Inverted Head And Shoulders Pattern

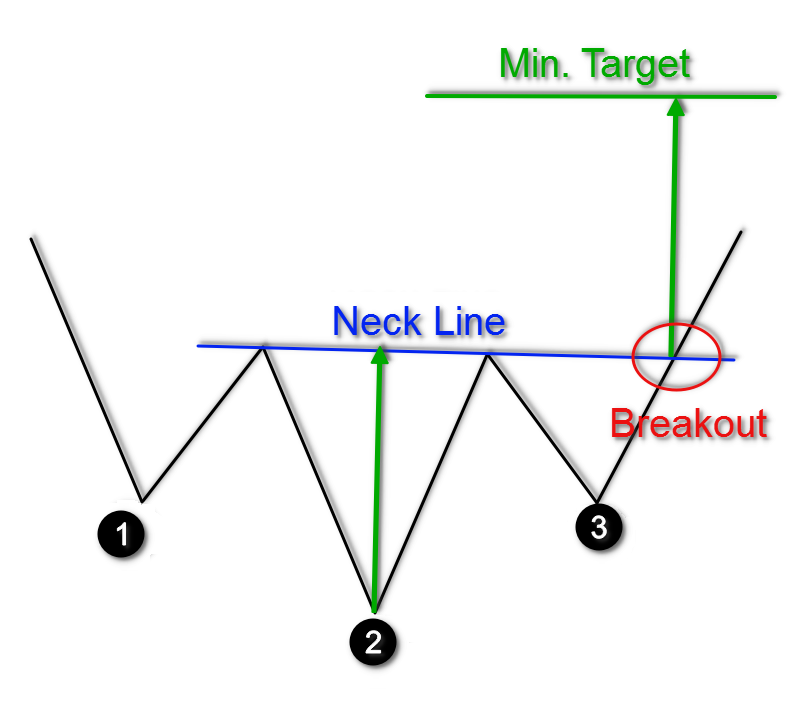

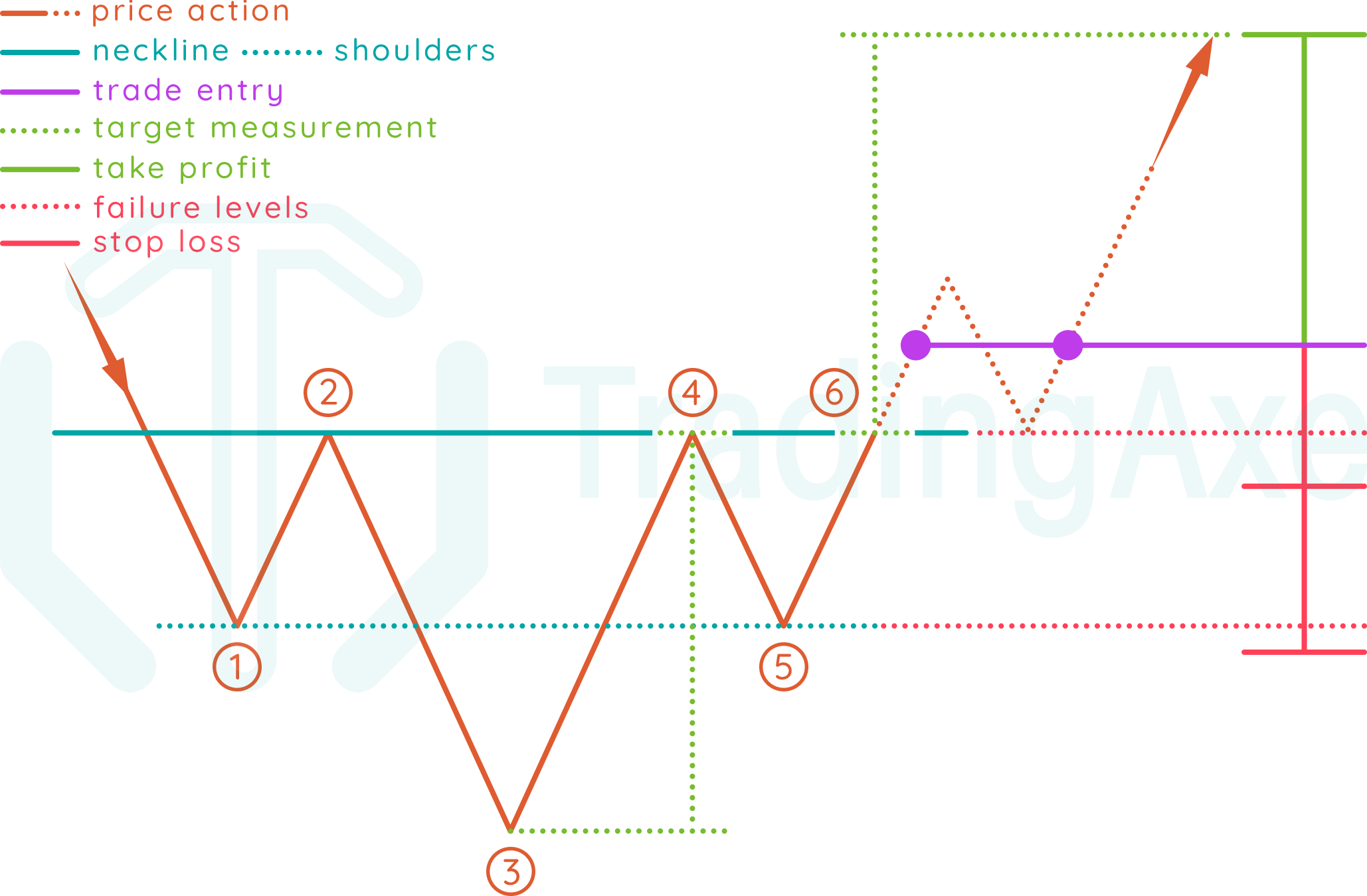

Inverted Head And Shoulders Pattern - The name speaks for itself. This pattern, recognized for indicating potential upward momentum, suggests a positive shift in market dynamics. Furthermore, the pattern appears at the end of a downward trend and should have a clear neckline used as a resistance level. This relatively small inverted head and shoulders pattern marked the end to heating oil's minor downtrend and the beginning to a powerful rally. With inverted head and shoulders the neckline is drawn through the highest points of the two intervening peaks. Cardi b attends the 2024 met gala. Web an inverted head and shoulder pattern is a significant technical analysis pattern commonly used in financial markets to identify potential trend reversals. May 6, 2024, 8:23 pm pdt. Web inverse head and shoulders pattern is the mirror image of head and shoulders pattern. These formations occur after extended downward movements. The lowest price of the incoming cycle. The pattern contains three successive peaks, with the middle peak ( head) being the highest and the two outside peaks ( shoulders) being low and roughly equal. Read about head and shoulder pattern here: The opposite of a head and shoulders chart is the inverse head and shoulders, also called a head and. Cardi b attends the 2024 met gala. Traders use it to time the bottom of a downtrend and buy into an asset at the perfect time i.e. Furthermore, the pattern appears at the end of a downward trend and should have a clear neckline used as a resistance level. A downward sloping neckline signals continuing weakness and is less reliable. Furthermore, the pattern appears at the end of a downward trend and should have a clear neckline used as a resistance level. Web the inverse head and shoulders pattern is a reversal pattern in stock trading. May 6, 2024, 8:23 pm pdt. The lowest price of the incoming cycle. Traders use it to time the bottom of a downtrend and. It is inverted with the head and shoulders. It signals that the market may embark on an upward trend soon. The opposite of a head and shoulders chart is the inverse head and shoulders, also called a head and shoulders bottom. This pattern, recognized for indicating potential upward momentum, suggests a positive shift in market dynamics. Volume play a major. A downward sloping neckline signals continuing weakness and is less reliable as a reversal signal. Investors typically enter into a long position when the price rises above the resistance of the neckline. The opposite of a head and shoulders chart is the inverse head and shoulders, also called a head and shoulders bottom. Web the head and shoulders chart pattern. It signals that the market may embark on an upward trend soon. Volume play a major role in both h&s and inverse h&s patterns. Web inverted head and shoulders is a reversal pattern formed by three consecutive lows and two intermediate highs. Web inverse head and shoulders. Erin mcdowell , samantha grindell , anneta konstantinides, and amanda krause. Web an inverse head and shoulders (h&si) pattern is a trend reversal chart pattern. The name speaks for itself. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Read about head and shoulder pattern here: Web a head and shoulders. With inverted head and shoulders the neckline is drawn through the highest points of the two intervening peaks. This relatively small inverted head and shoulders pattern marked the end to heating oil's minor downtrend and the beginning to a powerful rally. However, if traded correctly, it allows you to identify high probability breakout trades, catch the start of a new. Traders and investors widely recognize this pattern as it often signals a. Furthermore, the pattern appears at the end of a downward trend and should have a clear neckline used as a resistance level. Signals the traders to enter into long position above the neckline. The principle of the pattern is identical to that of a triple bottom, with the. Furthermore, the pattern appears at the end of a downward trend and should have a clear neckline used as a resistance level. The name speaks for itself. Web inverse head and shoulders is a price pattern in technical analysis that signals a potential reversal from a downtrend to an uptrend. May 6, 2024, 8:23 pm pdt. Erin mcdowell , samantha. Web the inverse head and shoulders pattern is a reversal pattern in stock trading. Erin mcdowell , samantha grindell , anneta konstantinides, and amanda krause. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Signals the traders to enter into long position above the neckline. Web the inverse head and shoulders chart pattern is a bullish indicator i.e. Web an inverse head and shoulders pattern, upon completion, signals a bull market. It is also the same as a head and shoulders pattern that flipped on its horizontal axis. A valley is formed (shoulder), followed by an even lower valley (head), and then another higher valley (shoulder). With inverted head and shoulders the neckline is drawn through the highest points of the two intervening peaks. These formations occur after extended downward movements. It is of two types: Web inverse head and shoulders is a price pattern in technical analysis that indicates a potential reversal from a downtrend to an uptrend. This pattern, recognized for indicating potential upward momentum, suggests a positive shift in market dynamics. The pattern is similar to the shape of a person’s head and two shoulders in an inverted position, with. Web a recent upward movement from this support has led to a 3.8% increase in trx’s price over two days, forming a bullish reversal pattern known as the inverted head and shoulders. However, if traded correctly, it allows you to identify high probability breakout trades, catch the start of a new trend, and even “predict” market bottoms ahead of time.

invertedheadandshoulderspattern Forex Training Group

Inverse Head and Shoulders Pattern How To Spot It

How To Trade Inverted Head And Shoulders Chart Pattern TradingAxe

Inverted Head and Shoulder Chart Pattern Best Analysis

The Head and Shoulders Pattern A Trader’s Guide

What is Inverse Head and Shoulders Pattern & How To Trade It

Inverse or Inverted Head and Shoulders Pattern Chart Patterns

Head and Shoulders Trading Patterns ThinkMarkets EN

Head and Shoulders Pattern What Is It & How to Trade With It? Bybit

Inverse Head and Shoulders Pattern Trading Strategy Guide

Web Inverse Head And Shoulders.

The Inverse Head And Shoulders Pattern Is A Chart Pattern That Has Fooled Many Traders (I’ll Explain Why Shortly).

Web An Inverse Head And Shoulders Is A Bullish Trend Reversal Pattern Used In Technical Analysis By Traders To Predict New Uptrends With Traders Entering Buy Trades When Market Prices Break Above The Neckline Resistance Breakout Point.

Web The Head And Shoulders Chart Pattern Is A Price Reversal Pattern That Helps Traders Identify When A Reversal May Be Underway After A Trend Is Exhausted.

Related Post: