Head And Shoulders Pattern Reversal

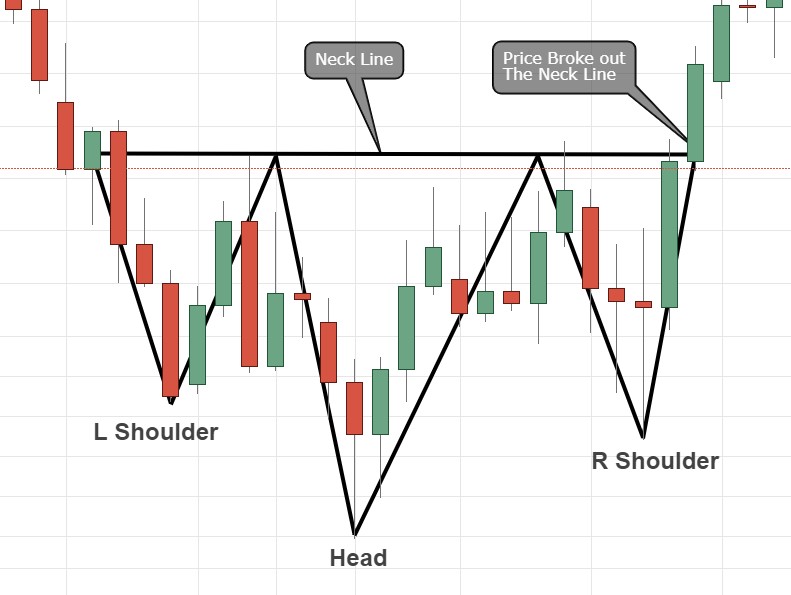

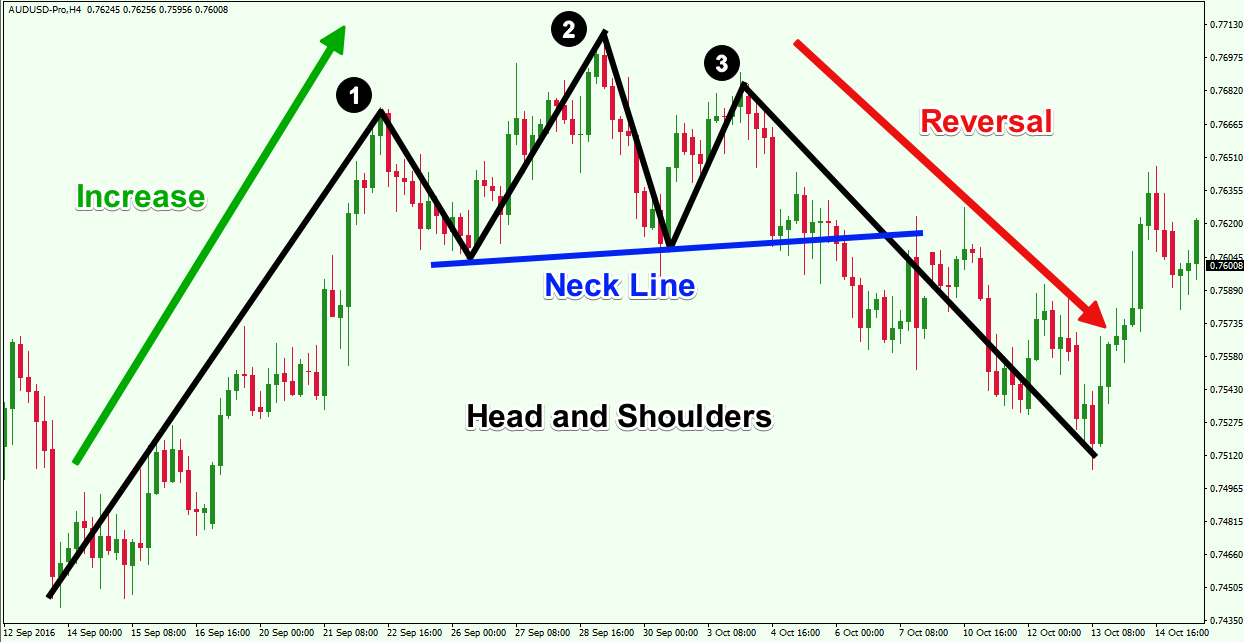

Head And Shoulders Pattern Reversal - Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend has exhausted itself. The pattern is typically formed after an uptrend and is considered a bearish reversal pattern. Web this pattern can signal a continuation of the uptrend or even a reversal during a downtrend. The pattern is similar to the shape of a person’s head and two shoulders in an inverted position, with. The pattern contains three successive troughs with the middle trough (head) being the deepest and the two outside troughs (shoulders) being shallower. The pattern contains three successive peaks, with the middle peak ( head ) being the highest and the two outside peaks ( shoulders ) being low and roughly equal. The head and shoulders pattern is exactly what the term indicates. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). This pattern, recognized for indicating potential upward momentum, suggests a positive shift in market dynamics. Web inverse head and shoulders is a price pattern in technical analysis that indicates a potential reversal from a downtrend to an uptrend. Web inverse head and shoulders is a price pattern in technical analysis that indicates a potential reversal from a downtrend to an uptrend. Web this pattern can signal a continuation of the uptrend or even a reversal during a downtrend. The pattern is never perfect in shape, as price fluctuations can happen in between the shifts. Web a head and. Web this pattern can signal a continuation of the uptrend or even a reversal during a downtrend. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Web bitcoin market indicators and breakout signals. A characteristic pattern takes shape and is. The pattern resembles a left shoulder, head, and right shoulder, hence the term head and. [1] head and shoulders top. Web the head and shoulders pattern is a popular chart pattern used in technical analysis to predict potential reversals in price trends. Let’s take a look at the four components that make up the formation. The pattern is similar to. Web inverse head and shoulders is a price pattern in technical analysis that indicates a potential reversal from a downtrend to an uptrend. Web a head and shoulders pattern is a bearish reversal pattern, which signals that the uptrend has peaked, and the reversal has started as the series of the higher highs (the first and second peak) is broken. Often associated with bullish price reversals, this unique pattern is one of the most accurate and effective chart patterns in technical analysis. Web a head and shoulders pattern is also a trend reversal formation. Both “inverse” and “reverse” head and shoulders patterns are the same. Web the head and shoulder pattern is formed after an uptrend in the price of. Often associated with bullish price reversals, this unique pattern is one of the most accurate and effective chart patterns in technical analysis. It is also the same as a head and shoulders pattern that flipped on its horizontal axis. The pattern is typically formed after an uptrend and is considered a bearish reversal pattern. Web the head and shoulders pattern. Chart pattern signaling trend reversal. Both “inverse” and “reverse” head and shoulders patterns are the same. The slope of this line can either be up or down. Web bitcoin's price has somewhat recovered from the head at $58,614 on may 1. Let’s take a look at the four components that make up the formation. It resembles a baseline with three peaks with the middle topping the other two. Both “inverse” and “reverse” head and shoulders patterns are the same. Often associated with bullish price reversals, this unique pattern is one of the most accurate and effective chart patterns in technical analysis. The pattern resembles a left shoulder, head, and right shoulder, hence the term. The pattern contains three successive peaks, with the middle peak ( head ) being the highest and the two outside peaks ( shoulders ) being low and roughly equal. It resembles a baseline with three peaks with the middle topping the other two. The flat upper line serves as a resistance level that the price attempts to breach, while the. Web a recent upward movement from this support has led to a 3.8% increase in trx’s price over two days, forming a bullish reversal pattern known as the inverted head and shoulders. “head and shoulder bottom” is also the same thing. Web bitcoin's price has somewhat recovered from the head at $58,614 on may 1. Web the head and shoulder. It typically forms at the end of a bullish trend. The pattern resembles a left shoulder, head, and right shoulder, hence the term head and. Web the head and shoulder pattern is formed after an uptrend in the price of an asset and indicates a potential trend reversal to a downtrend. It is the opposite of the head and shoulders chart pattern, which is a. Web a recent upward movement from this support has led to a 3.8% increase in trx’s price over two days, forming a bullish reversal pattern known as the inverted head and shoulders. A “ neckline ” is drawn by connecting the lowest points of the two troughs. The pattern contains three successive peaks, with the middle peak ( head ) being the highest and the two outside peaks ( shoulders ) being low and roughly equal. Web a head and shoulders pattern is also a trend reversal formation. The pattern appears as a head, 2 shoulders, and neckline in an inverted position. Often associated with bullish price reversals, this unique pattern is one of the most accurate and effective chart patterns in technical analysis. The pattern is similar to the shape of a person’s head and two shoulders in an inverted position, with. Web a head and shoulders reversal pattern forms after an uptrend, and its completion marks a trend reversal. Web a head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are close in height, and the middle is the. Let’s take a look at the four components that make up the formation. Web on the technical analysis chart, the head and shoulders formation occurs when a market trend is in the process of reversal either from a bullish or bearish trend; Web the head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend has exhausted itself.

Head and Shoulders Pattern Trading Strategy Guide Pro Trading School

Reversal Candlestick Chart Patterns ThinkMarkets

Five Powerful Patterns Every Trader Must know Video and Examples

headandshouldersreversalchartpattern Forex Training Group

The Essential Guide To Reversal Chart Patterns TradingwithRayner

Head and Shoulders Reversal Pattern Lesson 5 Part 1a Getting

How to Trade the Head and Shoulders Pattern Trading Pattern Basics

The Head and Shoulders Pattern A Trader’s Guide

Head And Shoulders Pattern The Trend Reversal Spotter

Top 5 Chart Patterns For Consistent Trading Results

Web The Head And Shoulders Pattern Is A Reversal Trend, Indicating Price Movement Is Changing From Bullish To Bearish.

Web A Head And Shoulders Pattern Is A Bearish Reversal Pattern, Which Signals That The Uptrend Has Peaked, And The Reversal Has Started As The Series Of The Higher Highs (The First And Second Peak) Is Broken With The Third Peak, Which Is Lower Than The Second.

This Pattern Appears When A Security's Price Experiences Three Peaks:

It Resembles A Baseline With Three Peaks With The Middle Topping The Other Two.

Related Post: