Head And Shoulders Pattern Failure

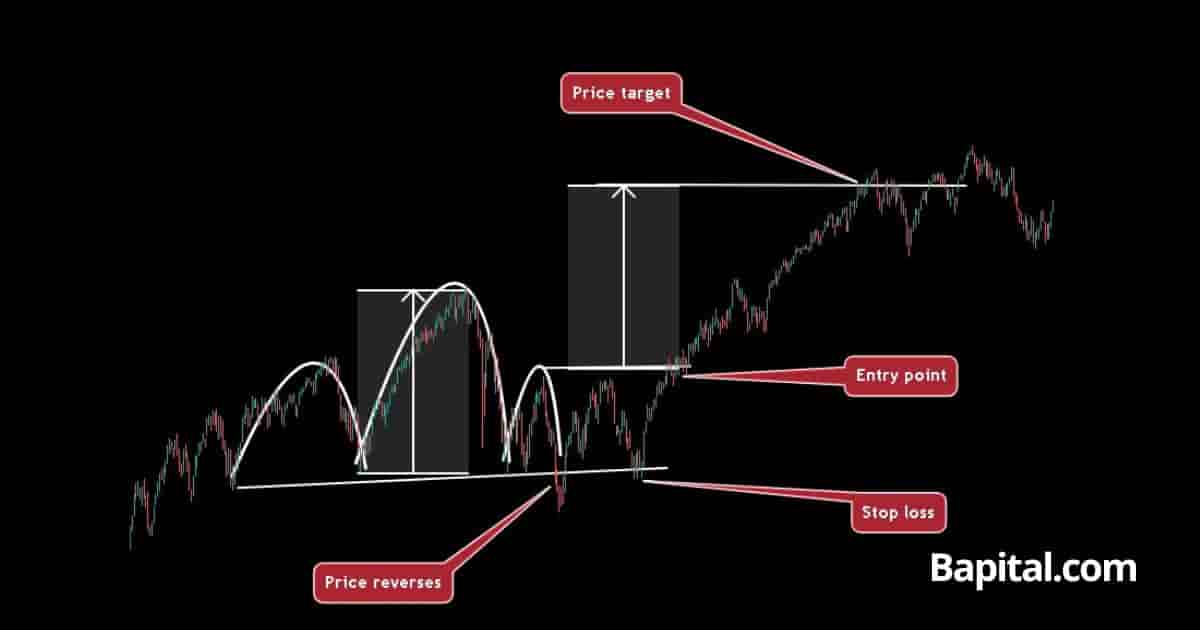

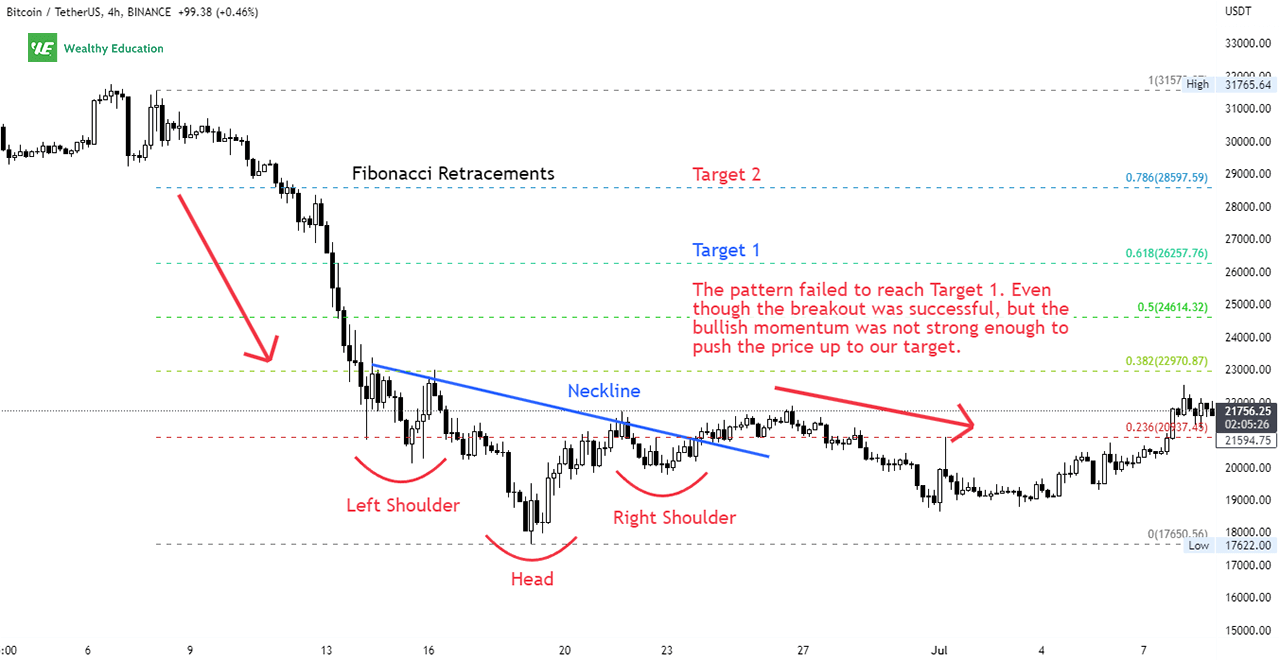

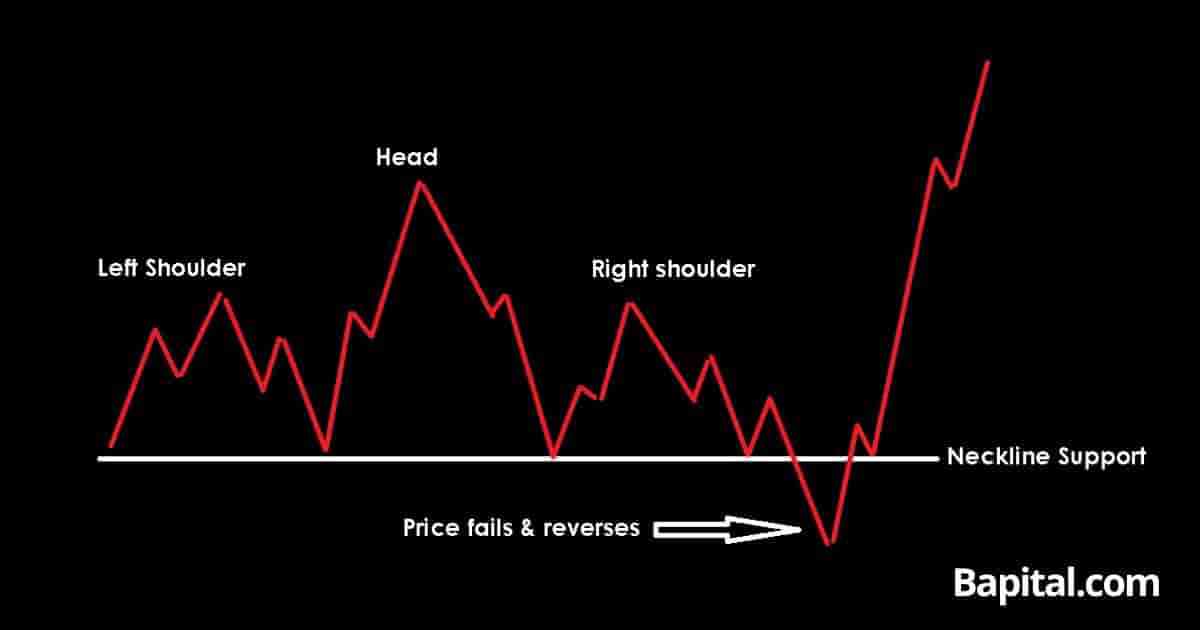

Head And Shoulders Pattern Failure - Forexuseful.com failed head and shoulders pattern after completion. Overview | how to trade | examples | benefits | limitations | psychology | faq. Here are a few things that can cause an inverse h&s pattern to fail: Web april 3, 2024 by sebastian l. 2 reverse head and shoulders patterns. The pattern is characterized by a neckline, which acts as a support or. Web a group of sexual abuse survivors have filed suit in los angeles superior court, saying their high school district failed to protect them from predatory teachers for years. In the intricate landscape of financial markets, the head and shoulders pattern stands out as a hallmark indicator for traders, typically signaling an impending trend reversal. 5 the bombed head and shoulders. 65% percentage meeting price target: Traders often study trends and patterns when analyzing the market in hopes of detecting the next most probable price movement. Web a head and shoulders pattern is a chart formation that technical analysts use to predict a bearish trend in prices. 4 the complicated failed head and shoulders pattern. A head and shoulders pattern is a technical indicator with a. 5 the bombed head and shoulders. In this case, it acts as a bearish reversal pattern; Loss of momentum after breakout; 3 opposite head and shoulders patterns. The head and shoulders pattern is invalidated and considered a failed pattern when the market security price declines and breaks down below the neckline support area but quickly results in a major reversal. Loss of momentum after breakout; Web however, the head and shoulders pattern failure rate is also noteworthy. 6 failed head and shoulders pattern solidification. Web the head and shoulders pattern is a crystal ball in the trading world, a respected component of technical analysis, known for its ability to hint at upcoming market shifts. Web a head and shoulders pattern. Traders often study trends and patterns when analyzing the market in hopes of detecting the next most probable price movement. Web however, the head and shoulders pattern failure rate is also noteworthy. Web in this video, our analyst fawad razaqzada discusses how to spot and trade the failure of the head and shoulders pattern. Web november 2, 2023 lee bohl.. Web a group of sexual abuse survivors have filed suit in los angeles superior court, saying their high school district failed to protect them from predatory teachers for years. But, the two shoulders appear symmetrical about the head. 65% percentage meeting price target: Web h&s failure chart pattern price target is calculated by taking the width of the chart pattern. What is an inverse head and shoulders pattern? I plan to highlight more h&s failures in the tech charts alert section as they take place. Web the head and shoulders pattern is quite popular amongst the market participants due to its reliability in the past and, of course, the success ratio. Forexuseful.com failed head and shoulders pattern after completion. Web. In the intricate landscape of financial markets, the head and shoulders pattern stands out as a hallmark indicator for traders, typically signaling an impending trend reversal. Web general pattern failure occurs when a chart pattern breaks out, fails to hit target, quickly reverses then rejects off that same breakout level back inside the pattern continuing in the opposite direction of. Web by patrick stockdale | december 8, 2023. Web november 2, 2023 lee bohl. 3 opposite head and shoulders patterns. Web the head and shoulders pattern has been completed. While failure of the h&s and other reversal patterns can be frustrating. Web a head and shoulders pattern failure, also known as a failed head and shoulders, is when a head and shoulders forms but fails. While this can be a continuation of a previous bearish trend, it is more common to see it reverse an upward trend. It consists of three successive peaks, with the middle peak (the head) being higher. Web the inverse head and shoulders chart pattern is a bullish indicator i.e. Common reasons for failed head and shoulders patterns include: Bars, head and shoulders inversion. Web the head and shoulders pattern is quite popular amongst the market participants due to its reliability in the past and, of course, the success ratio. An inverse head and shoulders patterns is. Bars, head and shoulders inversion. Sometimes, we will receive our confirmation signal and the price does not reach our minimum target. A head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are close in height, and the. 65% percentage meeting price target: Here are a few things that can cause an inverse h&s pattern to fail: In the intricate landscape of financial markets, the head and shoulders pattern stands out as a hallmark indicator for traders, typically signaling an impending trend reversal. Web a head and shoulders pattern failure, also known as a failed head and shoulders, is when a head and shoulders forms but fails. Web november 2, 2023 lee bohl. Web in this video, our analyst fawad razaqzada discusses how to spot and trade the failure of the head and shoulders pattern. The lowest price of the incoming cycle. Web the head and shoulders pattern is a crystal ball in the trading world, a respected component of technical analysis, known for its ability to hint at upcoming market shifts. Web the inverse head and shoulders chart pattern is a bullish indicator i.e. Web april 3, 2024 by sebastian l. Web by patrick stockdale | december 8, 2023. The head and shoulders pattern is invalidated and considered a failed pattern when the market security price declines and breaks down below the neckline support area but quickly results in a major reversal and. Web the head and shoulders pattern has been completed.

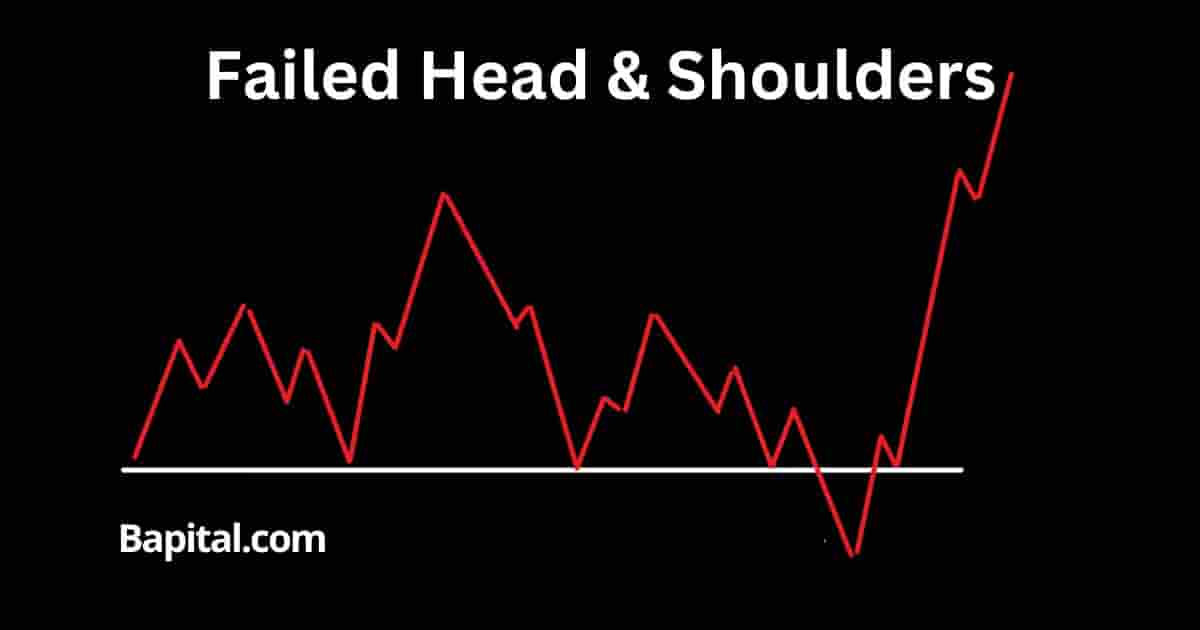

Failed Head and Shoulders Pattern What does failure mean?

Failed Head And Shoulders Pattern Explained With Examples

Reverse Head And Shoulders Pattern (Updated 2023)

Failed Head And Shoulders Pattern Explained With Examples

Failed Head And Shoulders Pattern Explained With Examples

Cara Trading Dengan Head And Shoulders Failure Pattern Artikel Forex

Chart Patterns The Head And Shoulders Pattern Forex Academy

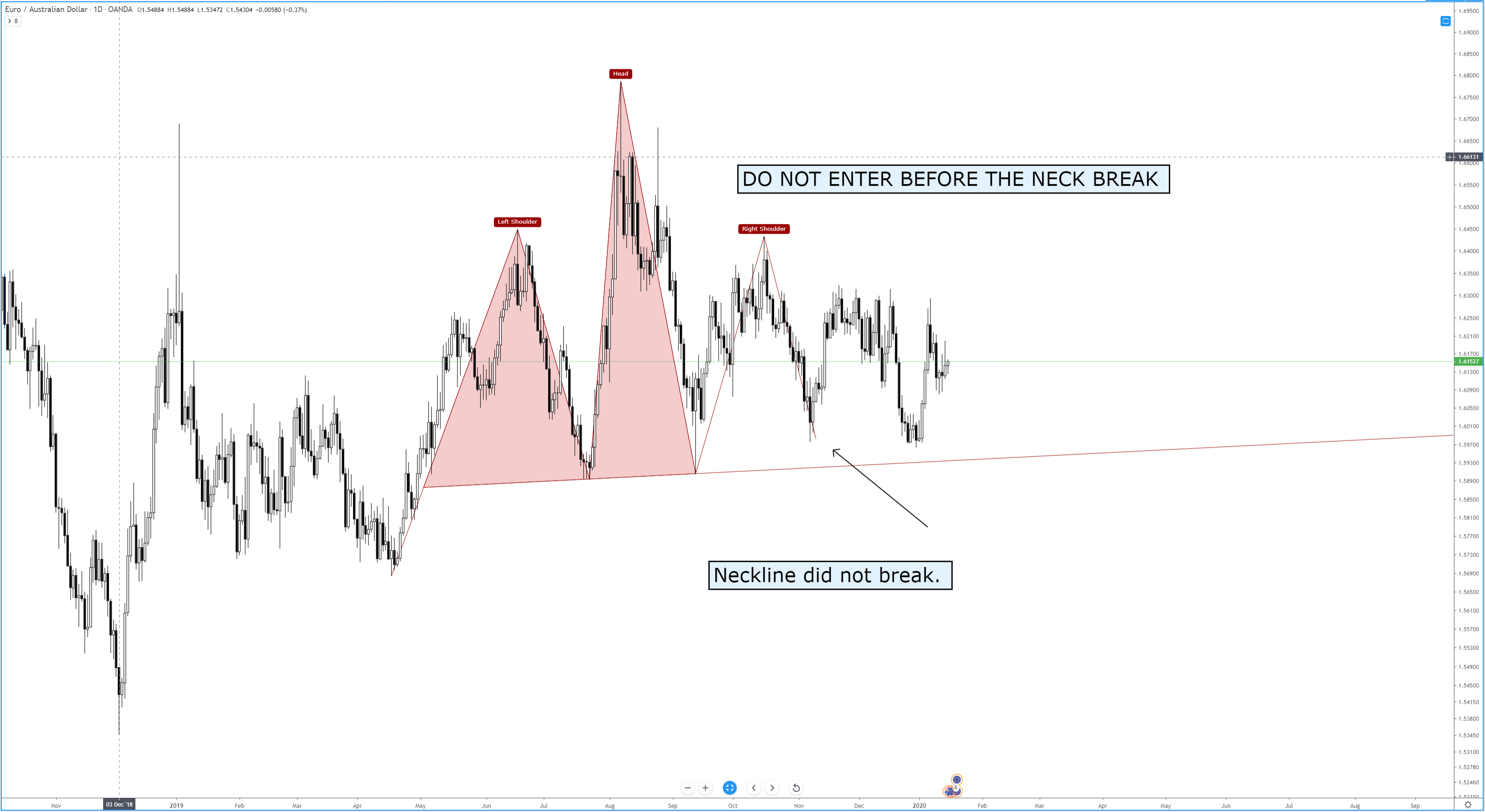

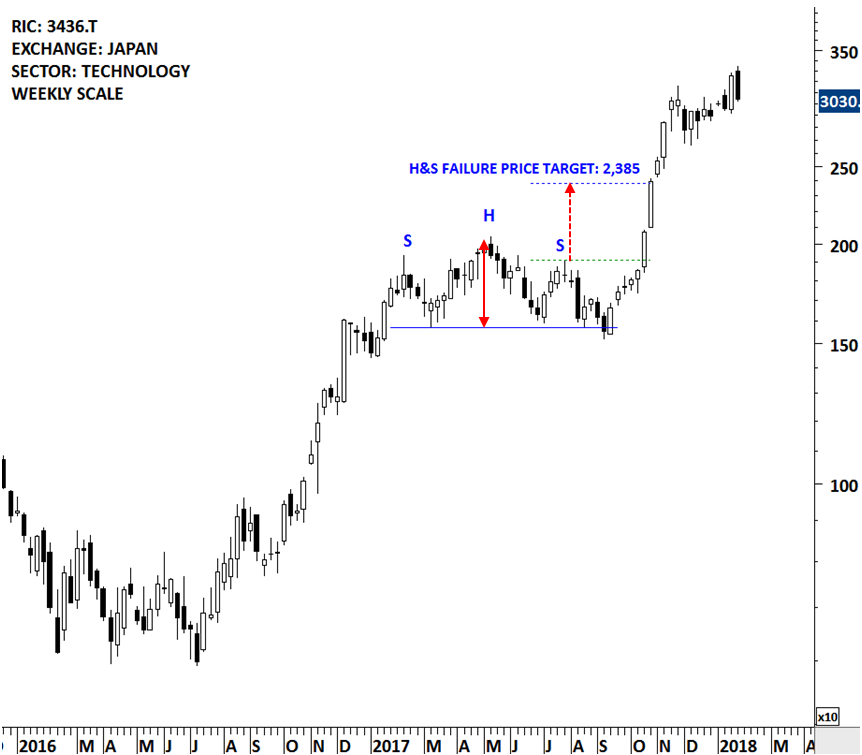

HEAD & SHOULDER FAILURE Tech Charts

Failed Head And Shoulders Pattern Explained With Examples

Failed Head And Shoulders Pattern Explained With Examples

Not All Inverse Head And Shoulders Pattern Will Work Like A Charm.

Web H&S Failure Chart Pattern Price Target Is Calculated By Taking The Width Of The Chart Pattern Between The Head And The Neckline And Adding It To The Highest Point Of The Right Shoulder (For H&S Top Reversal Failures).

Failed Head And Shoulders Pattern.

4 The Complicated Failed Head And Shoulders Pattern.

Related Post: