Head And Shoulders Pattern Bottom

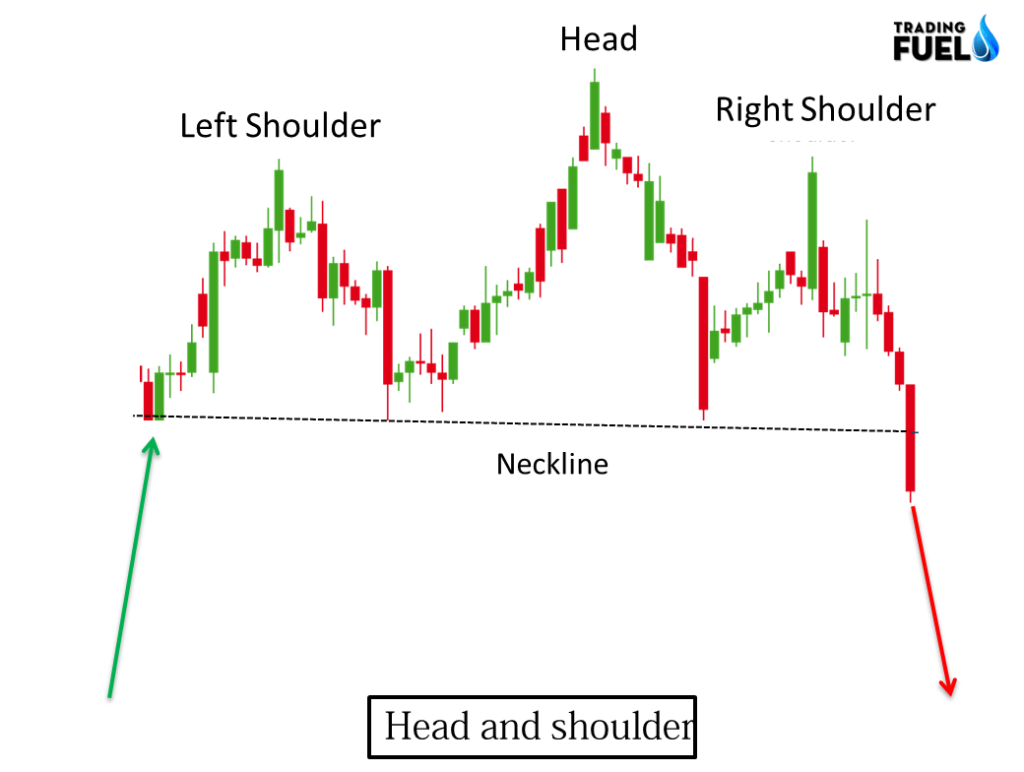

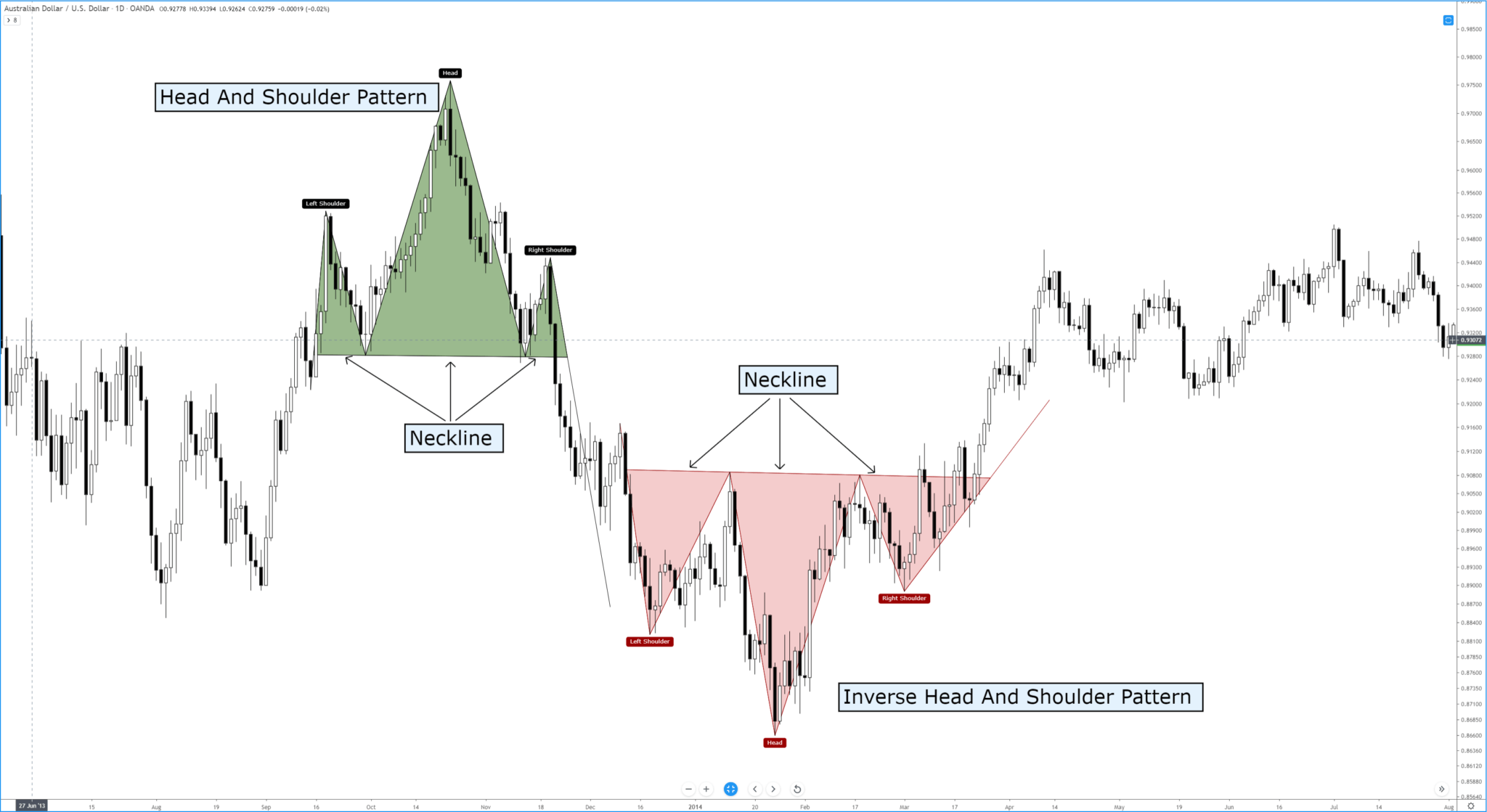

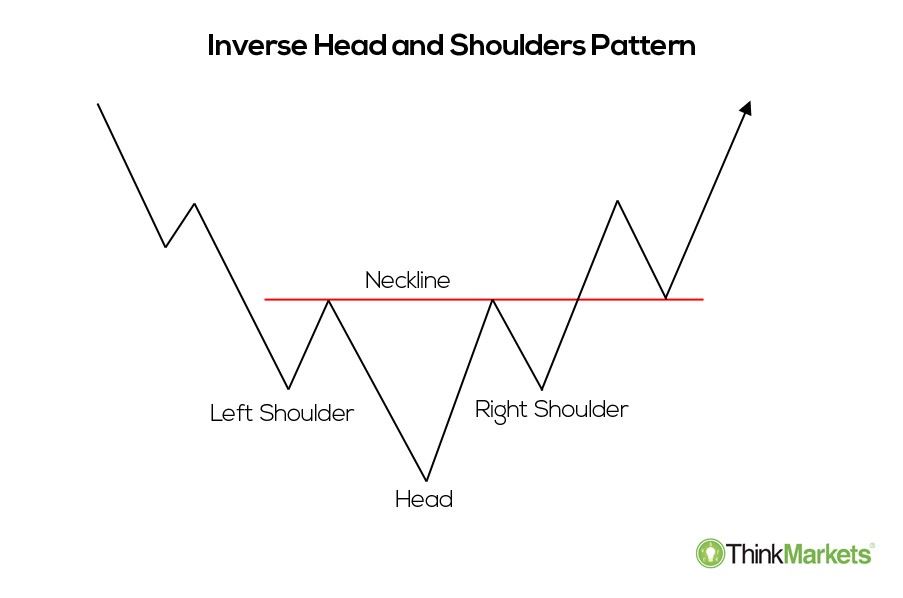

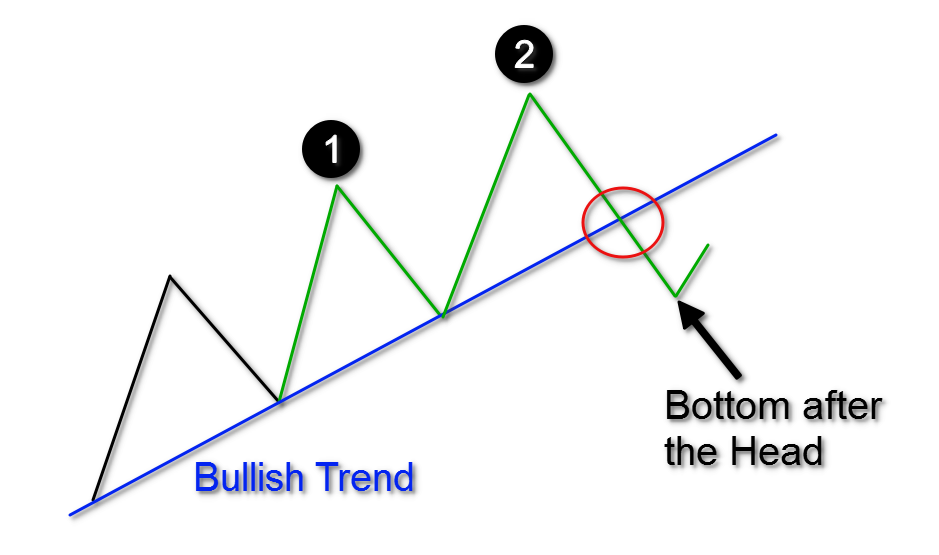

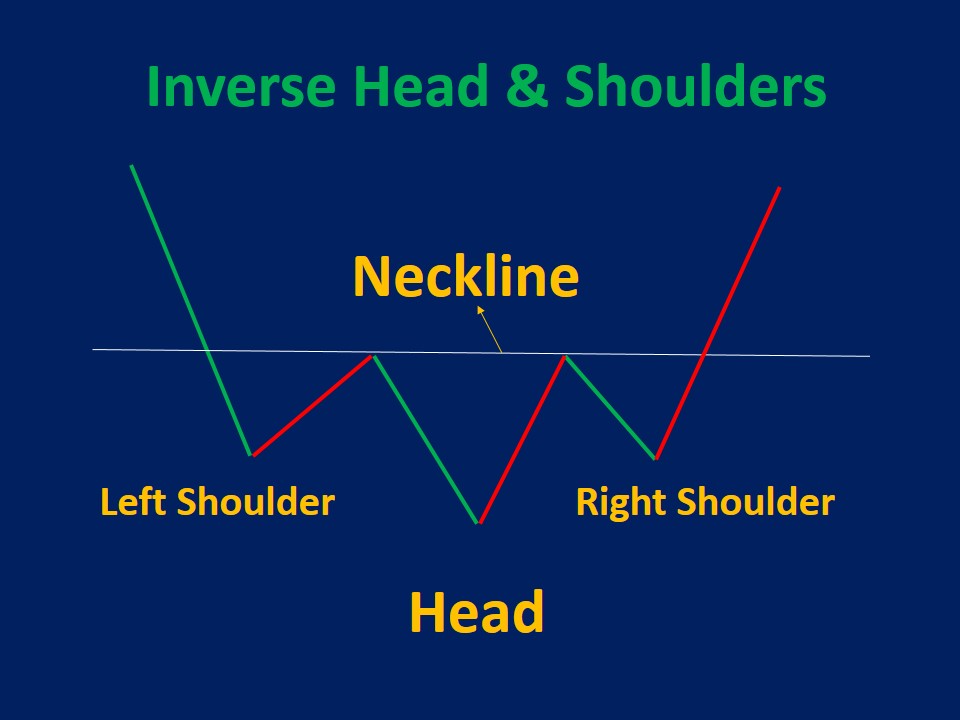

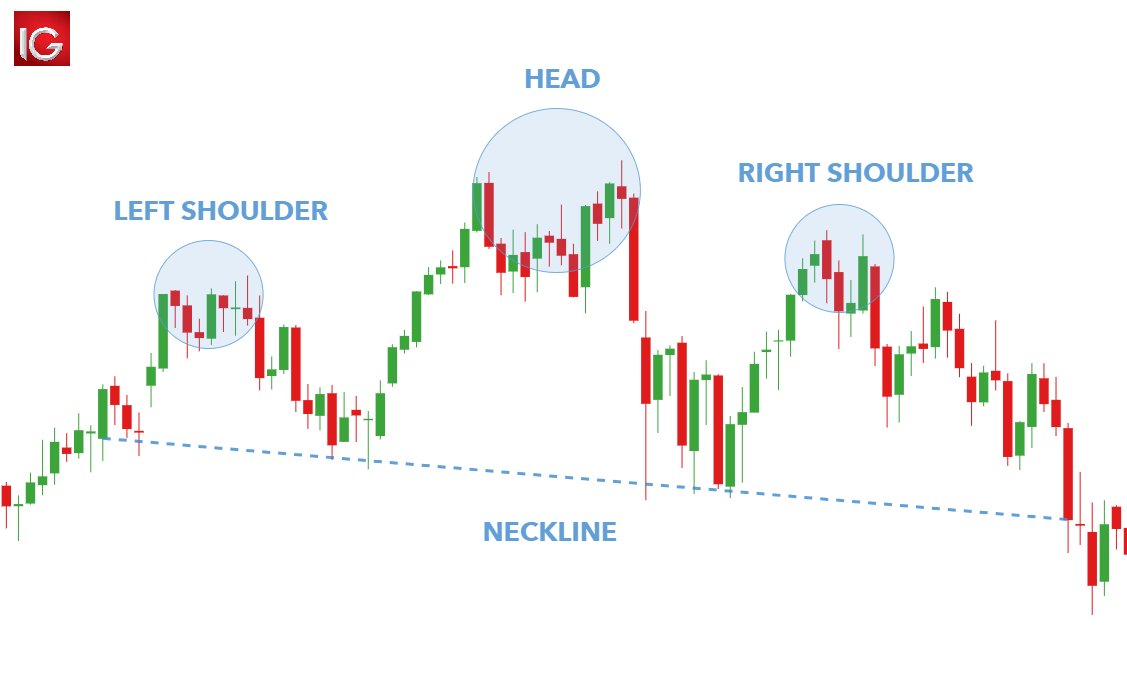

Head And Shoulders Pattern Bottom - Web the first guideline is simple: Web an inverse head and shoulders, also called a head and shoulders bottom or a reverse head and shoulders, is inverted with the head and shoulders top used to predict reversals in downtrends. The pattern contains three successive troughs with the middle trough (head) being the deepest and the two outside troughs (shoulders) being shallower. “if $56,000 was not the bottom then. Web a head and shoulders pattern is a technical indicator with a chart pattern of three peaks, where the outer two are close in height, and the middle is the highest. The head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. It typically forms at the end of a bullish trend. Web bitcoin’s price chart is showing an inverse head and shoulders pattern, a strong indicator that often predicts a reversal of a previous downward trend. Because we’re discussing bottom and not top patterns, the head should pro t ru d e below the lows of the two shoulders. The break even failure rate is low and the performance is good from this chart pattern. It is often referred to as an inverted head and shoulders pattern in downtrends, or simply the head and shoulders stock pattern in uptrends. Look for a pair of shoulders on opposite sides of a head. The neckline coincides with the previously outlined resistance trend line. Web a head and shoulders pattern occurs at the end of a lengthened uptrend. It is identified by three peaks; The pattern resembles a left shoulder, head, and right shoulder, hence the term head. Web head and shoulders formations consist of a left shoulder, a head, and a right shoulder and a line drawn as the neckline. The reaction lows of each peak can be connected to form support, or a neckline. Web a. Web a rounding bottom could be thought of as a head and shoulders bottom without readily identifiable shoulders. Here are some key ones: Web an inverse head and shoulders, also called a head and shoulders bottom or a reverse head and shoulders, is inverted with the head and shoulders top used to predict reversals in downtrends. The break even failure. Web a rounding bottom could be thought of as a head and shoulders bottom without readily identifiable shoulders. This candlestick pattern suggests an impending change in the trend direction after the sellers failed to break the support in three consecutive attempts. Look for a pair of shoulders on opposite sides of a head. The bottom head and shoulders pattern is. Web head and shoulders formations consist of a left shoulder, a head, and a right shoulder and a line drawn as the neckline. The triple bottom chart pattern is a rare, but extremely effective reversal pattern. The pattern resembles a left shoulder, head, and right shoulder, hence the term head. The head represents the low and is fairly central to. Web bitcoin’s price chart is showing an inverse head and shoulders pattern, a strong indicator that often predicts a reversal of a previous downward trend. The break even failure rate is low and the performance is good from this chart pattern. The pattern is shaped with three peaks, a left shoulder peak, a higher head peak, and a right shoulder. It consists of 3 tops with a higher high in the middle, called the head. Web bitcoin’s price chart is showing an inverse head and shoulders pattern, a strong indicator that often predicts a reversal of a previous downward trend. It consists of 3 tops with a higher high in the middle, called the head. The pattern is shaped with. It consists of 3 tops with a higher high in the middle, called the head. The middle peak, or head, is the highest and is flanked by two lower peaks, the shoulders. Bitcoin’s retrace to $56,000 has likely marked the local price bottom, according to popular crypto analyst rekt. This candlestick pattern suggests an impending change in the trend direction. Web as a major reversal pattern, the head and shoulders bottom forms after a downtrend, with its completion marking a change in trend. Ordering after breaking the neckline. It resembles a baseline with three peaks with the middle topping the other two. So, a breakout from it will confirm the bullish pattern and take the price to the $71,000 resistance. This candlestick pattern suggests an impending change in the trend direction after the sellers failed to break the support in three consecutive attempts. The pattern contains three successive peaks, with the middle peak ( head) being the highest and the two outside peaks ( shoulders) being low and roughly equal. Volume is absolutely crucial to a head and shoulders bottom.. Head and shoulders pattern examples. The pattern is shaped with three peaks, a left shoulder peak, a higher head peak, and a right shoulder peak similar in height to the left shoulder. The head and shoulders pattern is a reversal trading strategy, which can develop at the end of bullish or bearish trends. Web an icon in the shape of a person's head and shoulders. So, a breakout from it will confirm the bullish pattern and take the price to the $71,000 resistance area. From top to bottom, the staff is trained in a way that violates the law, said attorney michael. The middle peak, or head, is the highest and is flanked by two lower peaks, the shoulders. Web a rounding bottom could be thought of as a head and shoulders bottom without readily identifiable shoulders. The pattern resembles a left shoulder, head, and right shoulder, hence the term head. It resembles a baseline with three peaks with the middle topping the other two. Here are some key ones: The left shoulder is formed at the end of an extensive move during which volume is noticeably high. Ideally, the two shoulders would be equal in height and. Key components of the head and. It typically forms at the end of a bullish trend. Web the first guideline is simple:

How to Trade the Head and Shoulders Pattern Trading Pattern Basics

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

Head and Shoulders pattern How To Verify And Trade Efficiently How

Chart Patterns The Head And Shoulders Pattern Forex Academy

Homily Chart(English) Learning Chart Pattern 6 Head and shoulders

Head and Shoulders Trading Patterns ThinkMarkets EN

:max_bytes(150000):strip_icc()/dotdash_Final_Head_And_Shoulders_Pattern_Sep_2020-01-4c225a762427464699e42461088c1e86.jpg)

What Is a Head and Shoulders Chart Pattern in Technical Analysis?

Keys to Identifying and Trading the Head and Shoulders Pattern Forex

Head and Shoulders Pattern Types, How to Trade & Examples

The Head and Shoulders Pattern A Trader’s Guide

An Investor Will Be Looking For Increasing Volumes At The Point Of Breakout.

Web As A Major Reversal Pattern, The Head And Shoulders Bottom Forms After A Downtrend, With Its Completion Marking A Change In Trend.

The Head Represents The Low And Is Fairly Central To The Pattern.

Web The Pro Is The Boom’s Heaviest And Most Demanding Model In The Lineup, But Don’t Let That Scare You—It’s A Got A Very Friendly Demeanor.

Related Post: