Irs B Notice Template

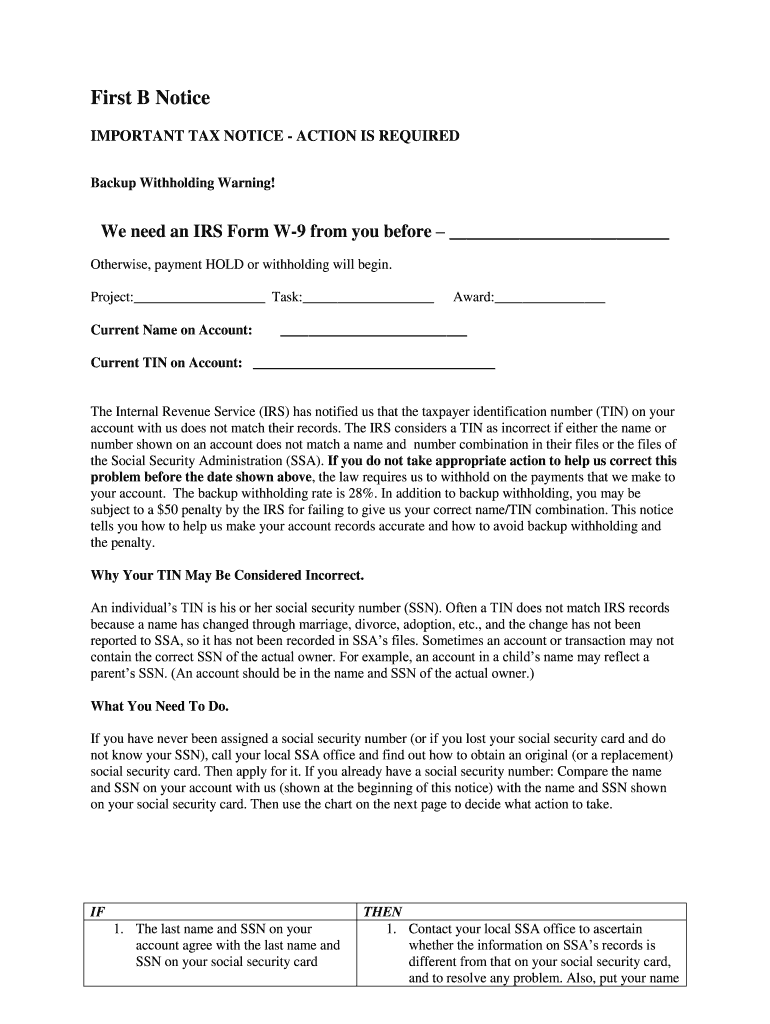

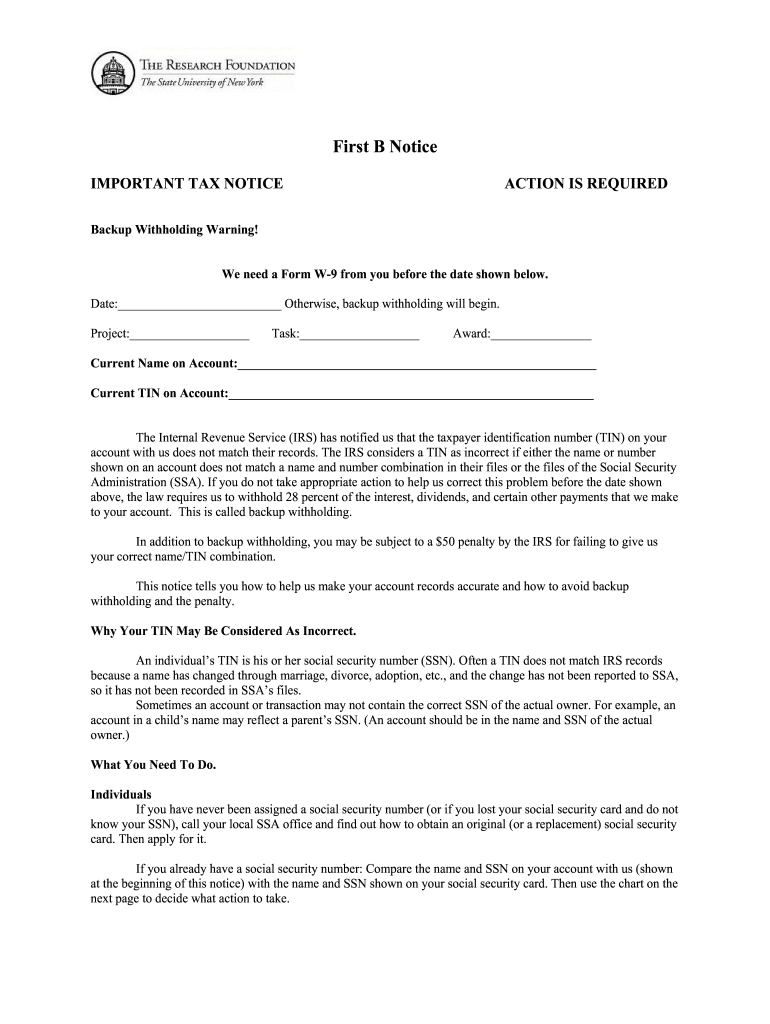

Irs B Notice Template - Write the internal revenue service center where you file your income tax return, and ask the irs to send you a letter 147c; Backup withholding notices are sent in october and april. Here are the next steps. Compare your records with the list of incorrect tins or name/tin combinations. Web check that your mailing address is correct and up to date with us, so you’ll receive your cp2100 or cp 2100a notice. This letter is issued by the appeals office of the irs acknowledging they received your withdrawal request for a collection due process. Web irs publication 1281, backup withholding for missing and incorrect names/tin (s), contains detailed information with respect to backup withholding and the. Web published october 13, 2012 · updated may 11, 2021. Web adjustment, notices of final partnership administrative adjustment, notices of final partnership adjustment, and appraisals and similar materials relating to any real or. Web if the irs identifies discrepancies in a business’s tax filings in relation to forms 1099, it will issue a “b” notice to alert the business of the problem. If this is the first time an incorrect name and tin for an individual has been. Additional complexities of b notice resolution. Here are the next steps. There are situations when the payer is required to withhold at the current rate of 24 percent. Web this includes a template letter to send to your payees to get the corrected information. Identify which irs notice you received. Web the irs sends two kinds of b notices to payers: Compare your records with the list of incorrect tins or name/tin combinations. Check those out in irs publication 1281. If this is the first time an incorrect name and tin for an individual has been. We mail these notices to your address of. Check those out in irs publication 1281. Compare your records with the list of incorrect tins or name/tin combinations. Here are the next steps. There are situations when the payer is required to withhold at the current rate of 24 percent. Backup withholding notices are sent in october and april. Web this includes a template letter to send to your payees to get the corrected information. You do not need to. Web did you receive an irs notice or letter? Free trialpaperless solutionsbbb a+ rated business Web did you receive an irs notice or letter? Web got a letter or notice from the irs? Compare your records with the list of incorrect tins or name/tin combinations. Web the irs sends two kinds of b notices to payers: What is a b notice (i.e., what is required if a b notice is received? Web the irs sends two kinds of b notices to payers: Backup withholding notices are sent in october and april. When the irs needs to ask a question about a. Identify which irs notice you received. Web this includes a template letter to send to your payees to get the corrected information. Web did you receive an irs notice or letter? Web this includes a template letter to send to your payees to get the corrected information. You do not need to. Here are the next steps. This letter is issued by the appeals office of the irs acknowledging they received your withdrawal request for a collection due process. Backup withholding notices are sent in october and april. Web check that your mailing address is correct and up to date with us, so you’ll receive your cp2100 or cp 2100a notice. What is a b notice (i.e., what is required if a b notice is received? Web this includes a template letter to send to your payees to get. Web check that your mailing address is correct and up to date with us, so you’ll receive your cp2100 or cp 2100a notice. Web published october 13, 2012 · updated may 11, 2021. If this is the first time an incorrect name and tin for an individual has been. Web adjustment, notices of final partnership administrative adjustment, notices of final. Web if the irs identifies discrepancies in a business’s tax filings in relation to forms 1099, it will issue a “b” notice to alert the business of the problem. There are situations when the payer is required to withhold at the current rate of 24 percent. Web what is backup withholding? Write the internal revenue service center where you file. Important ta x notice action is required backup withholding warning! We mail these notices to your address of. Here are the next steps. Web check that your mailing address is correct and up to date with us, so you’ll receive your cp2100 or cp 2100a notice. Web first b notice important tax notice action is required backup withholding warning! This letter is issued by the appeals office of the irs acknowledging they received your withdrawal request for a collection due process. Compare your records with the list of incorrect tins or name/tin combinations. Web table of contents. There are situations when the payer is required to withhold at the current rate of 24 percent. Search for your notice or letter to learn what it means and what you should do. Web what is backup withholding? Web if the irs identifies discrepancies in a business’s tax filings in relation to forms 1099, it will issue a “b” notice to alert the business of the problem. Additional complexities of b notice resolution. This 24 percent tax is taken from any future. You do not need to. Write the internal revenue service center where you file your income tax return, and ask the irs to send you a letter 147c;

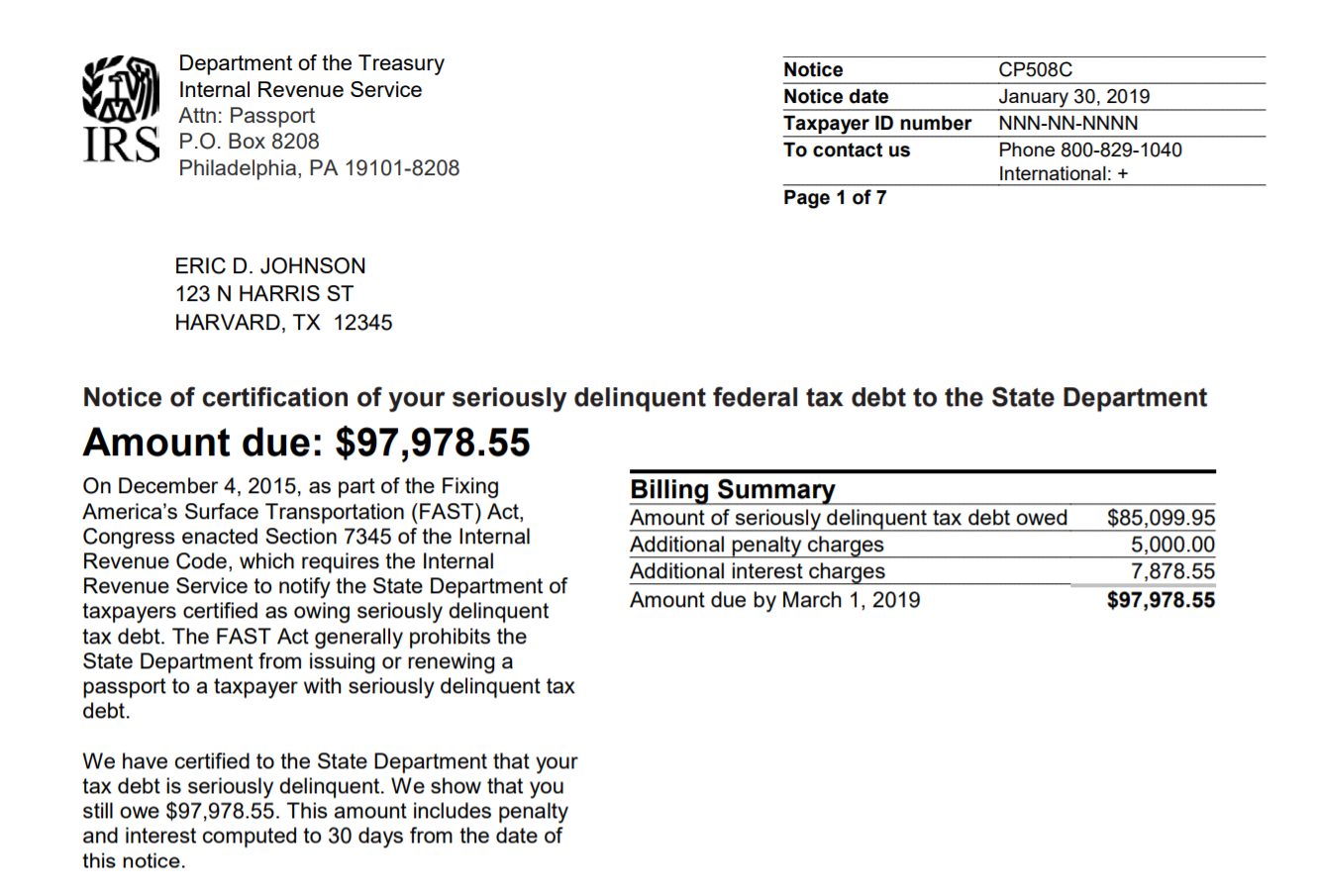

IRS CP508C Notice How To Keep Your Passport In Good Standing

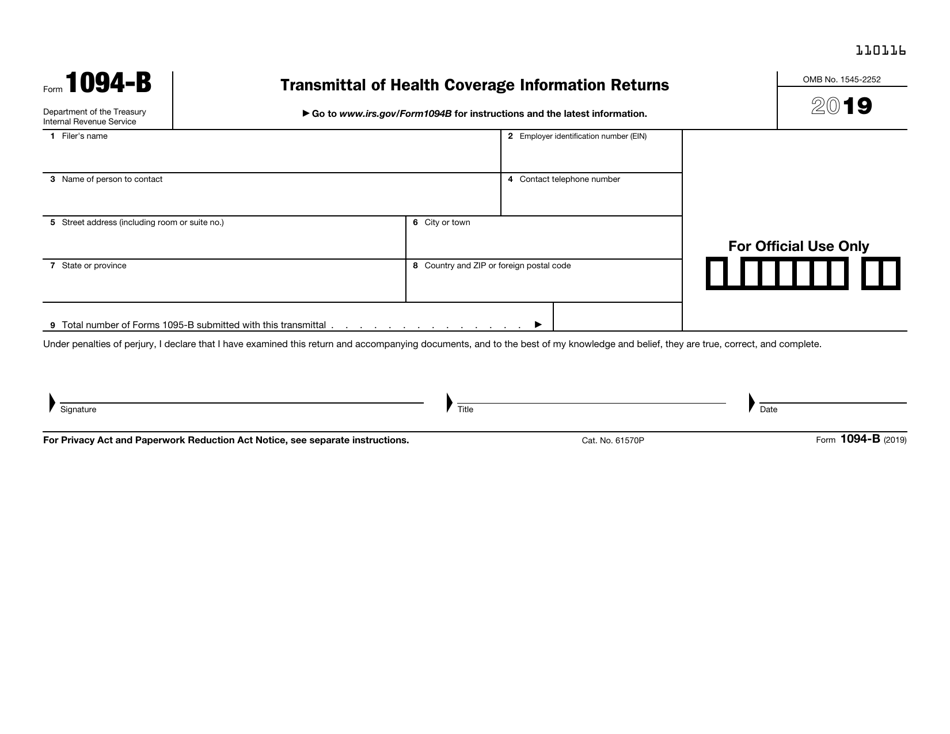

IRS Form 1094B Download Fillable PDF or Fill Online Transmittal of

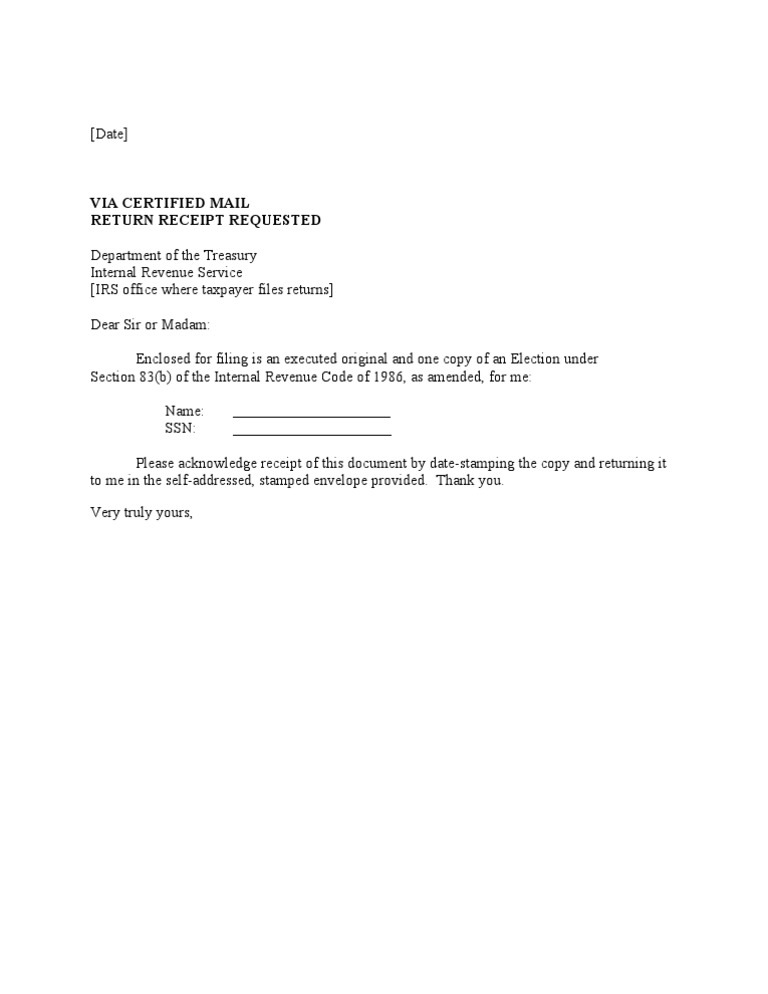

EXAMPLE 83 (B) Letter To IRS Individual) PDF Postal System

IRS Letter 2202 Sample 1

Get Our Image of First B Notice Form Template Templates, One, Form

Get Our Printable First B Notice Form Template Templates, Form, One

IRS Audit Letter CP134B Sample 1

B Notice Irs Fill Online, Printable, Fillable, Blank pdfFiller

B Notice Form Complete with ease airSlate SignNow

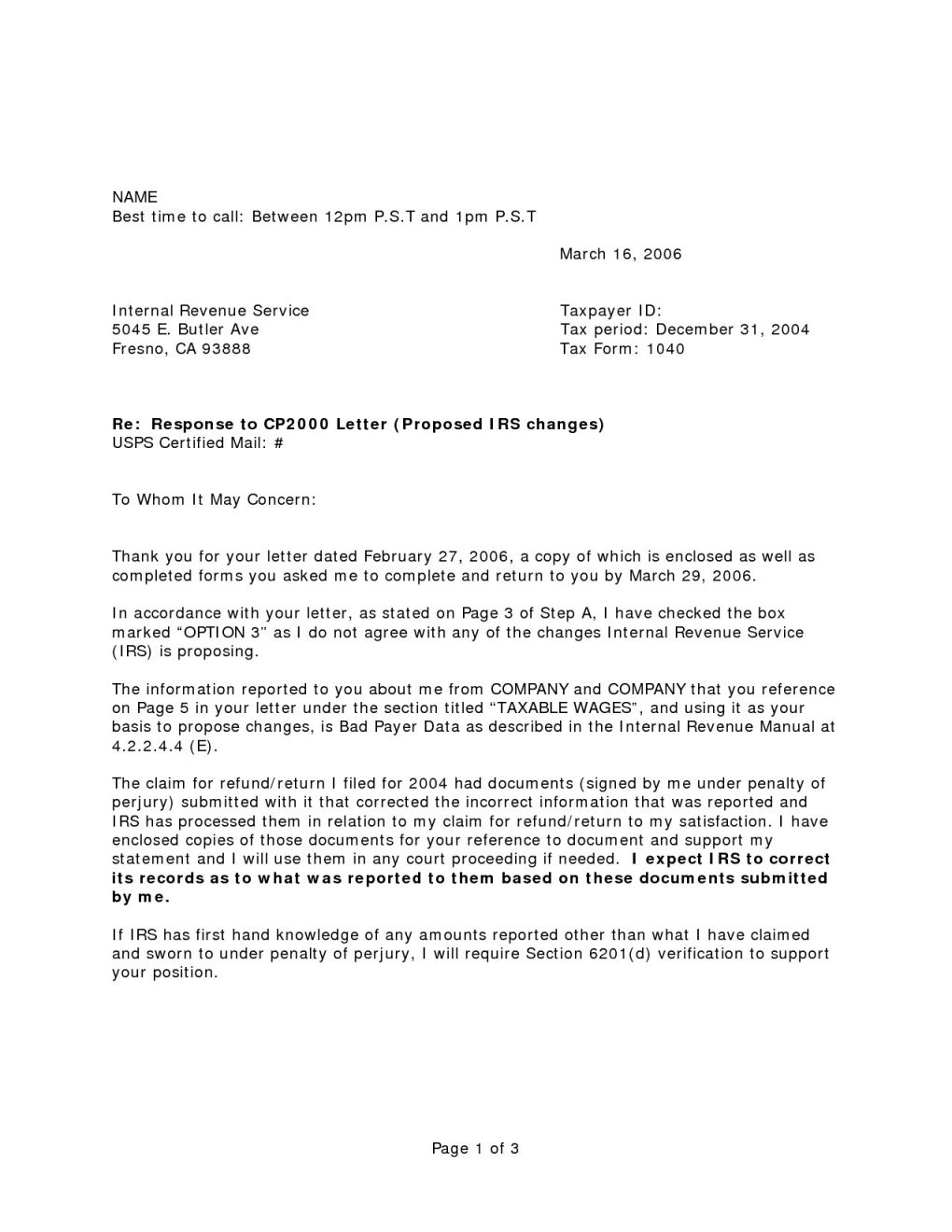

Irs Response Letter Template Samples Letter Template Collection

Web This Includes A Template Letter To Send To Your Payees To Get The Corrected Information.

Web Did You Receive An Irs Notice Or Letter?

Download Pdf (2.8 Mb) The Irs Celebrated “Tax Day” By Announcing On April 15, 2022, That Backup Withholding Notices Were On The Way.

If This Is The First Time An Incorrect Name And Tin For An Individual Has Been.

Related Post: