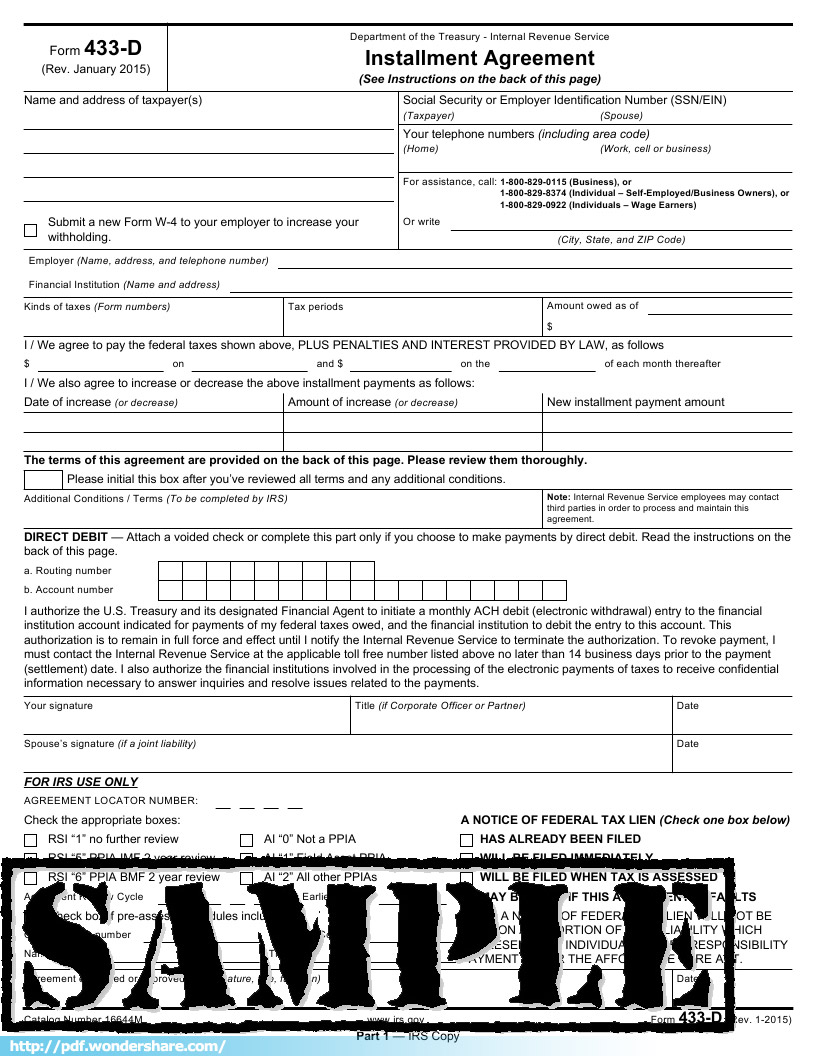

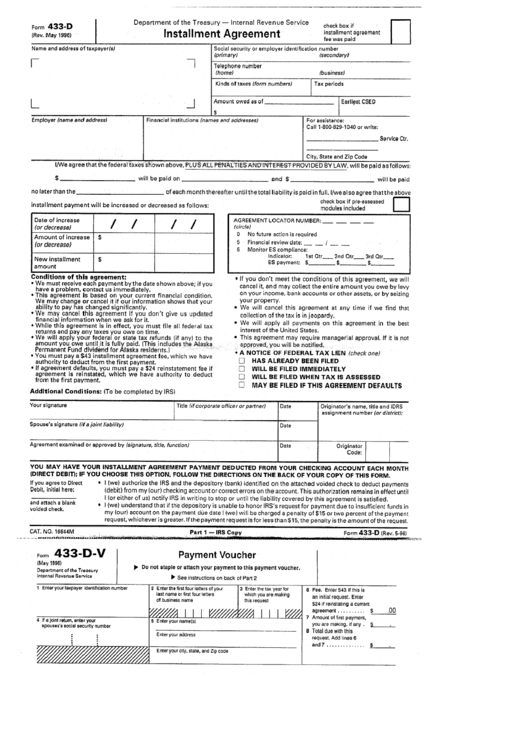

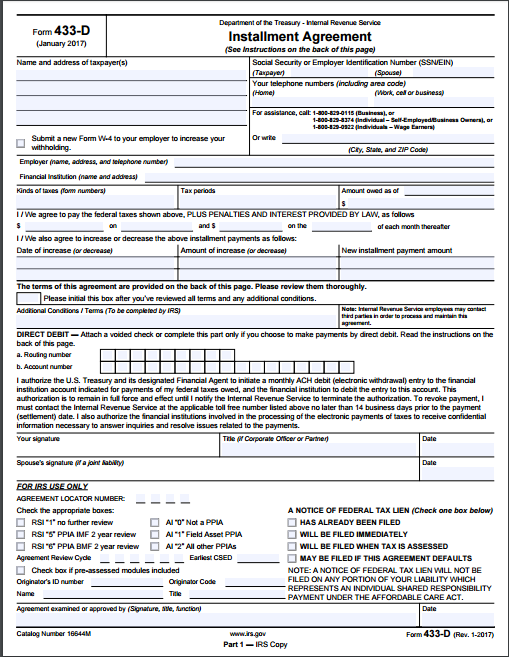

Irs Form 433 D Printable

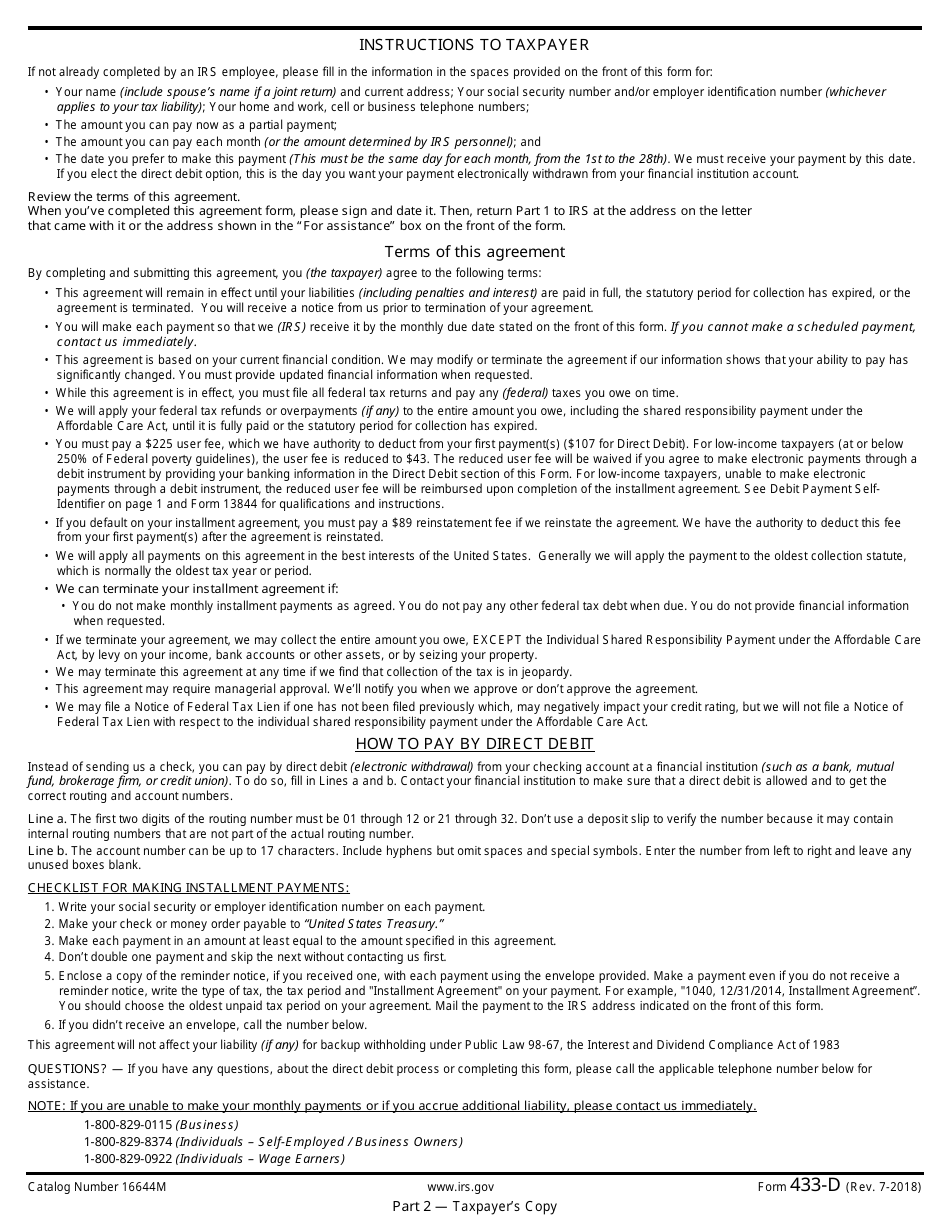

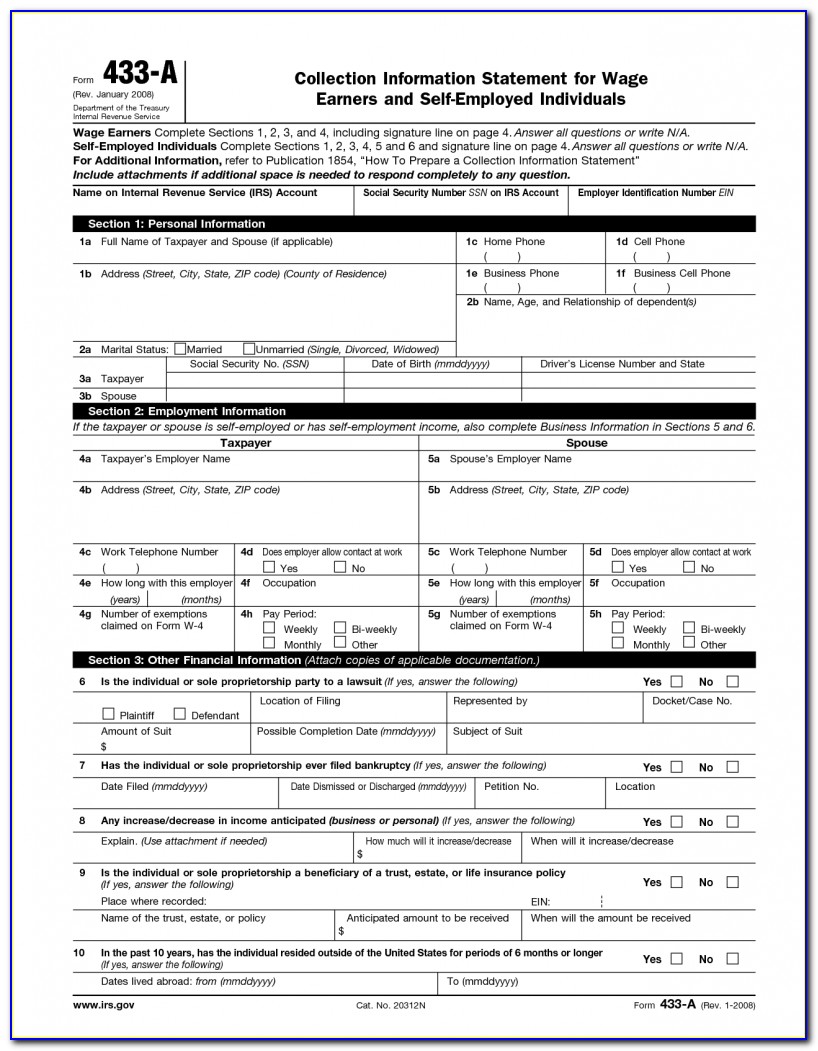

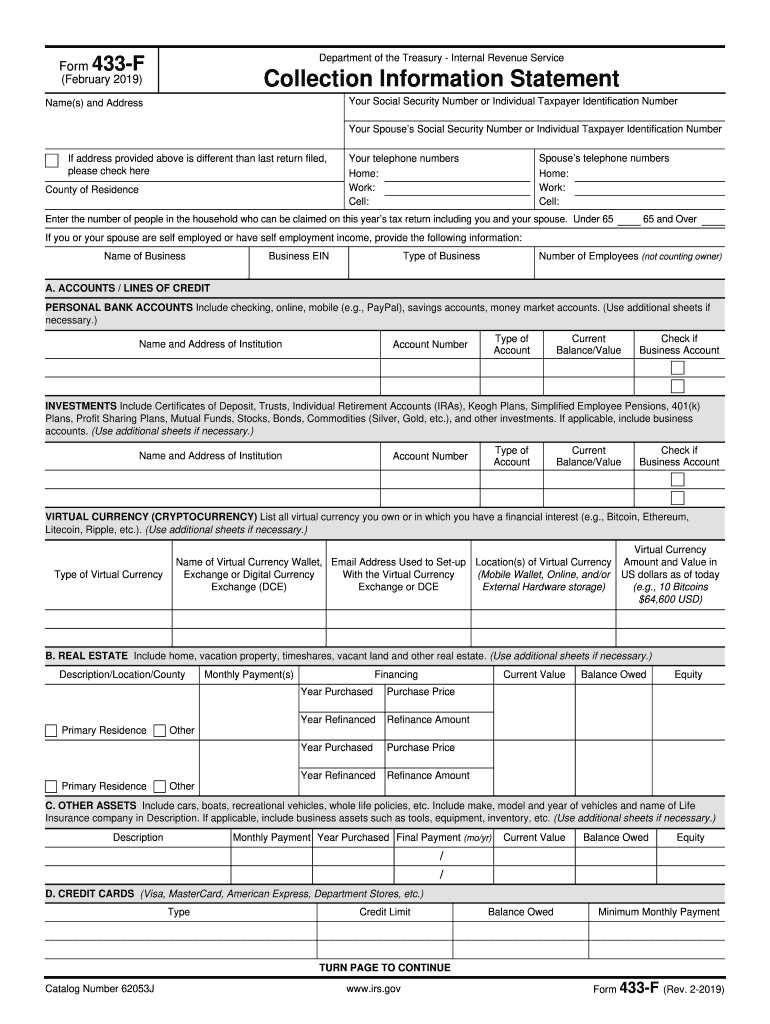

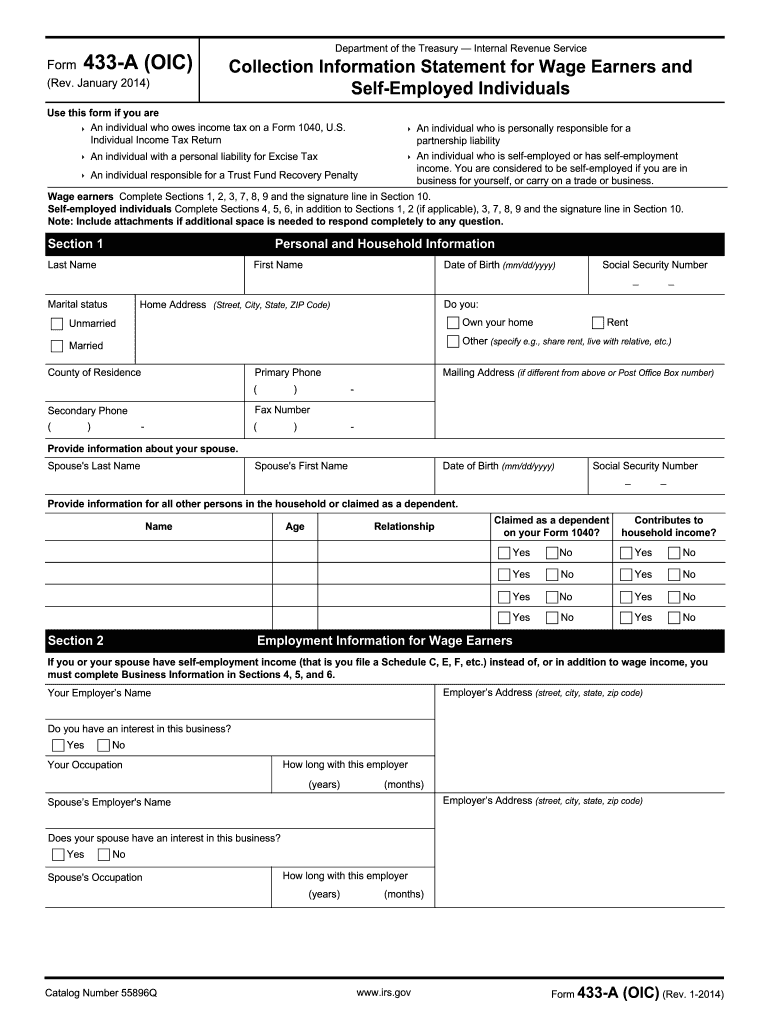

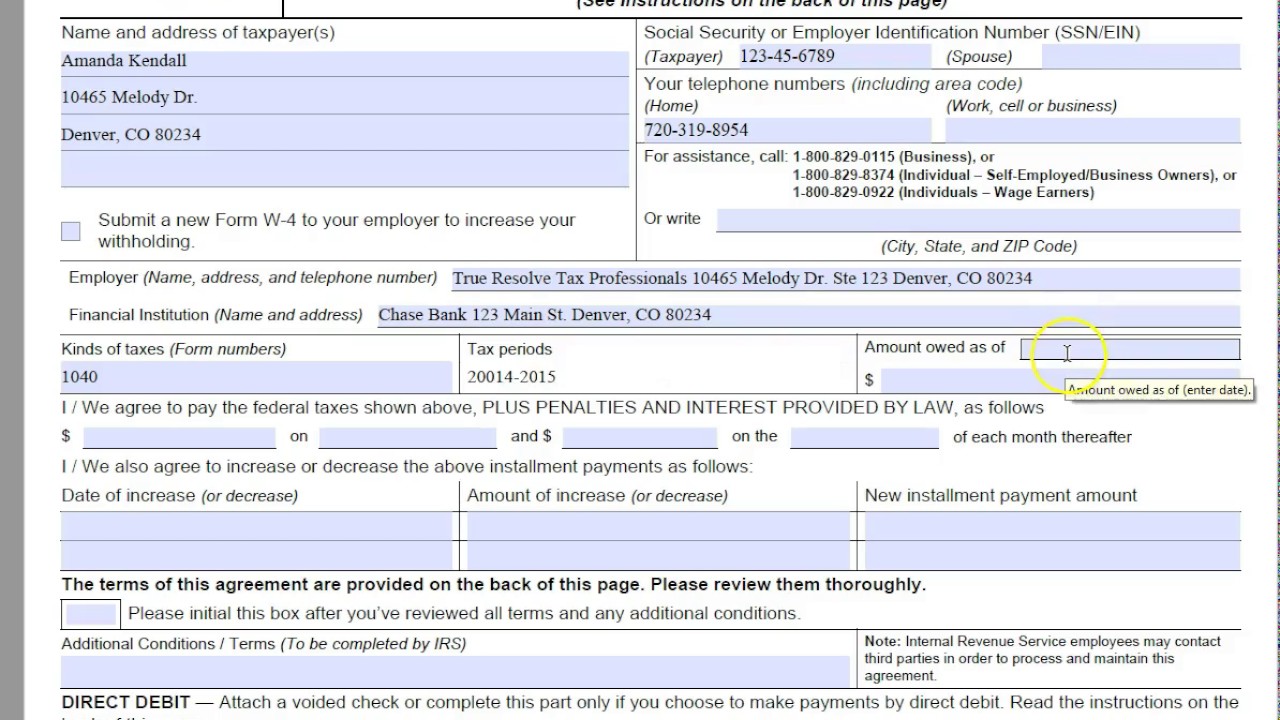

Irs Form 433 D Printable - May 31, 2019 4:46 pm. Find out the qualifications, terms, fees, and faqs of this agreement. Paperless workflowbbb a+ rated businessover 100k legal formstrusted by millions Your name (include spouse’s name if a joint return) and current address; Find out the eligibility, terms, conditions, and consequences of this tax resolution scheme. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. Find out who should file, what information to include, and what fees and terms apply. Let’s start with some step by step guidance on completing your installment agreement request. Web download and print the official pdf form for entering into a payment plan with the irs. The back of the form lists the requirements for your payment plan and the reasons the irs may put your plan into default. If not already completed by an irs employee, please fill in the information in the spaces provided on the front of this form for: (see instructions on the back of this page) name and address of taxpayer(s) social security or employer identification number (ssn/ein) (taxpayer) (spouse) your telephone numbers. Fill in your personal and tax information, payment details, and terms. Find out the eligibility criteria, fees, and steps to complete this form accurately and timely. Web download and print the official pdf form for entering into a payment plan with the irs. Known as an installment agreement, this form takes information related to the amount due and helps the parties come to a reasonable installment plan to pay off what. Your name (include spouse’s name if a joint return) and current address; This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. If not already completed by an irs employee, please fill in the information in the spaces provided on the front of this form for: Find out. Keep in mind that this is not the form you use to apply for a payment plan in the first place. Known as an installment agreement, this form takes information related to the amount due and helps the parties come to a reasonable installment plan to pay off what is owed. View solution in original post. Web download and print. What is an irs form 433d? (see instructions on the back of this page) name and address of taxpayer(s) social security or employer identification number (ssn/ein) (taxpayer) (spouse) your telephone numbers. The back of the form lists the requirements for your payment plan and the reasons the irs may put your plan into default. Your name (include spouse’s name if. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. If not already completed by an irs employee, please fill in the information in the spaces provided on the front of this form for: Web download and print the official pdf form for entering into a payment plan. Paperless workflowbbb a+ rated businessover 100k legal formstrusted by millions Let’s start with some step by step guidance on completing your installment agreement request. Your name (include spouse’s name if a joint return) and current address; (see instructions on the back of this page) name and address of taxpayer(s) social security or employer identification number (ssn/ein) (taxpayer) (spouse) your telephone. View solution in original post. If not already completed by an irs employee, please fill in the information in the spaces provided on the front of this form for: What is an irs form 433d? Find out the qualifications, terms, fees, and faqs of this agreement. Your name (include spouse’s name if a joint return) and current address; If not already completed by an irs employee, please fill in the information in the spaces provided on the front of this form for: Your social security number and/or employer identification number (whichever applies to your tax liability); Web download and print the official pdf form for entering into a payment plan with the irs. (see instructions on the back. Known as an installment agreement, this form takes information related to the amount due and helps the parties come to a reasonable installment plan to pay off what is owed. May 31, 2019 4:46 pm. You must do that by submitting an application through the irs’s online payment agreement. Find out who should file, what information to include, and what. You must do that by submitting an application through the irs’s online payment agreement. If not already completed by an irs employee, please fill in the information in the spaces provided on the front of this form for: Web download and print the official pdf form for entering into a payment plan with the irs. May 31, 2019 4:46 pm. Find out the qualifications, terms, fees, and faqs of this agreement. This particular form is used to apply for an installment agreement, which breaks up an overdue tax balance into smaller monthly payments. Find out who should file, what information to include, and what fees and terms apply. Let’s start with some step by step guidance on completing your installment agreement request. View solution in original post. Known as an installment agreement, this form takes information related to the amount due and helps the parties come to a reasonable installment plan to pay off what is owed. Keep in mind that this is not the form you use to apply for a payment plan in the first place. The back of the form lists the requirements for your payment plan and the reasons the irs may put your plan into default. Find out the eligibility criteria, fees, and steps to complete this form accurately and timely. Find out the requirements, options, and instructions for this form and compare it with other irs forms. Your social security number and/or employer identification number (whichever applies to your tax liability); Fill in your personal and tax information, payment details, and terms of agreement, and return it to the irs address.

IRS Form 433d Fill Out, Sign Online and Download Fillable PDF

Irs Form 433 D Printable

Irs Form 433 D Printable

IRS Form 433D Fill out, Edit & Print Instantly

433d form Fill out & sign online DocHub

IRS Form 433D Free Download, Create, Edit, Fill and Print

Form 433D Installment Agreement Internal Revenue Service printable

Irs Form 433 D Printable Master of Documents

How to Fill Out IRS Form 433D

Irs Form 433 D Printable Printable World Holiday

Your Name (Include Spouse’s Name If A Joint Return) And Current Address;

What Is An Irs Form 433D?

Paperless Workflowbbb A+ Rated Businessover 100K Legal Formstrusted By Millions

Find Out The Eligibility, Terms, Conditions, And Consequences Of This Tax Resolution Scheme.

Related Post: