Internal Rate Of Return Excel Template

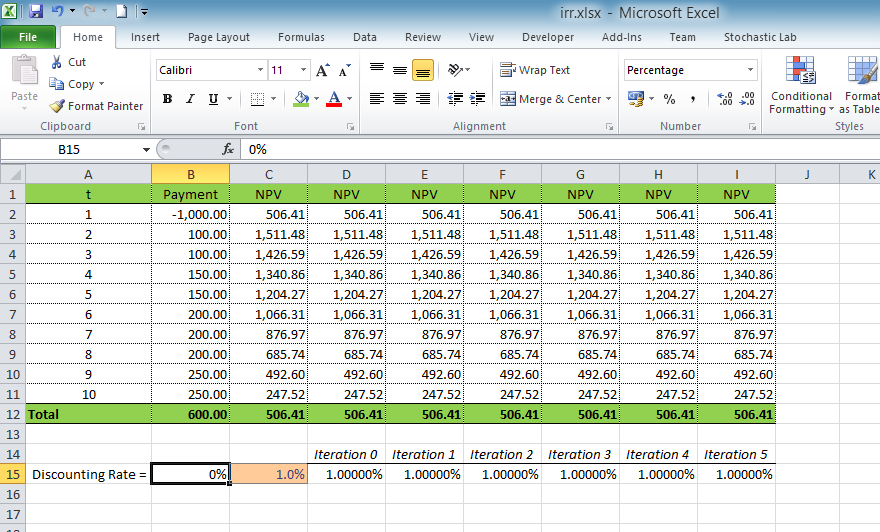

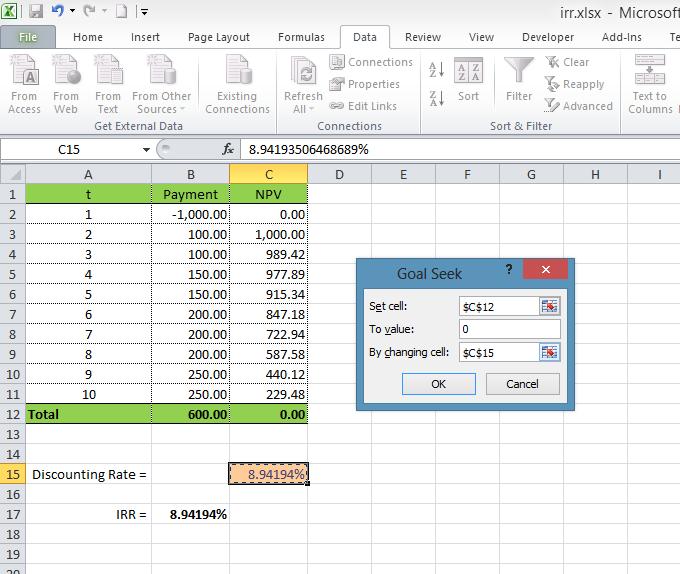

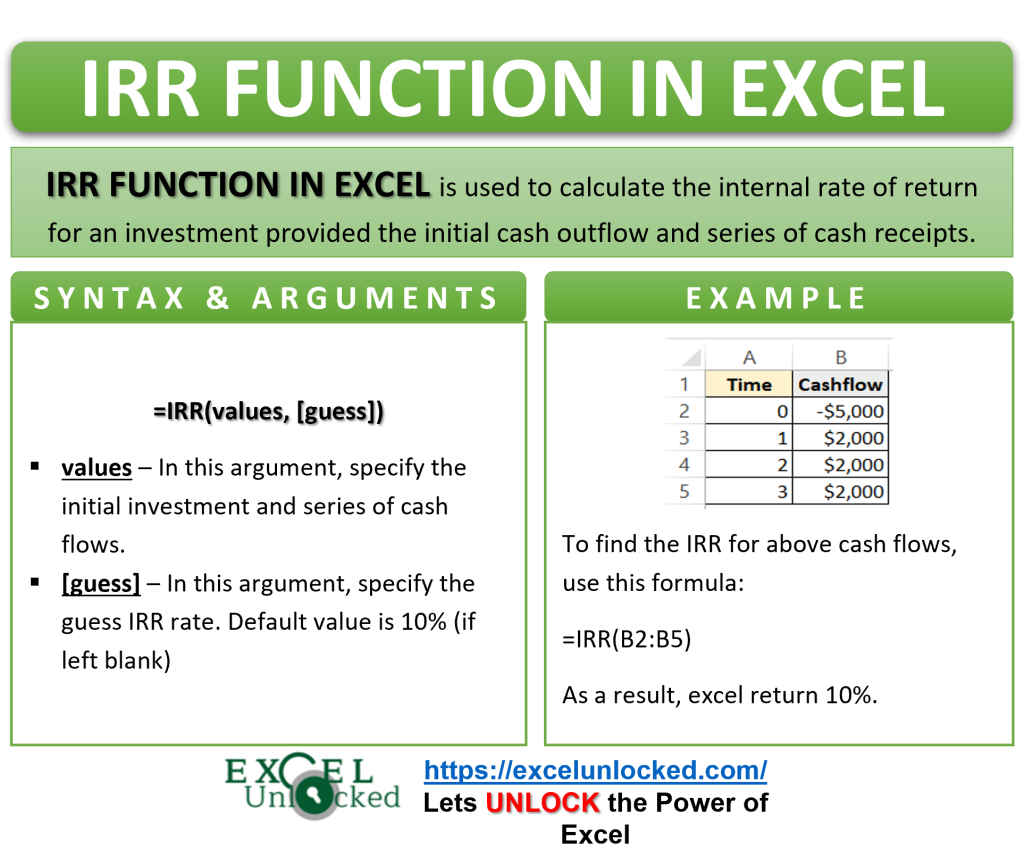

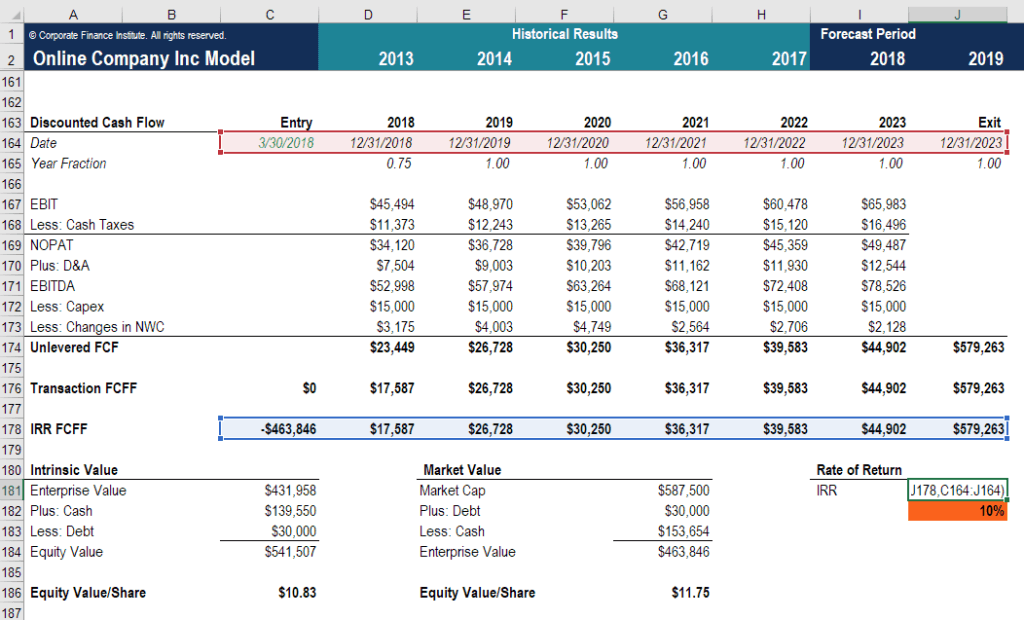

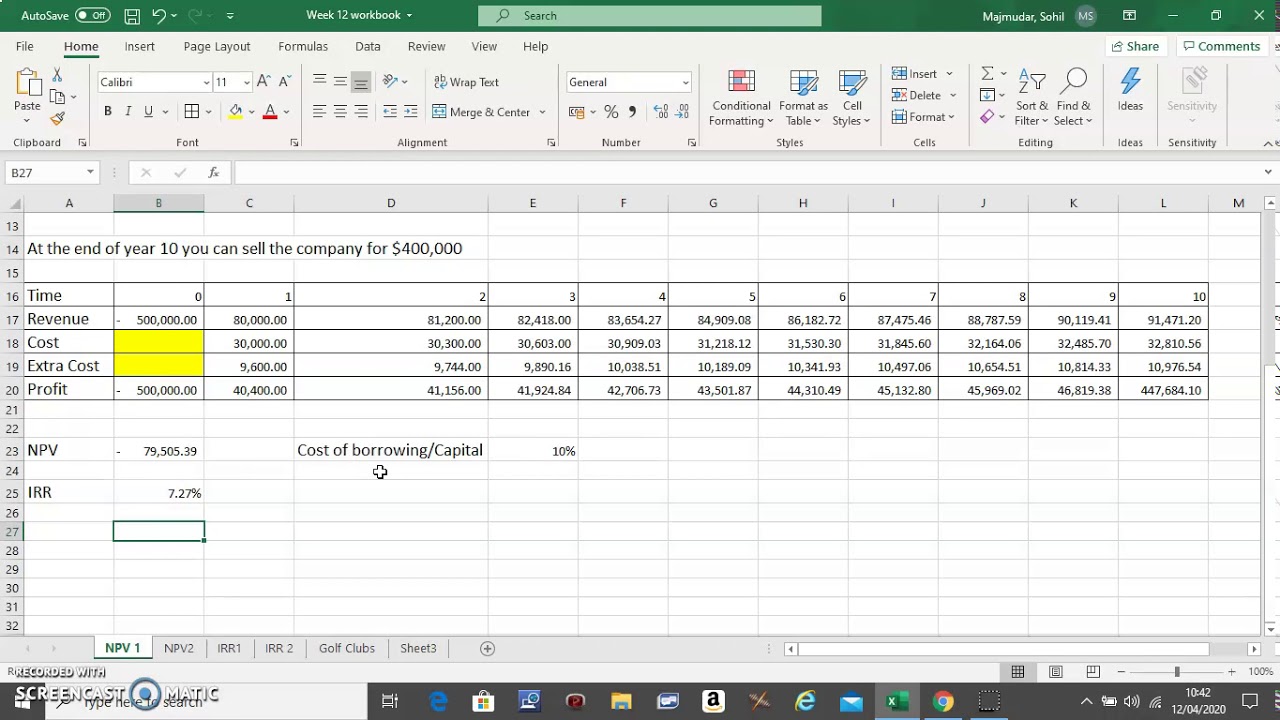

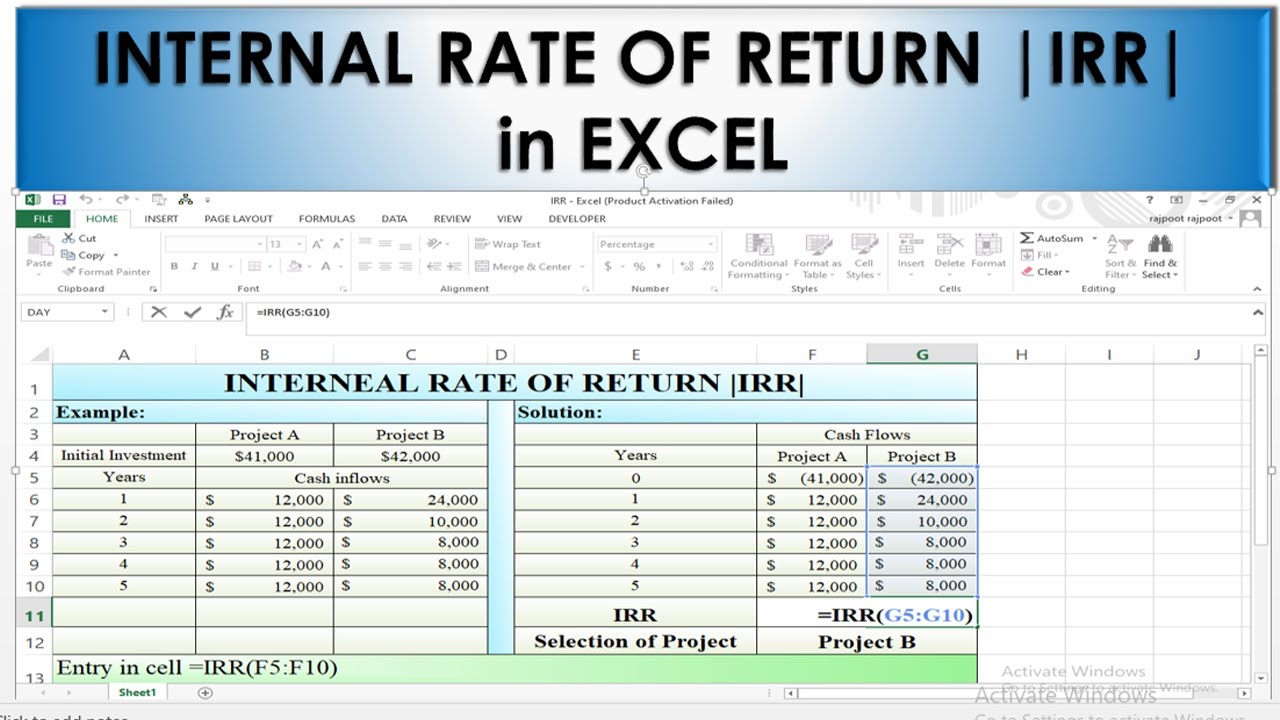

Internal Rate Of Return Excel Template - Npv (irr (values),values) = 0. =irr(b5:b9) the irr function returns the value of. You will also learn how to create an internal rate of return template to do. Web the formula used for the calculation is: Web to calculate irr in excel, you can use the irr function, mirr function, or xirr function. Prepare your spreadsheet by creating the column. Web this xirr vs irr template allows you to differentiate between the use of irr and xirr functions to compute the internal rate of return. Determine the projects or investments you will be analyzing and the future period to use. Lbo returns analysis (irr and mom) how to calculate irr. For instance, assume that you have been asked to calculate an irr for 3 projects over a period of 5 years. Although the dates cell values will be irregular payment, we must ensure the payment dates are always in increasing order. Web to calculate irr in excel, you can use the irr function, mirr function, or xirr function. Where n is the number of cash flows, and i is the interest or discount rate. These cash flows do not have to. Determine the projects or investments you will be analyzing and the future period to use. Irr is a discount rate, whereby npv equals to zero. Web by svetlana cheusheva, updated on march 15, 2023. Web the internal rate of return (irr)—or the discounted cash flow rate of return—is the discount rate that makes the net present value equal to zero.. Irr will return the internal rate of return for a given cash flow, that is, the initial investment value and a series of net income values. Using the example data shown above, the irr formula would be =irr (d2:d14,.1)*12, which yields an internal rate of return of 12.22%. In the above formula the value1 would be the initial investment (period. The syntax of the xirr function is as follows: Internal rate of return is another method used for cash flow valuation. Web so the formula ( or function) for calculating irr in excel is : Web when your cash flows are not regular, you can use excel’s xirr function to calculate the internal rate of return. Web the formula for. You might use the following excel function: The internal rate of return (irr) metric is an estimate of the annualized rate of return on an. This function has the following parameters: =irr(b5:b9) the irr function returns the value of. Accounting cashflow financial analysis forecasting goalseek intermediate. Excel mirr function not working. =irr(b5:b9) the irr function returns the value of. Npv (irr (values),values) = 0. The xirr in excel calculates the percentile of the internal return rate. The irr function [1] is categorized under excel financial functions. However, the cash flows must occur at regular intervals, such as monthly or. Web the formula for npv is: Prepare your spreadsheet by creating the column. Web by svetlana cheusheva, updated on may 3, 2023. Npv (irr (values),values) = 0. You can think of it as a special case of npv, where the rate of return that is calculated is the interest rate corresponding to a 0 (zero) net present value. Last week, i covered how to calculate discounted cash flow. Npv (irr (values),values) = 0. The syntax of the xirr function is as follows: Web by svetlana cheusheva, updated. Npv (irr (values),values) = 0. Calculating internal rate of return (irr) using excel. Next time that someone asks you what the irr of your project is, do ask him in return (if circumstances permit) to explain to you what the irr is. Create a new workbook and save it with a descriptive name. You might use the following excel function: Web excel mirr template. =irr(b5:b9) the irr function returns the value of. The xirr in excel calculates the percentile of the internal return rate. Web excel allows you to calculate the internal rate of return using the irr function. Web when your cash flows are not regular, you can use excel’s xirr function to calculate the internal rate of return. Lbo returns analysis (irr and mom) how to calculate irr. Web by svetlana cheusheva, updated on may 3, 2023. Web this template allows you quick and dynamic irr calculation, in addition to npv analysis. Using the example data shown above, the irr formula would be =irr (d2:d14,.1)*12, which yields an internal rate of return of 12.22%. In the above formula the value1 would be the initial investment (period 0 with negative cash flow) followed by cash flows from all other periods. Web • the internal rate of return (irr) is the discount rate providing a net value of zero for a future series of cash flows. The function was introduced in excel 2007 and is available in all later versions of excel 2010, excel 2013, excel 2016, excel 2019, and excel for office 365. It is used to estimate the profitability of a potential investment. Multiple of money calculation example (mom) 5. For instance, assume that you have been asked to calculate an irr for 3 projects over a period of 5 years. Next time that someone asks you what the irr of your project is, do ask him in return (if circumstances permit) to explain to you what the irr is. Irr is based on npv. Accounting cashflow financial analysis forecasting goalseek intermediate. The irr function [1] is categorized under excel financial functions. Web excel allows you to calculate the internal rate of return using the irr function. Calculating internal rate of return (irr) using excel.

Calculating Internal Rate of Return (IRR) using Excel Excel VBA Templates

How to Calculate an IRR in Excel 10 Steps (with Pictures)

Calculating Internal Rate of Return (IRR) using Excel Excel VBA Templates

Excel IRR Function Calculating Internal Rate of Return Excel Unlocked

Microsoft Excel 3 ways to calculate internal rate of return in Excel

Internal Rate of Return (IRR) Definition, Examples and Formula

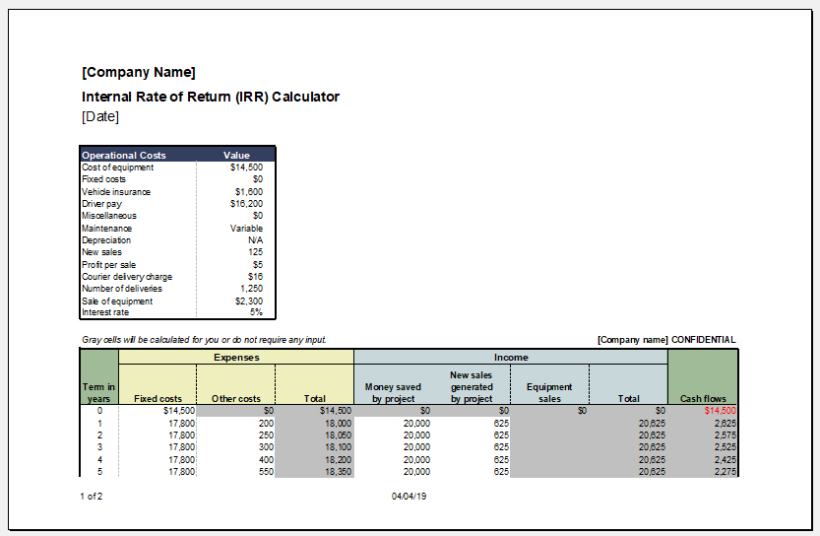

IRR (internal rate of return) Calculator for Excel Excel Templates

IRR Internal Rate of Return in Excel YouTube

How to Calculate Net Present Value (NPV) and Internal Rate of Return

How to Calculate IRR in excel Internal Rate of return YouTube

Web By Svetlana Cheusheva, Updated On March 15, 2023.

These Cash Flows Do Not Have To Be Even, As They Would Be For An Annuity.

Internal Rate Of Return Is Another Method Used For Cash Flow Valuation.

To Input Dates In Text Format Is A Risk That Excel May Misinterpret Depending On The Date System Or Date Interpretation Settings.

Related Post: