Intraday Chart Patterns

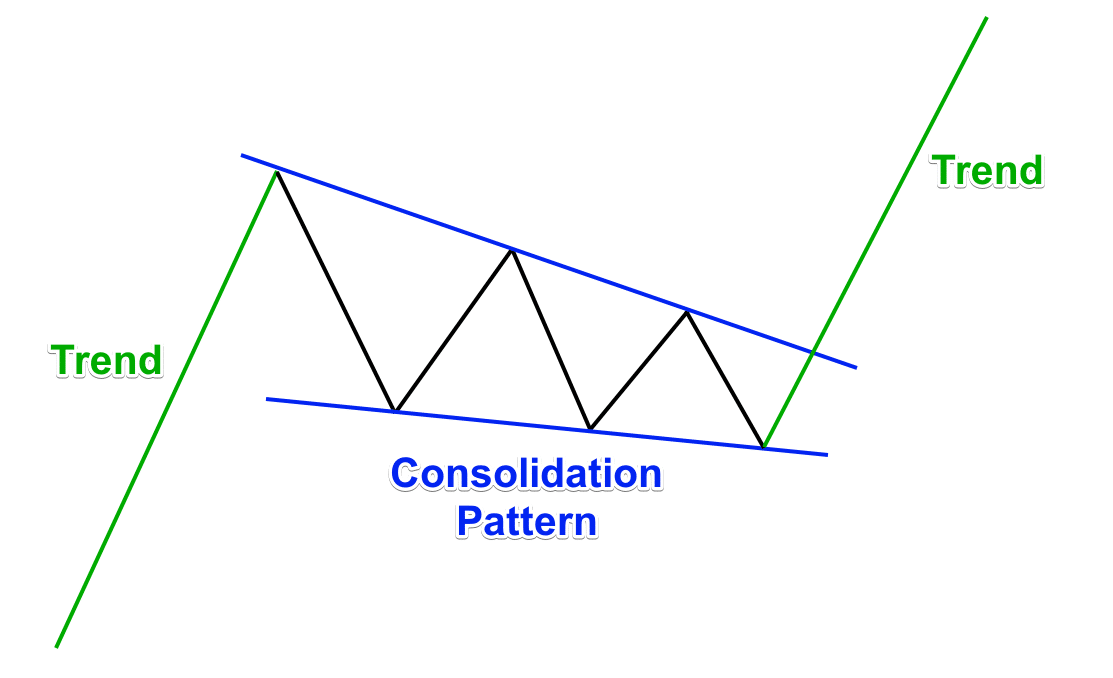

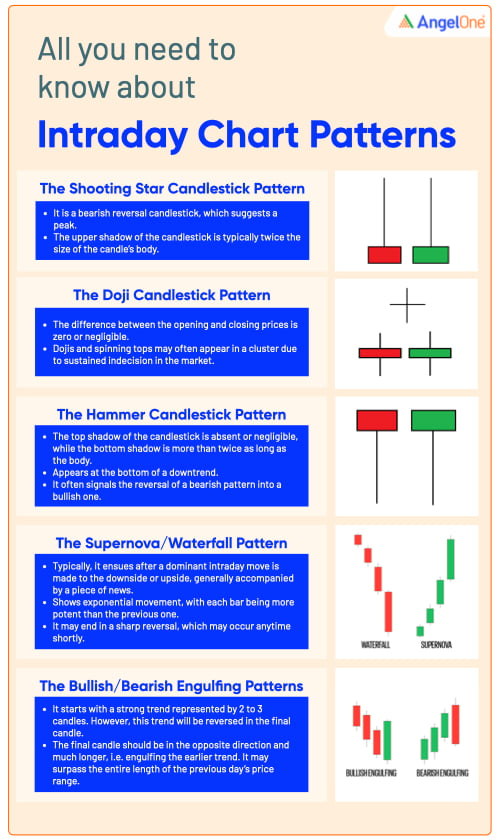

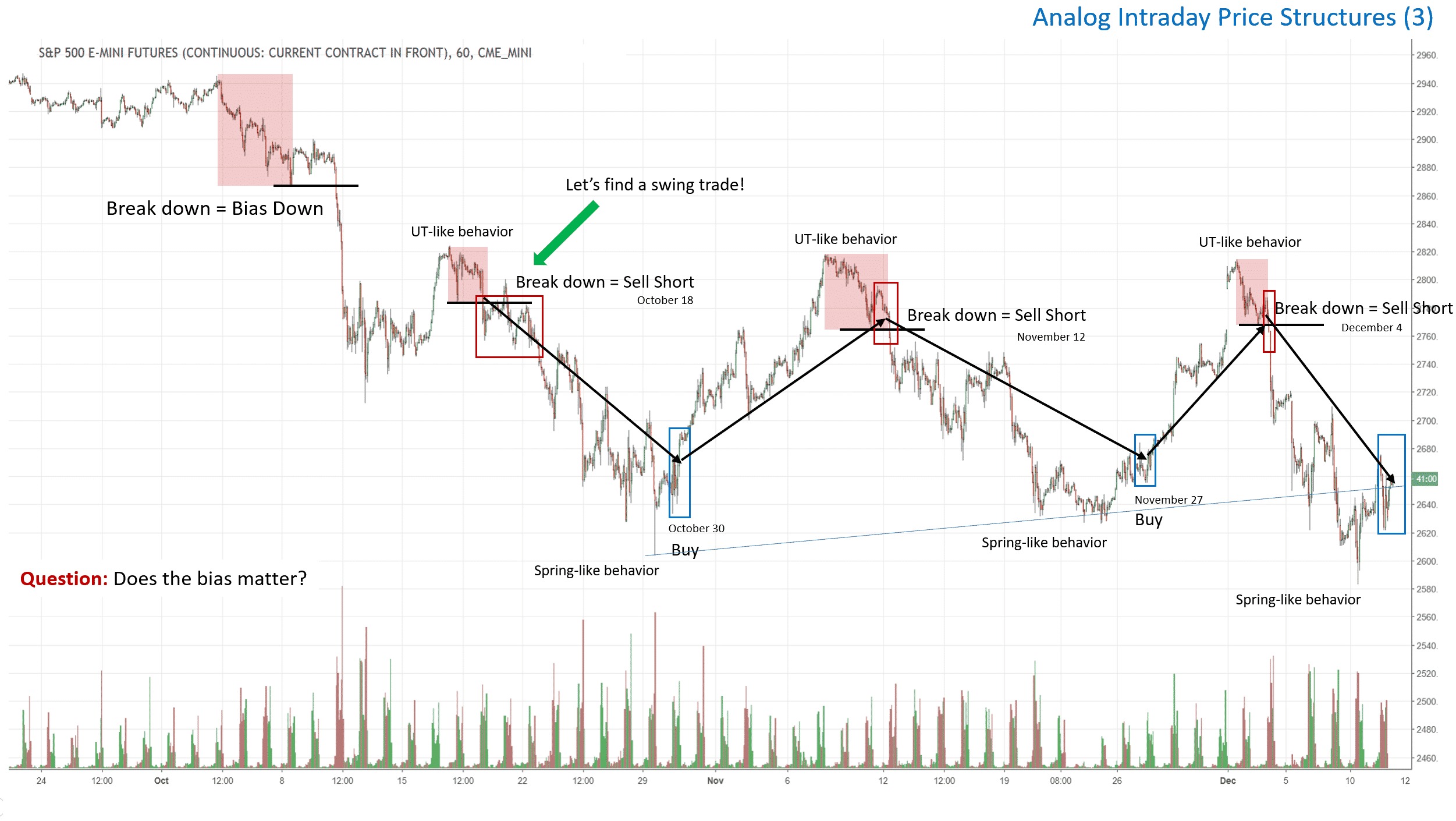

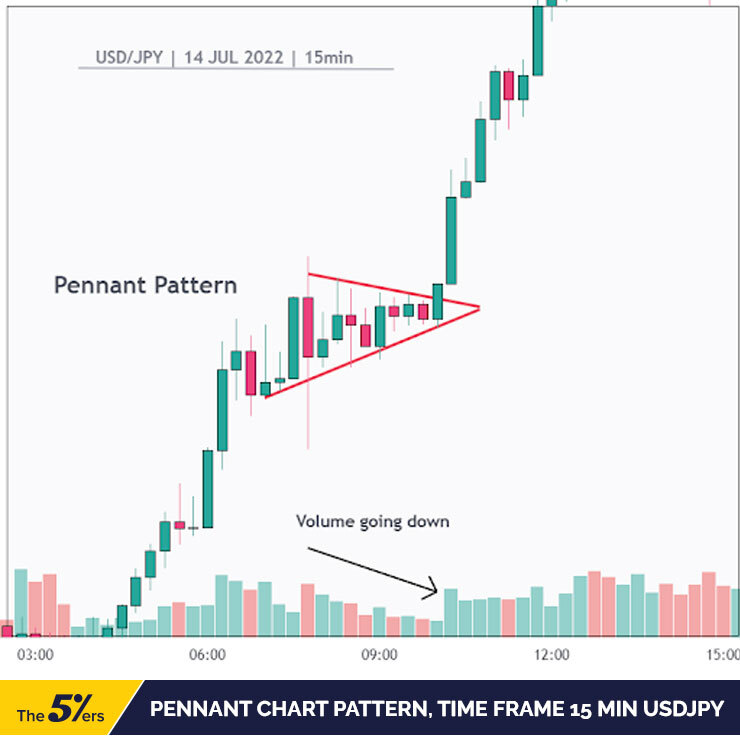

Intraday Chart Patterns - Charts display volume alongside price movements, providing insights into market activity and validating the strength of trends or potential reversals. This is how a candlestick chart pattern looks like: Web chart patterns form a key part of day trading. Web using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns. Research shows that the most reliable chart patterns are the head and shoulders, with an 89% success rate, the double bottom (88%), and the triple bottom and descending triangle (87%). As you can see, there are several horizontal bars or candles that form this chart. Use candlestick charts for the most visual representation of price action. Charts in the stock market depict how prices have moved in the past and how they are moving in the present. Chart patterns fall broadly into three categories: Here are some tips for finding patterns in the charts: Web identify the various types of technical indicators including, trend, momentum, volume, and support and resistance. Reversal chart patterns indicate that a. Web chart patterns cheat sheet is an essential tool for every trader who is keen to make trading decisions by identifying repetitive patterns in the market. As you can see, there are several horizontal bars or candles that. Use candlestick charts for the most visual representation of price action. In this free video course, we teach you how to identify trading chart patterns in the real trading market scenario. It also has periods that tend to have high volume and movement, and low volume and movement. Use charts and learn chart patterns through specific examples of important patterns. Web discover intraday trading chart patterns. They also provide traders insights into the trends and reversals in the stock market. In this article, we will analyze popular patterns for stock markets, which can also be applied to various complex instruments, for example, currency and cryptocurrency pairs. Web identify the various types of technical indicators including, trend, momentum, volume, and support. Advantages of using intraday trading strategies. Charts in the stock market depict how prices have moved in the past and how they are moving in the present. It also has periods that tend to have high volume and movement, and low volume and movement. Web chart patterns, like head and shoulders, triangles, and flags, help you to anticipate potential future. Candlestick, renko, line, bar, heikin ashi, and more types of charts are available. Charts display volume alongside price movements, providing insights into market activity and validating the strength of trends or potential reversals. Charts in the stock market depict how prices have moved in the past and how they are moving in the present. Updated on october 20, 2021. In. It also has periods that tend to have high volume and movement, and low volume and movement. In this article we will cover the basics of intraday trading, including the strategies used by successful traders, how to get started with intraday trading, how to avoid beginner mistakes and the risks involved. Here are some tips for finding patterns in the. Web chart patterns form a key part of day trading. Web types of chart patterns. How to use chart patterns for intraday trading? Web intraday chart patterns offer traders a tool to understand price fluctuation psychology, analyze market movements, and make intelligent decisions. It also has periods that tend to have high volume and movement, and low volume and movement. Candlestick, renko, line, bar, heikin ashi, and more types of charts are available. Common intraday trading chart patterns. Updated on october 20, 2021. Charts display volume alongside price movements, providing insights into market activity and validating the strength of trends or potential reversals. There are many different day candlestick trading patterns used in intraday trading on forex. This is how a candlestick chart pattern looks like: One of the easiest ways to get to grips with intraday trading is to set up a demo account and practice trading virtual funds. Each candle has three parts: Reversal chart patterns indicate that a. How to use chart patterns for intraday trading? In this free video course, we teach you how to identify trading chart patterns in the real trading market scenario. Candlestick, renko, line, bar, heikin ashi, and more types of charts are available. Traders utilize this information to forecast how the price will move in the future. Candlestick and other charts produce frequent signals that cut through price action “noise”.. As you can see, there are several horizontal bars or candles that form this chart. The business of trading intraday is a tricky one, indeed. Use candlestick charts for the most visual representation of price action. How to use chart patterns for intraday trading? Chart patterns fall broadly into three categories: Frequently asked questions (faqs) photo: 58k views 1 year ago. A continuation signals that an ongoing trend will continue; Web chart patterns, like head and shoulders, triangles, and flags, help you to anticipate potential future price movements and determine entry and exit points. In this free video course, we teach you how to identify trading chart patterns in the real trading market scenario. If you watch an intraday chart of the spdr s&p 500 etf (spy), for example, you’ll see that it tends to trend and reverse at similar times each day. 📣 ipos to look out for. Web chart patterns cheat sheet is an essential tool for every trader who is keen to make trading decisions by identifying repetitive patterns in the market. Use charts and learn chart patterns through specific examples of important patterns in bar and candlestick charts. There are many different day candlestick trading patterns used in intraday trading on forex. Web discover intraday trading chart patterns.

3 Best Chart Patterns for Intraday Trading in Forex

intraday chart patterns intraday stocks pattern shorts YouTube

How to Read Candlestick Charts for Intraday Trading

Common Intra Day Stock Market Patterns

Intraday Chart Patterns Know the Candlestick Pattern Angel One

Intraday Trading Using the Wyckoff Method Wyckoff Analytics

Stock Market Intraday Repeating Patterns Trade That Swing

Chart Patterns For Day Trading 16 Ultimate Patterns For Profitable

5 Popular Intraday Chart Patterns Forex Traders Love to Use

5 Popular Intraday Chart Patterns Forex Traders Love to Use

Disadvantages Of Using Intraday Trading Strategies.

Research Shows That The Most Reliable Chart Patterns Are The Head And Shoulders, With An 89% Success Rate, The Double Bottom (88%), And The Triple Bottom And Descending Triangle (87%).

Web In Intraday Trading, Patterns Help In Understanding The Movement Of Prices Within The Same Trading Day.

☆ Research You Can Trust ☆.

Related Post: