Head And Shoulders Pattern Target

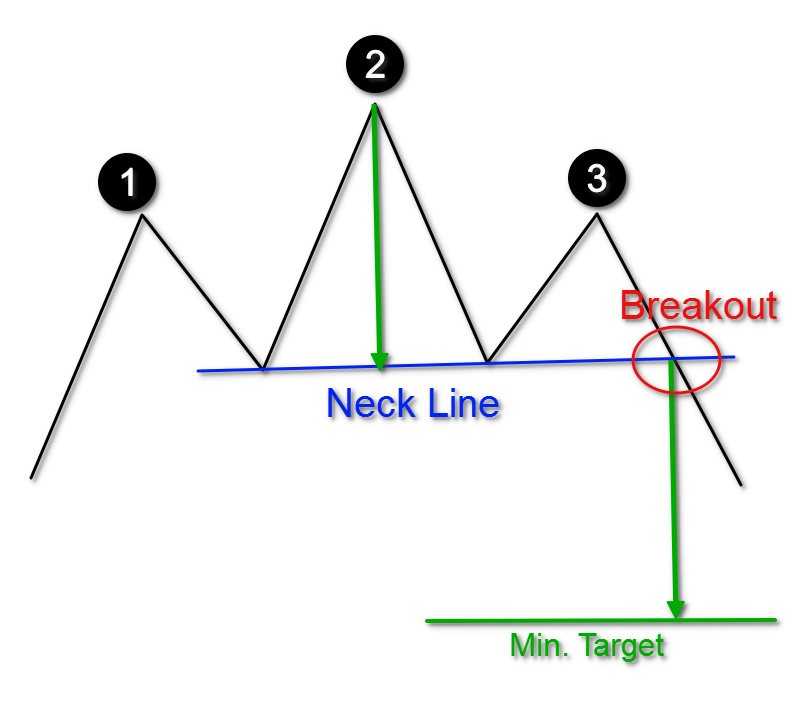

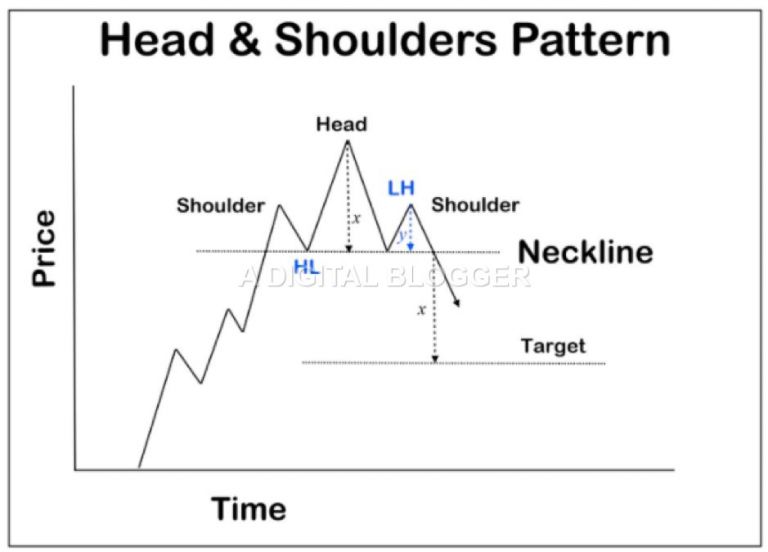

Head And Shoulders Pattern Target - Entry, stop loss and profit target. The two shoulders also form peaks but do not exceed the height of the head. Web the head and shoulders price pattern strategy is a pivotal tool for traders aiming to maximize gains in the fluctuating market. The line connecting the 2 valleys is the neckline. Below it, you will find a list elaborating on each aspect. The height of the last top can be higher than the first, but not higher than the head. Key components of the head and shoulders. Head and shoulders pattern screener 7. The creation of the pattern on the chart starts from the left shoulder. Web updated february 19, 2022. Head and shoulders trading strategy: Below it, you will find a list elaborating on each aspect. The pattern, when seen in an uptrend, is considered a bearish reversal sign, indicating that the uptrend is about to turn into a downtrend. Other parts playing a role in the pattern are volume, the breakout, price target and support turned resistance. What is. The two shoulders also form peaks but do not exceed the height of the head. Web may 12, 2024. Web why the head and shoulders patterns are statistically the most accurate of the price action patterns, reaching their projected target between 80% and 90%. H&s and inverse h&s pattern basic structure. To determine the target spread: It may be either a reversal pattern or a continuous pattern. Web the head is the second peak and is the highest point in the pattern. Head and shoulders pattern screener 7. After the head and shoulders pattern completes, investors can determine profit and price targets. Despite the bearish outlook, kevin suggested that now would be an ideal time for. It is often referred to as an inverted head and shoulders pattern in downtrends, or simply the head and shoulders stock pattern in uptrends. Inverse head and shoulders pattern 4. The pattern, when seen in an uptrend, is considered a bearish reversal sign, indicating that the uptrend is about to turn into a downtrend. It may be used to predict. The head and shoulders pattern is a reversal trading strategy, which can develop at the end of bullish or bearish trends. The line connecting the 2 valleys is the neckline. Head and shoulders trading strategy: Key components of the head and shoulders. Web the head and shoulders pattern is very easy to spot and can be a caution for traders. It is often referred to as an inverted head and shoulders pattern in downtrends, or simply the head and shoulders stock pattern in uptrends. Despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and shoulders pattern, with a price target of $0.22. What is. The two shoulders also form peaks but do not exceed the height of the head. The pattern can also be used to forecast a potential price target and is often used in combination with other technical indicators to confirm a reversal. The line connecting the 2 valleys is the neckline. Other parts playing a role in the pattern are volume,. But how do you identify and use it? A regular pattern is a form of stock market prediction for a trend reversal from bullish to bearish. Web the inverse head and shoulders is a candlestick formation that occurs at the end of a downward trend and indicates that the previous trend is about to reverse. Head and shoulders pattern screener. Web updated february 19, 2022. Web the head and shoulders pattern occurs when the price of security starts rising, marking the bullish trend, and reaches a new high level. Web analysts see bullish future with $3,000 target. Web the head and shoulders pattern is very easy to spot and can be a caution for traders especially when the pattern occurs. Web may 12, 2024. Web best pattern form guidelines. The formation of an ascending broadening wedge pattern beginning from the 2016 lows of $1045.40, along with an inverted head and shoulders. Web analysts see bullish future with $3,000 target. Below it, you will find a list elaborating on each aspect. The formation of an ascending broadening wedge pattern beginning from the 2016 lows of $1045.40, along with an inverted head and shoulders. How to identify the head and shoulders. Engage core, draw shoulders down and back, and gaze forward. Web the head and shoulders pattern is a chart pattern formed by three consecutive price rallies and two intervening pullbacks, with the second rally being the highest among the three. Entry, stop loss and profit target. The height of the last top can be higher than the first, but not higher than the head. The line connecting the 2 valleys is the neckline. Web updated february 19, 2022. Web the head and shoulders pattern is very easy to spot and can be a caution for traders especially when the pattern occurs at the top end of a rally or its bearish counterpart, the inverse head and shoulders that occurs at the trough of a downtrend. Web despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and shoulders pattern, with a price target of $0.22. Web may 12, 2024. Web a head and shoulders pattern occurs at the end of a lengthened uptrend and generally signals a reversal. Key components of the head and shoulders. It may be either a reversal pattern or a continuous pattern. The reason for its formation is a tug of war between bullish investors, who sell at every peak. To determine the target spread:

Head and Shoulders Trading Patterns ThinkMarkets EN

Keys to Identifying and Trading the Head and Shoulders Pattern Forex

How to Trade the Head and Shoulders Pattern Trading Pattern Basics

Head and Shoulders pattern How To Verify And Trade Efficiently How

Head and Shoulders Pattern

Head and Shoulders Pattern Trading Target, Indicator, Neckline, Example

Head and Shoulders Pattern Trading Strategy Guide Pro Trading School

Head and Shoulders Pattern Quick Trading Guide StockManiacs

Head and Shoulders Pattern Trading Strategy Guide Pro Trading School

Head and Shoulders Pattern Strategy COMPLETE GUIDE!

After The Head And Shoulders Pattern Completes, Investors Can Determine Profit And Price Targets.

The Creation Of The Pattern On The Chart Starts From The Left Shoulder.

H&S And Inverse H&S Pattern Basic Structure.

Example Of A Head And Shoulders Pattern 3.

Related Post: