Inverted Hammer Candlestick Pattern

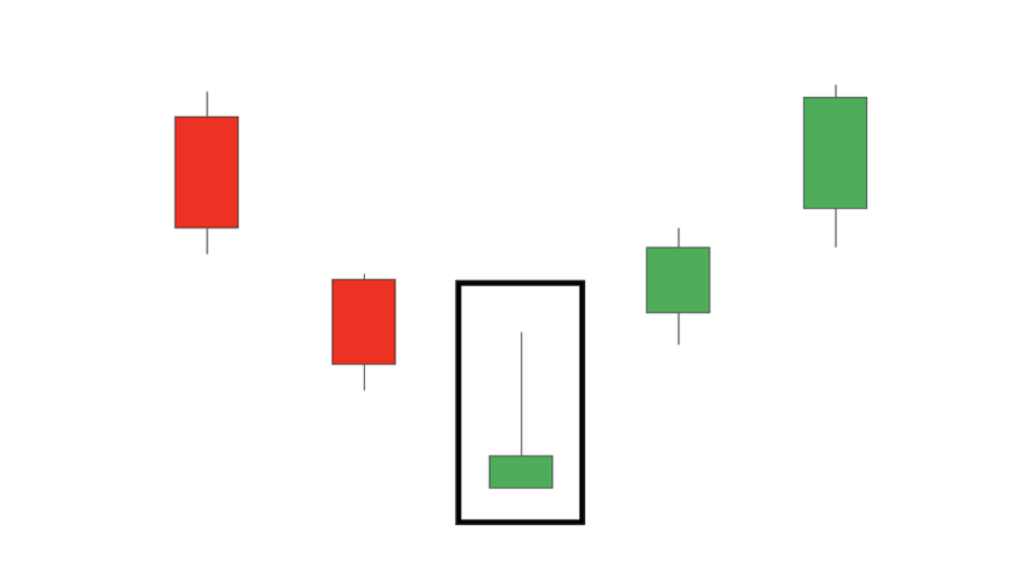

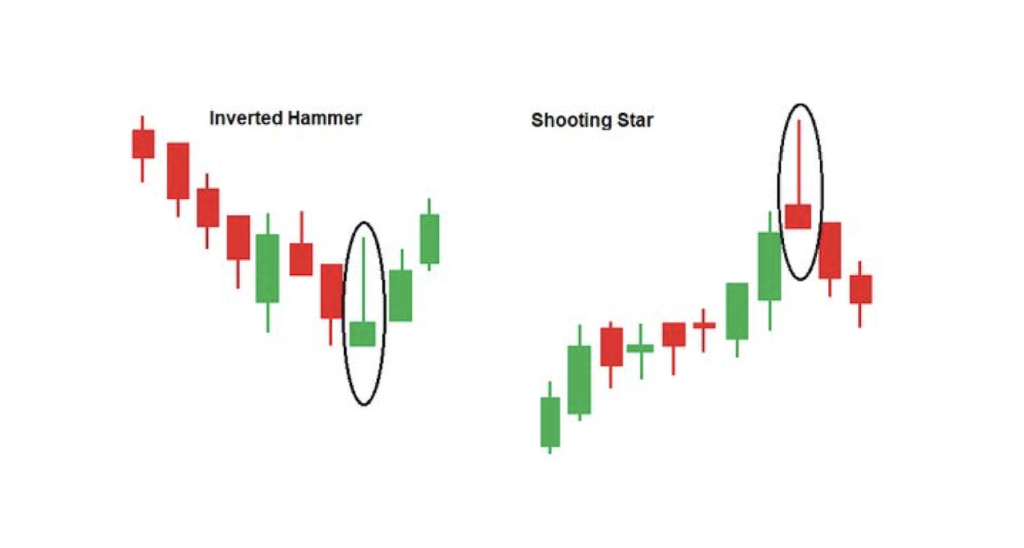

Inverted Hammer Candlestick Pattern - What is an inverted hammer candlestick pattern? The inverted hammer candlestick pattern is formed on the chart. Web trading guides technical analysis. Appears at the bottom of a downtrend. Inverted hammer is a bullish trend reversal candlestick pattern consisting of two candles. Web the inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. It often appears at the bottom of a downtrend, signalling potential bullish reversal. It’s a bullish reversal pattern. The first candle is bearish and continues the downtrend; Web inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. Web learn how to identify and trade the inverted hammer candlestick pattern, a bullish reversal signal that occurs at the bottom of a downtrend. What is an inverted hammer candlestick pattern? Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near. What is meant by the inverted hammer candlestick? How to identify an inverted hammer candlestick pattern? Web trading guides technical analysis. Candle with a small real body, a long upper wick and little to no lower wick. The inverted hammer candlestick pattern is recognized if: How to use the inverted hammer candlestick pattern in trading? Web learn how to identify and trade the inverted hammer candlestick pattern, a bullish reversal signal that occurs at the bottom of a downtrend. Web inverted hammer candlesticks are bullish candlestick patterns that form at the bottom of a downtrend, which signals a potential reversal. The inverted hammer candlestick is. The second candle is short and located in the bottom of the price range; It shows that the buyers are gaining momentum against the. Web learn how to use an inverted hammer candlestick pattern in technical analysis to identify bullish reversals in a downtrend. See examples of inverted hammer candles on the stock market. Appears at the bottom of a. Web the inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. The inverted hammer candlestick is a. Web learn what an inverted hammer is, how it forms, and how to trade it as a bullish reversal candlestick pattern. Web inverted hammer candlesticks. The second candle is short and located in the bottom of the price range; See examples, definitions, and tips for trading with this. Web the inverted hammer candlestick pattern is a chart pattern used in technical analysis to find trend reversals. How to identify an inverted hammer candlestick pattern? The inverted hammer candlestick is a. Web what is the inverted hammer candlestick pattern? Web inverted hammer candlesticks are bullish candlestick patterns that form at the bottom of a downtrend, which signals a potential reversal. Web the inverted hammer candlestick pattern is a bullish reversal pattern that forms in a downward price swing. Web learn what an inverted hammer is, how it forms, and how to. How to use the inverted hammer candlestick pattern in trading? Web the inverted hammer candlestick pattern is a bullish reversal pattern that forms in a downward price swing. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening. The. Web learn how to identify and trade the inverted hammer candlestick pattern, a bullish reversal signal that occurs at the bottom of a downtrend. By stefano treviso, updated on: It shows that the buyers are gaining momentum against the. How to use the inverted hammer candlestick pattern in trading? Web the inverted hammer is characterized by a small real body. Inverted hammer is a bullish trend reversal candlestick pattern consisting of two candles. Web trading guides technical analysis. Appears at the bottom of a downtrend. It shows that the buyers are gaining momentum against the. The inverse hammer candlestick and. Web in this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an. Web what is the inverted hammer candlestick pattern? The inverted hammer candlestick is a. Web learn what an inverted hammer is, how it forms, and how to trade it as a bullish reversal candlestick pattern. Web a hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening. It often appears at the bottom of a downtrend, signalling potential bullish reversal. Web inverted hammer candlesticks are bullish candlestick patterns that form at the bottom of a downtrend, which signals a potential reversal. What is meant by the inverted hammer candlestick? Web the inverted hammer candlestick pattern is a chart pattern used in technical analysis to find trend reversals. See examples, definitions, and tips for trading with this. What is the inverted hammer candlestick pattern. Web the inverted hammer is characterized by a small real body at the upper end of the trading range and a long lower shadow, with little or no upper shadow. Web what is an inverted hammer pattern in candlestick analysis? Back to all stocks candlestick patterns. The inverse hammer candlestick and. The first candle is bearish and continues the downtrend;

INVERTED HAMMER Candlestick pattern explained ONGC Procapital Academy

Inverted Hammer Candlestick Pattern Quick Trading Guide

Understanding the Inverted Hammer Candlestick Pattern Premium Store

Inverted Hammer Candlestick How to Trade it ForexBoat Trading

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

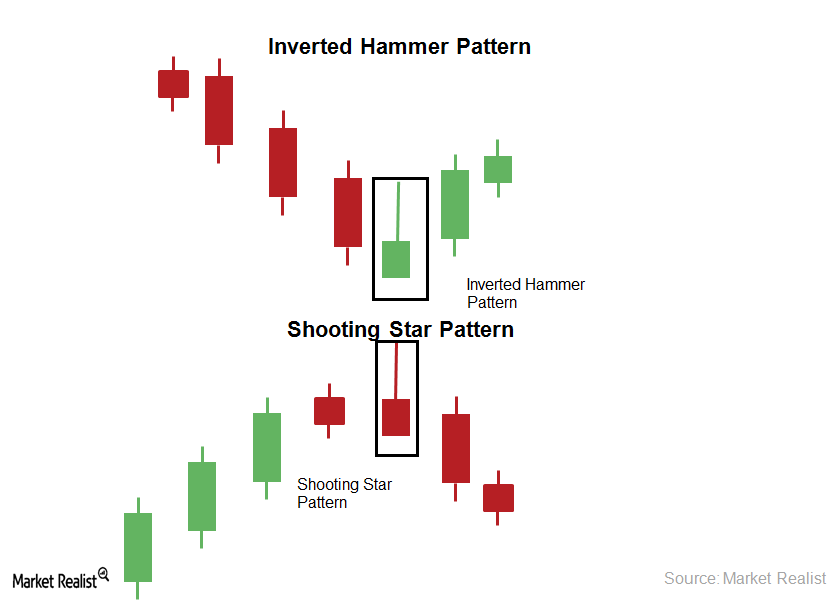

The Inverted Hammer And Shooting Star Candlestick Pattern

Inverted Hammer Candlestick Pattern Definition, Structure, Trading

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Inverted Hammer Candlestick Pattern Forex Trading

What Is An Inverted Hammer Candlestick Pattern?

The Inverted Hammer Is A Japanese Candlestick Pattern.

Inverted Hammer Is A Bullish Trend Reversal Candlestick Pattern Consisting Of Two Candles.

See Examples Of Inverted Hammer Candles On The Stock Market.

Related Post: