Inverted Head And Shoulders Chart Pattern

Inverted Head And Shoulders Chart Pattern - Studied mostly in technical analysis, bearish stock patterns often show a downfall or impending decline in the price of an asset, indices, or security. Web as a major reversal pattern, the head and shoulders bottom forms after a downtrend, with its completion marking a change in trend. The line connecting the 2 valleys is the neckline. Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. This pattern is associated with a reversal of a downward trend in price. After a downtrend, the price of the respective asset makes a low and then rallies to a. Read about head and shoulder pattern here: Web the rally from the head however, should show greater volume than the rally from the left shoulder. Web the inverse head and shoulders pattern is a reversal pattern in stock trading. Web the head and shoulders pattern is a market chart that crypto traders use to identify price reversals. Web as a major reversal pattern, the head and shoulders bottom forms after a downtrend, with its completion marking a change in trend. Volume has a great importance in the head and shoulders pattern. The line connecting the 2 valleys is the neckline. It resembles a baseline with three peaks with the middle topping the other two. It is one. Mostly such downfalls are followed by a good. The first and third lows are called shoulders. It is of two types: The height of the last top can be higher than the first, but not higher than the head. After a downtrend, the price of the respective asset makes a low and then rallies to a. Head & shoulder and inverse head & shoulder. The inverse head and shoulders pattern is a chart pattern that has fooled many traders (i’ll explain why shortly). As price moves back downward, it hits a low point (a trough) and then begins to recover and swing upward. The significant aspect of this pattern was the breakout above the neckline at. Web the inverse head and shoulders is a technical chart pattern that signals a potential trend reversal from a downward trend to an upward trend in the price of a security or asset. The pattern resembles a left shoulder, head, and right shoulder, hence the term head. Stock passes all of the below filters in cash segment: It consists of. Studied mostly in technical analysis, bearish stock patterns often show a downfall or impending decline in the price of an asset, indices, or security. Bullish reversal patterns and bearish reversal patterns. Web community ideas chart patterns head and shoulders. The head and shoulders pattern is exactly what the term indicates. Monthly low greater than previous and 2 months ago low. The signal boasts the upcoming selling pressure and a series of lower lows and lower highs in the price action. Web the inverted head and shoulders pattern is a popular and reliable technical chart pattern used by intermediate and advanced traders to identify potential reversals in market trends. Web the rally from the head however, should show greater volume than. The head and shoulders pattern is exactly what the term indicates. Web the inverted head and shoulders pattern is a popular and reliable technical chart pattern used by intermediate and advanced traders to identify potential reversals in market trends. Web the structure of the inverse head and shoulders chart pattern is described as follows: This pattern is formed when an. Web inverted head and shoulders. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Web the inverse head and shoulders pattern is a reversal pattern in stock trading. It resembles a baseline with three peaks with the middle topping the. When the price breaks below the neckline connecting the lows of the shoulders, it suggests a potential shift from. It is inverted with the head and. Mostly such downfalls are followed by a good. The head and shoulders pattern is exactly what the term indicates. The first and third lows are called shoulders. Monthly low greater than previous and 2 months ago low. The line connecting the 2 valleys is the neckline. Stock passes all of the below filters in cash segment: Bullish reversal patterns and bearish reversal patterns. With inverted head and shoulders the neckline is drawn through the highest points of the two intervening peaks. Web an inverse head and shoulders (h&si) pattern is a trend reversal chart pattern. The line connecting the 2 valleys is the neckline. Web the structure of the inverse head and shoulders chart pattern is described as follows: Initially, the pattern illustrates a bearish outlook with the drop to form the left shoulder. The height of the last top can be higher than the first, but not higher than the head. Inverted head and shoulders as a reversal pattern in a downtrend (bullish) the inverted head and shoulders signaled a bottom. The pattern contains three successive troughs with the middle trough (head) being the deepest and the two outside troughs (shoulders) being shallower. Web the head of this pattern formed at $1622.20, with shoulders completing at $1673.30 and $1810.80. For instance, a bullish reversal pattern known as a hammer candle pattern indicates that a stock is about to reach the bottom of a downturn. Web the head and shoulders chart pattern is a technical analysis formation that typically signals a reversal in a trend. The inverse head and shoulders pattern is a chart pattern that has fooled many traders (i’ll explain why shortly). Web inverted head and shoulders is a reversal pattern formed by three consecutive lows and two intermediate highs. Scanner guide scan examples feedback. The head and shoulders pattern is exactly what the term indicates. The first and third lows are called shoulders. After a downtrend, the price of the respective asset makes a low and then rallies to a.

What is Inverse Head and Shoulders Pattern & How To Trade It

Head and Shoulders Trading Patterns ThinkMarkets EN

The Head and Shoulders Pattern A Trader’s Guide

What is Inverse Head and Shoulders Pattern & How To Trade It

Inverse or Inverted Head and Shoulders Pattern Chart Patterns

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Inverse Head and Shoulders Pattern How To Spot It

Inverse Head and Shoulders Pattern Trading Strategy Guide

What is Inverse Head and Shoulders Pattern & How To Trade It

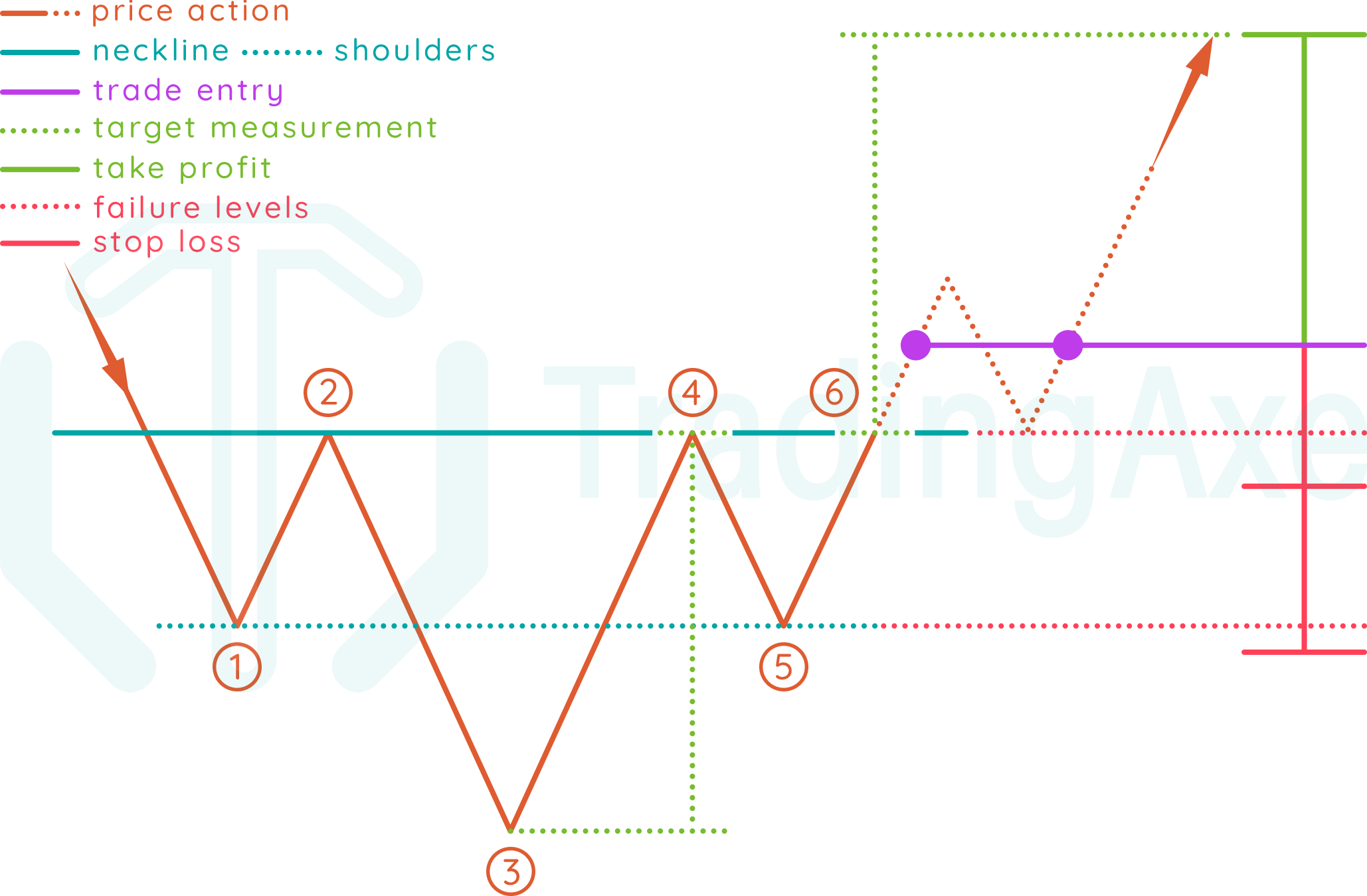

How To Trade Inverted Head And Shoulders Chart Pattern TradingAxe

The Opposite Of A Head And Shoulders Chart Is The Inverse Head And Shoulders, Also Called A Head And Shoulders Bottom.

The Pattern Resembles The Shape Of A Person’s Head And Two Shoulders In An Inverted Position, With Three Consistent Lows And Peaks.

However, If Traded Correctly, It Allows You To Identify High Probability Breakout Trades, Catch The Start Of A New Trend, And Even “Predict” Market Bottoms Ahead Of Time.

Stock Passes All Of The Below Filters In Cash Segment:

Related Post: