Head And Shoulders Pattern Neckline

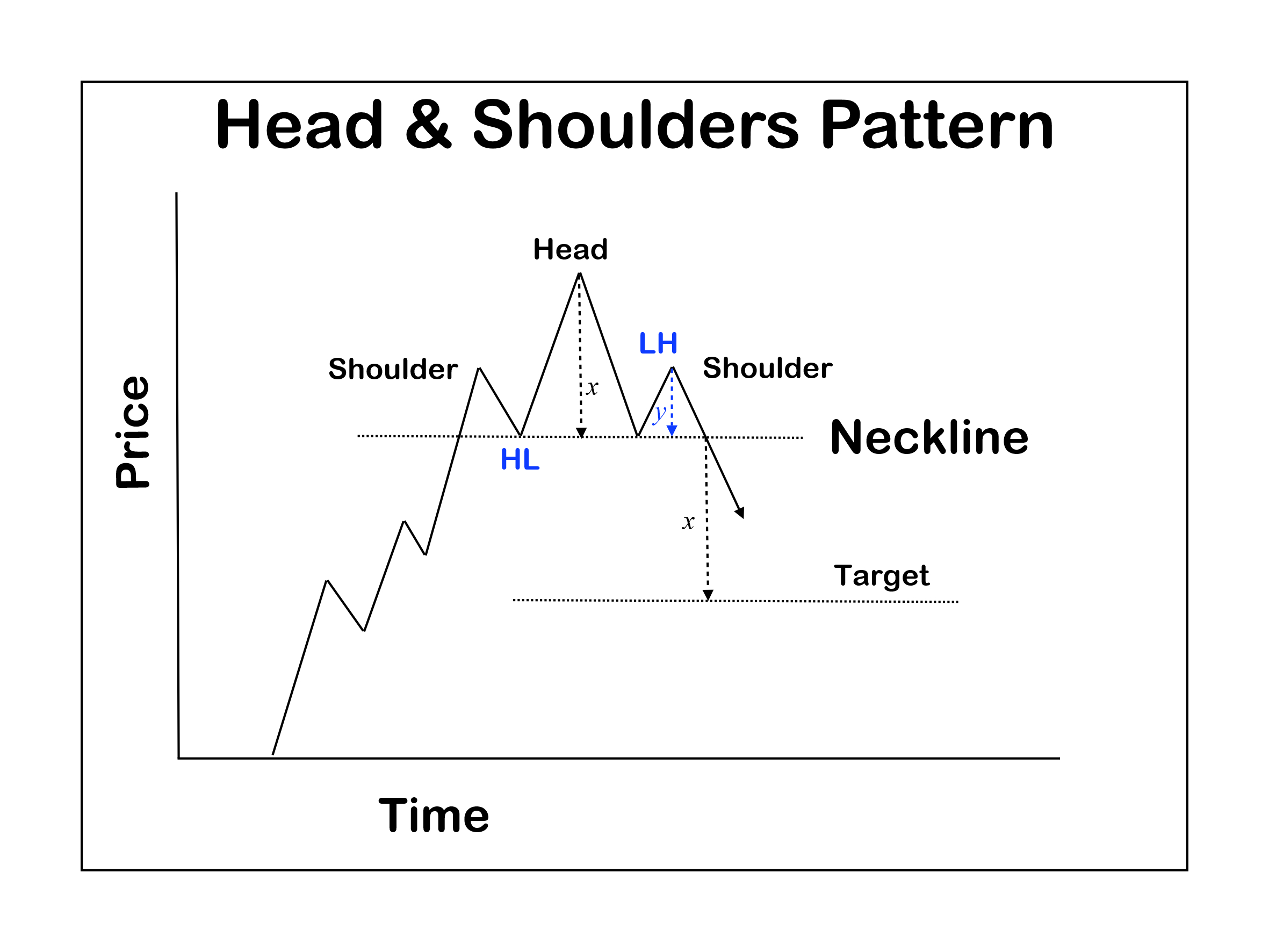

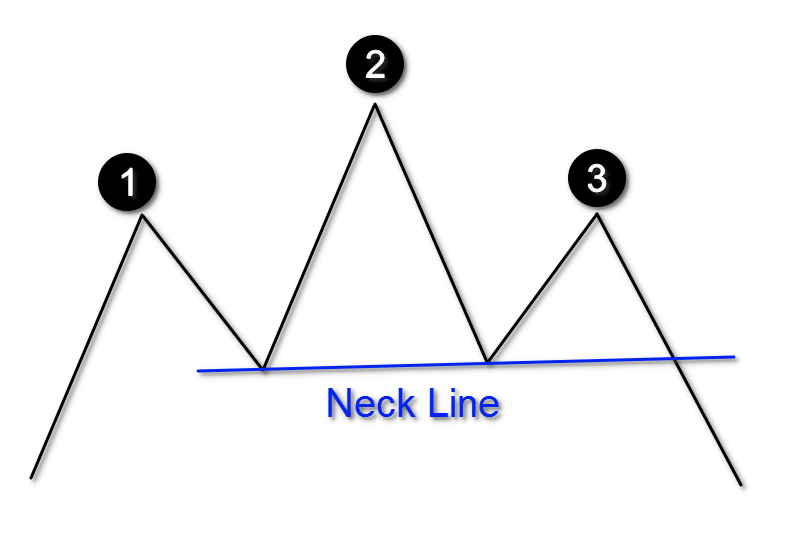

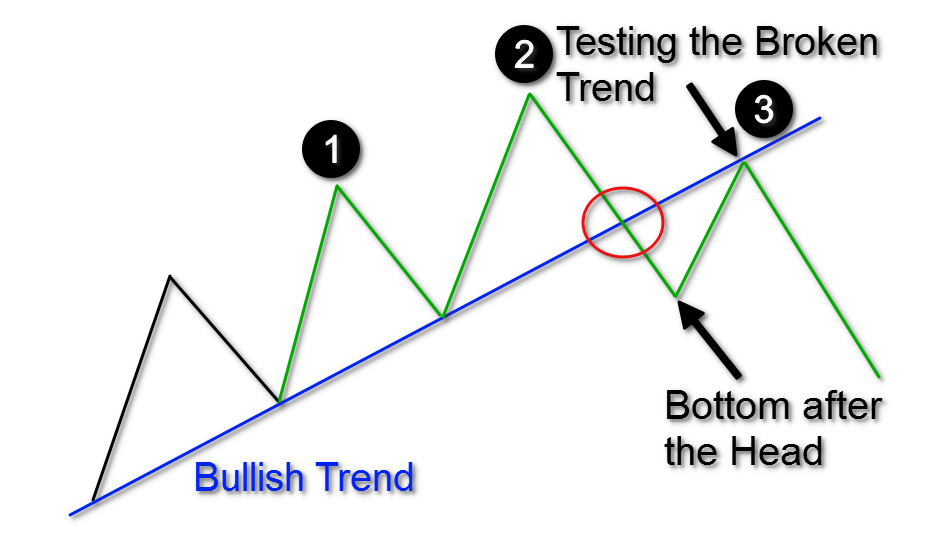

Head And Shoulders Pattern Neckline - He suggests that breaking the neckline. It represents a bullish signal suggesting a potential reversal of a current downtrend. It forms after an uptrend and consists of a peak, a retracement, a higher second peak, another retracement, and a lower third peak. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. What is an alternative name for a head and shoulders pattern in technical analysis? The shoulders may not be symmetrical, making it more difficult to spot the pattern. A head and shoulder pattern's alternative name is head and. Web meghan's $275 midi dress was made by orire, a nigerian designer. Web aptly named for sharing a few of the same characteristics as the human body, the h&s formation consists of five key reversal points; Web the head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. It resembles a baseline with three peaks with the middle topping the other two. It is considered one of the most reliable chart patterns and is identified by three peaks. There are two things to keep in mind when looking for a head and shoulders pattern. It is a specific chart formation that predicts a. Web the head and shoulders. The head is the largest of the three peaks. The reaction lows of each peak can be connected to form support, or a neckline. Head and shoulders pattern example. The neckline coincides with the previously outlined resistance trend line. Web a head and shoulder pattern means the market is primed for a bullish to bearish reversal and falling market prices. Web fact checked by. Reaction high 1 marks the end of the left shoulder and the beginning of the head. The neckline, a support line, connects the two lowest points of the stock price during this period. The head is the second peak and is the highest point in the pattern. Web monitor if tesla shares can close above the. How to interpret head and shoulders pattern? Web the head and shoulders is a reversal pattern because it signals a change in an uptrend and forecasts a downtrend from its breakdown. The red garment's scooped neckline featured spaghetti straps and a slightly cinched waist. A head and shoulder pattern's alternative name is head and. The slope of this line can. It consists of 3 tops with a higher high in the middle, called the head. What is an alternative name for a head and shoulders pattern in technical analysis? Head and shoulders pattern volume. Web characterized by three (3) distinct troughs: You have likely come across the pattern in your trading journey. Head and shoulders pattern example. Reaction high 1 marks the end of the left shoulder and the beginning of the head. It is a specific chart formation that predicts a. Web aptly named for sharing a few of the same characteristics as the human body, the h&s formation consists of five key reversal points; How to interpret head and shoulders. How to interpret head and shoulders pattern? Does the head and shoulders pattern ring a bell? Web characterized by three (3) distinct troughs: The importance of the neckline lies in its function as a key support or resistance level. Web the head and shoulders chart pattern is a technical analysis chart formation used to identify potential reversals in the trend. It is considered one of the most reliable chart patterns and is identified by three peaks. Web aptly named for sharing a few of the same characteristics as the human body, the h&s formation consists of five key reversal points; Web monitor if tesla shares can close above the neckline of an inverse head and shoulders pattern around $197, a. Web the inverse head and shoulders, or the head and shoulders bottom, is a popular chart pattern used in technical analysis. A head and shoulders pattern is used in technical analysis. So, a breakout from it will confirm the bullish pattern and take the price to the $71,000 resistance area. A lower head between two (2) higher shoulders, this pattern. What is the head and shoulders pattern? The neckline, a support line, connects the two lowest points of the stock price during this period. In this example, we can easily see the head and shoulders pattern. Web a neckline can be drawn across the bottoms of the left shoulder, the head and the right shoulder. Web a head and shoulder. It is considered one of the most reliable chart patterns and is identified by three peaks. Web when the advance from the low of the right shoulder breaks the neckline, the head and shoulders bottom reversal is complete. The reaction lows of each peak can be connected to form support, or a neckline. It resembles a baseline with three peaks with the middle topping the other two. The neckline forms by connecting reaction highs 1 and 2. You have likely come across the pattern in your trading journey. Web the pattern contains three successive peaks, with the middle peak ( head) being the highest and the two outside peaks ( shoulders) being low and roughly equal. The shoulders may not be symmetrical, making it more difficult to spot the pattern. Web monitor if tesla shares can close above the neckline of an inverse head and shoulders pattern around $197, a move that could potentially mark the start of a new trend higher in the stock. Web a neckline can be drawn across the bottoms of the left shoulder, the head and the right shoulder. How to interpret head and shoulders pattern? So, a breakout from it will confirm the bullish pattern and take the price to the $71,000 resistance area. The head and shoulders chart pattern boasts high accuracy and reliability. The line connecting the 2 valleys is the neckline. The neckline, a support line, connects the two lowest points of the stock price during this period. It forms after an uptrend and consists of a peak, a retracement, a higher second peak, another retracement, and a lower third peak.

Head and Shoulders Pattern Trading Strategy Guide Pro Trading School

A Guide To Trading Head And Shoulders Patterns

:max_bytes(150000):strip_icc()/dotdash_Final_Head_And_Shoulders_Pattern_Sep_2020-01-4c225a762427464699e42461088c1e86.jpg)

What Is a Head and Shoulders Chart Pattern in Technical Analysis?

Head and Shoulders pattern How To Verify And Trade Efficiently How

Head and Shoulders pattern How To Verify And Trade Efficiently How

Head & Shoulders Reversals Necklines Are For P*sSIES! Master Investor

Keys to Identifying and Trading the Head and Shoulders Pattern Forex

A Short Explanation The Head and Shoulders chart pattern

How To Trade Blog Head and Shoulders pattern How To Verify And Trade

Keys to Identifying and Trading the Head and Shoulders Pattern Forex

This Pattern Is Signified By Three Successive Peaks Resembling Two Shoulders On Both Sides And A Head In The Middle.

Inverted Head And Shoulders Pattern.

He Suggests That Breaking The Neckline.

In This Example, We Can Easily See The Head And Shoulders Pattern.

Related Post: