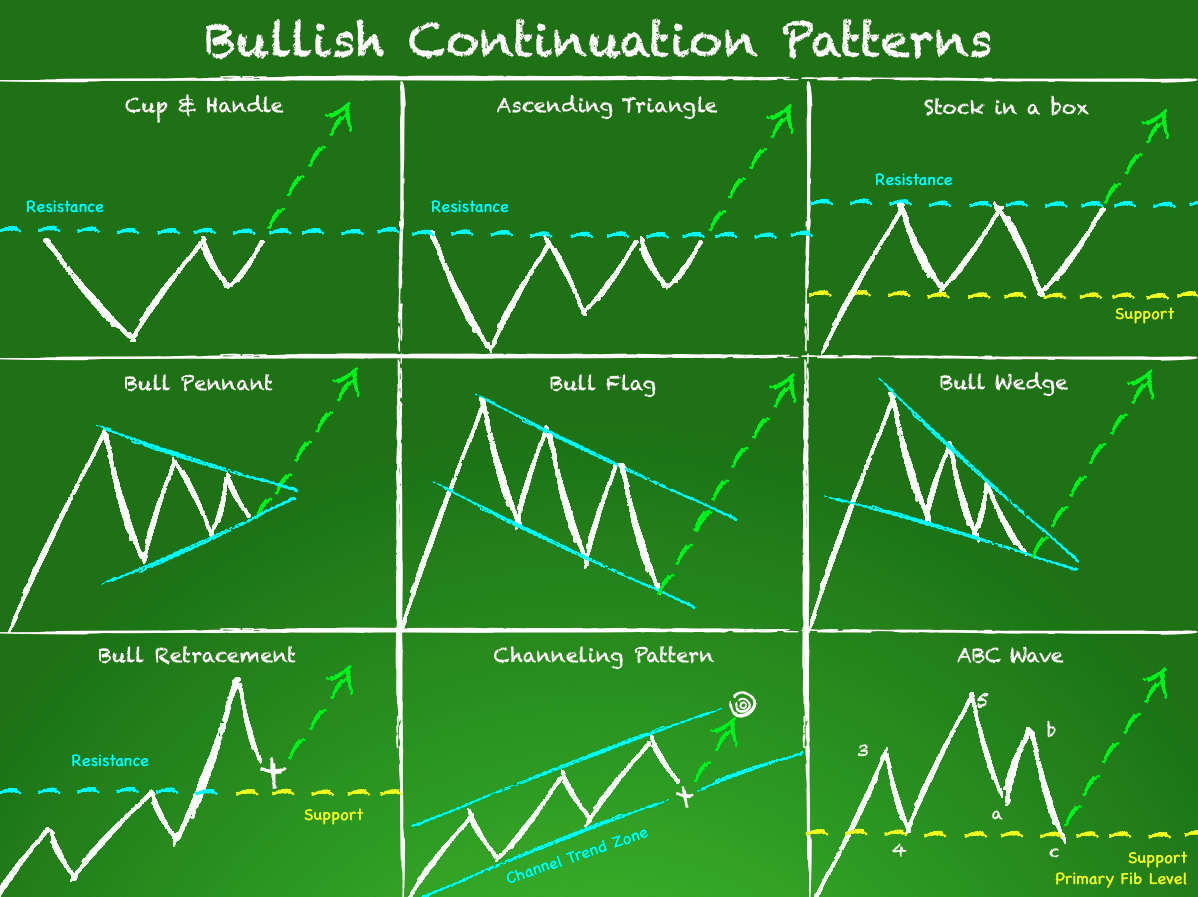

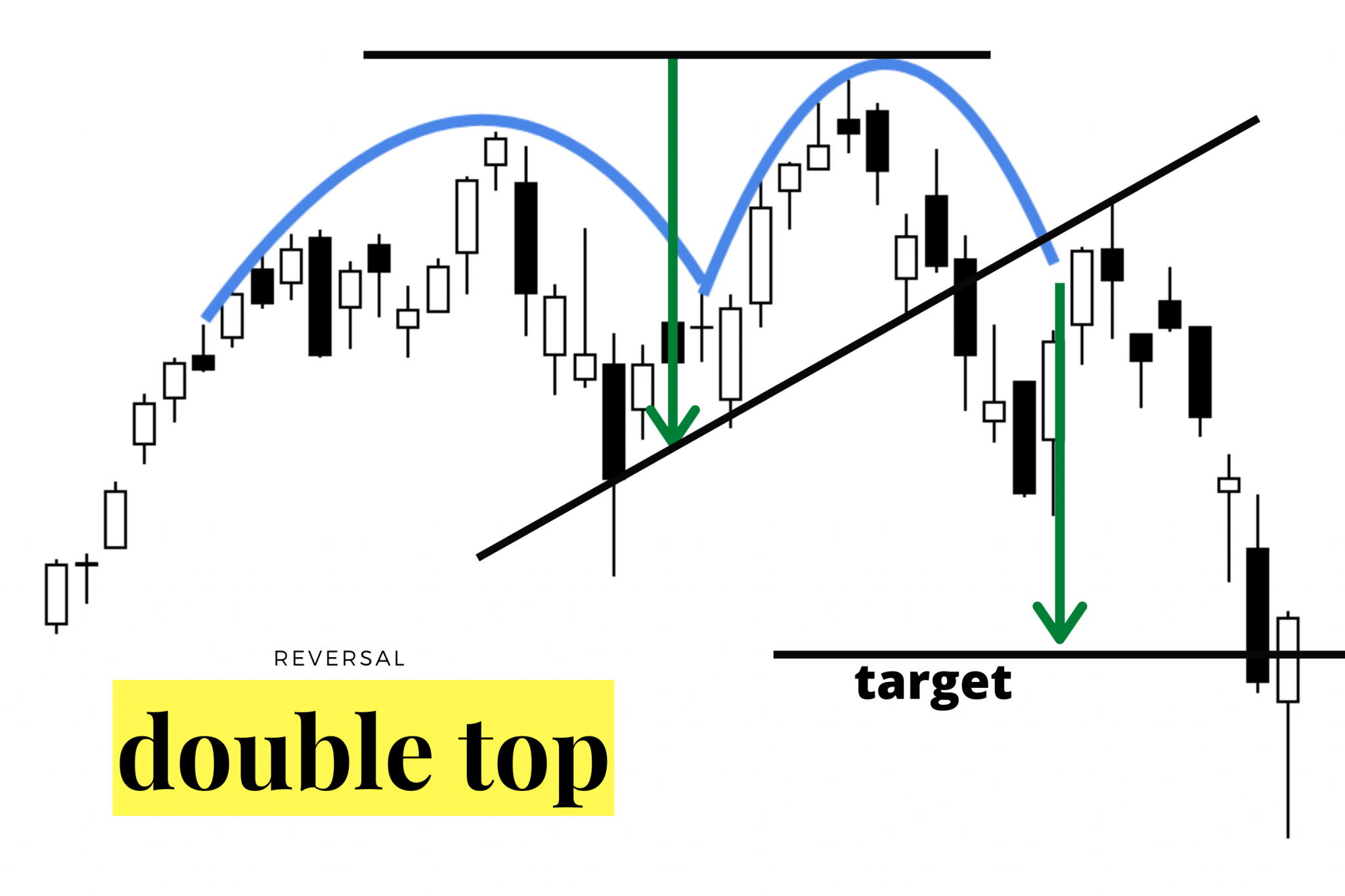

M Stock Pattern - Web research shows that the most reliable chart patterns are the head and shoulders, with an 89% success rate, the double bottom (88%), and the triple bottom and descending triangle (87%). Double top (m) chart pattern. The second candlestick is another red bearish candle, but smaller than the first one. Web double top (m) chart pattern. A reversal pattern tells a trader that a price trend will likely reverse. The ascending triangle is a bullish ‘continuation’ chart pattern that signifies a breakout is likely where the triangle lines converge. Web m pattern trading is a technical analysis strategy used by traders to identify potential reversals in the market. The cup and handle is a bullish stock patterns chart that suggests a stalled upward trend will continue when the pattern is confirmed. By analyzing historical price data and identifying these. The first candlestick is a big red bearish candle. This pattern is formed when the price of an asset reaches a high point, retraces slightly, rises to a similar high point. Web the m pattern is another classic reversal formation that signals a potential change from a bullish to a bearish trend. What is double top pattern? When reading stock charts, traders typically use one or more of. The. Web m and w patterns are chart formations in technical analysis that resemble the letters ‘m’ and ‘w’. It usually forms in a downtrend. This pattern is formed when the price of an asset reaches a high point, retraces slightly, rises to a similar high point. A double top pattern occurs when the stock fails to continue the uptrend in. Ascending triangle trading chart patterns are some of the most widely used stock market patterns. Conversely, the w pattern, known as the double bottom, signals a bullish reversal, indicating that a. The pattern consists of two distinct peaks, separated by a trough in the middle. Web m and w patterns are chart formations in technical analysis that resemble the letters. Web m and w patterns are chart formations in technical analysis that resemble the letters ‘m’ and ‘w’. Web stock chart patterns are like a roadmap for traders, providing vital clues about future price movements. The pattern resembles the letter ‘m’ and indicates a shift from an uptrend to a downtrend. Web double top (m) chart pattern. These patterns can. A double top pattern occurs when the stock fails to continue the uptrend in its second attempt as it meets resistance pressure from sellers at its highs. A pattern is identified by a line. It refers to a chart formation that resembles the letter “m” and is also known as a double top pattern. The “cup” portion of the pattern. Ascending triangle trading chart patterns are some of the most widely used stock market patterns. It refers to a chart formation that resembles the letter “m” and is also known as a double top pattern. The ascending triangle is a bullish ‘continuation’ chart pattern that signifies a breakout is likely where the triangle lines converge. This pattern is formed with. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The first candlestick is a big red bearish candle. The peaks represent the market’s failed attempts to push the price higher, while the trough acts as a support level. Web the bullish breakaway pattern has five candlesticks. The ascending triangle is a bullish ‘continuation’ chart pattern that signifies a breakout is likely where the triangle lines converge. The peaks represent the market’s failed attempts to push the price higher, while the trough acts as a support level. The cup and handle is a bullish stock patterns chart that suggests a stalled upward trend will continue when the. The rectangle top is the most profitable, with an average win of 51%. The pattern consists of two distinct peaks, separated by a trough in the middle. Chart patterns in which the quote for the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). The m pattern, also known as the double. The characteristics of this pattern are: Web price charts visualize the trading activity that takes place during a single trading period (whether it's five minutes, 30 minutes, one day, and so on). Web stock chart patterns are like a roadmap for traders, providing vital clues about future price movements. The double top should have twin peaks with highs less than. Web research shows that the most reliable chart patterns are the head and shoulders, with an 89% success rate, the double bottom (88%), and the triple bottom and descending triangle (87%). It consists of two consecutive peaks at approximately the same price level. Conversely, the w pattern, known as the double bottom, signals a bullish reversal, indicating that a. It usually forms in a downtrend. A big m shape with twin peaks and tall sides. There will be three lows in a line. Web m and w patterns are chart formations in technical analysis that resemble the letters ‘m’ and ‘w’. This pattern is formed with two peaks above a support level which is also known as the neckline. By analyzing historical price data and identifying these. Double top (m) chart pattern. The pattern resembles the letter ‘m’ and indicates a shift from an uptrend to a downtrend. After bottoming at $18.6 in december last year, it has soared to $30 and is now. M pattern denotes that the. Web stock chart patterns are like a roadmap for traders, providing vital clues about future price movements. Generally speaking, each period consists of several data points, including the opening, high, low, and/or closing prices. In a market rally, sellers suddenly take control and push the price downward.M pattern and W pattern

The 2 Best Chart Patterns For Trading Ehelpify Stock Market For Vrogue

Double Top (M) Chart Pattern for NSENIFTY by PrasantaP — TradingView India

Stock Chart Patterns 13 stock chart patterns you should know a

Printable Chart Patterns Cheat Sheet

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-02-59df8834491946bcb9588197942fabb6.jpg)

Introduction to Stock Chart Patterns

What are the patterns of "M" and "W"? for BINANCEBTCUSDT by

M Chart Pattern New Trader U

How To Read Candlestick Charts For Stock Patterns Candlestick Chart

![Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim](https://www.tradingsim.com/hubfs/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

The “Cup” Portion Of The Pattern Is A “U” Shape Rather Than A “V”.

This Pattern Is Formed When The Price Of An Asset Reaches A High Point, Retraces Slightly, Rises To A Similar High Point.

Double Tops And Double Bottoms Are Both Reversal Patterns, Indicating A Major Trend Shift From One Direction To The.

Patterns Are The Distinctive Formations Created By The Movements Of Security Prices On A Chart And Are The Foundation Of Technical Analysis.

Related Post: