Heikin Ashi Candlestick Patterns

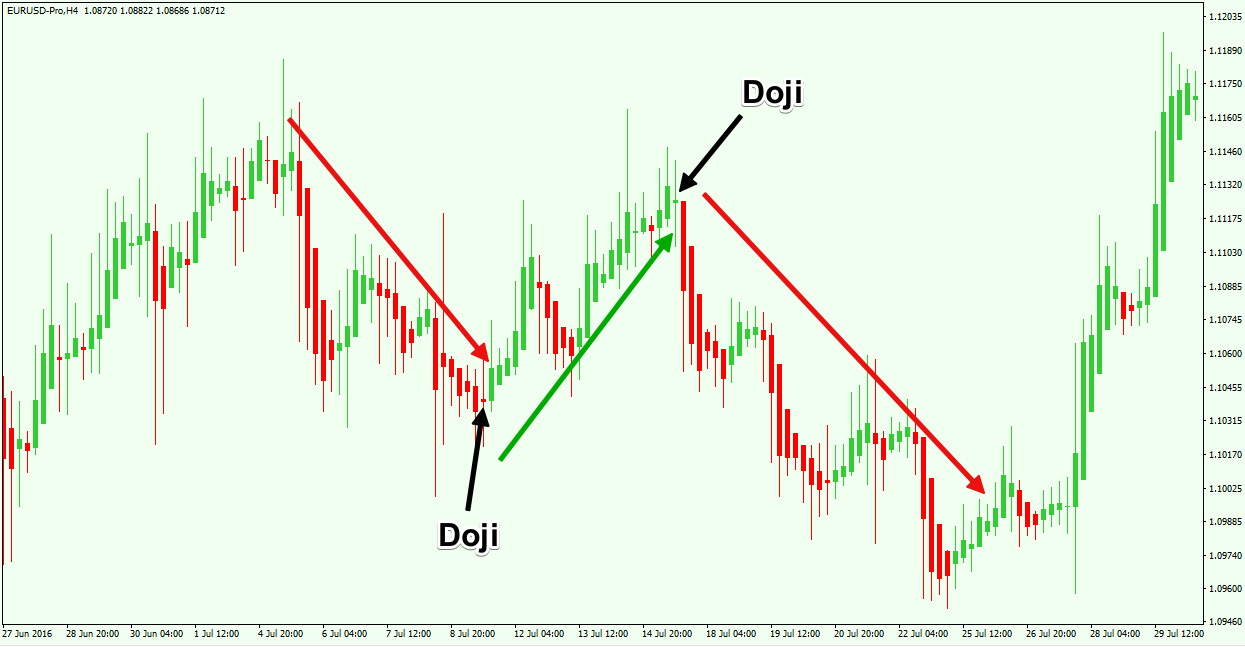

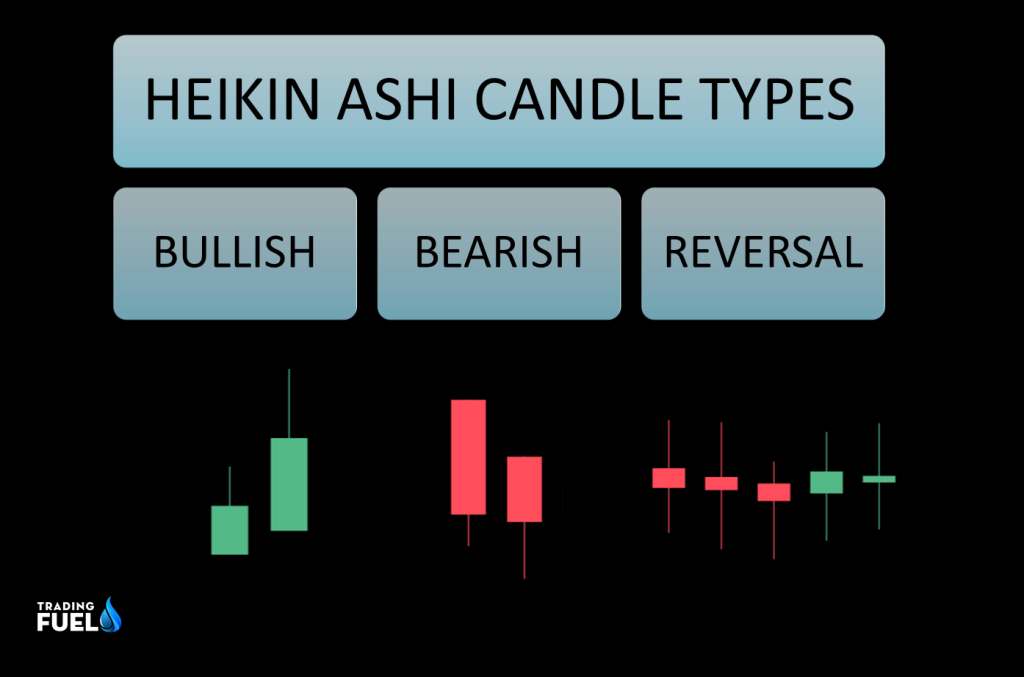

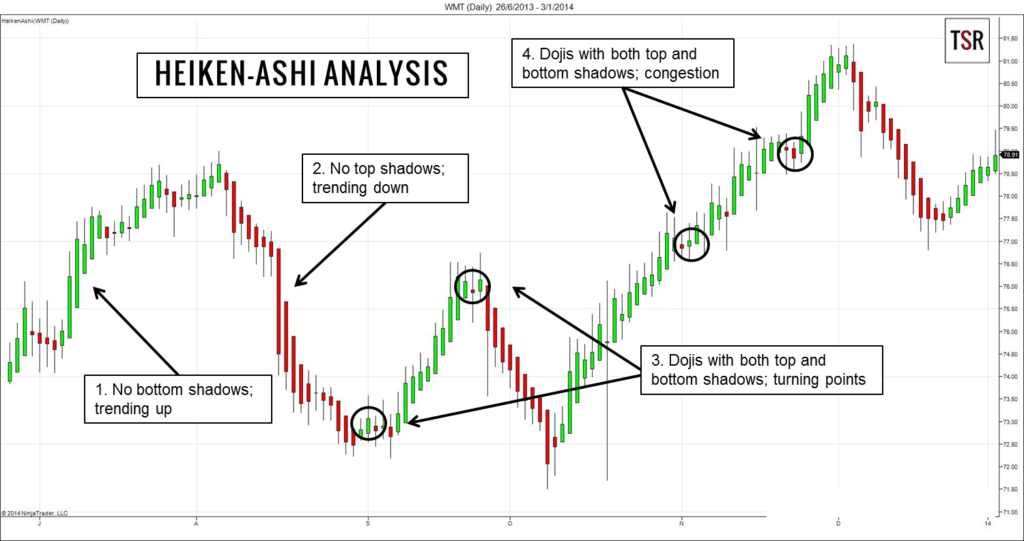

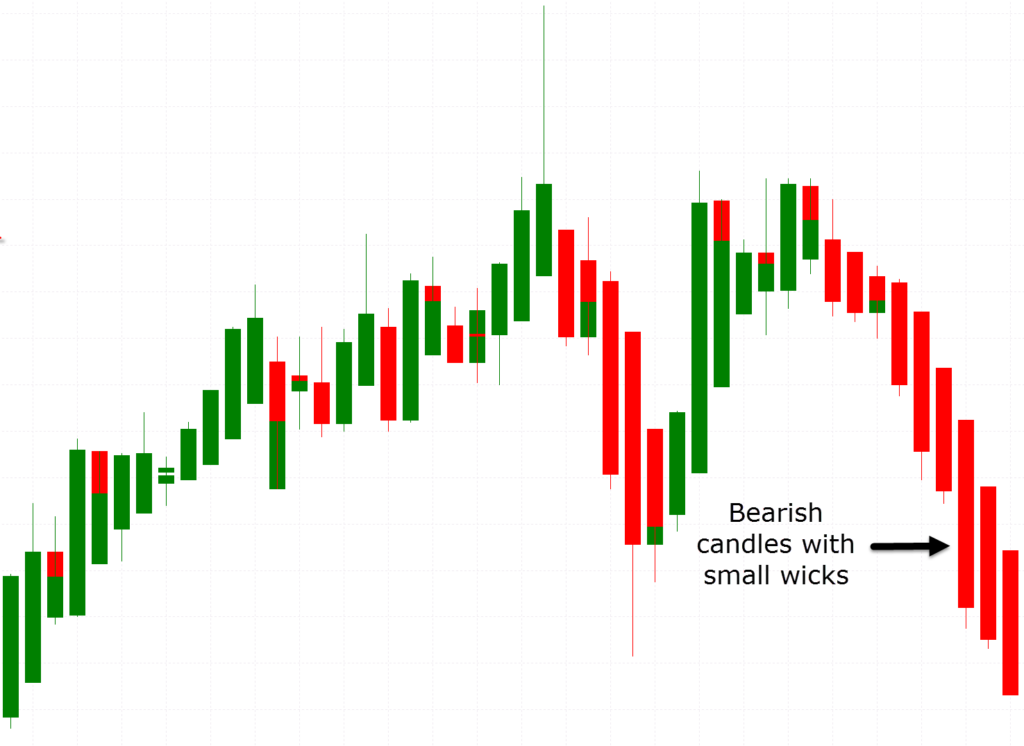

Heikin Ashi Candlestick Patterns - Web heikin ashi shares some features with the normal candlestick charts. Förbättrad trendklarhet, visuellt rena diagram, kompatibla med andra analysverktyg. In fact, all aspects of classical technical analysis can be applied to these charts. Web heikin ashi charts can potentially help traders identify when trends are likely to reverse. Förenklad trendvisualisering, beräkning av genomsnittspris, minskat marknadsbrus. Consider the graphic given below… Web heikin ashi is based on the principles of the japanese candlestick charting technique, which dates back to the 18th century. They are a charting method which get attached to your price chart on your trading terminal. Web the heikin ashi candlestick aims to filter out any noise in the currency pair prices by creating a chart pattern with averaged out prices. Developed in japan, these patterns are derived from average price movements and are depicted as a series of candlesticks on a chart. Close = ¼ (open + close + low + close) (the average price of the current bar) Identify candlesticks with no shadows. Web heikin ashi shares some features with the normal candlestick charts. Web heikin ashi is based on the principles of the japanese candlestick charting technique, which dates back to the 18th century. Discover how you can incorporate ha. How to use heikin ashi to identify trend strength. Developed in japan, these patterns are derived from average price movements and are depicted as a series of candlesticks on a chart. Web the heiken ashi trading strategy analyses candlestick patterns to decide whether momentum is building, continuing, or reversing. Discover how you can incorporate ha candlesticks in your technical analysis.. Discover how you can incorporate ha candlesticks in your technical analysis. It is used to identify market trend signals and forecast price movements. How to use heikin ashi to identify trend strength. Förenklad trendvisualisering, beräkning av genomsnittspris, minskat marknadsbrus. Learn how to read these charts and how to use them in your trading. Identify candlesticks with no shadows. Web the heikin ashi candlestick aims to filter out any noise in the currency pair prices by creating a chart pattern with averaged out prices. How to apply it in actual trading scenarios to profit from trends? In fact, all aspects of classical technical analysis can be applied to these charts. A heikin ashi chart. Heikin ashi is a type of price chart that consists of candlesticks. Web heikin ashi patterns are a technical analysis tool that chartists use to identify market trends and potential reversals. How to use heikin ashi to identify trend strength. A heikin ashi chart filters market noise and provides a clearer visual representation of the trend. In fact, all aspects. Web the heikin ashi candlestick aims to filter out any noise in the currency pair prices by creating a chart pattern with averaged out prices. Web the heiken ashi is a type of candlestick that is used in technical analysis. They are a charting method which get attached to your price chart on your trading terminal. Web heikin ashi shares. The pattern helps traders understand the market direction, trends, gaps, and reversals. There are slight differences that you must know. Heikin ashi candles can form traditional candlestick patterns such as doji, hammers, and shooting stars. Förbättrad trendklarhet, visuellt rena diagram, kompatibla med andra analysverktyg. They are similar to standard candlesticks, but the calculation of the open, high, low, and close. The formula is not straightforward and is a bit complicated. How to calculate heikin ashi. Consider the graphic given below… Heikin ashi is a type of price chart that consists of candlesticks. There are slight differences that you must know. How to apply it in actual trading scenarios to profit from trends? A green candle is telling you that trend is up. Discover how you can incorporate ha candlesticks in your technical analysis. Web heikin ashi cheat sheet. Web heikin ashi charts can potentially help traders identify when trends are likely to reverse. Consider the graphic given below… This causes candles to have a smoothened and continuous look making them them better to visualize trends. In this tutorial, you’ll learn: There are slight differences that you must know. Close = ¼ (open + close + low + close) (the average price of the current bar) Web heikin ashi is based on the principles of the japanese candlestick charting technique, which dates back to the 18th century. In fact, all aspects of classical technical analysis can be applied to these charts. Consider the graphic given below… In this tutorial, you’ll learn: A heikin ashi chart filters market noise and provides a clearer visual representation of the trend. The formula is not straightforward and is a bit complicated. The pattern helps traders understand the market direction, trends, gaps, and reversals. It's useful for making candlestick. It is used to identify market trend signals and forecast price movements. How to apply it in actual trading scenarios to profit from trends? Heikin ashi candles can form traditional candlestick patterns such as doji, hammers, and shooting stars. For beginner traders, this means that the trend is easier to see. Heikin ashi smooths the candlesticks using average open, high, low, and close values. Web the heiken ashi trading strategy analyses candlestick patterns to decide whether momentum is building, continuing, or reversing. A heikin ashi chart shows you the strength of the trend by observing the shadows (or wicks). It looks very similar to japanese candlesticks that you must have seen before.

What Is Heikin Ashi Chart? 3 Best Heiken Ashi Trading Strategies

Your Ultimate Guide to Trading with Heikin Ashi Candles

A complete Guide to Trading with Heikin Ashi Candles Pro Trading School

A complete Guide to Trading with Heikin Ashi Candles Pro Trading School

Ultimate Guide to Trading with Heikin Ashi Candles Forex Training Group

Understanding Candlestick Charts A Comprehensive Guide To Stock Market

Heikin Ashi Candlesticks Formula, Strategy, Technique (Trading Fuel Lab)

How to Use a Heikin Ashi Chart

The difference between Heikin Ashi and Regular Candlesticks

What is Heikin Ashi and How You Use it With Free PDF

Web What Are Heikin Ashi Candles?

Identifying Candlesticks With No Lower Shadows Is A Credible Signal That A Strong Bullish Trend Is Starting.

Learn How To Read These Charts And How To Use Them In Your Trading.

This Causes Candles To Have A Smoothened And Continuous Look Making Them Them Better To Visualize Trends.

Related Post: