Head And Shoulders Pattern Breakout

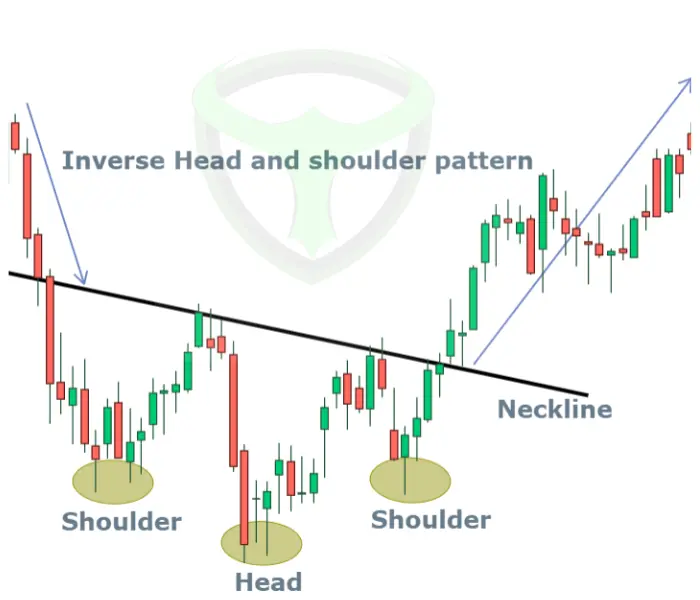

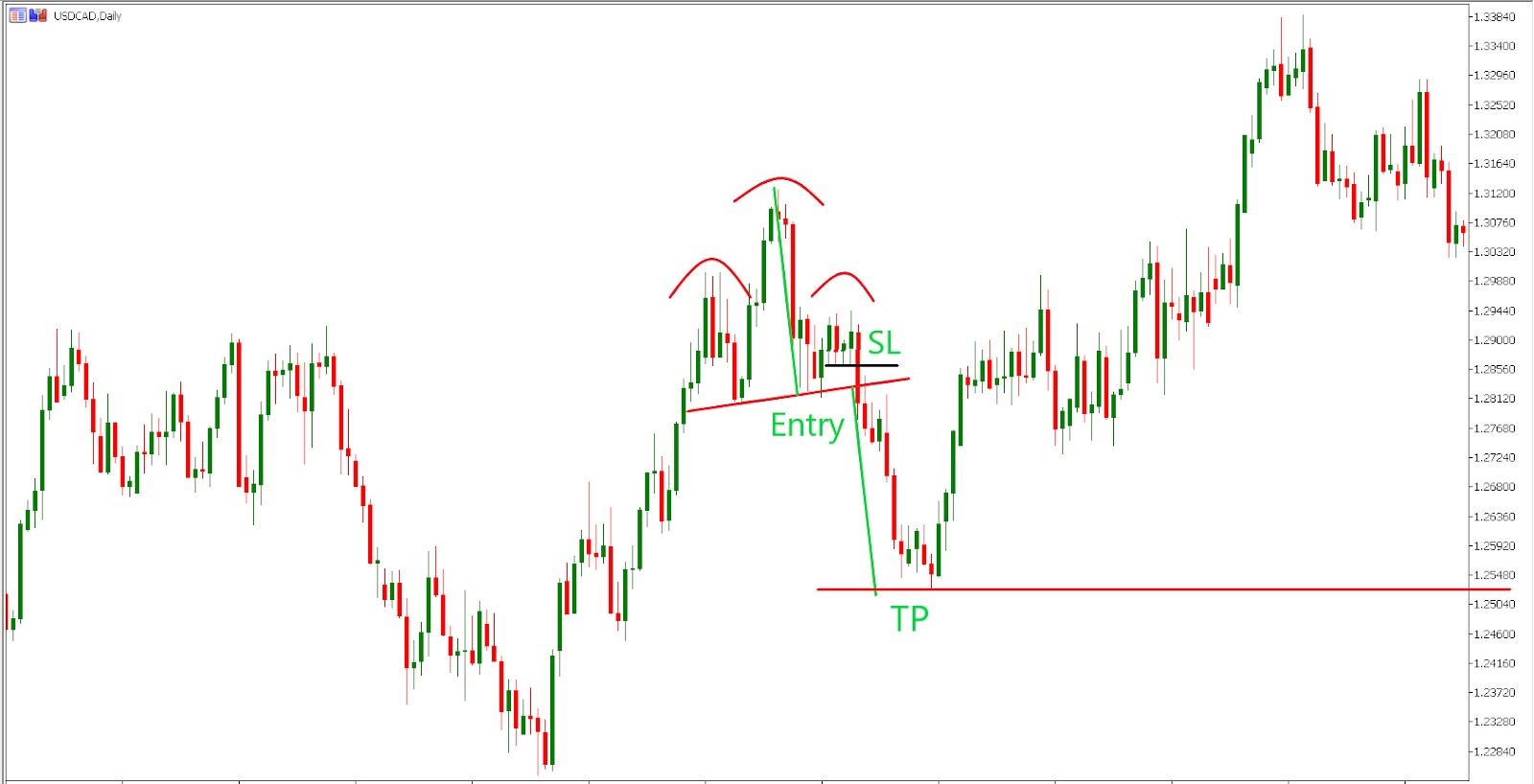

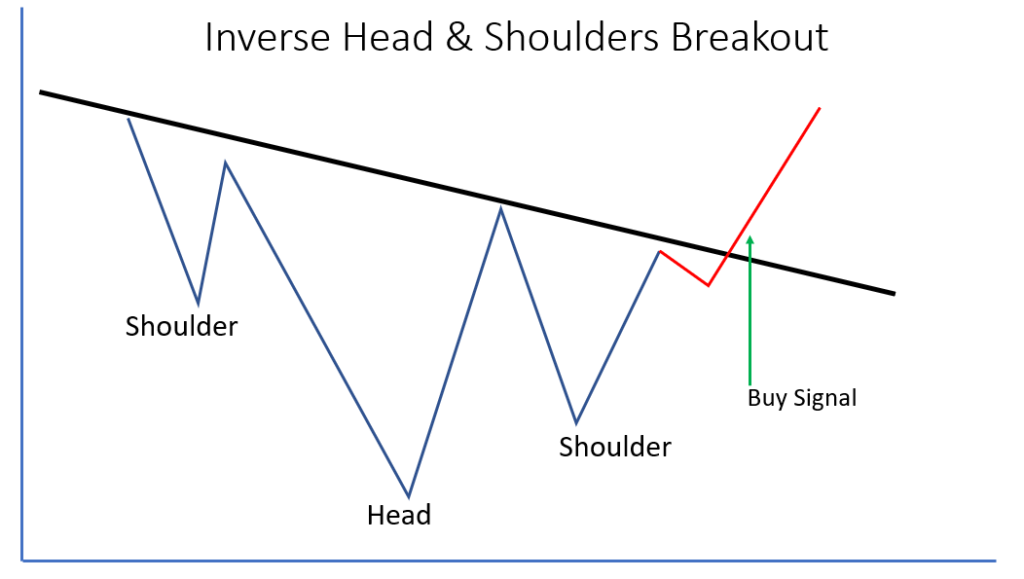

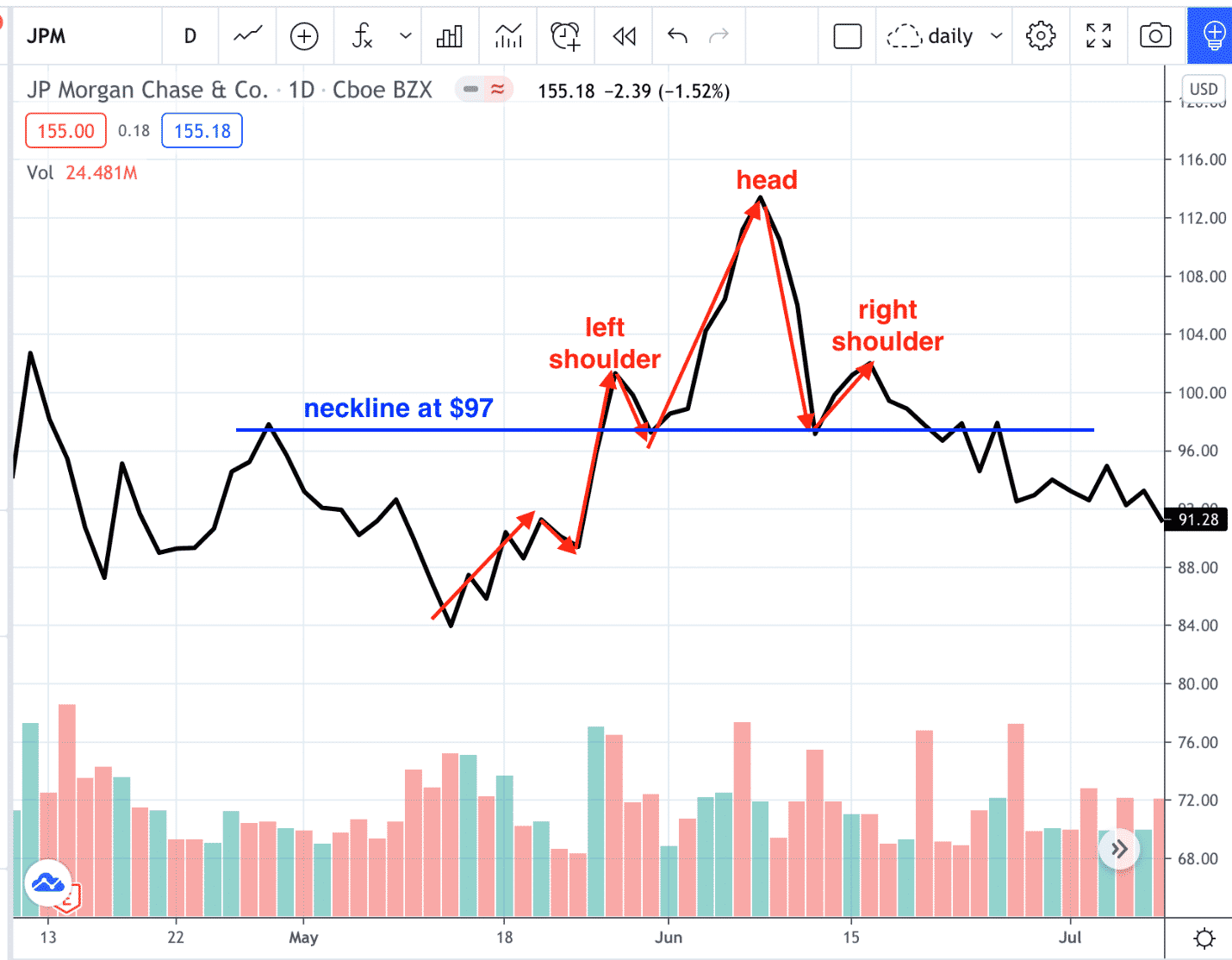

Head And Shoulders Pattern Breakout - However, there are many misconceptions about how breakouts happen and how to trade them. Inverted head and shoulders pattern. It was the highest swing on april 29th and the right side of the head and shoulders (h&s) pattern. Potentially leading prices to targets of $0.133 and then $0.144 if the. Web the head and shoulders pattern is one of the most widely followed and traded chart formations among technical analysts and traders. Web as bitcoin (btc) continues to trade within a narrow range, crypto traders and analysts are closely monitoring the asset’s price charts for signs of a potential breakout. What is head and shoulders pattern? Price rise again forming a higher peak. Weekly chart looks even stronger, earlier than before. The first and third troughs are roughly equal in depth and are known as shoulders, while the second trough is. Web head and shoulder pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. So, a breakout from it will confirm the bullish pattern and take. What causes a head and shoulders to form? Other parts playing a role in the pattern are volume, the breakout, price. We will look at each part individually, and then put them together with some examples. Web a head and shoulders pattern, which is a bearish reversal pattern, indicates that the uptrend has peaked and that the reversal has begun when the succession of higher highs—the first and second peaks—is broken by the third peak, which is. Web the inverse head. However, there are many misconceptions about how breakouts happen and how to trade them. Web as bitcoin (btc) continues to trade within a narrow range, crypto traders and analysts are closely monitoring the asset’s price charts for signs of a potential breakout. But what does it mean? Head and shoulders pattern breakout is a statistically reliable reversal phenomenon. Don’t forget. Web these patterns typically manifest in forms such as the “head and shoulders” for topping reversals, or the “inverse head and shoulders” for bottoming reversals. Web the head and shoulders bottom, sometimes referred to as an inverse head and shoulders, is a reversal pattern that shares many common characteristics with the head and shoulders top, but relies more heavily on. The slope of this line can either be up or down. This pattern clearly shows the battle between buyers and sellers (bulls and bears). If you want to up your trading game, you'll need to get familiar with how to spot this powerful formation. Web gbp/usd forex signal: Inverted head and shoulders pattern. Web these patterns typically manifest in forms such as the “head and shoulders” for topping reversals, or the “inverse head and shoulders” for bottoming reversals. Bitcoin’s price chart is showing an inverse head and shoulders pattern, a strong indicator that often predicts a reversal of a previous downward. Web the creation of an inverse head and shoulders pattern and the. The neckline coincides with the previously outlined resistance trend line. We will look at each part individually, and then put them together with some examples. What causes a head and shoulders to form? Web a head and shoulders top is characterized by three prominent components: Based on the technical formation, bitcoin could rally to the upside if a break above. What is the inverse head and shoulders candlestick pattern? Web as bitcoin (btc) continues to trade within a narrow range, crypto traders and analysts are closely monitoring the asset’s price charts for signs of a potential breakout. Bitcoin’s price chart is showing an inverse head and shoulders pattern, a strong indicator that often predicts a reversal of a previous downward.. Web the inverse head and shoulders chart pattern consists of three (3) troughs: But what does it mean? Web formation of the pattern: How to confirm the break. It is formed by a peak (shoulder), followed by a higher peak (head), and then another lower peak (shoulder). A “ neckline ” is drawn by connecting the lowest points of the two troughs. How to interpret head and shoulders pattern? This pattern clearly shows the battle between buyers and sellers (bulls and bears). From support levels to bullish breakouts. Nse:rushil double bottom breakout awaited on closing basis, price broke out today. This pattern clearly shows the battle between buyers and sellers (bulls and bears). Head and shoulders pattern example. Web the head and shoulders bottom, sometimes referred to as an inverse head and shoulders, is a reversal pattern that shares many common characteristics with the head and shoulders top, but relies more heavily on volume patterns for confirmation. Web these patterns typically manifest in forms such as the “head and shoulders” for topping reversals, or the “inverse head and shoulders” for bottoming reversals. Don’t forget about the inverse head and shoulders. The breakout pattern offers a clear signal of a stock’s potential upward trajectory, making it an excellent opportunity for investors to enter the market. The left shoulder ( ls) appears above the right shoulder ( rs ). How to confirm the break. Web head and shoulder pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. But what does it mean? Where to place your stop loss and risk management. Other parts playing a role in the pattern are volume, the breakout, price target and support turned resistance. Based on the technical formation, bitcoin could rally to the upside if a break above the trendline occurs, according to a may 13 x post from crypto investor quinten. What is head and shoulders pattern? Head and shoulders pattern breakout is a statistically reliable reversal phenomenon. Find the neckline support level.

Head And Shoulders Pattern Breakout 3 Strong Ways To Trade Head and

Head And Shoulders Pattern Breakout 3 Strong Ways To Trade Head and

![Inverse Head And Shoulders Pattern [2023 Update] Daily Price Action](https://dailypriceaction.com/wp-content/uploads/2015/03/AUDUSD-inverse-head-and-shoulders.png)

Inverse Head And Shoulders Pattern [2023 Update] Daily Price Action

What is Head and Shoulders Pattern & How to trade it Phemex Academy

Silver Can See More Gains After A Bullish Breakout Wavetraders

Head and Shoulders Trading Patterns ThinkMarkets NZ

Inverse Head & Shoulders Definition & How to Trade Stock Trading Teacher

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-01-d955fe7807714feea05f04d7f322dfaf.jpg)

How to Trade the Head and Shoulders Pattern

head and shoulders pattern breakout Options Trading IQ

Inverse Head and Shoulders Pattern How To Spot It

Web The Head And Shoulders Pattern Is A Reversal Chart Pattern.

Potentially Leading Prices To Targets Of $0.133 And Then $0.144 If The.

However, There Are Many Misconceptions About How Breakouts Happen And How To Trade Them.

As A Trader, Being Able To Recognize These Chart Patterns Can Give You A Huge Advantage.

Related Post: