Head And Shoulders Trade Pattern

Head And Shoulders Trade Pattern - It is considered a reliable and accurate chart pattern and is often used by traders and investors to. To avoid confusion, the explanation in this guide is for the head and shoulders top pattern. So if you’re looking for a new chart pattern to add to your arsenal… why not learn a classic pattern that traders have used for decades, if not longer? Head and shoulders chart pattern: It's called head and shoulders formation because it resembles a baseline with three peaks, with the center peak being the highest out of the three. Web the head and shoulders pattern is a reversal chart pattern. The pattern resembles a left shoulder, head, and right shoulder, hence the term head. The line connecting the 2 valleys is the neckline. Just because you spot a head and shoulders pattern doesn’t mean the. The head and shoulders pattern is a reversal trading strategy, which can develop at the end of bullish or bearish trends. 18, 2020 16 min read. Web the head is the second peak and is the highest point in the pattern. Often associated with bullish price reversals, this unique pattern is one of the most accurate and effective chart patterns in technical analysis. Web the inverse head and shoulders is a candlestick formation that occurs at the end of a downward. You have likely come across the pattern in your trading journey. For traders, it is an extremely useful pattern, whether they are trend trading and want to be alerted of potential danger or they want to catch a. However, most traders get it wrong. It consists of four parts: Web the head and shoulders pattern is a crystal ball in. Web the head and shoulders pattern is a reversal chart pattern. It is a bearish reversal formation. A head and shoulders pattern is a trading pattern with three peaks on a chart, the outside two being near in height and the centre peak being the highest. After the head and shoulders pattern completes, investors can determine profit and price targets.. Web the head and shoulders pattern is a crystal ball in the trading world, a respected component of technical analysis, known for its ability to hint at upcoming market shifts. Web monitor if tesla shares can close above the neckline of an inverse head and shoulders pattern around $197, a move that could potentially mark the start of a new. It is often referred to as an inverted head and shoulders pattern in downtrends, or simply the head and shoulders stock pattern in uptrends. So if you’re looking for a new chart pattern to add to your arsenal… why not learn a classic pattern that traders have used for decades, if not longer? The head and shoulders pattern is exactly. Web recommended by warren venketas. It is often referred to as an inverted head and shoulders pattern in downtrends, or simply the head and shoulders stock pattern in uptrends. After the head and shoulders pattern completes, investors can determine profit and price targets. The head and shoulders chart pattern is popular and easy to spot once traders are aware of. However, most traders get it wrong. It consists of 3 tops with a higher high in the middle, called the head. We can also calculate a target by measuring the high point of the head to the neckline. The head and shoulders pattern is a classic. Web the head and shoulders pattern is a technical formation that indicates a trend. It's called head and shoulders formation because it resembles a baseline with three peaks, with the center peak being the highest out of the three. The head and shoulders pattern is a classic. The head and shoulders chart pattern is popular and easy to spot once traders are aware of what they are watching for. The patterns appear as a. Head and shoulders chart pattern: The pattern resembles a left shoulder, head, and right shoulder, hence the term head. The 7 head and shoulder pattern trading steps are listed below. It is easy to recognize and signals a potential price reversal. Web the head and shoulders pattern is a crystal ball in the trading world, a respected component of technical. After the head and shoulders pattern completes, investors can determine profit and price targets. What is a head and shoulders pattern? Head and shoulders chart pattern: It consists of four parts: It suggests that the buyers are losing control and the sellers are taking over, leading to a downward movement in price. To avoid confusion, the explanation in this guide is for the head and shoulders top pattern. Observing these formations allows traders to anticipate a shift and adjust their holdings accordingly, potentially securing profits from previous positions or entering new. An iconic chart pattern widely recognized and utilized by traders for decades. We can also calculate a target by measuring the high point of the head to the neckline. Web the head and shoulders pattern is a reversal chart pattern. Head and shoulders chart pattern: The 7 head and shoulder pattern trading steps are listed below. What is a head and shoulders pattern? It suggests that the buyers are losing control and the sellers are taking over, leading to a downward movement in price. Web monitor if tesla shares can close above the neckline of an inverse head and shoulders pattern around $197, a move that could potentially mark the start of a new trend higher in the stock. It consists of 3 tops with a higher high in the middle, called the head. It serves as a reliable guide, shedding light on potential price reversals and offering clarity to both novice and experienced traders alike. It's called head and shoulders formation because it resembles a baseline with three peaks, with the center peak being the highest out of the three. So if you’re looking for a new chart pattern to add to your arsenal… why not learn a classic pattern that traders have used for decades, if not longer? Web the head and shoulders pattern is arguably the most popular reversal pattern among traders. As such, the three tops look like a ‘left shoulder’, ‘head’, and a ‘right shoulder’.:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-01-d955fe7807714feea05f04d7f322dfaf.jpg)

How to Trade the Head and Shoulders Pattern

ULTIMATE Head And Shoulders Pattern Trading Course (PRICE ACTION

What is Head and Shoulders Pattern & How to trade it Phemex Academy

Head and Shoulders pattern How To Verify And Trade Efficiently How

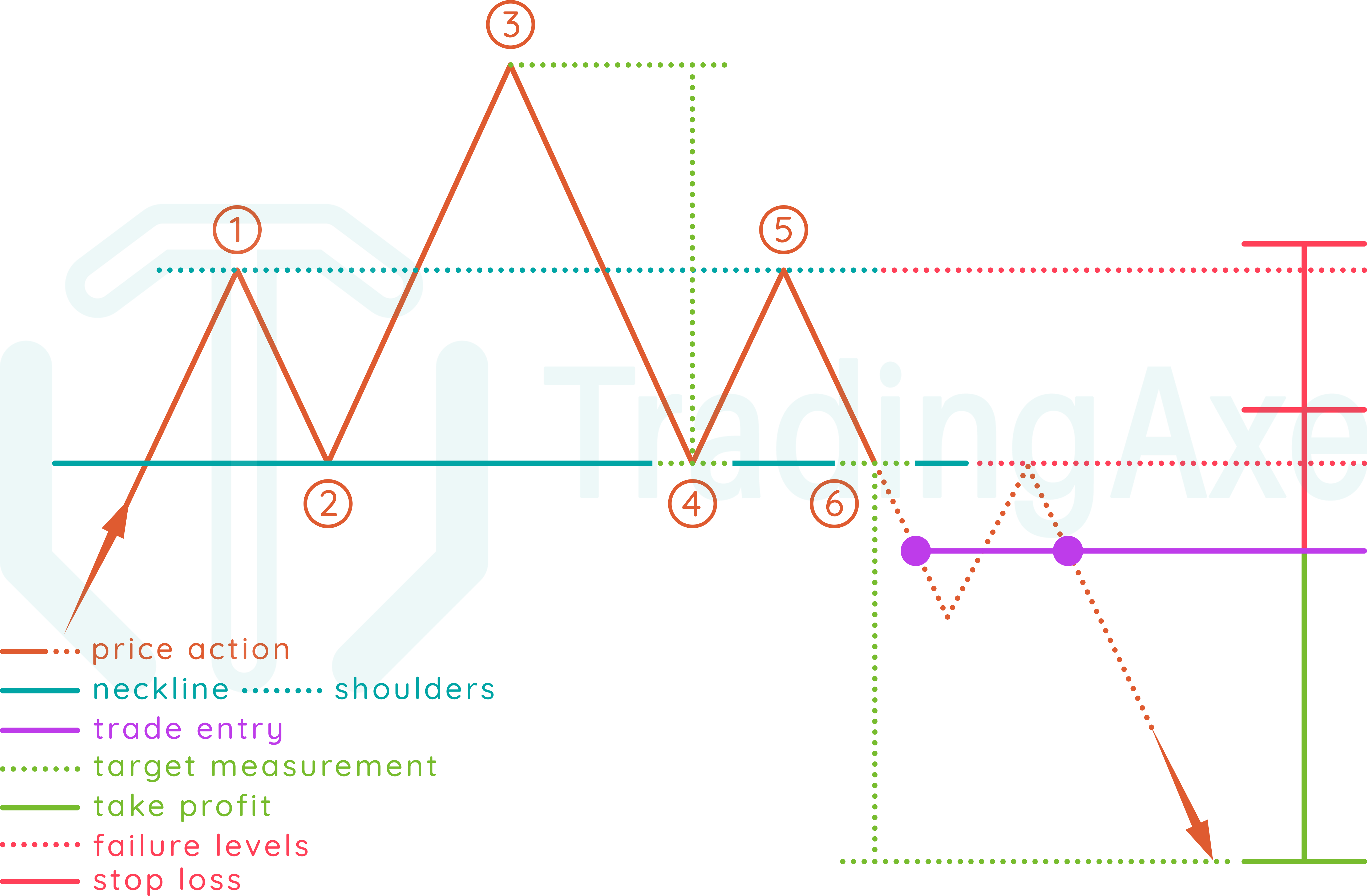

How To Trade Head And Shoulders Chart Pattern TradingAxe

Head and Shoulders Pattern Trading Strategy Guide Pro Trading School

Head and Shoulders Pattern Trading Strategy Guide Pro Trading School

How to Trade the Head and Shoulders Pattern Trading Pattern Basics

Head and Shoulders Pattern Trading Strategy Guide Pro Trading School

Head and Shoulders Pattern in Forex A Reversal Trading Strategy

The Head And Shoulders Pattern Is A Classic.

It Is Often Referred To As An Inverted Head And Shoulders Pattern In Downtrends, Or Simply The Head And Shoulders Stock Pattern In Uptrends.

Web These Patterns Typically Manifest In Forms Such As The “Head And Shoulders” For Topping Reversals, Or The “Inverse Head And Shoulders” For Bottoming Reversals.

After The Head And Shoulders Pattern Completes, Investors Can Determine Profit And Price Targets.

Related Post: