M Pattern Chart

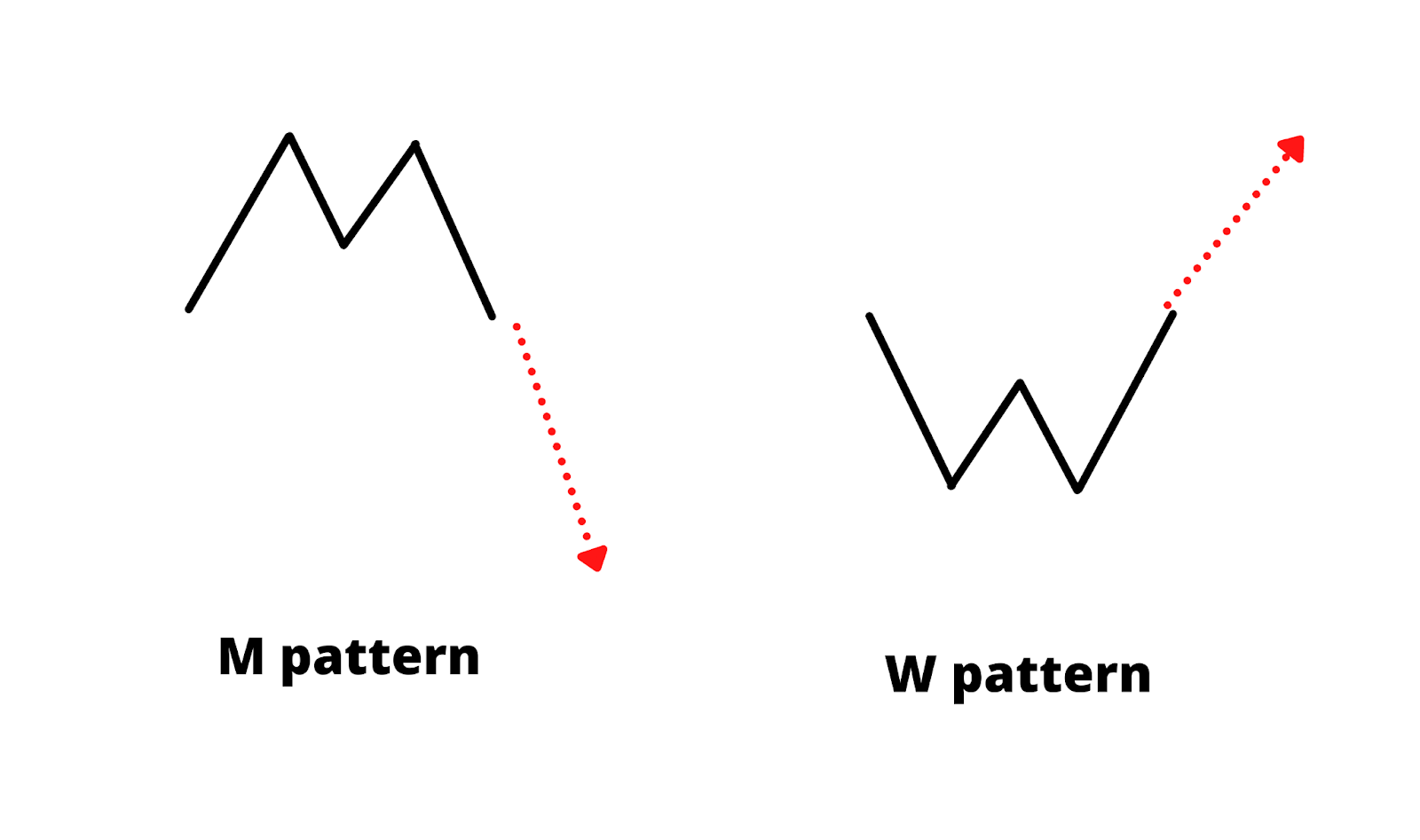

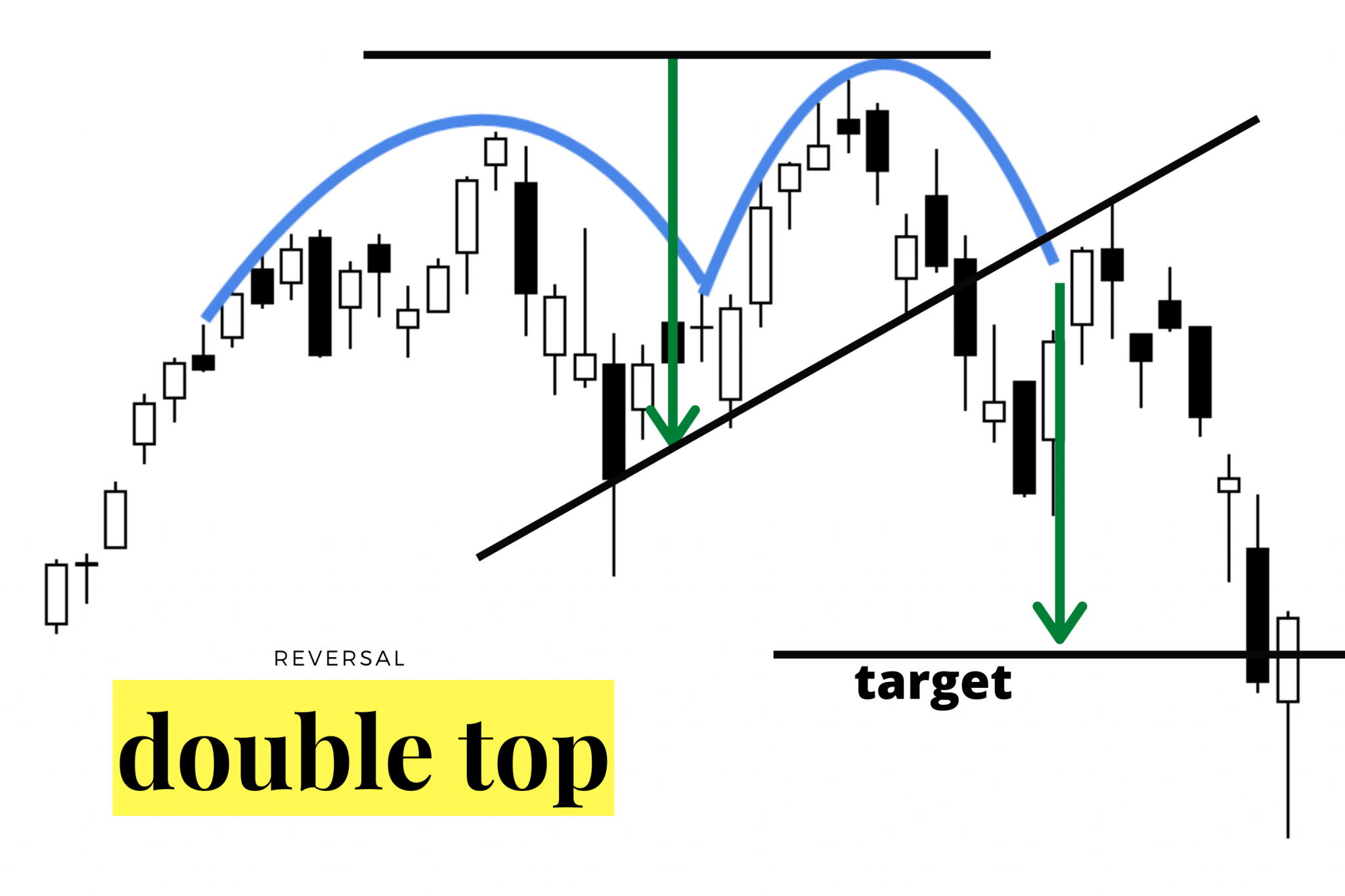

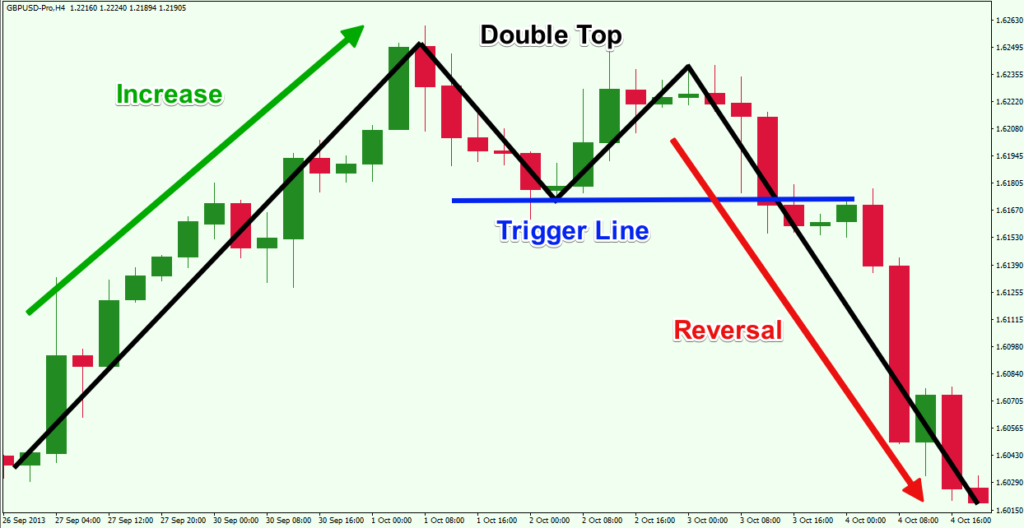

M Pattern Chart - Web m and w patterns are chart formations in technical analysis that resemble the letters ‘m’ and ‘w’. How are m/w patterns different than xabcd patterns? Web the double top, sometimes called m formation, is a chart pattern used by technical traders to spot potential trend reversals. An m formation forms when the price reaches the same high twice, creating an “m” shape, fails. Financial data sourced from cmots internet technologies pvt. It is also called the double top pattern. Trading ideas 1000+ educational ideas 149. Please be aware of the risk's involved in trading & seek independent advice, if necessary. Sequencer [luxalgo] luxalgo wizard updated apr 5. This creates the shape of an m on the m pattern chart. Continuation and reversal patterns are two types of chart patterns that traders use to identify potential entry points. The four main points of the m shape stock pattern are: Web the m pattern, or double top, is a bearish reversal chart pattern in technical trading, indicating a shift from an uptrend to a downtrend. Trading ideas 1000+ educational ideas 149.. The first peak is formed after a strong uptrend and then retrace back to. In this video we take a look at the m and w shapes/patterns that form commonly in the market. The first peak after a sustained rally This pattern is created when a key price resistance level on a chart is tested twice with a pullback between. The big m chart pattern is a double top with tall sides. The history of arthur merrill patterns. Web updated with new statistics on 8/25/2020. Price is currently around the resistance line, if see a resistance breakout then we have potential for a good long trade. It is a bearish reversal pattern that indicates a potential trend reversal from an. It indicates a potential reversal in an upward trend, signaling a shift from bullish to bearish sentiment in the market. The pattern consists of two tops, with the second top being lower than the first top, forming the letter m. Ideal example of a big m. Web the m chart pattern is a reversal pattern that is bearish. How to. Web the m pattern, or double top, is a bearish reversal chart pattern in technical trading, indicating a shift from an uptrend to a downtrend. The pattern consists of two tops, with the second top being lower than the first top, forming the letter m. It is a bearish reversal pattern that indicates a potential trend reversal from an uptrend. These peaks, characterized by similar price highs, are divided by a trough indicating a temporary decline in price. It indicates a potential reversal in an upward trend, signaling a shift from bullish to bearish sentiment in the market. Binance:trxusdt (6h chart) technical analysis update trx is currently trading at $0.12346 and has formed a inverse head and shoulder pattern. How. The history of arthur merrill patterns. Sequencer [luxalgo] luxalgo wizard updated apr 5. These patterns can provide traders with information about the stock's trend, momentum, and potential future direction. Continuation and reversal patterns are two types of chart patterns that traders use to identify potential entry points. Web a double top chart pattern is a bearish reversal chart pattern that. The pattern consists of two tops, with the second top being lower than the first top, forming the letter m. The pattern is composed of two consecutive troughs that form a w shape on the chart. Continuation and reversal patterns are two types of chart patterns that traders use to identify potential entry points. Binance:trxusdt (6h chart) technical analysis update. Price is currently around the resistance line, if see a resistance breakout then we have potential for a good long trade. Web m pattern trading is a technical analysis strategy used by traders to identify potential reversals in the market. This pattern is formed with two peaks above a support level which is also known as the neckline. Web this. You can spot the m pattern by finding two peaks forming an ‘m’ shape at a similar price level, with the area between the peaks acting as support. It indicates a potential reversal in an upward trend, signaling a shift from bullish to bearish sentiment in the market. How are m/w patterns different than xabcd patterns? The m pattern, also. It is a bearish reversal pattern that indicates a potential trend reversal from an uptrend to a downtrend. Web the m pattern, or double top, is a bearish reversal chart pattern in technical trading, indicating a shift from an uptrend to a downtrend. The pattern looks like an m. It indicates a potential reversal in an upward trend, signaling a shift from bullish to bearish sentiment in the market. Web the m chart pattern is a reversal pattern that is bearish. Web the m pattern chart boasts a high level of recognition due to its two peaks, which signal price resistance. The pattern is composed of two consecutive troughs that form a w shape on the chart. An m formation forms when the price reaches the same high twice, creating an “m” shape, fails. 21k views 1 year ago #shapes #trading #m. The history of arthur merrill patterns. Web m pattern trading is a technical analysis strategy used by traders to identify potential reversals in the market. Sequencer [luxalgo] luxalgo wizard updated apr 5. M and w patterns look for chart patterns that have price. You can spot the m pattern by finding two peaks forming an ‘m’ shape at a similar price level, with the area between the peaks acting as support. The first peak is formed after a strong uptrend and then retrace back to. The first peak after a sustained rally

W Pattern Trading vs. M Pattern Strategy Choose One or Use Both? • FX

M Chart Pattern New Trader U

Mastering M Pattern Trading Strategies and Insights

Pattern Trading Unveiled Exploring M and W Pattern Trading

The M and W Pattern/Shapes Complete Guide YouTube

M Chart Pattern New Trader U

The M and W Pattern YouTube

Double Top (M) Chart Pattern for NSENIFTY by PrasantaP — TradingView India

Double Top — Chart Patterns — Education — TradingView — India

M Forex Pattern Fast Scalping Forex Hedge Fund

Web A Double Top Is A Pattern For Two Successive Peaks, Which May Or May Not Be Of The Same Price Levels.

A Double Top Pattern Occurs When The Stock Fails To Continue The Uptrend In Its Second Attempt As.

In The Last 30 Years, The City Has Undergone A Transformation To.

Please Be Aware Of The Risk's Involved In Trading & Seek Independent Advice, If Necessary.

Related Post: