Irs Name Change Letter Template

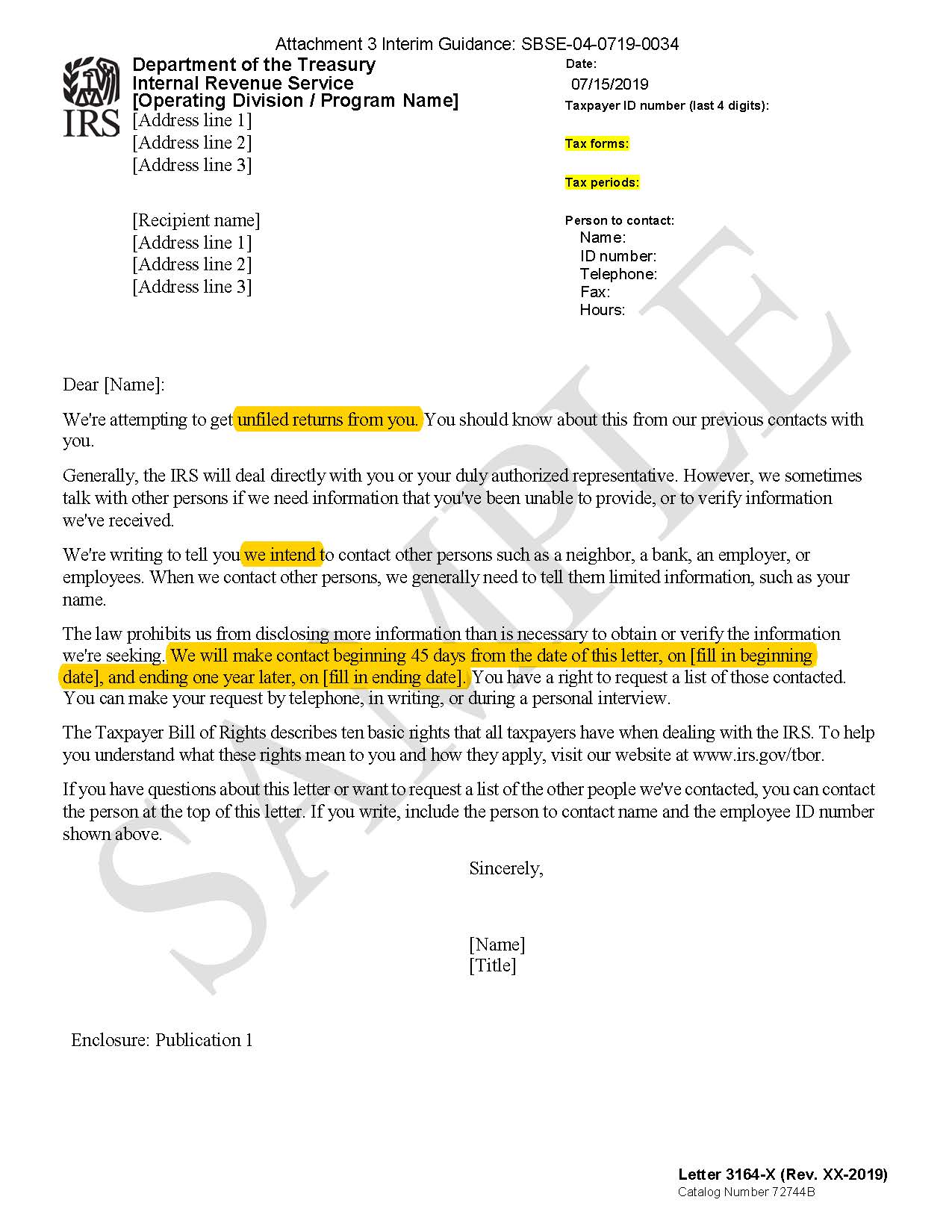

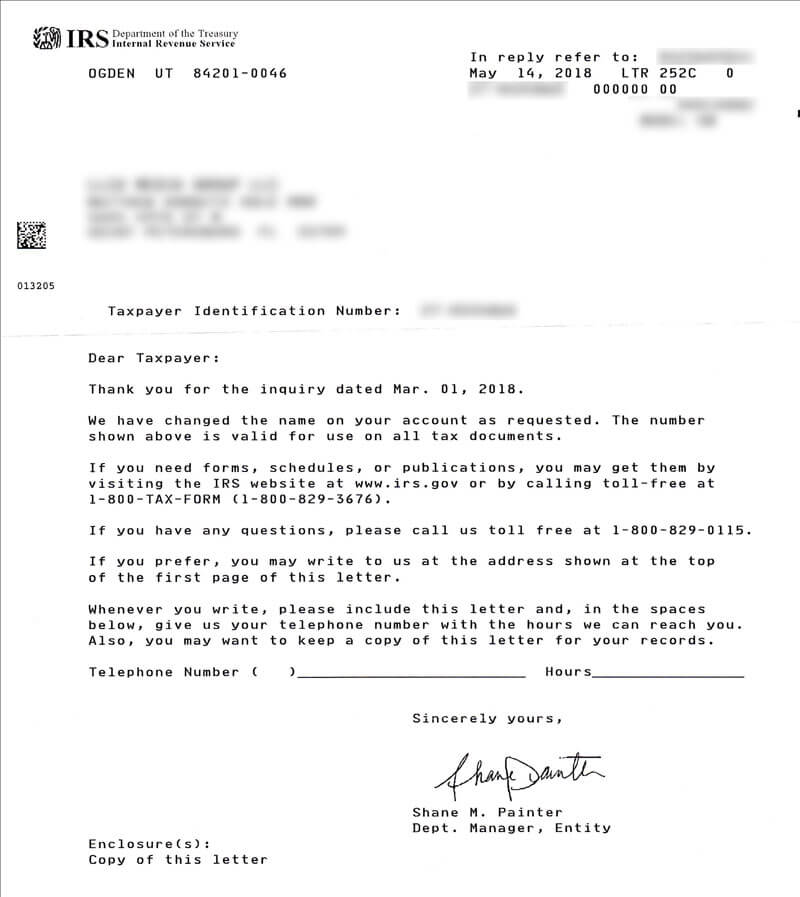

Irs Name Change Letter Template - Web when filing a current year tax return, you can change your business name with the irs by checking the name change box on the entity’s respective form:. Web business owners and other authorized individuals can submit a name change for their business. Sign it in a few clicks. If you have previously reported a change of name, you may wish to confirm with customer account services. How to write a hardship letter to the irs. To whom it may concern: If the ein was recently assigned and filing liability has yet to be determined,. (i) the ein number for the business, (ii) the old business name, and. Web sample letter to irs for business name change. Web changing a business name with the irs can be done in one of two ways. Web when filing a current year tax return, you can change your business name with the irs by checking the name change box on the entity’s respective form:. Web dear irs, i am writing to inform you of a crucial change in our business details. If you change the legal name of your business, then as the owner, partner or. If you haven’t changed your name with the ssa, you'll. The specific action required may vary depending on the type of business. Web sample letter to irs for business name change. (i) the ein number for the business, (ii) the old business name, and. Letter to the irs template. If you have previously reported a change of name, you may wish to confirm with customer account services. If you haven’t changed your name with the ssa, you'll. If you are running your business as a sole proprietor, you can use this sample letter to inform the. Corporations and llcs can check the name change box while filing their annual. How to write a hardship letter to the irs. With us legal forms, finding a verified official template for a specific. Type text, add images, blackout confidential details, add comments, highlights and more. If you have previously reported a change of name, you may wish to confirm with customer account services. Corporate entities that have already filed their taxes can. Type text, add images, blackout confidential details, add comments, highlights and more. Web dear irs, i am writing to inform you of a crucial change in our business details. (i) the ein number for the business, (ii) the old business name, and. Web business owners and other authorized individuals can submit a name change for their business. Edit your irs. Corporations and llcs can check the name change box while filing their annual tax. Web changing a business name with the irs can be done in one of two ways. The ein number for the business, the old business name, as well as. Web the irs will automatically update the business name associated with your current ein after you send. If you change the legal name of your business, then as the owner, partner or corporate officer, you are authorized to file the name change with the internal revenue service. 2 asking for an abatement. Type text, add images, blackout confidential details, add comments, highlights and more. The irs wants people experiencing a name change to remember these important things:. Web the irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the. When you legally change your name, there are tax consequences. If you change the legal name of your business, then as the owner, partner or corporate officer, you are authorized to file the. Irs sends notices and letters when it needs to ask a question about a taxpayer’s federal tax return, let them know about a change to their. To whom it may concern: Web dear irs, i am writing to inform you of a crucial change in our business details. The ein number for the business, the old business name, as well. The specific action required may vary depending on the type of business. If you haven’t changed your name with the ssa, you'll. Web for a corporation filing a tax return, mark the “name change” box on form 1120. How to write a hardship letter to the irs. The irs wants people experiencing a name change to remember these important things: Corporate entities that have already filed their taxes can send a letter signed by a. Church name church street address church city, state and zip tin: Web when filing a current year tax return, you can change your business name with the irs by checking the name change box on the entity’s respective form:. If you are running your business as a sole proprietor, you can use this sample letter to inform the. To whom it may concern: The irs wants people experiencing a name change to remember these important things: Irs sends notices and letters when it needs to ask a question about a taxpayer’s federal tax return, let them know about a change to their. Letter to the irs template. Web changing a business name with the irs can be done in one of two ways. Old church name has recently changed their name to new. The ein number for the business, the old business name, as well as. The specific action required may vary depending on the type of business. Corporations and llcs can check the name change box while filing their annual tax. Sample letter to irs for business name change (sole proprietorship): Web dear irs, i am writing to inform you of a crucial change in our business details. 1 responding to a request for information.

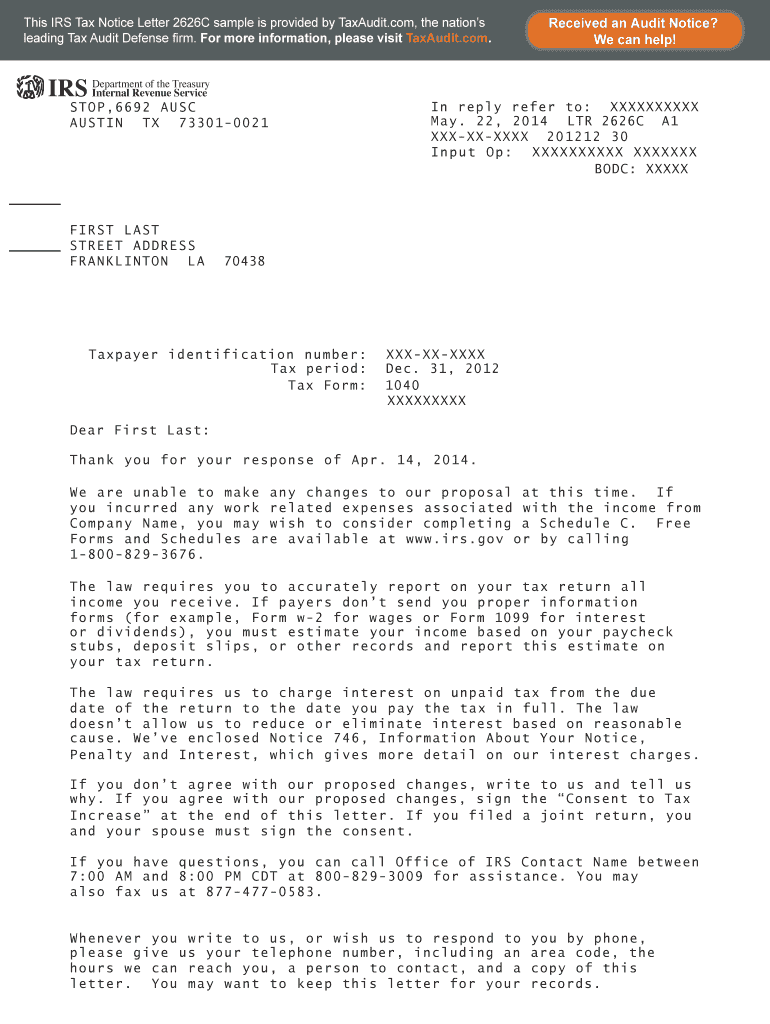

Irs Name Change Letter Sample An irs corporate name change form 8822

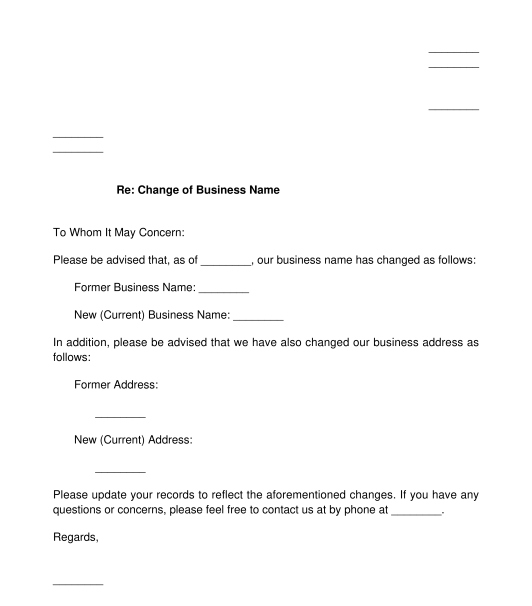

Irs business name change letter template Fill out & sign online DocHub

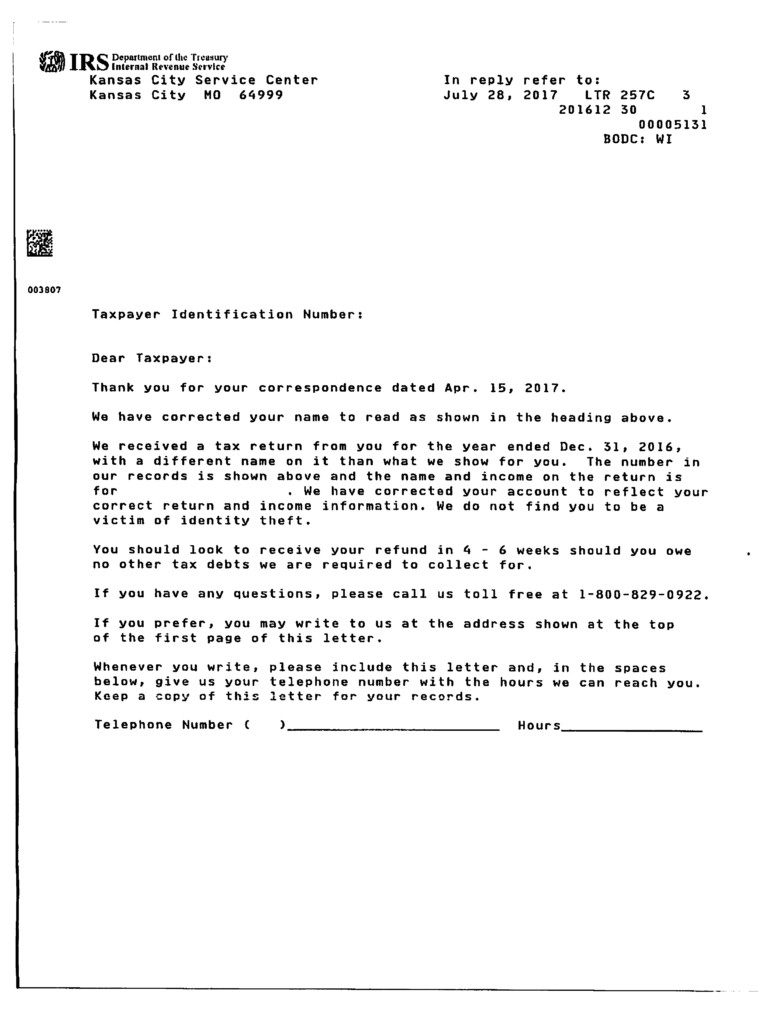

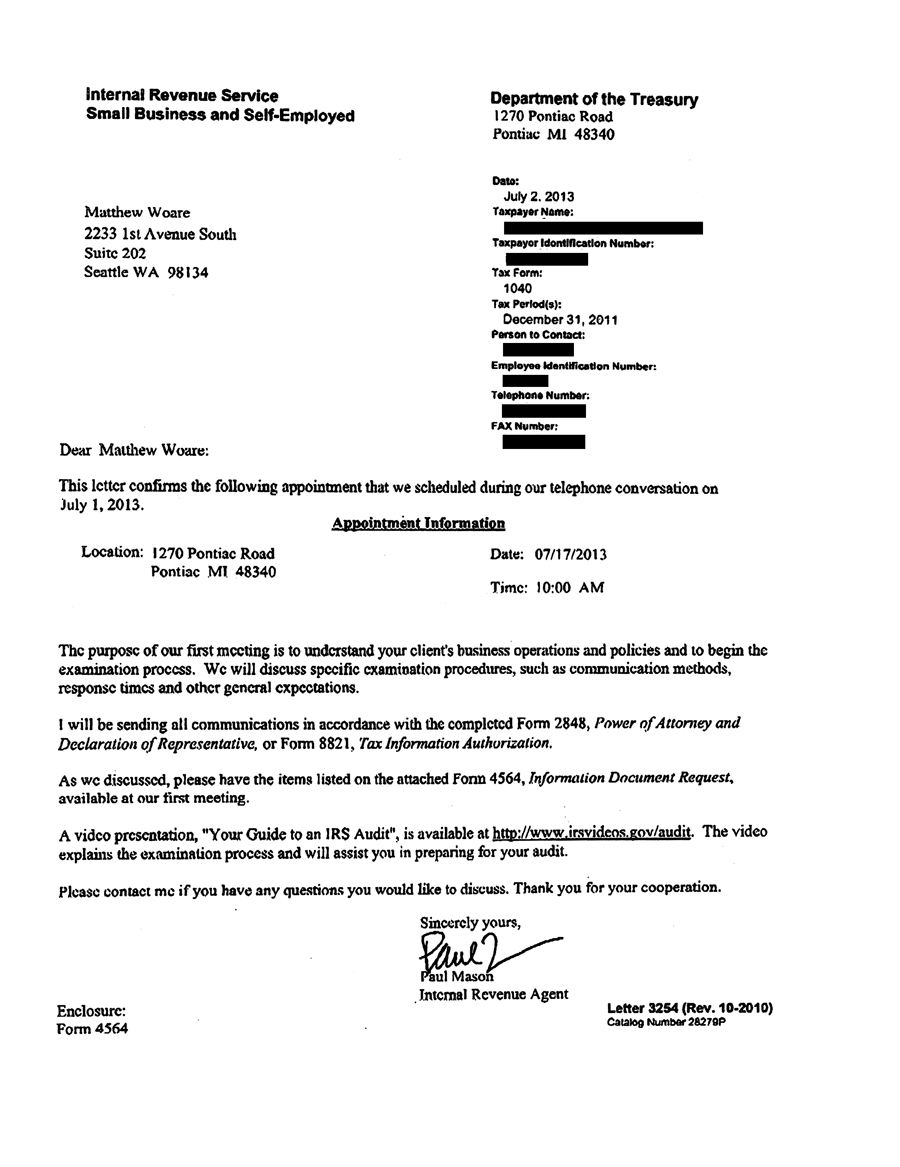

IRS Letter 257C We Corrected Your Name or Taxpayer Identification

Irs Name Change Letter Sample Irs Ein Name Change Form Lovely Irs

Irs Name Change Letter Sample / Irs Name Change Letter Sample / This

Irs Name Change Letter Sample Example of business name change letter

How to Change your LLC Name with the IRS? LLC University®

Irs Business Name Change Letter Template

Irs Name Change Letter Sample Free 8 Sample Business Name Change

Irs Name Change Letter Sample / Company name change letter examples

If You Haven’t Changed Your Name With The Ssa, You'll.

Web The Irs Will Automatically Update The Business Name Associated With Your Current Ein After You Send The Name Change Letter And Certificate Of Amendment To The.

If The Ein Was Recently Assigned And Filing Liability Has Yet To Be Determined,.

How To Write A Hardship Letter To The Irs.

Related Post: