Irs Form 9465 Printable

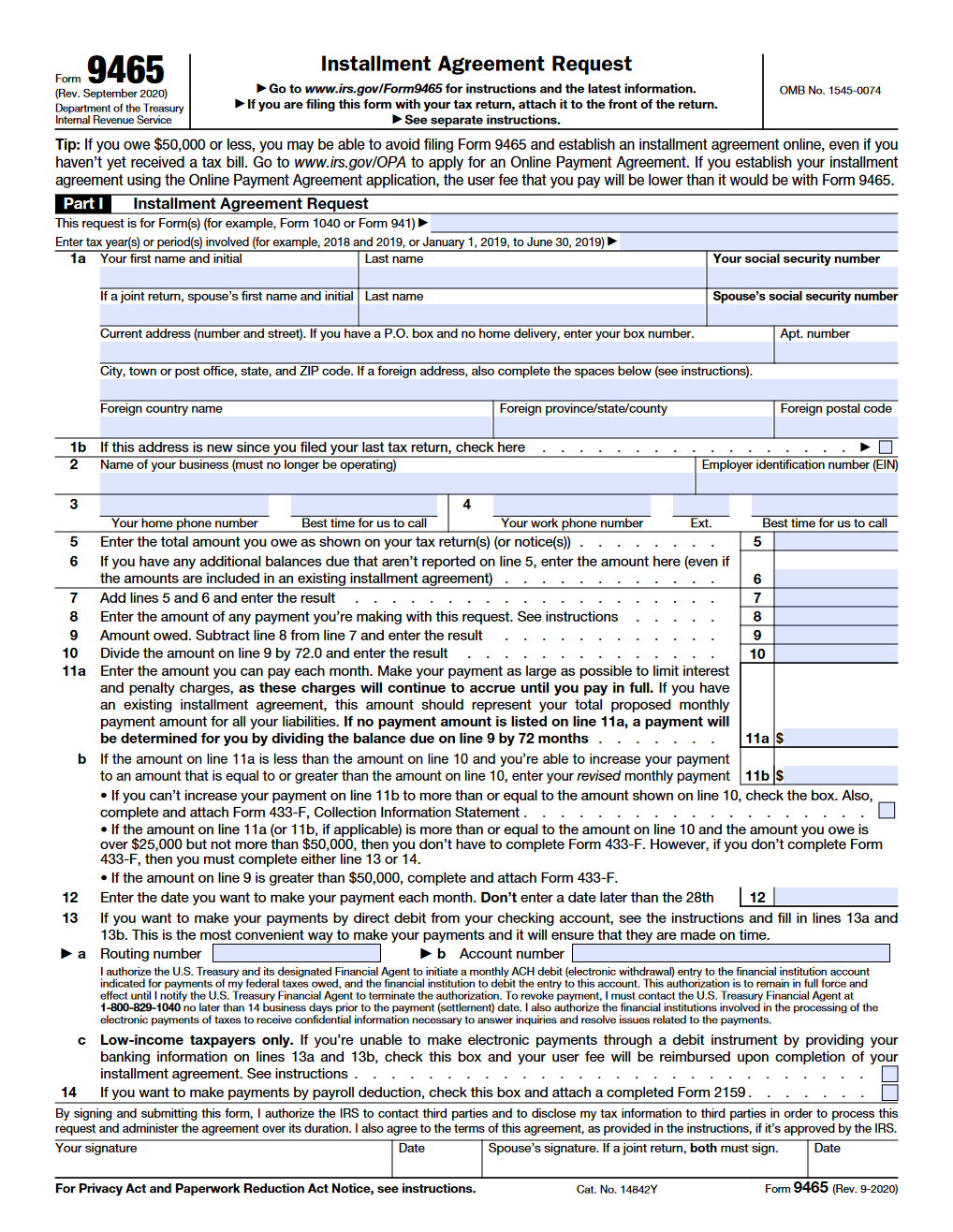

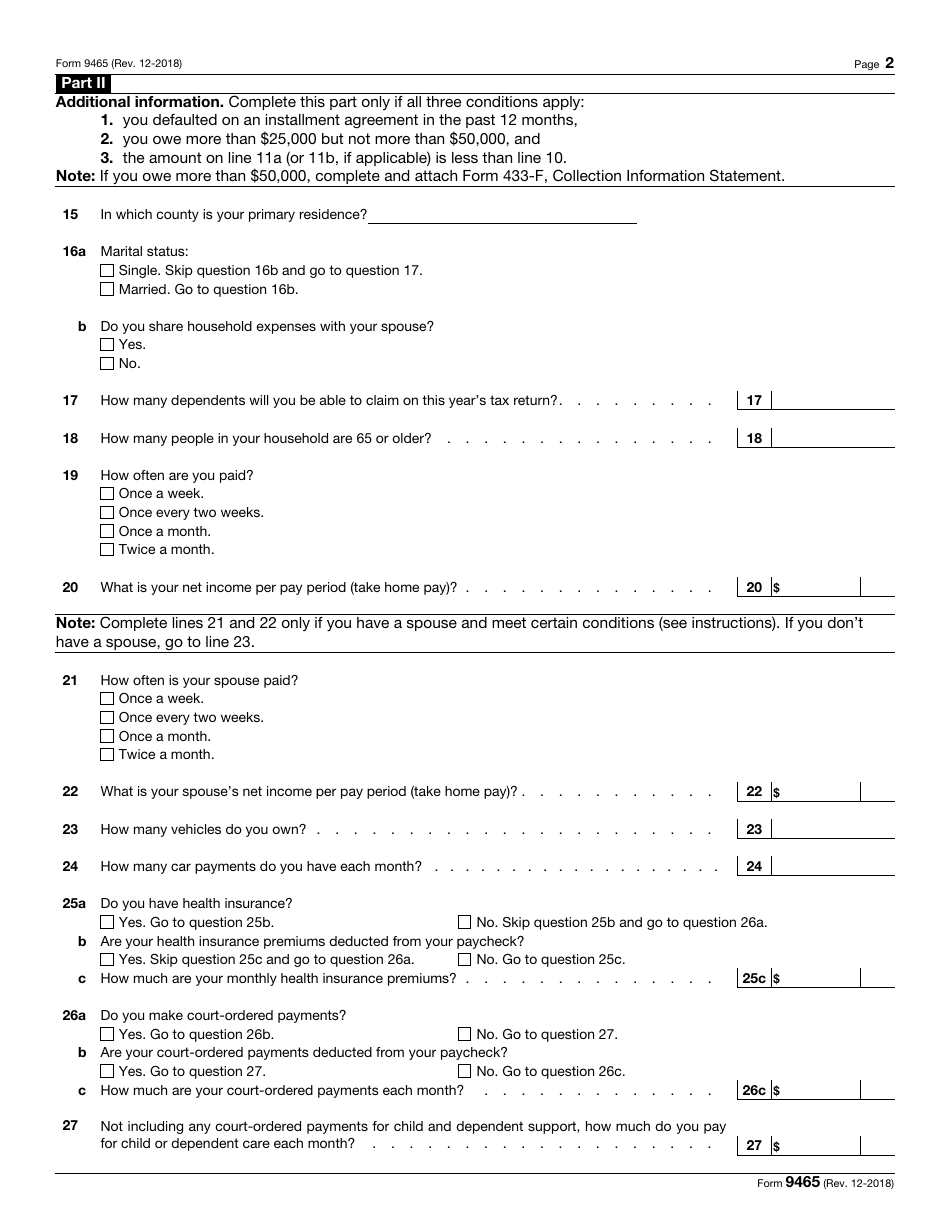

Irs Form 9465 Printable - Find out the user fees, eligibility requirements and alternatives to. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). If the irs doesn’t approve your installment request: If you occupied your home jointly with someone, each occupant must complete their own. Use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. Web individual taxpayers and individuals representing businesses no longer in operation can use form 9465. If you cannot use the irs’s online payment agreement or you don’t want to call the irs,. Find out the eligibility requirements, fees, and alternatives for paying your. You can apply for a payment plan online or using this form if you owe. Open your tax return and select the. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). You can apply for a payment plan online or using this form if you owe. If you occupied your home jointly with someone, each occupant must complete. Web learn how to use form 9465 to request a monthly payment plan with the irs if you can't pay your tax bill in full. From the left of the screen, select miscellaneous forms and choose installment agreement (9465). If you cannot use the irs’s online payment agreement or you don’t want to call the irs,. Web use form 9465. This form is used to request an installment payment agreement with the irs for. If the irs doesn’t approve your installment request: To complete and file the online payment agreement request form electronically with us: If you occupied your home jointly with someone, each occupant must complete their own. Web use form 9465 to request a monthly installment agreement (payment. Web learn what irs form 9465 is, who can fill it out, and how to submit it online or by mail. Find out the user fees, eligibility requirements and alternatives to. You can apply for a payment plan online or using this form if you owe. From the left of the screen, select miscellaneous forms and choose installment agreement (9465).. This form is used to request an installment payment agreement with the irs for. The irs encourages you to pay a portion. Web the 9465 form is rather short and only requires your personal information, the name and addresses of your bank and employer, the amount of tax you owe, an. From the left of the screen, select miscellaneous forms. Web use form 9465 if you’re an individual: To complete and file the online payment agreement request form electronically with us: Web download and print the official form to request an installment agreement with the irs for your tax debt. Web the 2023 instructions for form 5695 will not be revised. You can apply for a payment plan online or. Find out how to apply, what to expect, and what forms to use for. Under the installment agreement request (9465). If you cannot use the irs’s online payment agreement or you don’t want to call the irs,. Web the 9465 form is rather short and only requires your personal information, the name and addresses of your bank and employer, the. Web download and print the official form to request an installment agreement with the irs for your tax debt. Web learn what irs form 9465 is, who can fill it out, and how to submit it online or by mail. Web what is form 9465? This form is used to request an installment payment agreement with the irs for. Find. Web download and print the official form to request an installment agreement with the irs for your tax debt. If you occupied your home jointly with someone, each occupant must complete their own. Open your tax return and select the. Form 9465, installment agreement request, is used to request a monthly installment plan if you can't pay the full amount. This form is used to request an installment payment agreement with the irs for. Web use form 9465 if you’re an individual: Under the installment agreement request (9465). Web learn what irs form 9465 is, who can fill it out, and how to submit it online or by mail. Follow the instructions and fill in the required information, such as. The irs encourages you to pay a portion. Web the 2023 instructions for form 5695 will not be revised. Open your tax return and select the. Web download and print the official form to request an installment agreement with the irs for your tax debt. Find out the eligibility requirements, fees, and alternatives for paying your. Web learn about different types of payment plans for taxpayers who can't pay their taxes in full. Web individual taxpayers and individuals representing businesses no longer in operation can use form 9465. This form is used to request an installment payment agreement with the irs for. Under the installment agreement request (9465). Web open the client return. Find out how to apply, what to expect, and what forms to use for. Use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. Web what is form 9465? Web form 9465 is available in all versions of taxact. From the left of the screen, select miscellaneous forms and choose installment agreement (9465). Form 9465, installment agreement request, is used to request a monthly installment plan if you can't pay the full amount you owe shown on.

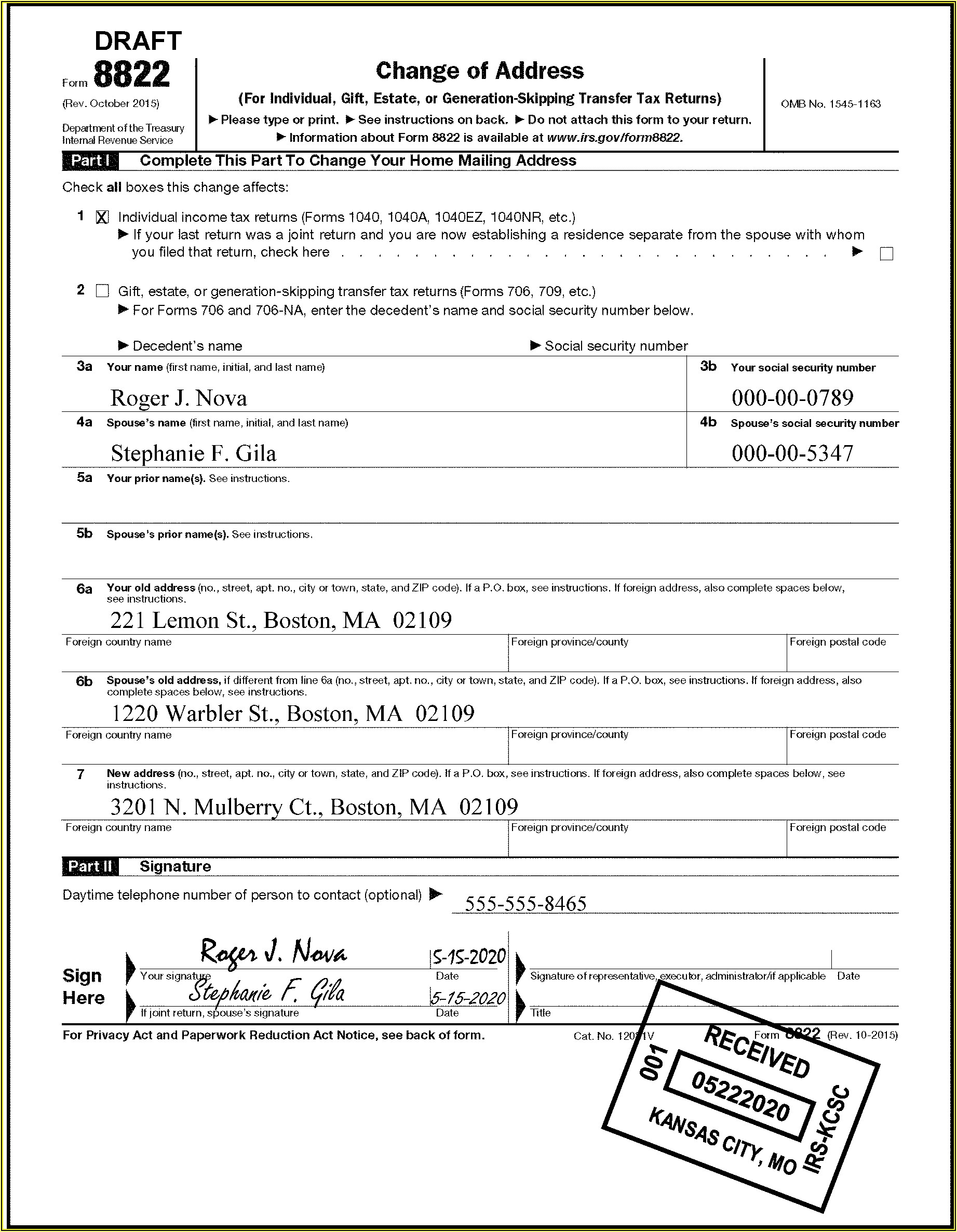

Irs Form 9465 Fillable and Editable PDF Template

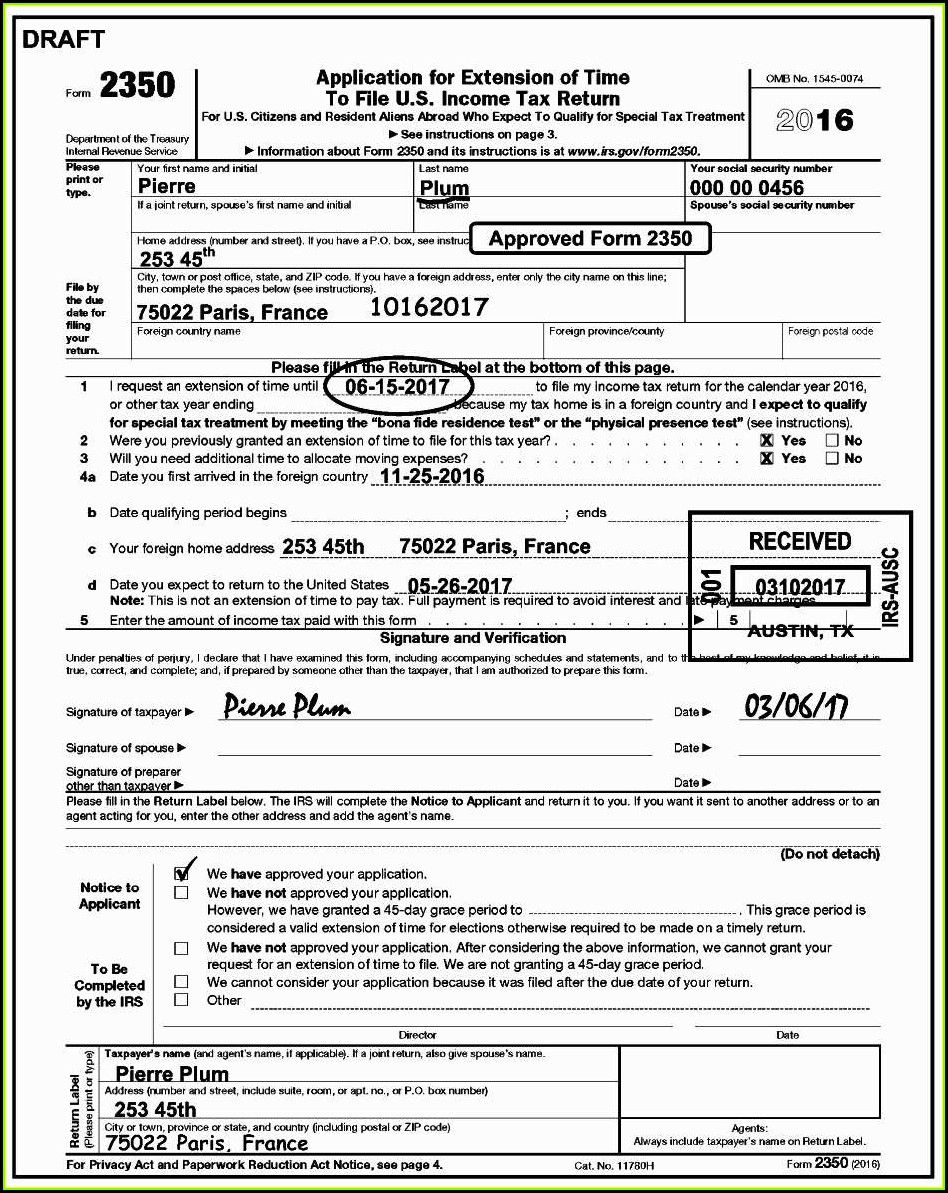

Printable Irs Form 8822 B Printable Forms Free Online

Irs Form 9465 Printable

IRS Form 9465 Instructions Your Installment Agreement Request

1995 Form IRS 9465 Fill Online, Printable, Fillable, Blank pdfFiller

Irs Form 9465 Form Fillable Printable Forms Free Online

IRS Form 9465. Installment Agreement Request Forms Docs 2023

Irs Payment Agreement Form 9465 Form Resume Examples djVaJXxw2J

IRS Form 9465 Download Fillable PDF or Fill Online Installment

Irs Form 3911 Printable

If You Occupied Your Home Jointly With Someone, Each Occupant Must Complete Their Own.

To Complete And File The Online Payment Agreement Request Form Electronically With Us:

Web Use Form 9465 If You’re An Individual:

If You Cannot Use The Irs’s Online Payment Agreement Or You Don’t Want To Call The Irs,.

Related Post: