Head And Shoulders Pattern Stocks

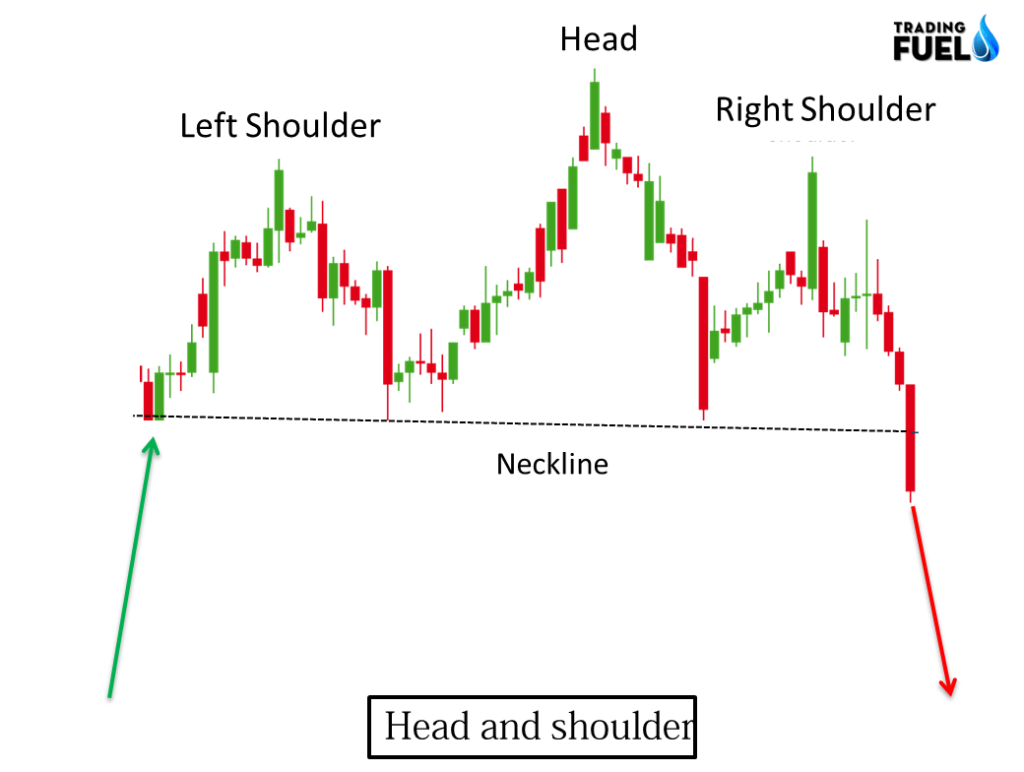

Head And Shoulders Pattern Stocks - The components of a head and shoulders trading pattern. Web the head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. Web the head and shoulders pattern is a formation that includes 3 crest points with the 2 side crests (shoulders) even and the middle point (head) sitting higher. Web a head and shoulders pattern form after an uptrend and is composed of a peak, a retracement, a higher second peak, a retracement, a lower third peak, and a drop below the neckline. Web there are four components of a head and shoulders pattern: Web the head and shoulders pattern is a technical analysis tool to identify potential reversals in the stock market. Web recognizing a reversal pattern early can be particularly advantageous in the penny stock market, where changes can occur rapidly and with significant impact. Web head and shoulder pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web on a stock chart, the head and shoulders pattern has three peaks, with the middle peak being the highest. Web meghan's $275 midi dress was made by orire, a nigerian designer. The head and shoulders pattern can appear near both up trends and down trends. Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. Web a head and shoulders pattern form after an uptrend and is composed of a peak, a retracement, a higher second. Web a head and shoulders reversal pattern forms after an uptrend, and its completion marks a trend reversal. Web a head and shoulders pattern form after an uptrend and is composed of a peak, a retracement, a higher second peak, a retracement, a lower third peak, and a drop below the neckline. It typically forms at the end of a. Web the head and shoulders bottom, sometimes referred to as an inverse head and shoulders, is a reversal pattern that shares many common characteristics with the head and shoulders top, but relies more heavily on volume patterns for confirmation. The reaction lows of each peak can be connected to form support, or a neckline. Web the head and shoulders pattern. These patterns typically manifest in forms such as the “head and shoulders” for topping reversals, or the “inverse head and shoulders” for bottoming reversals. It is considered one of the most reliable chart patterns and is identified by three peaks. Web recognizing a reversal pattern early can be particularly advantageous in the penny stock market, where changes can occur rapidly. Web monitor if tesla shares can close above the neckline of an inverse head and shoulders pattern around $197, a move that could potentially mark the start of a new trend higher in the stock. Web the head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. Web. It consists of 3 tops with a higher high in the middle, called the head. The head and shoulders pattern can appear near both up trends and down trends. The reaction lows of each peak can be connected to form support, or a neckline. The pattern is never perfect in shape, as price fluctuations can happen in between the shifts.. The head and shoulders pattern can appear near both up trends and down trends. To understand the pattern name, think of the two outside peaks as the shoulders and the middle peak as the head. The pattern is shaped with three peaks, a left shoulder peak, a higher head peak, and a right shoulder peak similar in height to the. It typically forms at the end of a bullish trend. The reaction lows of each peak can be connected to form support, or a neckline. Web the head and shoulders pattern is a formation that includes 3 crest points with the 2 side crests (shoulders) even and the middle point (head) sitting higher. The line connecting the 2 valleys is. Head and shoulders — check out the trading ideas, strategies, opinions, analytics at absolutely no cost! Web the head and shoulders chart pattern is a technical analysis chart formation used to identify potential reversals in the trend of a stock. Web head and shoulder pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth,. Web stock screener for investors and traders, financial visualizations. Web the head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. The head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. Web updated february 19,. Web head and shoulder pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web recognizing a reversal pattern early can be particularly advantageous in the penny stock market, where changes can occur rapidly and with significant impact. It consists of 3 tops with a higher high in the middle, called the head. The pattern contains three successive peaks, with the middle peak ( head) being the highest and the two outside peaks ( shoulders) being low and roughly equal. Web stock screener for investors and traders, financial visualizations. Web monitor if tesla shares can close above the neckline of an inverse head and shoulders pattern around $197, a move that could potentially mark the start of a new trend higher in the stock. It consists of 3 tops with a higher high in the middle, called the head. Let’s take a look at the four components that make up the. The left shoulder forms when a stock's price rises from a baseline, forms a peak, then drops back down to a. Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. Web a head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are close in height, and the middle is the highest. Dal) head and shoulders chart pattern (source:. To understand the pattern name, think of the two outside peaks as the shoulders and the middle peak as the head. The formation of an ascending broadening wedge pattern beginning from the 2016 lows of $1045.40, along with an inverted head and shoulders formation noted from. The hem of the dress was lined with. Web on a stock chart, the head and shoulders pattern has three peaks, with the middle peak being the highest.

Head and Shoulders pattern How To Verify And Trade Efficiently How

:max_bytes(150000):strip_icc()/dotdash_Final_Head_And_Shoulders_Pattern_Sep_2020-01-4c225a762427464699e42461088c1e86.jpg)

What Is a Head and Shoulders Chart Pattern in Technical Analysis?

Head and Shoulders Pattern Quick Trading Guide StockManiacs

ULTIMATE Head And Shoulders Pattern Trading Course (PRICE ACTION

Chart Pattern Head And Shoulders — TradingView

The Head and Shoulders Pattern A Trader’s Guide

The Head and Shoulders Pattern A Trader’s Guide

How to Trade the Head and Shoulders Pattern Trading Pattern Basics

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-01-d955fe7807714feea05f04d7f322dfaf.jpg)

How to Trade the Head and Shoulders Pattern

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Web The Head And Shoulders Pattern Is A Reversal Trend, Indicating Price Movement Is Changing From Bullish To Bearish.

Web The Pattern Should Be Taken Into The Fundamental Context Though, So If We Get Hot Us Inflation Figures, Then The Probabilities That We Break Out To The Downside Will Increase, While Soft Inflation Numbers Might Invalidate The Pattern And Take Us To New Highs.

Web The Head And Shoulders Pattern Is A Technical Analysis Tool To Identify Potential Reversals In The Stock Market.

The Red Garment's Scooped Neckline Featured Spaghetti Straps And A Slightly Cinched Waist.

Related Post: