Head And Shoulders Pattern Bearish

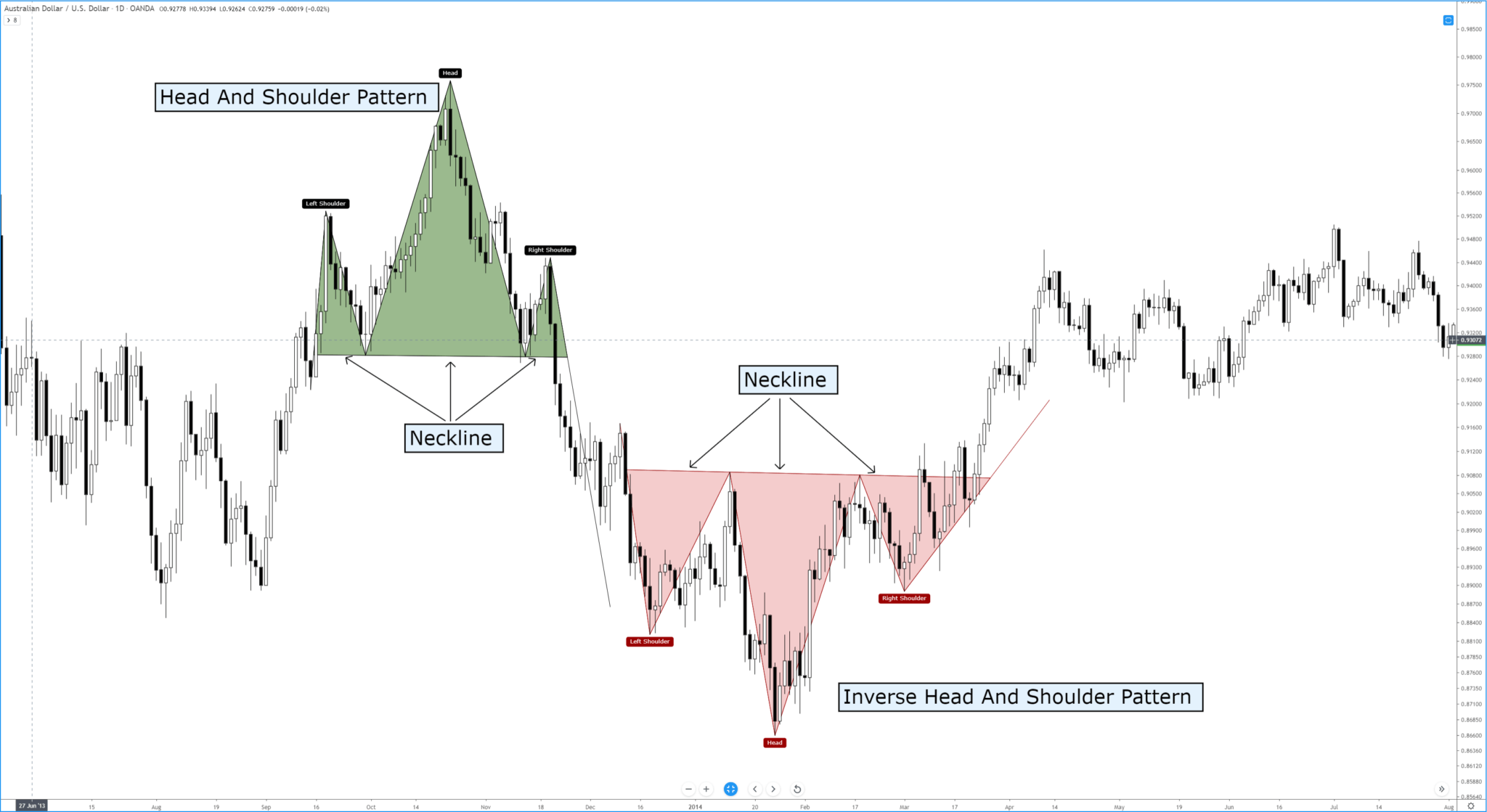

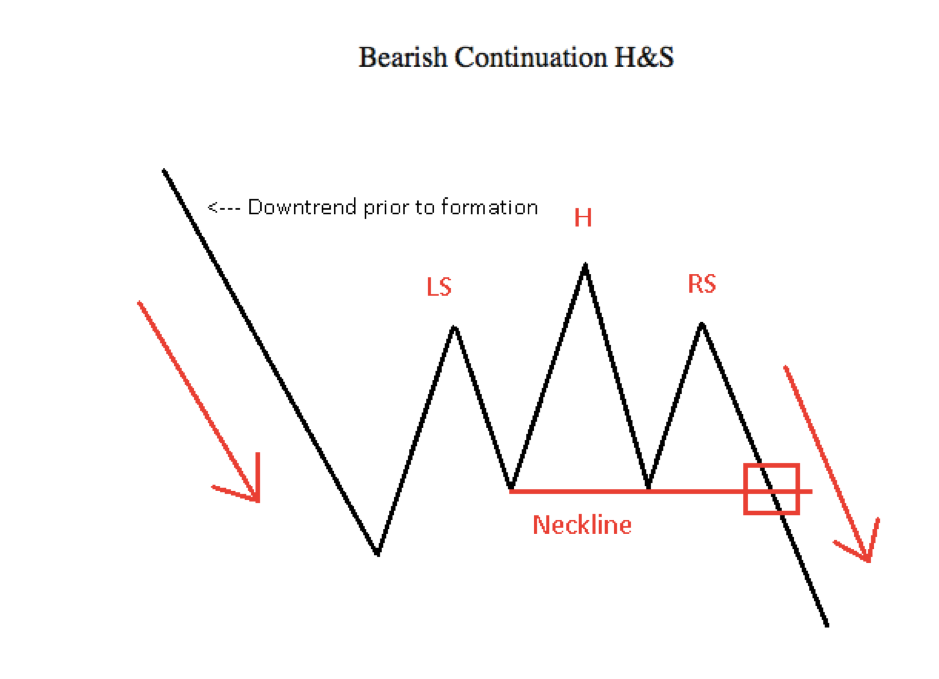

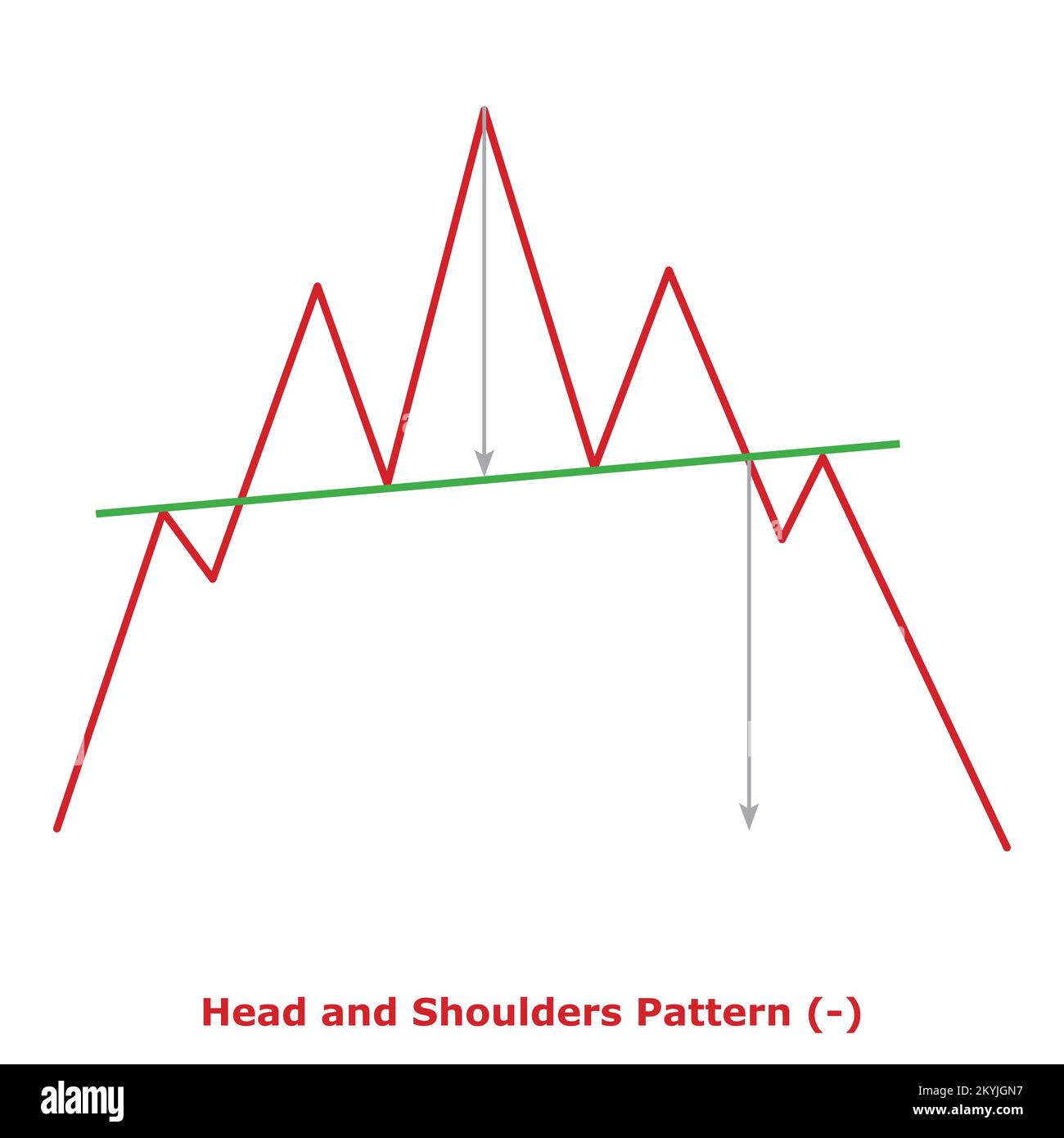

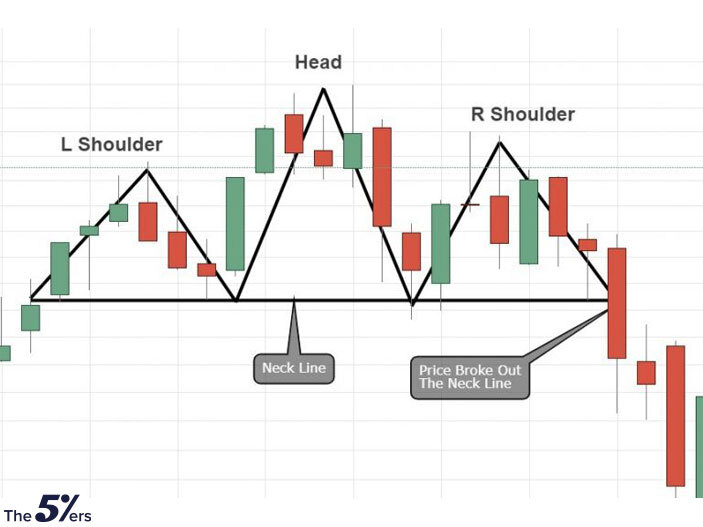

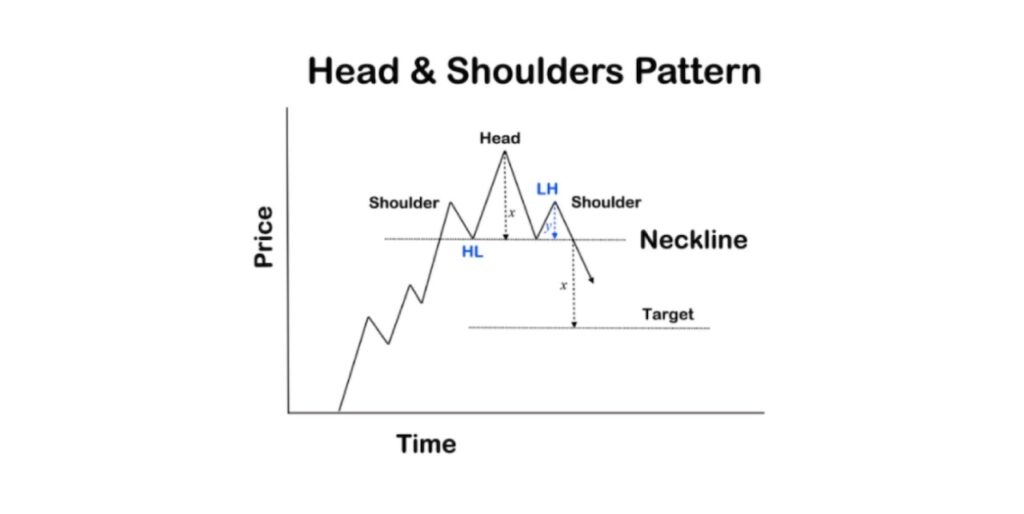

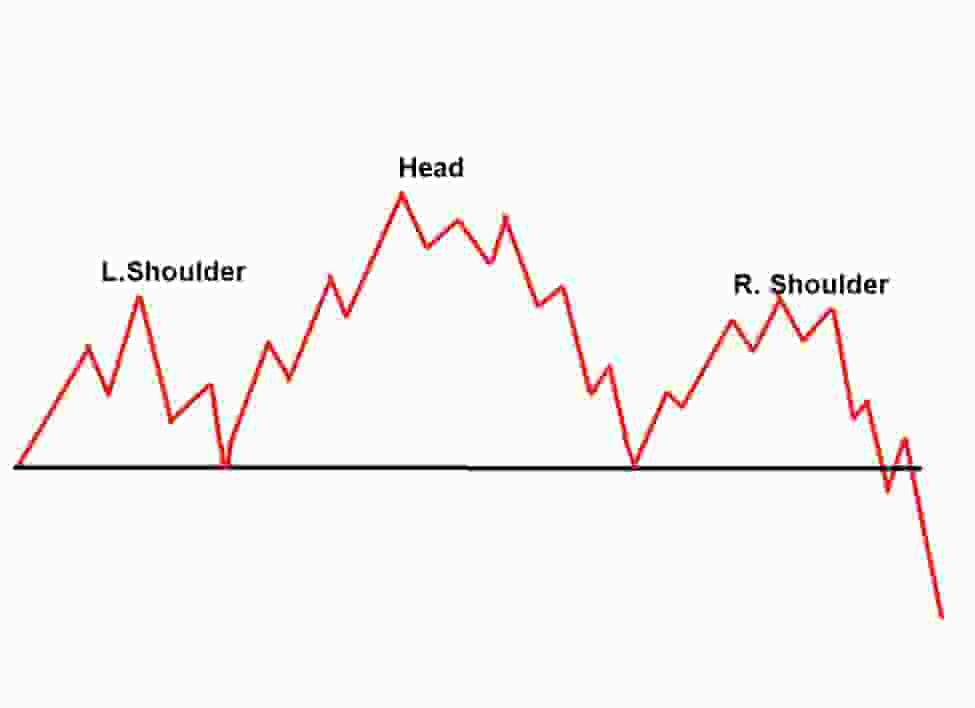

Head And Shoulders Pattern Bearish - It was the highest swing on april 29th and the right side of the head and shoulders (h&s) pattern. Right shoulder, head, left shoulder, neckline support breaks then sell. It is pretty accurate at informing that an uptrend is ending. As dramatically expressed through this pattern, it’s the peak formations that traders scrutinize for signs of upcoming trend reversals. It consists of 3 tops with a higher high in the middle, called the head. It is considered a reliable and accurate chart pattern and is often used by traders and investors to. The head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. The daily time frame wave count points to the correction not being over yet. The line connecting the 2. Web a head and shoulders pattern forms at the end of a prolonged uptrend and usually indicates a reversal. Web a head and shoulders pattern is a bearish reversal pattern, which signals that the uptrend has peaked, and the reversal has started as the series of the higher highs (the first and second peak) is broken with the third peak, which is lower than the second. Web the head & shoulders pattern is a specific chart pattern informing of. The signal boasts the upcoming selling pressure and a series of lower lows and lower highs in the price action. The line connecting the 2. Wave count gives bearish scenario. Web the head & shoulders pattern is a specific chart pattern informing of a bullish to a bearish trend reversal. The pattern can be used to predict both the reversal. In contrast, the inverse or reverse head and shoulders pattern is bullish, showing a downward trend is about to. Web the head and shoulders top pattern is bearish, indicating prices could be reversed and trending down again. Web is head and shoulders bullish or bearish? The reaction lows of each peak can be connected to form support, or a neckline.. Bearish outlook suggests selling with tp at 1.2500 and sl at 1.2630. In contrast, the inverse or reverse head and shoulders pattern is bullish, showing a downward trend is about to. What is the head and shoulders pattern? It is the opposite of the head and shoulders chart pattern, which is. It often indicates a user profile. It consists of 3 tops with a higher high in the middle, called the head. The left shoulder forms at the end of a significant bullish period in the market. Head and shoulders (chart pattern) on the technical analysis chart, the head and shoulders formation occurs when a market trend is in the process of reversal either from a bullish. Gbp/usd rose amid uk gdp growth but faces resistance at 1.2573. The reaction lows of each peak can be connected to form support, or a neckline. The daily time frame wave count points to the correction not being over yet. The head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after. The pattern contains three successive peaks, with the middle peak ( head) being the highest and the two outside peaks ( shoulders) being low and roughly equal. The line connecting the 2 valleys is the neckline. The reaction lows of each peak can be connected to form support, or a neckline. Web the head & shoulders pattern is a specific. Studied mostly in technical analysis, bearish stock patterns often show a downfall or impending decline in the price of an asset, indices, or security. Wave count gives bearish scenario. Web the head and shoulders pattern is a market chart that crypto traders use to identify price reversals. It consists of 3 tops with a higher high in the middle, called. Web a head and shoulders pattern is a bearish reversal pattern, which signals that the uptrend has peaked, and the reversal has started as the series of the higher highs (the first and second peak) is broken with the third peak, which is lower than the second. The head and shoulders pattern is exactly what the term indicates. What does. Web the head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. As dramatically expressed through this pattern, it’s the peak formations that traders scrutinize for signs of upcoming trend reversals. It consists of 3 tops with a higher high in the middle, called the head. It is. Web the head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. Web the head and shoulders is a bearish candlestick pattern that occurs at the end of an uptrend and indicates a trend reversal. Web the head & shoulders pattern is a specific chart pattern informing of a bullish to a bearish trend reversal. The head and shoulders pattern is exactly what the term indicates. Head and shoulders technical analysis charting pattern. The head and shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend. Web head & shoulders are reversal patterns (like double/triple tops/bottoms and wedges) that form at the top or bottom of a trend with the bottoms being bullish and the tops being bearish. It is considered a reliable and accurate chart pattern and is often used by traders and investors to. It appears as a baseline with three consecutive peaks, where the outside two are close in height and the middle is the highest. What is the head and shoulders pattern? The head and shoulders pattern is one of the most reliable reversal patterns. Web the head and shoulders pattern is a market chart that crypto traders use to identify price reversals. The line connecting the 2. Web the head and shoulders top pattern is bearish, indicating prices could be reversed and trending down again. Web despite the bearish outlook, kevin suggested that now would be an ideal time for dogecoin to form a right shoulder for a textbook inverse head and shoulders pattern, with a price target of $0.22. As dramatically expressed through this pattern, it’s the peak formations that traders scrutinize for signs of upcoming trend reversals.

Chart Patterns The Head And Shoulders Pattern Forex Academy

A Short Explanation The Head and Shoulders chart pattern

Bearish Head & Shoulders Pattern (Daily) for FXEURUSD by Tradesy1

Bearish Chart Patterns Cheat Sheet Crypto Technical Analysis

Head and Shoulders Pattern Bearish () Small Illustration Green

What is Head and Shoulders Pattern & How to trade it Phemex Academy

Five Powerful Reversal Patterns Every Trader Must know

Bybit Learn Head and Shoulders Pattern What Is It & How to Trade

8 Powerful Bearish Chart Patterns

How to Trade the bearish Head and Shoulders Pattern in Best Forex

Web Explore Today's Signal:

After Its Apex Is Formed, The Price Of The Underlying Asset Tends To Slide Down To A Certain Extent As A Subsequent Reaction.

It Typically Forms At The End Of A Bullish Trend.

A Characteristic Pattern Takes Shape And Is Recognized As Reversal.

Related Post: