Heikin Ashi Patterns

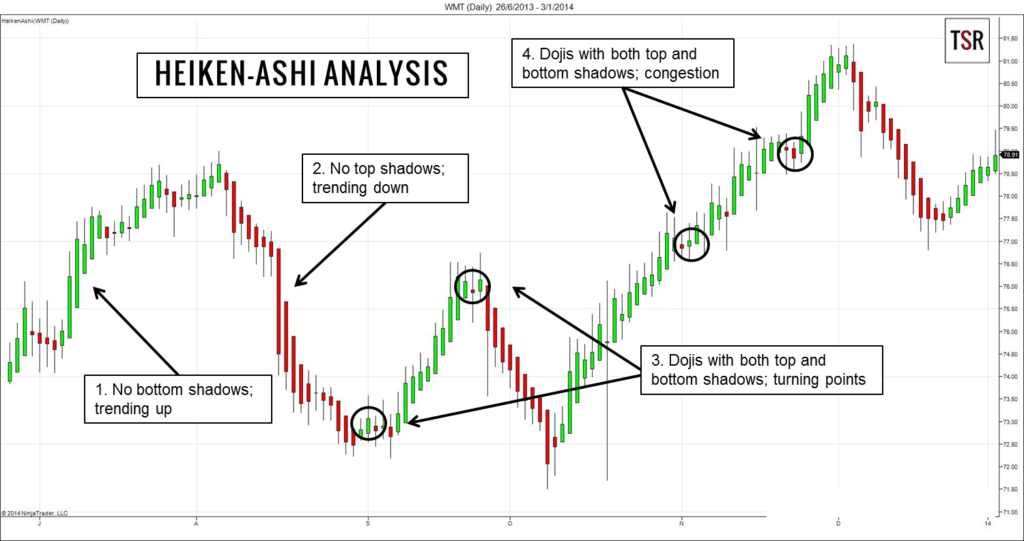

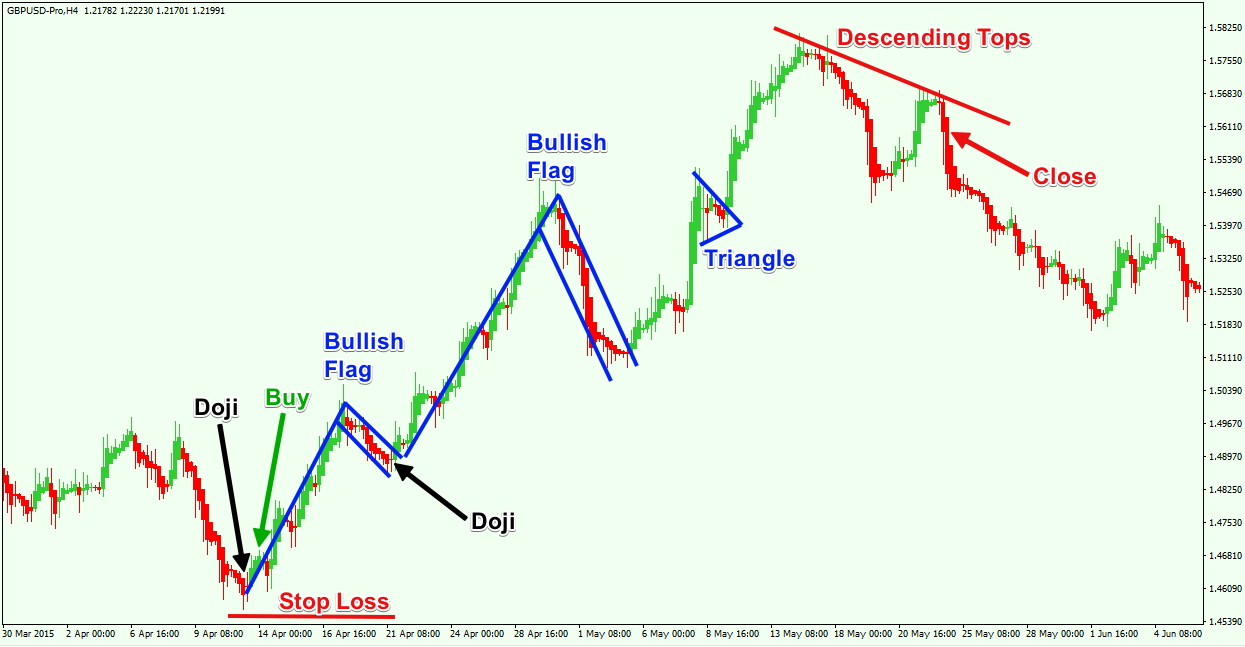

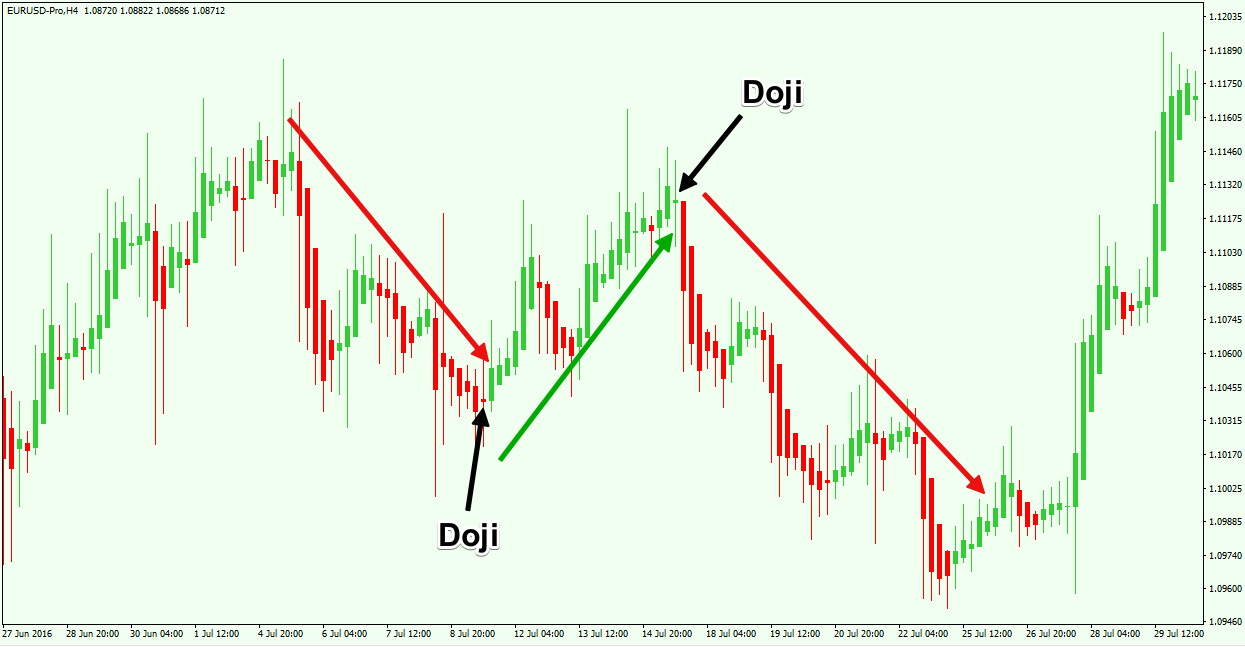

Heikin Ashi Patterns - Web by stefano treviso, updated on: A heikin ashi chart filters market noise and provides a clearer visual representation of the trend. Candles with a small body surrounded by both an upper and lower wick suggest that a potential trend change may be presenting itself. They are a charting method which get attached to your price chart on your trading terminal. In fact, all aspects of classical technical analysis can be applied to these charts. Web what is the heikin ashi formula? Web heikin ashi comes from a family of japanese candlestick patterns. The beginning of this bullish trend enables trades to enter long positions in the market to gain maximum potential profits. Web the heiken ashi is a type of candlestick that is used in technical analysis. The heikin ashi formula is the method used to calculate each candlestick on the chart. The heikin ashi can be used alone or in conjunction with candlestick charts. Register now or try free demo. Öppna metatrader 4 och navigera till menyn file. Candlesticks are one of the oldest forms of technical chart indicators that traders can use in their analysis of asset prices. (also known as a “doji”.) Just like with traditional candlestick charts, heikin ashi candles can form reversal patterns such as doji or engulfing patterns, which can signal potential trend reversals. Web heiken ashi is a unique charting method that i’ve found incredibly useful for understanding market trends and smoothing out price data. It is used to identify market trend signals and forecast price movements. A. Consider the graphic given below… Candles with a small body surrounded by both an upper and lower wick suggest that a potential trend change may be presenting itself. A heikin ashi chart shows you the strength of the trend by observing the shadows (or wicks). Here’s a simplified version of how to calculate the open, close, high and low for. Web the heiken ashi is a type of candlestick that is used in technical analysis. Some of the formulas or calculations are more complicated than those used for a standard candlestick. A heikin ashi chart shows you the strength of the trend by observing the shadows (or wicks). Strategies that work well with heiken ashi. Web heikin ashi comes from. This causes candles to have a smoothened and continuous look making them them better to visualize trends. The formula averages out the price movements of a typical candlestick chart. To construct a heikin ashi. Candlesticks are one of the oldest forms of technical chart indicators that traders can use in their analysis of asset prices. A red candle is telling. Heikin ashi charts look like typical candlestick charts, but they smooth out price action because their bars are computed out of. A green candle is telling you that trend is up. Web by stefano treviso, updated on: Web what is the heikin ashi formula? För att göra detta, följ dessa steg: A green candle is telling you that trend is up. (also known as a “doji”.) How to use heikin ashi to identify trend strength. Just like with traditional candlestick charts, heikin ashi candles can form reversal patterns such as doji or engulfing patterns, which can signal potential trend reversals. White candles with no lower “wicks” indicate a strong uptrend. In fact, all aspects of classical technical analysis can be applied to these charts. It is used to identify market trend signals and forecast price movements. They are a charting method which get attached to your price chart on your trading terminal. Candles with a small body surrounded by both an upper and lower wick suggest that a potential trend. To construct a heikin ashi. When looking for a potential end to a trend, solely relying. The formula averages out the price movements of a typical candlestick chart. The heikin ashi can be used alone or in conjunction with candlestick charts. Learn how to read these charts and how to use them in your trading. (also known as a “doji”.) Heikin ashi charts can potentially help traders identify when trends are likely to reverse. In fact, all aspects of classical technical analysis can be applied to these charts. Web what is the heikin ashi formula? The chart resembles a typical japanese candlestick chart, but it has a number of variations that makes reading it a. Candlesticks are one of the oldest forms of technical chart indicators that traders can use in their analysis of asset prices. A candlestick chart is used to visualise price movements and identify patterns, with each candle representing a trading session. Heikin ashi is a type of price chart that consists of candlesticks. A heikin ashi chart shows you the strength of the trend by observing the shadows (or wicks). The beginning of this bullish trend enables trades to enter long positions in the market to gain maximum potential profits. Web the heikin ashi candlestick pattern helps traders identify the candlesticks that come without any lower shadow, which are responsible for depicting a strong bullish trend. Register now or try free demo. It is used to identify market trend signals and forecast price movements. Candles with a small body surrounded by both an upper and lower wick suggest that a potential trend change may be presenting itself. Web the heiken ashi is a type of candlestick that is used in technical analysis. A heikin ashi chart filters market noise and provides a clearer visual representation of the trend. In this article, i’ll share my insights on how it transforms traditional candlestick charts into more readable signals, making it easier for you to spot trends and reversals. White candles in general signify an uptrend. The heikin ashi formula is the method used to calculate each candlestick on the chart. This causes candles to have a smoothened and continuous look making them them better to visualize trends. They are a charting method which get attached to your price chart on your trading terminal.

The difference between Heikin Ashi and Regular Candlesticks

How to Use a Heikin Ashi Chart

Ultimate Guide to Trading with Heikin Ashi Candles Forex Training Group

A complete Guide to Trading with Heikin Ashi Candles Pro Trading School

:max_bytes(150000):strip_icc()/dotdash_Final_Heikin-Ashi_A_Better_Candlestick_Sep_2020-02-3018496f496e4bbfabe61f78d3208a71.jpg)

HeikinAshi Technique Definition and Formula

How to Trade with Heikin Ashi Chart Pattern? StockManiacs

Ultimate Guide to Trading with Heikin Ashi Candles Forex Training Group

How to Use a Heikin Ashi Chart

A complete Guide to Trading with Heikin Ashi Candles Pro Trading School

What Is Heikin Ashi Chart? 3 Best Heiken Ashi Trading Strategies

White Candles With No Lower “Wicks” Indicate A Strong Uptrend.

Consider The Graphic Given Below…

There Are Slight Differences That You Must Know.

How To Use Heiken Ashi To Identify A Trend.

Related Post: