Irs Abatement Letter Template

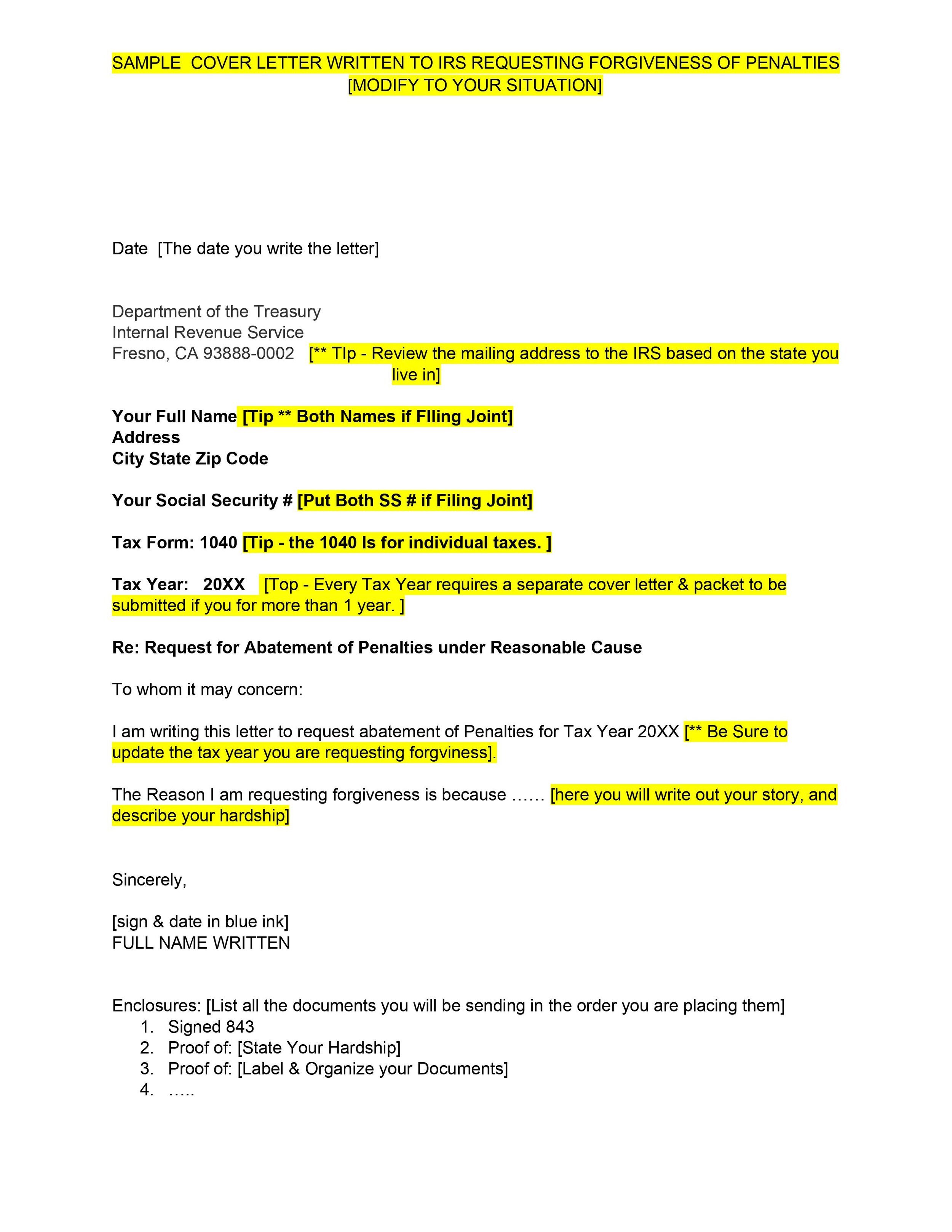

Irs Abatement Letter Template - A signed letter requesting that we reduce or adjust the overcharged interest. Web you may qualify for penalty relief if you tried to comply with tax laws but were unable due to circumstances beyond your control. Web an irs penalty abatement request letter is a formal statement composed by a taxpayer and sent to the internal revenue service (irs) to ask the latter to waive a penalty. Help with irs penalty abatement from community tax. Internal revenue service penalty abatement coordinator [address provided on notice of tax amount due] [indicate what tax form it is pertaining to, e.g. Last updated on june 27th, 2022. Examination of returns and claims for refund; Determination of tax liability (also: Web writing an irs penalty abatement request letter. The letter should explain why you deserve abatement. Last updated on june 27th, 2022. Web use this sample irs penalty abatement request letter as a template for your successful appeal letter. Web if we correctly charged the partnership or s corporation a penalty for filing late, but you believe it had reasonable cause for doing so, you can mail a written. Taxpayers hate paying irs penalties. Web writing. Last updated on june 27th, 2022. Determination of tax liability (also: 1040, 1065, etc, and the tax period] re: What is an example of reasonable cause. Web after the irs has assessed a penalty, the taxpayer can request penalty abatement, typically by writing a penalty abatement letter or by calling the irs. Fortunately, we have a sample petition letter so you get a. A customizable template to kickstart your letter. Web you can request penalty abatement by writing a letter to the irs. Last updated on june 27th, 2022. Web the irs denied your request to remove the penalty (penalty abatement), you received a letter denying your request, which gives you your. The letter should explain why you deserve abatement. Web if you don't qualify for either or we can't approve your relief over the phone, you can request relief in writing with form 843, claim for refund and request for. You may qualify for relief from a penalty. Web here is a simplified irs letter template that you can use when. Web writing an irs penalty abatement request letter. Web if such a letter arrives, we urge you to contact the state and local tax group at kilpatrick so that we may assist you throughout the process and, if need be, assist. Help with irs penalty abatement from community tax. Determination of tax liability (also: Web if you don't qualify for. Web writing an irs penalty abatement request letter. Web if such a letter arrives, we urge you to contact the state and local tax group at kilpatrick so that we may assist you throughout the process and, if need be, assist. You should also include a detailed. The letter should explain why you deserve abatement. Examination of returns and claims. Web if you don't qualify for either or we can't approve your relief over the phone, you can request relief in writing with form 843, claim for refund and request for. If you received a notice or. Web template for success: Examination of returns and claims for refund; Request for penalty abatement [taxpayer name(s)] [address] [ssn or tin] [date] to. You may qualify for relief from a penalty. Web writing an irs penalty abatement request letter. Last updated on june 27th, 2022. Up to 90% debt reduction.current on tax guidelines20+yrs in tax resolution Examination of returns and claims for refund; Web writing an irs penalty abatement request letter. Web template for success: A customizable template to kickstart your letter. The importance of tracking your request and being prepared for any follow. Web you can request penalty abatement by writing a letter to the irs. Help with irs penalty abatement from community tax. Web use this sample irs penalty abatement request letter as a template for your successful appeal letter. Web form 843, claim for refund and request for abatement pdf or. Affordable tax helpone time fee of $97instant payment quote Web the irs denied your request to remove the penalty (penalty abatement), you received. Web an irs penalty abatement request letter is a formal statement composed by a taxpayer and sent to the internal revenue service (irs) to ask the latter to waive a penalty. Web if such a letter arrives, we urge you to contact the state and local tax group at kilpatrick so that we may assist you throughout the process and, if need be, assist. Web if we correctly charged the partnership or s corporation a penalty for filing late, but you believe it had reasonable cause for doing so, you can mail a written. Fortunately, we have a sample petition letter so you get a. 1040, 1065, etc, and the tax period] re: What is an example of reasonable cause. Request for penalty abatement [taxpayer name(s)] [address] [ssn or tin] [date] to whom it may concern: Determination of tax liability (also: The letter should explain why you deserve abatement. Affordable tax helpone time fee of $97instant payment quote A penalty abatement request letter asks the irs to remove a penalty for reasonable cause and contains an explanation of your. Help with irs penalty abatement from community tax. Internal revenue service penalty abatement coordinator [address provided on notice of tax amount due] [indicate what tax form it is pertaining to, e.g. Web the irs denied your request to remove the penalty (penalty abatement), you received a letter denying your request, which gives you your appeal rights. Unfortunately, most taxpayers assessed an irs penalty do not request relief or are. Examination of returns and claims for refund;

How to remove IRS tax penalties in 3 easy steps. — Get rid of tax

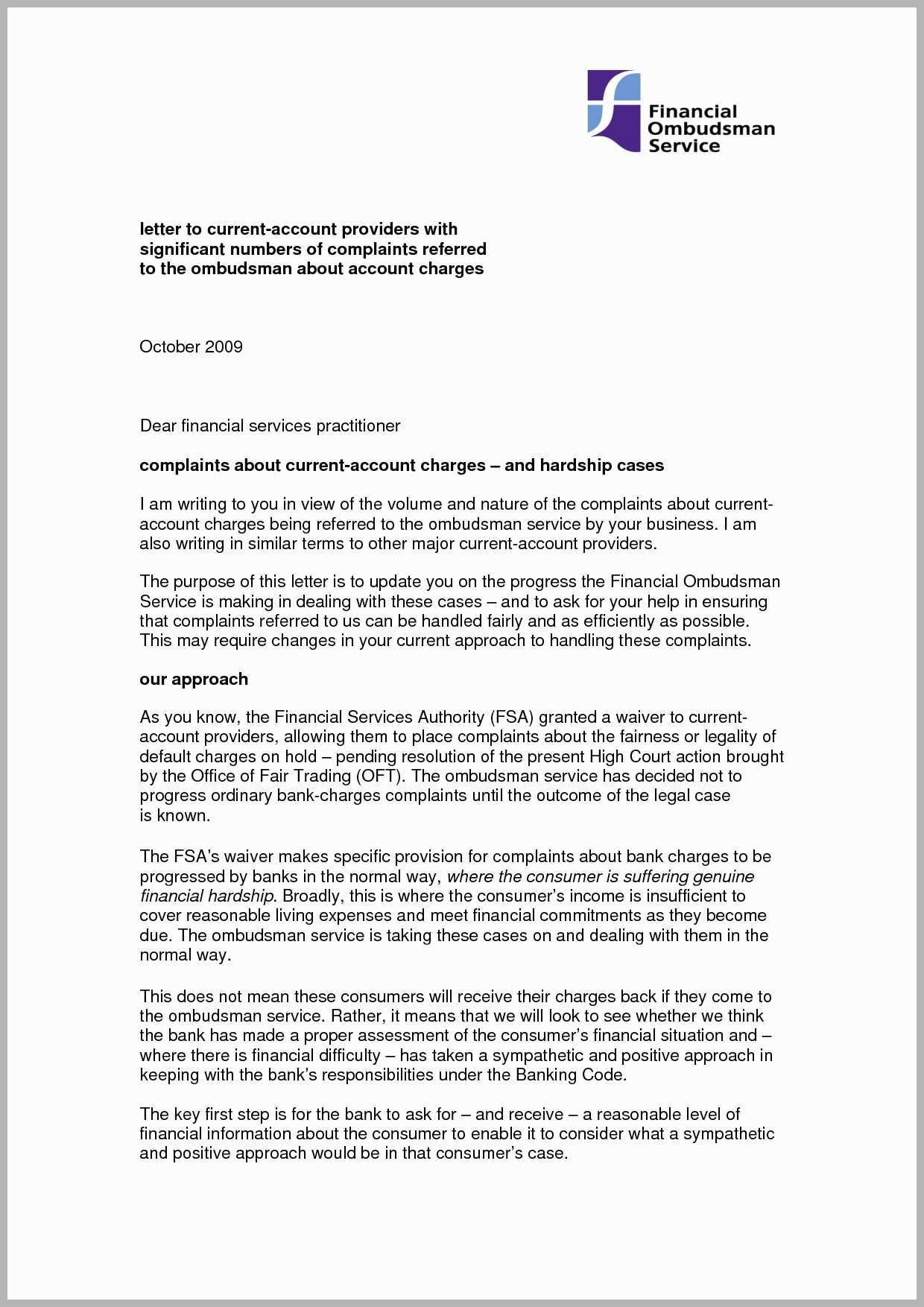

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties in Bank

How To Write Letter To Irs About Abatement businessbv

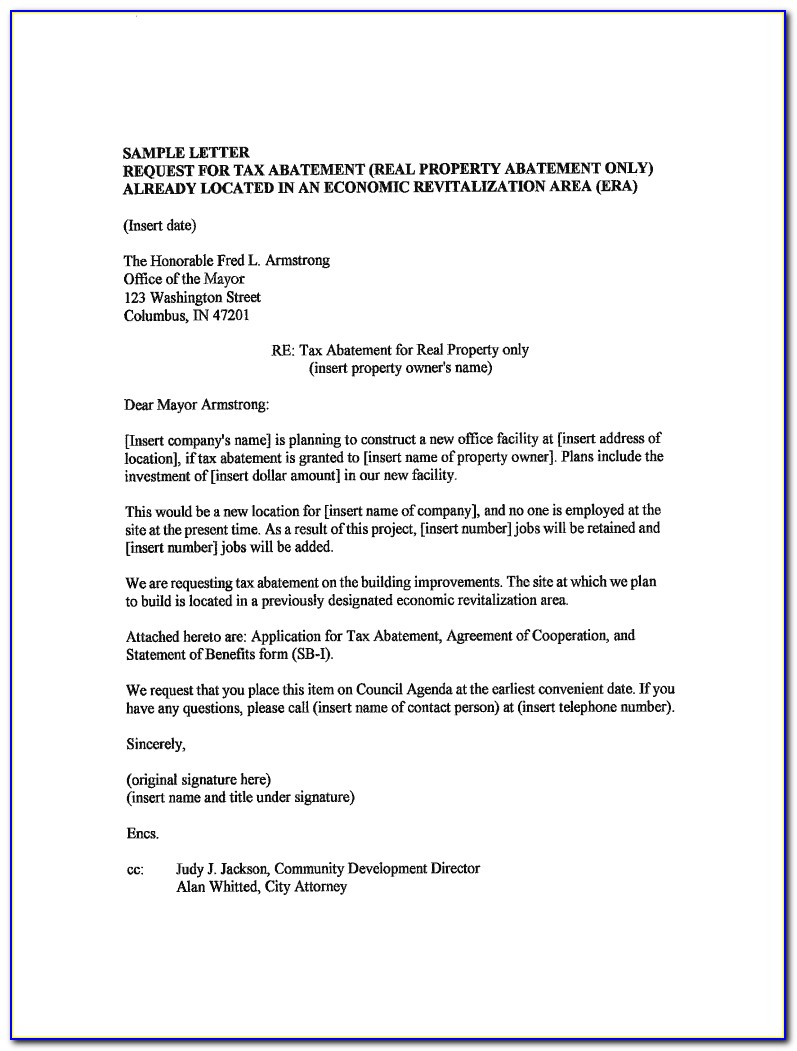

Penalty Abatement Letter Sample

Asking For Waiver Of Penalty Unique Irs Penalty Abatement Letter

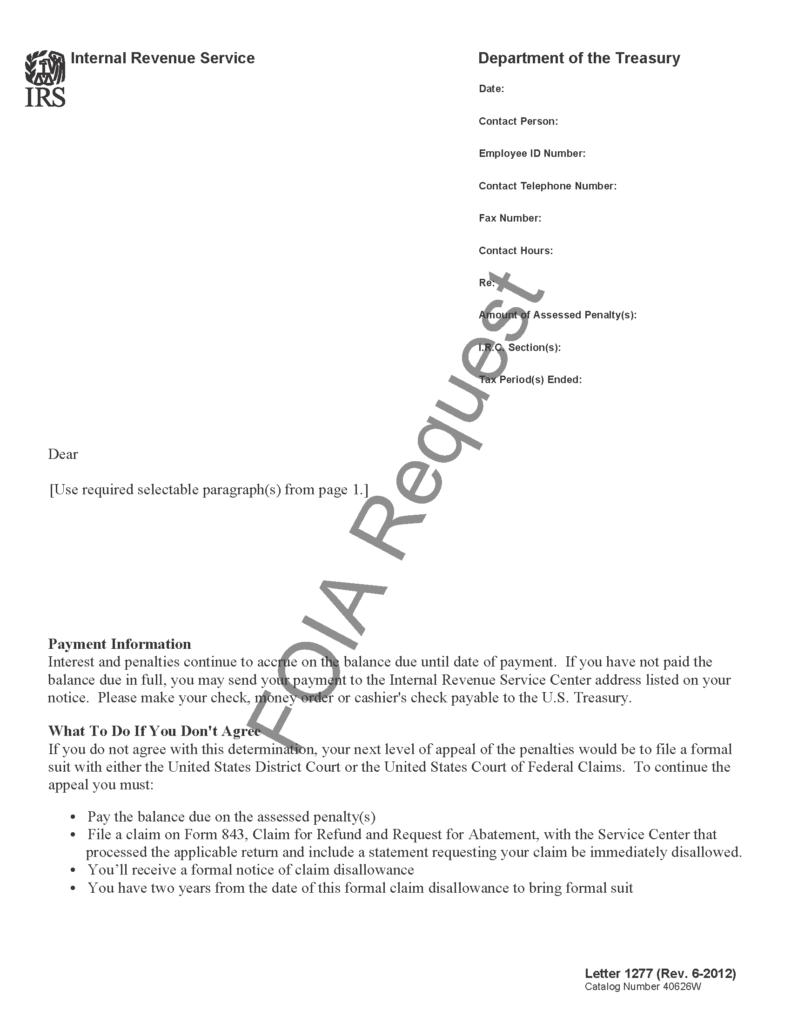

IRS Letter 1277 Penalty Abatement Denied H&R Block

IRS Abatement Letter Template PDF Internal Revenue Service

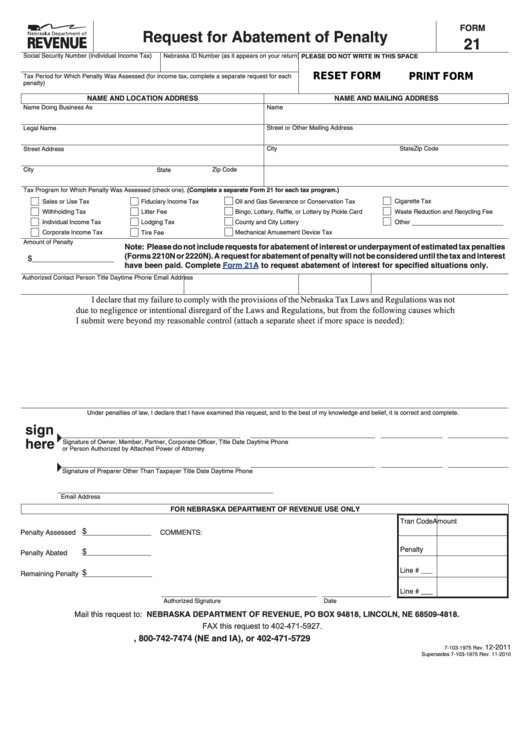

Fillable Form 21 Request For Abatement Of Penalty printable pdf download

Sample Letter To Irs To Waive Penalty

Sample IRS Penalty Abatement Request Letter PDF Internal Revenue

A Customizable Template To Kickstart Your Letter.

Web If You Don't Qualify For Either Or We Can't Approve Your Relief Over The Phone, You Can Request Relief In Writing With Form 843, Claim For Refund And Request For.

The Importance Of Tracking Your Request And Being Prepared For Any Follow.

The Template Is Available Free To.

Related Post: