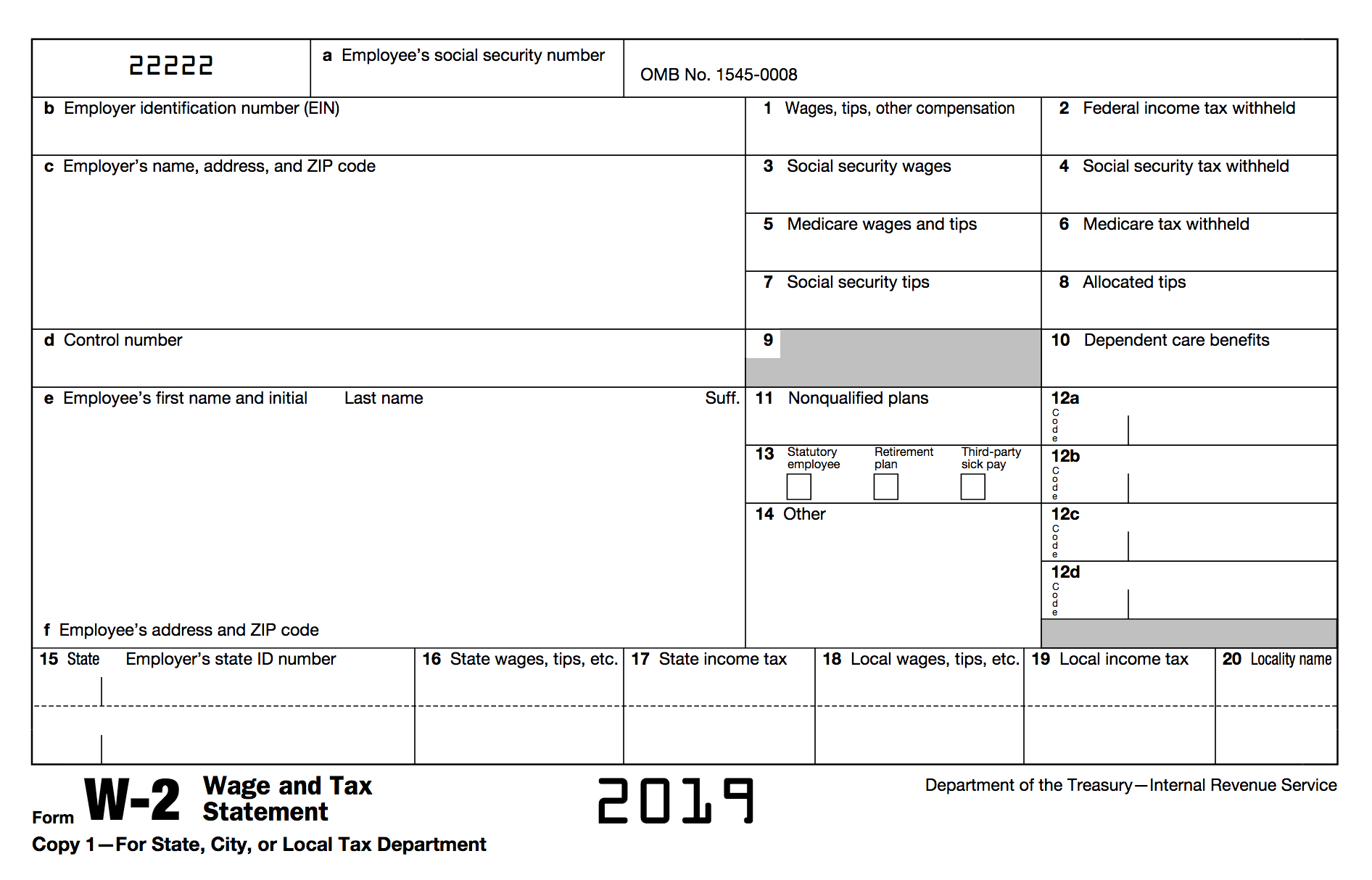

Irs Form W 4V Printable

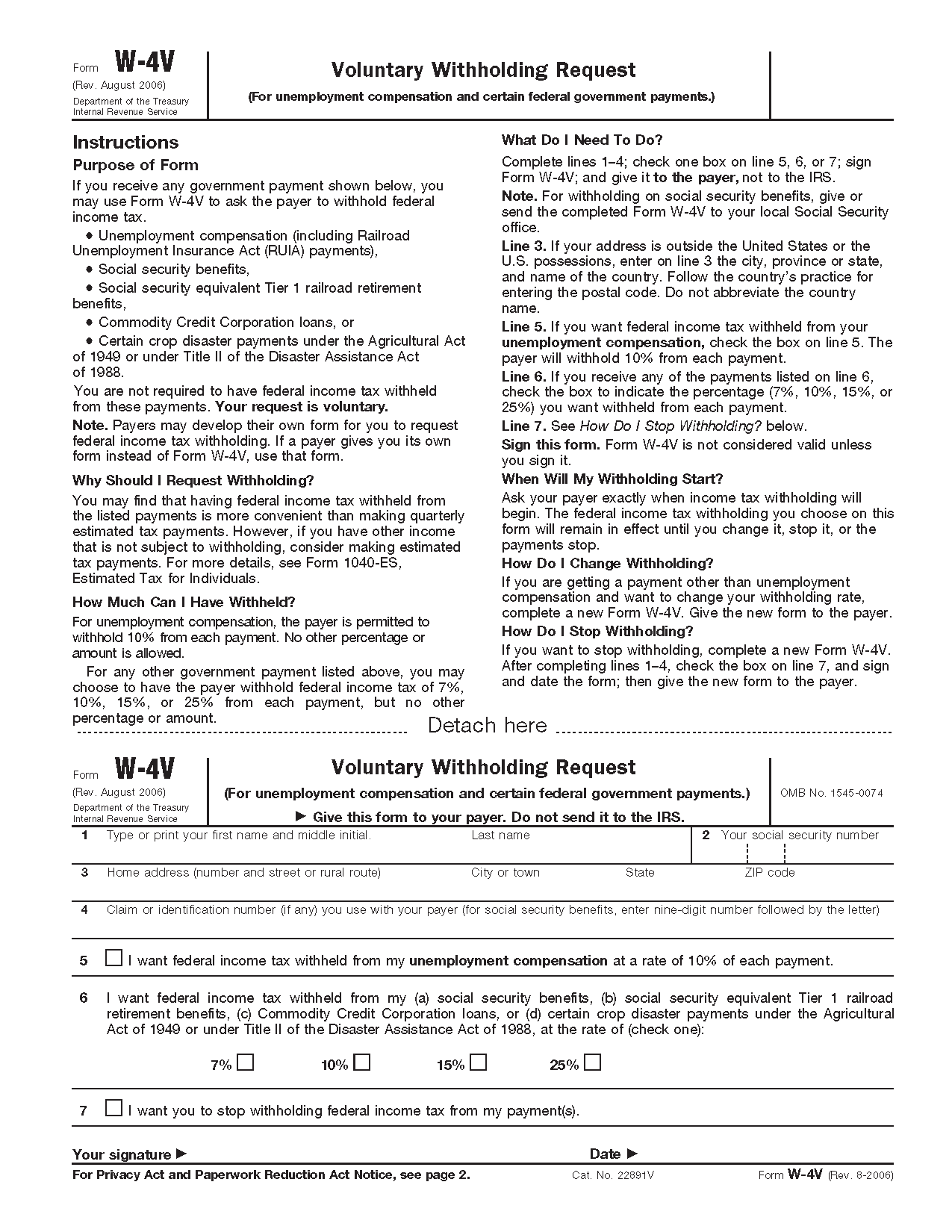

Irs Form W 4V Printable - Ify ou rad esi thun s. Voluntary withholding request from the irs' website. Check one box on either line 5, 6, or 7; If too little is withheld, you will generally owe tax when. And give it to the payer, not to the irs. (for unemployment compensation and certain federal government payments.) instructions. For line 3, if you live outside the u.s., add the city, state or. • unemployment compensation (including railroad unemployment. Then, find the social security office closest to your home and mail or fax us the completed form. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. • unemployment compensation (including railroad unemployment. If you receive any government. Check one box on either line 5, 6, or 7; For line 3, if you live outside the u.s., add the city, state or. (for unemployment compensation and certain federal government payments.) instructions. Web if you download, print and complete a paper form, please mail or take it to your local social security office or the office that requested it from you. Then, find the social security office closest to your home and mail or fax us the completed form. Check one box on. Line 3.— if your address is outside. Then, find the social security office closest to your home and mail or fax us the completed form. If you receive any government. Voluntary withholding request from the irs' website. Ify ou rad esi thun s. If too little is withheld, you will generally owe tax when. Check one box on either line 5, 6, or 7; Web if you download, print and complete a paper form, please mail or take it to your local social security office or the office that requested it from you. For line 3, if you live outside the u.s., add. (for unemployment compensation and certain federal government payments.) instructions. Ify ou rad esi thun s. Line 3.— if your address is outside. Voluntary withholding request from the irs' website. • unemployment compensation (including railroad unemployment. Check one box on either line 5, 6, or 7; Voluntary withholding request from the irs' website. For line 3, if you live outside the u.s., add the city, state or. If you receive any government. And give it to the payer, not to the irs. Line 3.— if your address is outside. (for unemployment compensation and certain federal government payments.) instructions. Web prepare and file your federal income tax online at no cost to you (if you qualify) using guided tax preparation, at an irs trusted partner site or using free file fillable forms. And give it to the payer, not to the irs. Ify. Check one box on either line 5, 6, or 7; While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. For line 3, if you live outside the u.s., add the city, state or. And give it to the payer, not to the irs. Then, find the social security office closest to your home. Line 3.— if your address is outside. • unemployment compensation (including railroad unemployment. And give it to the payer, not to the irs. For line 3, if you live outside the u.s., add the city, state or. Voluntary withholding request from the irs' website. Check one box on either line 5, 6, or 7; If too little is withheld, you will generally owe tax when. Ify ou rad esi thun s. • unemployment compensation (including railroad unemployment. Then, find the social security office closest to your home and mail or fax us the completed form. Ify ou rad esi thun s. Line 3.— if your address is outside. And give it to the payer, not to the irs. If you receive any government. Check one box on either line 5, 6, or 7; Voluntary withholding request from the irs' website. Web prepare and file your federal income tax online at no cost to you (if you qualify) using guided tax preparation, at an irs trusted partner site or using free file fillable forms. • unemployment compensation (including railroad unemployment. Web if you download, print and complete a paper form, please mail or take it to your local social security office or the office that requested it from you. (for unemployment compensation and certain federal government payments.) instructions. For line 3, if you live outside the u.s., add the city, state or.

Irs Form W 4V Printable

Irs Form W4V Printable IRS 656B 2020 Fill and Sign Printable

Irs Form W 4v Printable 2021 Irs Form W 4 Simple Inst vrogue.co

IRS Form W 4V Printable

Irs Form W 4V Printable

Irs Form W 4V Printable

W4v Form 2022 Printable Printable World Holiday

Irs Form W4V Printable 2002 Form NJ DoT NJW4 Fill Online, Printable

Irs Form W4V Printable The latest ones are on nov 07, 2020 9 new

Irs Form W 4V Printable

Then, Find The Social Security Office Closest To Your Home And Mail Or Fax Us The Completed Form.

While Most Taxpayers Have Income Taxes Automatically Withheld Every Pay Period By Their Employer, Taxpayers Who.

If Too Little Is Withheld, You Will Generally Owe Tax When.

Related Post: