Inverse Head And Shoulder Pattern

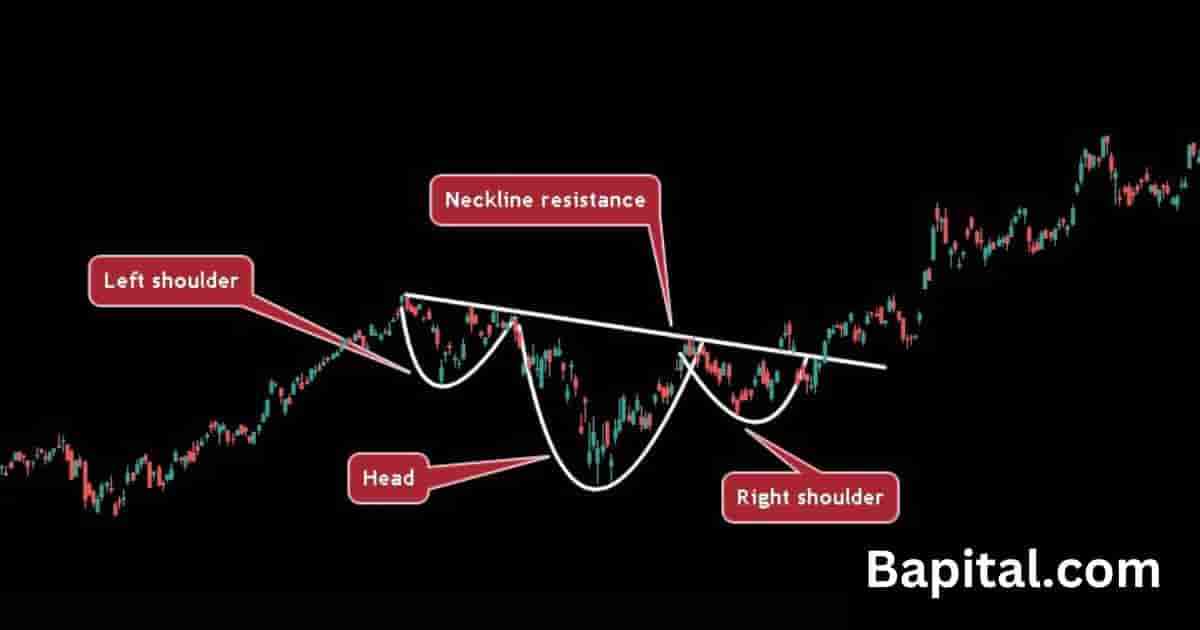

Inverse Head And Shoulder Pattern - Web monitor if tesla shares can close above the neckline of an inverse head and shoulders pattern around $197, a move that could potentially mark the start of a new trend higher in the stock. Web the btc/usd pair retreated on tuesday after forming a shooting star pattern. In this potential inverse head and shoulders pattern, btc is completing the right shoulder. Web an inverse head and shoulder pattern is similar to the standard head and shoulder patterns except it is inverted, and it also indicates a bullish trend reversal upon completion. In simpler words, an inverse head and shoulders pattern is like. It creates the appearance of a “head” and two “shoulders” on the. Web an inverse head and shoulders pattern is the opposite of a head and shoulders pattern. The height of the pattern plus the breakout price should be your target price using this indicator. The head and shoulders pattern is a reliable technical indicator for crypto. The pattern appears as a head, 2 shoulders, and neckline in an inverted position. Understanding the inverted head and. Crypto traders interpret the head and shoulders formation as a clear indication of a bullish trend reversing to a bearish one. Traders will then look for a price target by measuring the distance from the head to the neckline and applying it to the breakout point. Find out how to detect and use this chart. Web below, we mention two trading strategies to use this unique pattern: Traders will then look for a price target by measuring the distance from the head to the neckline and applying it to the breakout point. In this potential inverse head and shoulders pattern, btc is completing the right shoulder. A traditional head and shoulders pattern indicates a bullish. Web below, we mention two trading strategies to use this unique pattern: Understanding the inverted head and. It is of two types: Formation of the head and shoulders chart pattern. Following this formation is a bullish. This is a bullish reversal c. Following this formation is a bullish. It is of two types: The head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. 1) in an uptrend 2) when it leans against higher timeframe structure 3) it takes more than. However, the inverse head and shoulder signals a bullish trend. Following this formation is a bullish. It occurs when the price of a security falls to a new low, rises, falls again to a similar or slightly lower low, rises again, and then falls for a third time, but only to a higher low. Web bitcoin market indicators and breakout. Based on the technical formation, bitcoin could rally to the upside if a break above the trendline occurs, according to a may 13 x post from crypto investor. Web an inverse head and shoulders pattern is the opposite of a head and shoulders pattern. A closer look shows that bitcoin is forming an inverse head and shoulders pattern, which is. It creates the appearance of a “head” and two “shoulders” on the. Web an inverse head and shoulders (h&si) pattern is a trend reversal chart pattern. This reversal could signal an end of an uptrend or downtrend. Typically, when the slope is down, it. This chart pattern is the opposite of the traditional head and shoulder (h&s)” pattern. Web an inverse head and shoulder pattern is similar to the standard head and shoulder patterns except it is inverted, and it also indicates a bullish trend reversal upon completion. Web the inverse head and shoulders pattern typically indicates that a stock, cryptocurrency, future, or other asset is about to reverse a downtrend. It is also above the woodie pivot. Based on the technical formation, bitcoin could rally to the upside if a break above the trendline occurs, according to a may 13 x post from crypto investor. The head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. Crypto traders interpret the head and. Initially, the pattern illustrates a bearish outlook with the drop to form the left shoulder. The height of the pattern plus the breakout price should be your target price using this indicator. Web an inverse head and shoulders is an upside down head and shoulders pattern and consists of a low, which makes up the head, and two higher low. Web below, we mention two trading strategies to use this unique pattern: The height of the pattern plus the breakout price should be your target price using this indicator. Web an inverse head and shoulders (h&si) pattern is a trend reversal chart pattern. It is formed by a peak (shoulder), followed by a higher peak (head), and then another lower peak (shoulder). Following this formation is a bullish. This reversal could signal an end of an uptrend or downtrend. The slope of this line can either be up or down. Web the inverted head and shoulders pattern is confirmed when the price breaks above resistance created by the neckline. As a major reversal pattern, the head and shoulders bottom forms after a downtrend, with. The head and shoulders pattern is a reliable technical indicator for crypto. A traditional head and shoulders pattern indicates a bullish to bearish trend, whereas the inverted head and shoulders. Web an inverse head and shoulders pattern is the opposite of a head and shoulders pattern. 1) in an uptrend 2) when it leans against higher timeframe structure 3) it takes more than 100 bars to form. Typically, when the slope is down, it. The head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. The most common way to trade the inverse head and shoulders pattern is to immediately enter a position when the price breaks above the resistance neckline.

Inverse Head and Shoulders Pattern Trading Strategy Guide

Head and Shoulders Trading Patterns ThinkMarkets EN

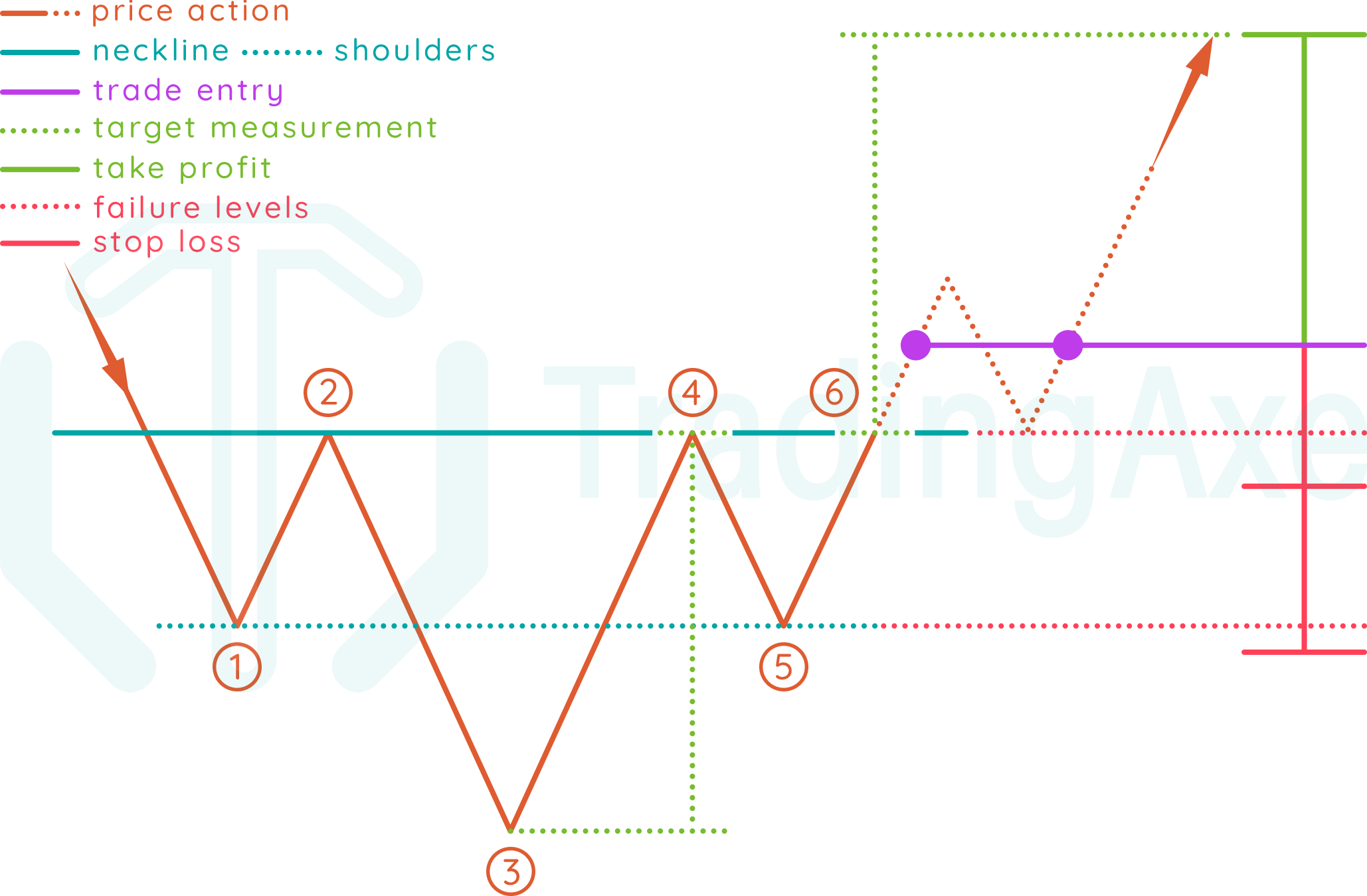

How To Trade Inverted Head And Shoulders Chart Pattern TradingAxe

What is Inverse Head and Shoulders Pattern & How To Trade It

Inverse Head and Shoulders Pattern Overview, How To Trade, Set Price

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Inverse Head and Shoulders Pattern Trading Strategy Guide

The Head and Shoulders Pattern A Trader’s Guide

Inverse Head and Shoulders Pattern How To Spot It

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Web An Inverse Head And Shoulder Pattern Is Similar To The Standard Head And Shoulder Patterns Except It Is Inverted, And It Also Indicates A Bullish Trend Reversal Upon Completion.

Web The Creation Of An Inverse Head And Shoulders Pattern And The Daily Macd Supports The Bullish Bitcoin Scenario.

It Occurs When The Price Of A Security Falls To A New Low, Rises, Falls Again To A Similar Or Slightly Lower Low, Rises Again, And Then Falls For A Third Time, But Only To A Higher Low.

The Right Shoulder On These Patterns Typically Is Higher Than The Left, But Many Times It’s Equal.

Related Post: