Inverted Hammer Candle Pattern

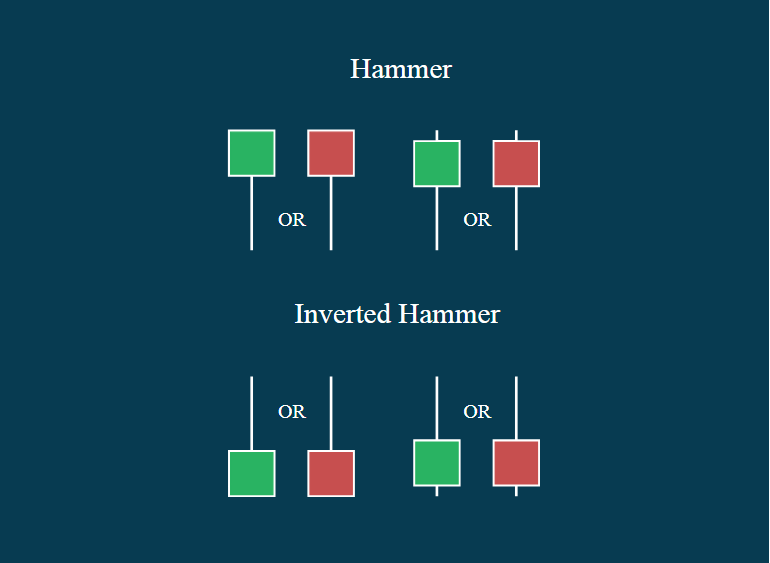

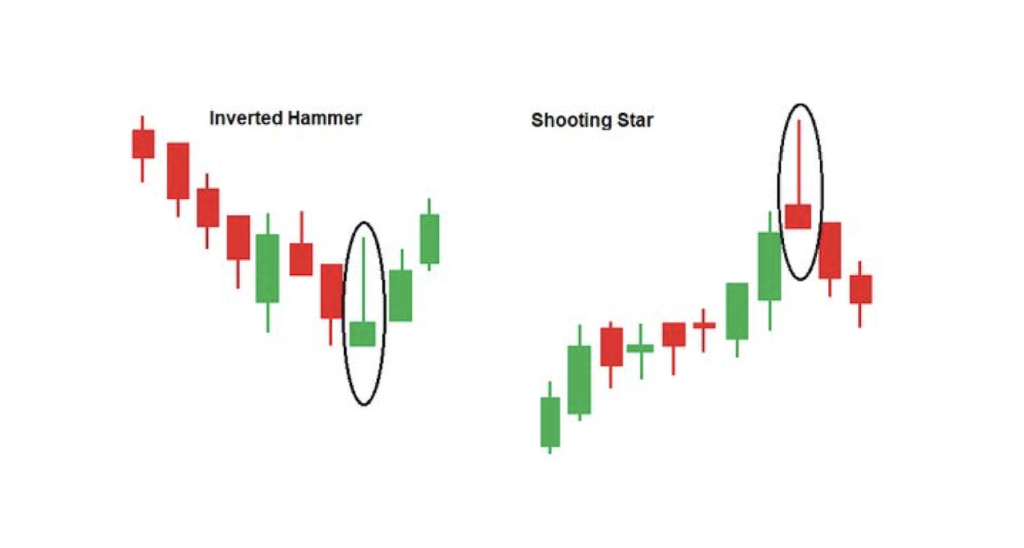

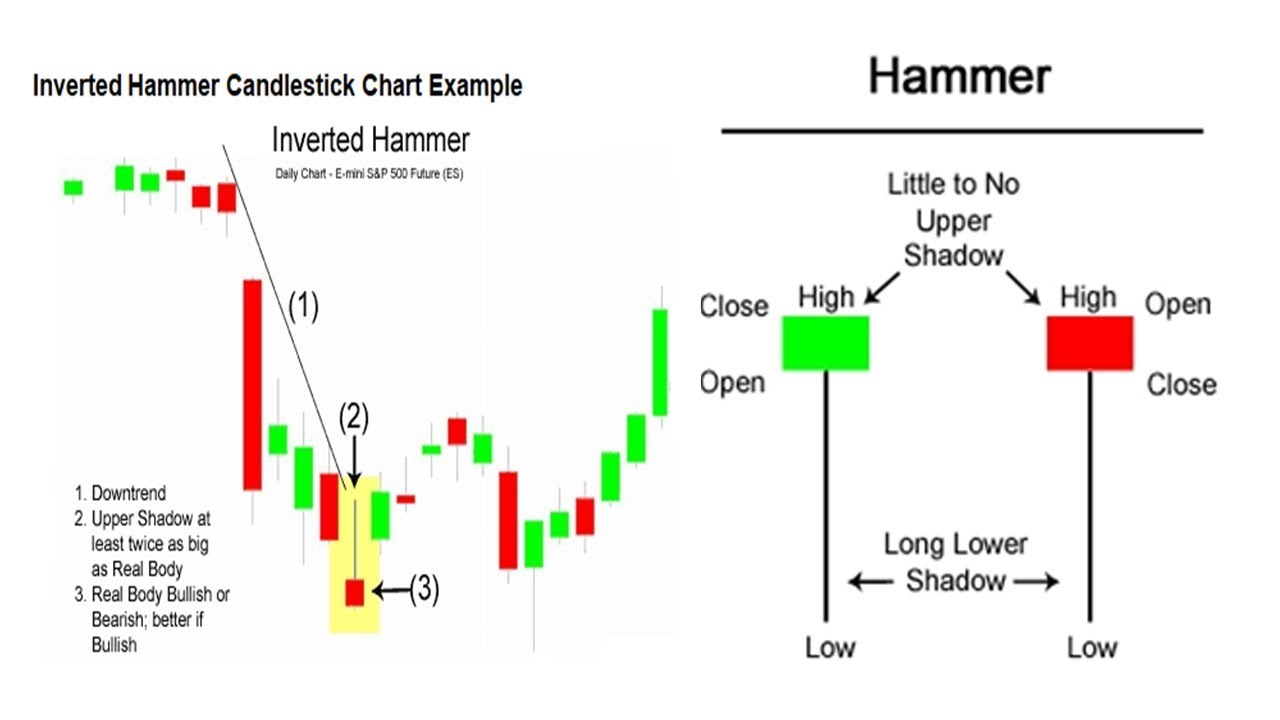

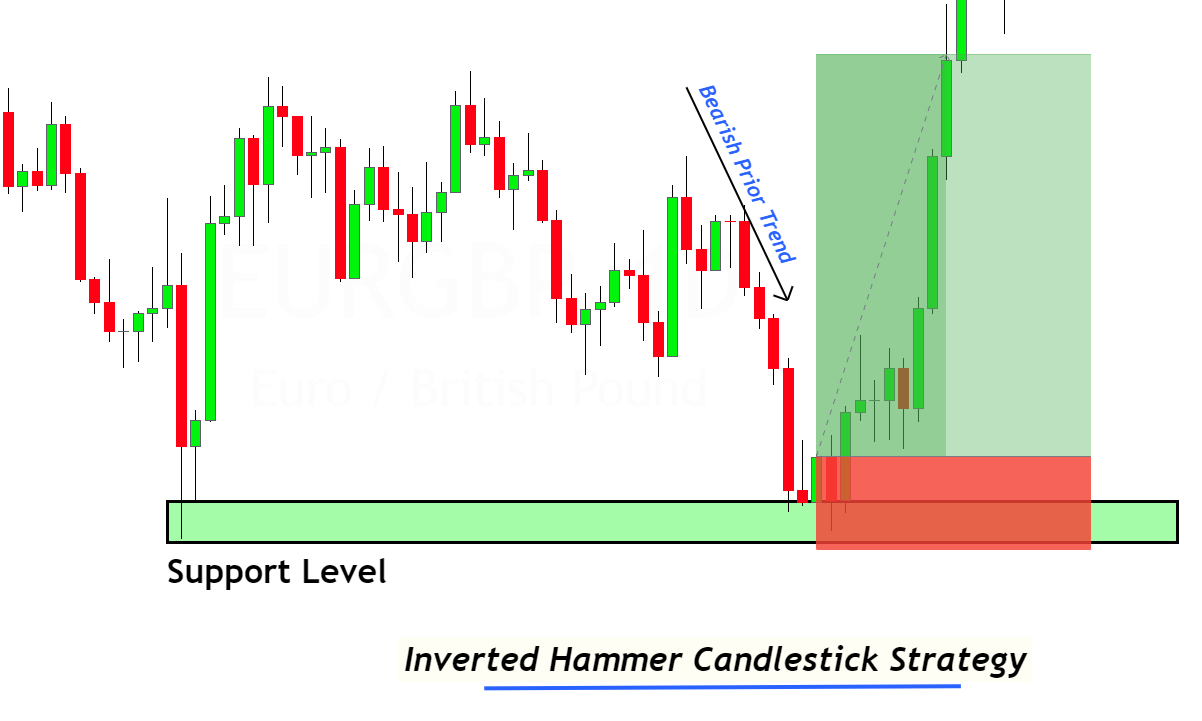

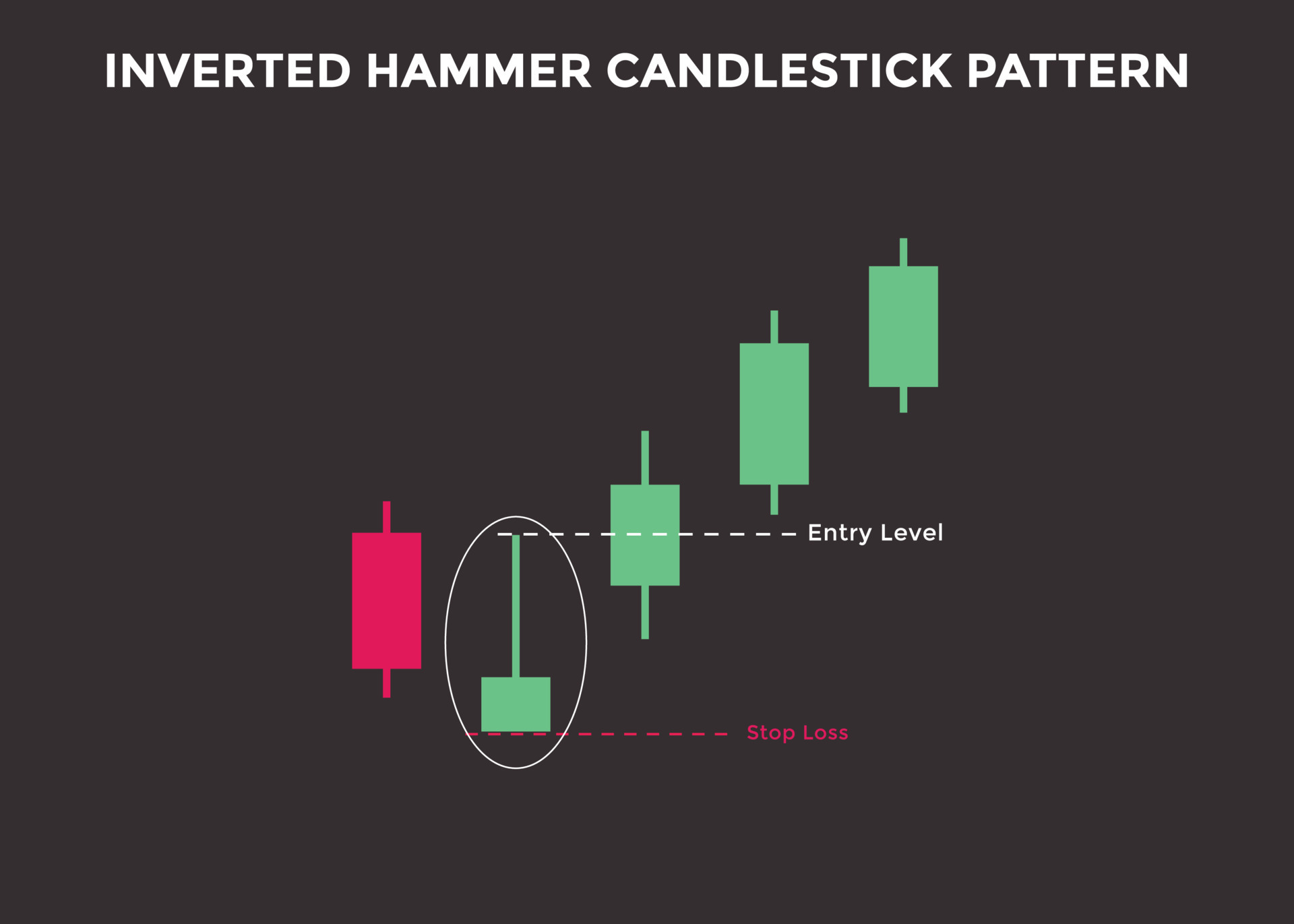

Inverted Hammer Candle Pattern - It’s a bullish reversal pattern, meaning that it signs a potential reversal to the upside. It is also pretty straightforward. This pattern is typically observed at the end of the downtrend, and hence it signals a bullish reversal. As such, the market is considered to initiate a bullish trend after forming the pattern. To increase the accuracy, you can trade the inverted hammer using pullbacks, moving averages, and other trading indicators. Both are reversal patterns, and they occur at the bottom of a downtrend. To be valid, it must appear after a move to the downside. Web the inverted hammer candlestick pattern holds significant importance in technical analysis for several reasons: In a downtrend, it indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. In particular, the inverted hammer can help to validate. As the name suggests, it resembles an inverted hammer, and it is characterized by a small real body located near the lower end of the candle, a little or no lower shadow, and a long upper wick. That means it can be one of the following candles: It usually appears around the bottom of a declining trend, suggesting a potential. To be valid, it must appear after a move to the downside. This article will focus on the other six patterns. Web as highlighted in yesterday's blog, the index fell below the low of the inside candle and dropped to the 21,800 level. Web the inverted hammer candlestick pattern is a valuable tool in a trader’s arsenal, signaling a potential. To be valid, it must appear after a move to the downside. A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies later in the day to close either above or near its. Black candle, long black candle, black marubozu, opening black marubozu, closing black marubozu. Web the. Web hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. However, making trading decisions based on a combination of factors and trading signals is essential. The second candle is short and located in the bottom of the price range; Web the inverted hammer candlestick. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. This article will focus on the other six patterns. Inverted hammer candlestick pattern illustration. However, making trading decisions based on a combination of factors and trading signals is essential. Web what is an inverted hammer candlestick pattern? The inverted hammer gets its name from looking like an inverted hammer on a candlestick chart. Other indicators such as a trendline break or confirmation candle should be used to generate a potential buy signal. Web the inverted hammer candlestick pattern appears on a chart when buyers exert pressure to drive up an asset's price, typically at the bottom of. Black candle, long black candle, black marubozu, opening black marubozu, closing black marubozu. The inverted hammer gets its name from looking like an inverted hammer on a candlestick chart. Web the inverted hammer is a single candle pattern. It’s a bullish reversal pattern, meaning that it signs a potential reversal to the upside. The pattern leads to bullish action, but. The pattern leads to bullish action, but the entry and. That means it can be one of the following candles: The reverse hammer candlestick also indicates the presence or absence of a high or low on the stock charts. Black candle, long black candle, black marubozu, opening black marubozu, closing black marubozu. Other indicators such as a trendline break or. Web the inverted hammer candlestick pattern is a valuable tool in a trader’s arsenal, signaling a potential bullish reversal after a downtrend. In a downtrend, it indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. The hammer or the inverted hammer. Both are reversal patterns, and they occur at. Its appearance can signal to traders and analysts that the downtrend may be losing. This pattern suggests that traders may. As to its appearance, the inverted hammer has a small body that’s found in the lower half of the range, with a long wick to the upside. However, making trading decisions based on a combination of factors and trading signals. In a downtrend, it indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. This includes sentimental factors as well as technical analysis. For a complete list of bullish (and bearish) reversal patterns, see greg morris' book, candlestick charting explained. As such, the market is considered to initiate a bullish trend after forming the pattern. Web the inverted hammer candlestick pattern is formed on the chart when there is pressure from the bulls (buyers) to push the price of the asset higher. Candles being spinning tops, even with black bodies, cannot appear on the first line. Web inverted hammer is a single candle which appears when a stock is in a downtrend. Web we will focus on five bullish candlestick patterns that give the strongest reversal signal. It usually appears around the bottom of a declining trend, suggesting a potential bullish reversal. Web the inverted hammer candlestick is a pattern that crypto traders can use to make, sell, or buy positions. To be valid, it must appear after a move to the downside. The second candle has a long upper shadow and does not. Its appearance can signal to traders and analysts that the downtrend may be losing. This article will focus on the other six patterns. Web hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. The reverse hammer candlestick also indicates the presence or absence of a high or low on the stock charts.

Inverted Hammer Candlestick Pattern Quick Trading Guide

Inverted Hammer Candlestick Pattern PDF Guide Trading PDF

15 Candlestick Patterns Every Trader Should Know Entri Blog

Understanding the Inverted Hammer Candlestick Pattern Premium Store

Hammer Candlestick What Is It and How to Use It in Trend Reversal

Inverted Hammer Candlestick Pattern Forex Trading

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Tutorial on How to Trade the Inverted Hammer signalHammer and inverted

Bullish Inverted Hammer Candlestick Pattern ForexBee

Inverted Hammer candlestick chart pattern. Candlestick chart Pattern

It’s A Bullish Reversal Pattern, Meaning That It Signs A Potential Reversal To The Upside.

Web As The Next Candle Opens Higher, A Long Position Should Be Taken.

As Mentioned In Yesterday's Blog, The Index Closed Above The Inverted Hammer Pattern Formed On The 9 May, Forming A Bullish.

Web The Inverted Hammer Candlestick Pattern Is A Valuable Tool In A Trader’s Arsenal, Signaling A Potential Bullish Reversal After A Downtrend.

Related Post: