Inside Bar Candle Pattern

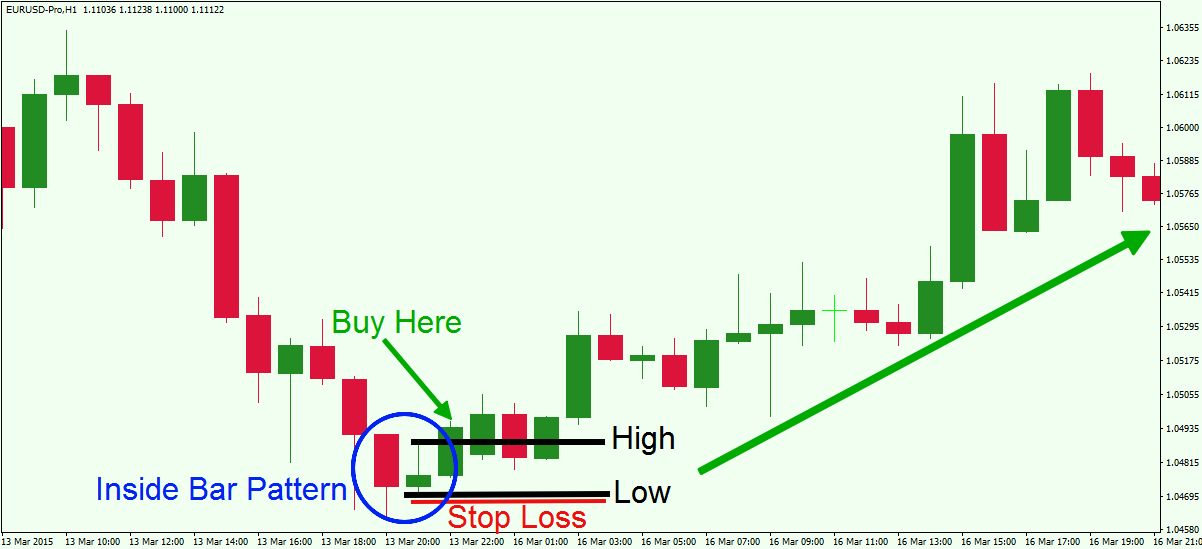

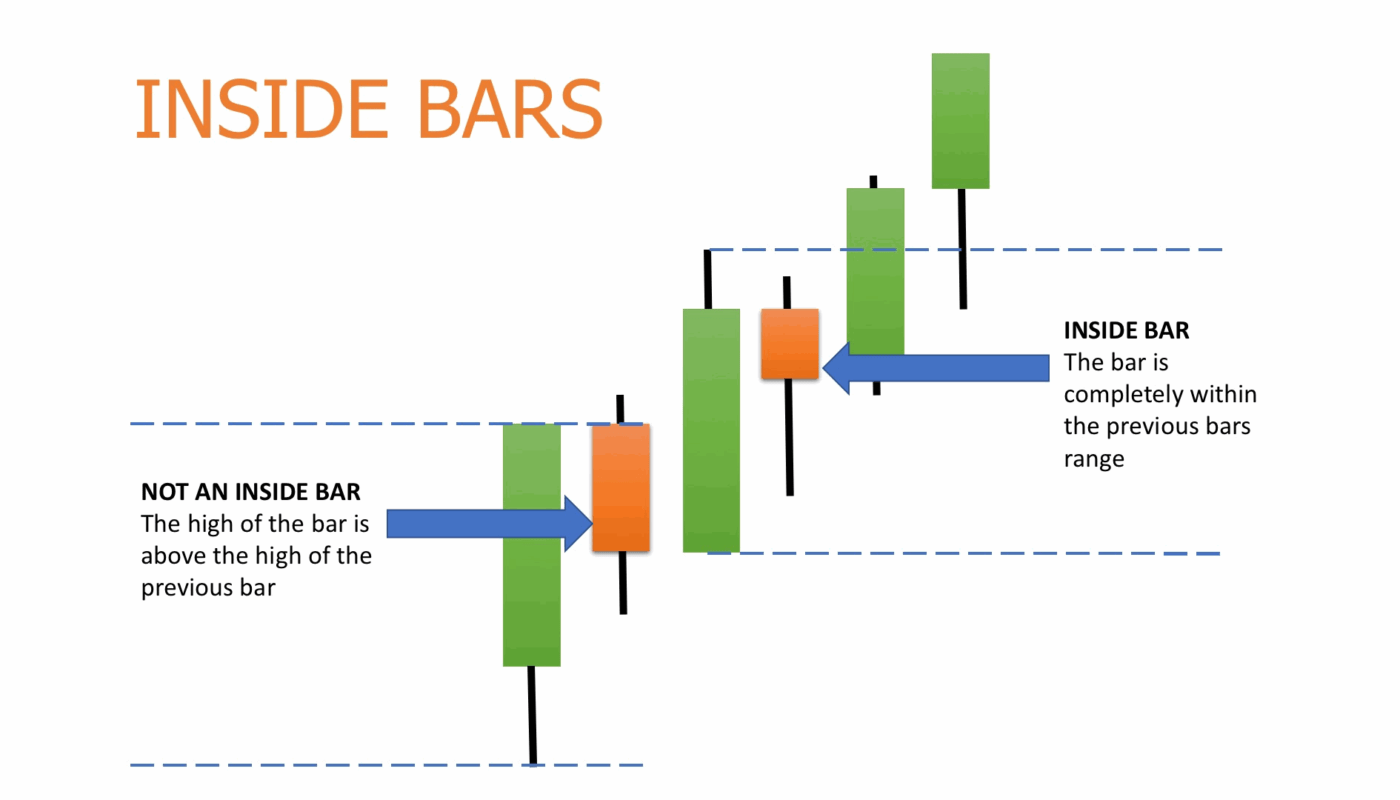

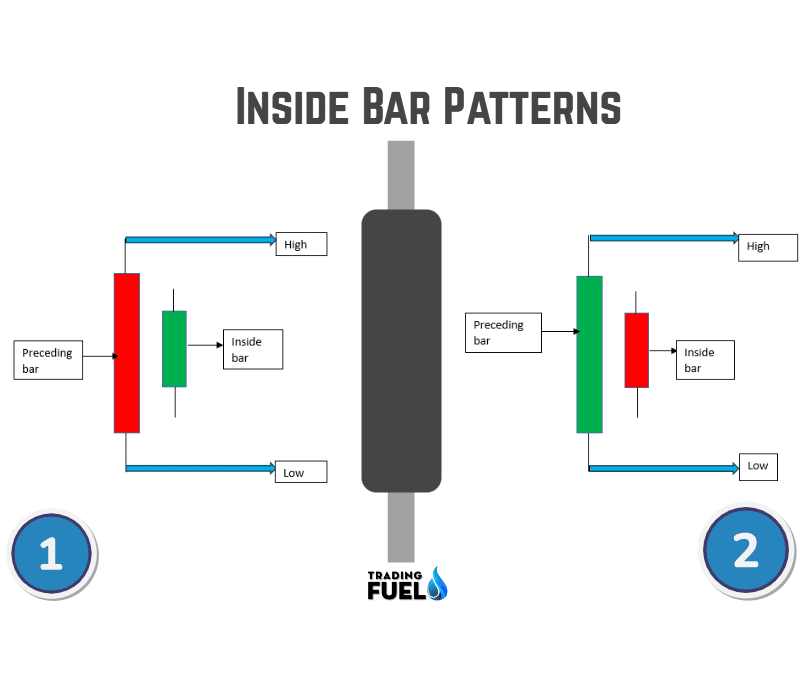

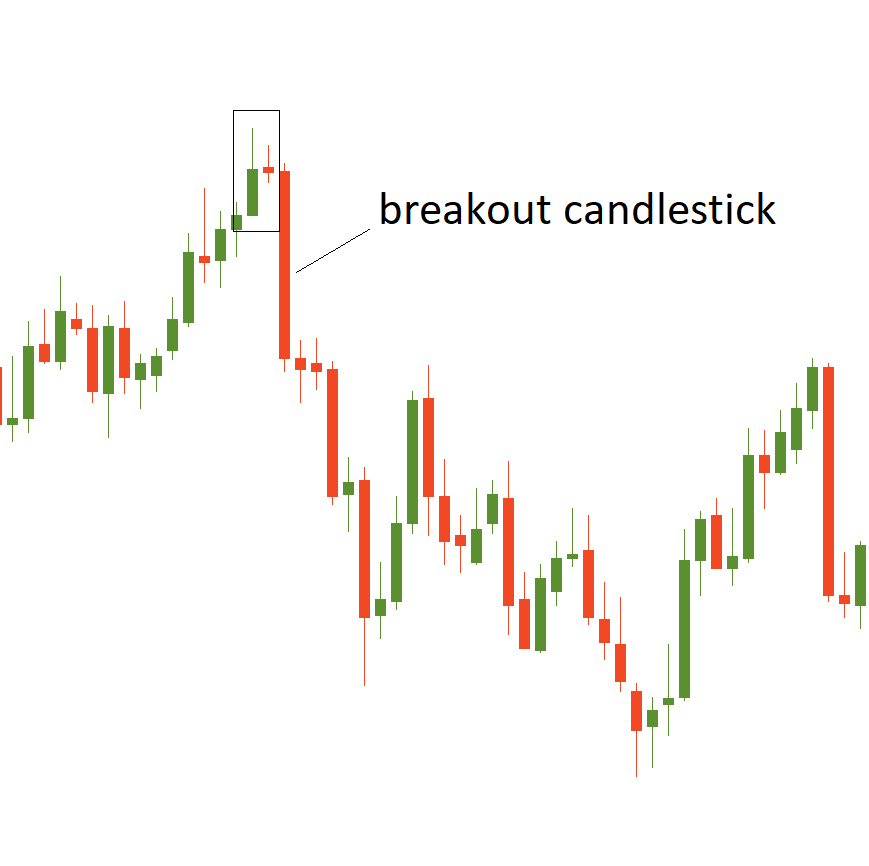

Inside Bar Candle Pattern - Web the inside day candlestick is a price bar that establishes a periodic range between the high and low of the previous trading day. This pattern is composed of a pair of candlesticks: Here you can take your position in the opposite direction to the initial inside bar trade entry, placing. Is inside bar trading profitable? It can be used to follow and trade with a trend or show reversals within the market through its candles. The high is lower than the previous bar’s high, and the low is higher than the previous bar’s low. The first being a large candle, referred to as the “mother bar,” often showing a clear trend in price movement, followed by a smaller “inside bar. This will be the focus of our article) 2. Web the inside bar candle pattern is not telling traders that the market is bidding price higher or lower but rather that the market is waiting before making the next big move in the asset. Inside bars vary in size and range of the candle body, with the smaller variants showing an indecisive market. As the inside bar has two candles. Web the inside bar strategy is a candlestick pattern used to time entries with low risk. Here you can take your position in the opposite direction to the initial inside bar trade entry, placing. Web the inside day candlestick is a price bar that establishes a periodic range between the high and low. The first candlestick has a tall body and is called the mother bar. Inside days are days where the high point of the bar is lower than the previous day's high, and the low point is higher. This tells you there are indecision and low volatility in the markets. Web the inside bar candle pattern is a price action signal. The strategy is useful when determining. Here you can take your position in the opposite direction to the initial inside bar trade entry, placing. Start by identifying a candlestick with a defined high and low range and check a subsequent candlestick. Inside bar with a small range. The first being a large candle, referred to as the “mother bar,” often. Web the inside day candlestick is a price bar that establishes a periodic range between the high and low of the previous trading day. Is inside bar trading profitable? This time, we identified the inside bar formation with a very large bullish candle followed by a smaller bearish candle covered by the first candlestick. 10 may, 2024 | 07:58:17 pm. Learn how to make a profit out of failed breakouts in just 2 hours by market experts. This is a standard inside bar candle where the range of the candle is small, and it’s “covered” by the prior candle. Locate a candlestick that is completely engulfed by the preceding candle’s high and. The high is lower than the previous bar’s. The ‘inside bar’ is characterized by a bar or candle that is entirely ‘inside’ the range of the preceding one, whereas the ‘outside bar’ completely ‘overshadows’ or ‘engulfs’ the previous bar. As the inside bar has two candles. In other words, the inside bar has a higher low and lower high than the previous bar. It does not matter if. This is a standard inside bar candle where the range of the candle is small, and it’s “covered” by the prior candle. The ‘inside bar’ is characterized by a bar or candle that is entirely ‘inside’ the range of the preceding one, whereas the ‘outside bar’ completely ‘overshadows’ or ‘engulfs’ the previous bar. If seen, a favourable inside bar setup. This time, we identified the inside bar formation with a very large bullish candle followed by a smaller bearish candle covered by the first candlestick. Web the inside day candlestick is a price bar that establishes a periodic range between the high and low of the previous trading day. This will be the focus of our article) 2. Web there. In order to confirm this pattern you need to see a candle on the chart, which is fully contained within the previous bar. However, there’s a slight controversy in. In other words, the inside bar's high is lower than the mother candle's high, and its low is higher than the. In other words, the inside bar has a higher low. This is a standard inside bar candle where the range of the candle is small, and it’s “covered” by the prior candle. Check if the high and low range of the subsequent candle is. This pattern is composed of a pair of candlesticks: Works extremely well in trending market. Compare the high and low range: However, there’s a slight controversy in. The first being a large candle, referred to as the “mother bar,” often showing a clear trend in price movement, followed by a smaller “inside bar. Compare the high and low range: Web inside bar candlestick pattern conclusion. Web identifying the inside bar on trading charts. It does not matter if the inside bar is bullish or bearish, all that matters is where. As the inside bar has two candles. This tells you there are indecision and low volatility in the markets. A charting term used by technical analysts and day traders. The second way to trade the inside bar pattern is the inside bar breakout trading method, which many believe is slightly more exciting to trade. Web the inside bar strategy is a candlestick pattern used to time entries with low risk. Inside bars vary in size and range of the candle body, with the smaller variants showing an indecisive market. Web nifty on monday ended 33 points lower to form an inside bar pattern on the daily chart with the india vix recording a surge of over 13%.“we need to wait and watch, till the high (22,589) or low (22,409) is taken out for further direction on nifty. If the headline index manages to hold thursday's low of 21,932, a pullback looks possible to chartists. Inside bar with a large range. Check if the high and low range of the subsequent candle is.How to Trade with an Inside Bar Pattern Market Pulse

Master the Simple Inside Bar Breakout Trading Strategy Forex Training

Best Inside Bar Trading Strategy Pro Trading School

The inside bar candlestick pattern Pro Trading School

Basics of Inside Bar Candle Strategy for Beginners Traders Ideology

Inside Bar Candle Trade Setup Trading Fuel Research Lab

A Complete Breakdown of Inside Bar and How To Trade It Forex Filli

How to Trade the Inside Bar Pattern

Inside Bar Pattern Explained Trading Heroes

Inside Bar Candlestick Pattern PDF Guide Trading PDF

Inside Day Often Refers To All Versions Of.

Web There Is A Candlestick Pattern Called Hikkake Candle Pattern Which Shows The Failure Of Inside Bar.

Web The Inside Bar Pattern Consists Of Two Candlesticks And Has The Following Characteristics:

In Order To Confirm This Pattern You Need To See A Candle On The Chart, Which Is Fully Contained Within The Previous Bar.

Related Post: