Harmonic Pattern Trading

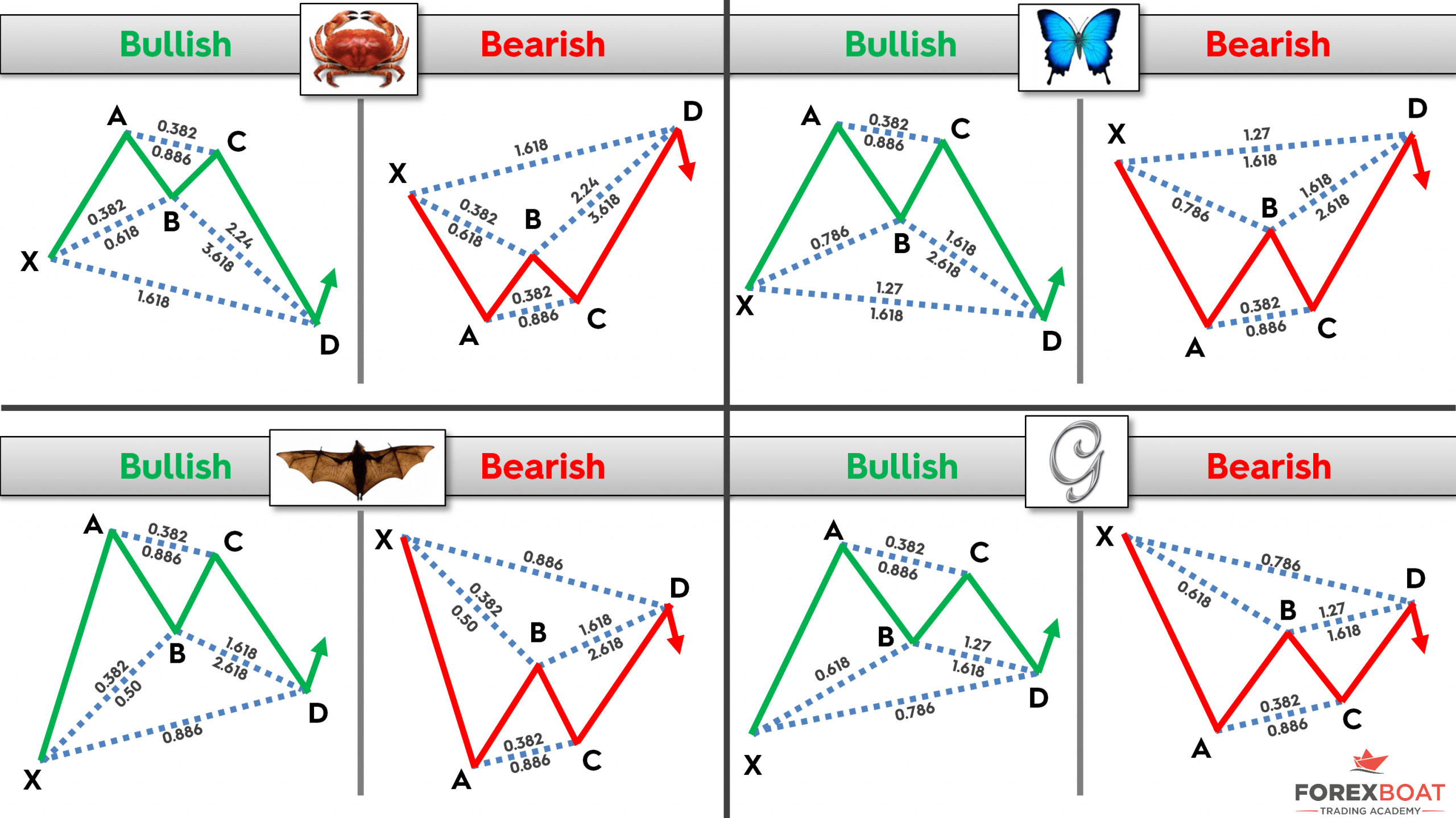

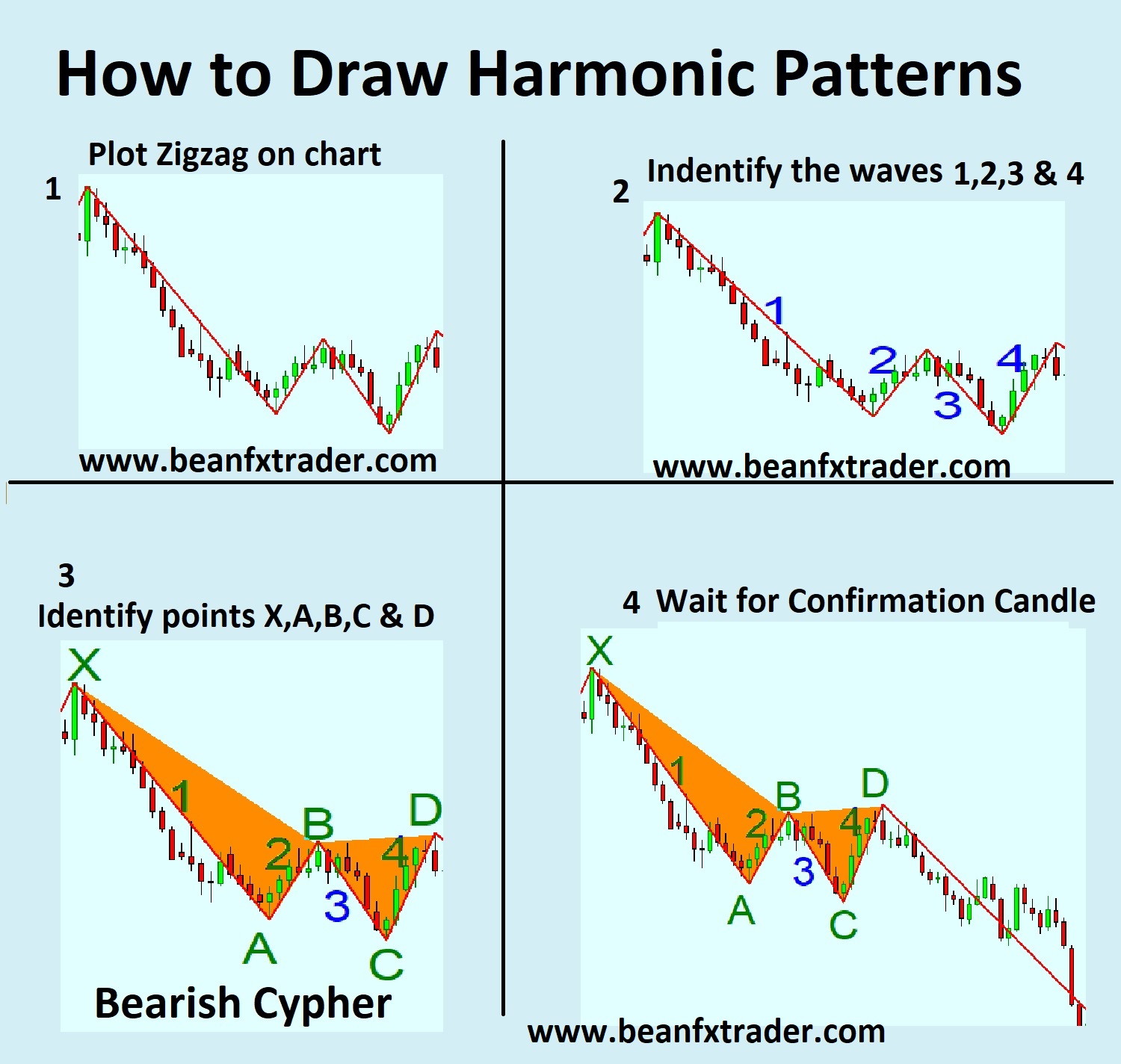

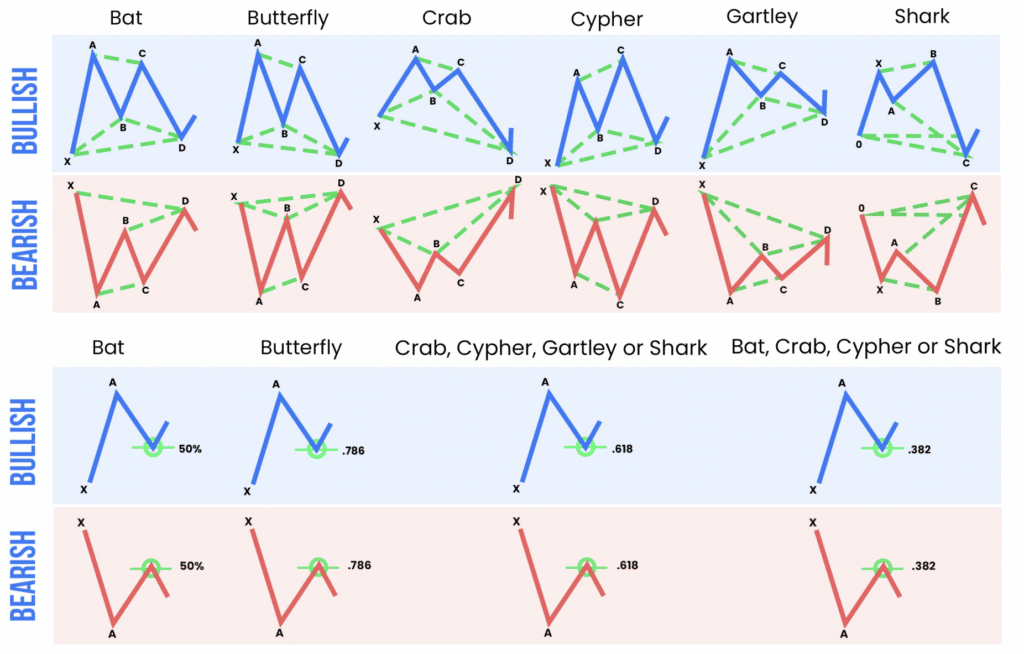

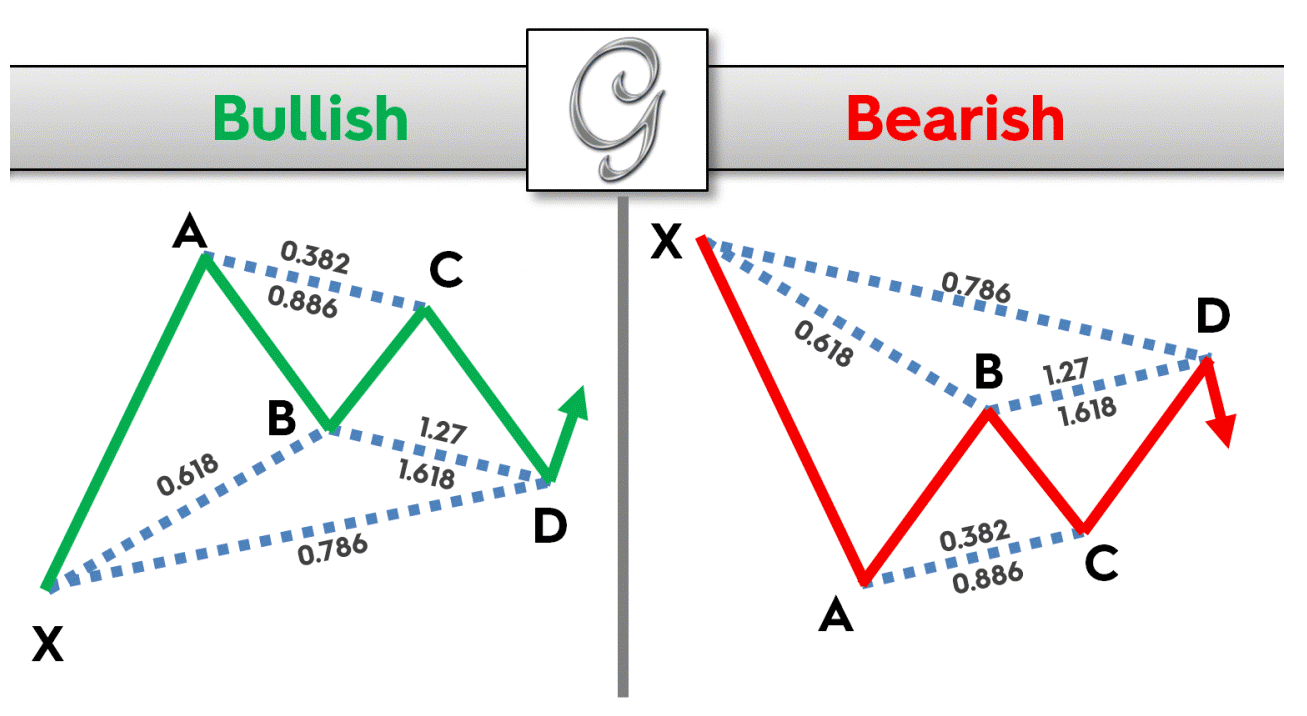

Harmonic Pattern Trading - How do harmonic patterns work? The similarity between harmonic and basic chart patterns is that, for each of them, the shape and structure are key factors to recognizing and validating a specific pattern. Scott carney, president and founder of harmonictrader.com, has delineated a system of price pattern recognition and fibonacci measurement techniques that comprises the harmonic trading approach. Each pattern has specific criteria that need to be met for it to be valid. Most likely established by h.m gartley in 1932, harmonic patterns depict potential price changes or trend reversal levels. The cypher harmonic pattern is a technical analysis indicator used by traders to identify valuable support and resistance levels based on the fibonacci sequence of numbers and detect trend. This charting style first came about in 1935 from the ‘profits in the stock market’ book authored by harold. Scott carney discovered and formalised most of the harmonic patterns of various financial markets. There are three ways for spotting a good harmonic pattern and making high probability trades: Locate a potential harmonic price pattern. They may be constructed in various ways, using technical tools such as fibonacci ratios, retracements, and extensions. From the above, it is clear that to profit from the harmonic patterns, you need to know how to correctly spot one, wait for its completion, and place a buy or sell order as indicated by the pattern. This is how harmonic trading. If you want to start with a simpler price action pattern, we recommend the head and shoulders price pattern strategy. We can distinguish six basic forex harmonic patterns: The four main harmonic patterns that can have bullish or bearish versions receive the following. There are three ways for spotting a good harmonic pattern and making high probability trades: Traders often. Web harmonic trading combines patterns and math into a trading method that is precise and based on the premise that patterns repeat themselves. Web practice this strategy. The next price movement can thus be projected with the goal of turning these patterns into profits. From the above, it is clear that to profit from the harmonic patterns, you need to. Web option swing trading is easy to learn and when done properly, has the potential to make you wealthy. They occur naturally in financial charts based on fibonacci levels and geometric price action. If you want to start with a simpler price action pattern, we recommend the head and shoulders price pattern strategy. Alexandros theophanopoulos mar 27, 2024 13 min. The next price movement can thus be projected with the goal of turning these patterns into profits. These patterns are a succession of up and down legs (price moves). Web as a trader, you can use harmonic patterns to gain insights into trades’ potential entry and exit points. From the above, it is clear that to profit from the harmonic. What are the harmonic pattern and how they are best applied. This is how harmonic trading patterns were born. Measure the potential harmonic price pattern. Web how to trade the cypher harmonic pattern. The similarity between harmonic and basic chart patterns is that, for each of them, the shape and structure are key factors to recognizing and validating a specific. They may be constructed in various ways, using technical tools such as fibonacci ratios, retracements, and extensions. Web it is considered a type of harmonic pattern and is grounded in the principles of fibonacci ratios. The cypher harmonic pattern is a technical analysis indicator used by traders to identify valuable support and resistance levels based on the fibonacci sequence of. Traders often use tools such as fibonacci retracement and extension levels to validate the pattern’s formation. It is similar to the bat pattern, except for the c point exceeding the bc leg. The similarity between harmonic and basic chart patterns is that, for each of them, the shape and structure are key factors to recognizing and validating a specific pattern.. Web harmonic patterns follow very strict requirements. These patterns are named after various animals or shapes, such as the butterfly, bat, crab, gartley, and more. In this guide, you’ll learn: What is the cypher harmonic candlestick pattern? I plotted the pattern using the exact required measurement for xb leg at 0.724 max and 0.886xd max. Harmonic patterns are a type of complex patterns that occur naturally in financial charts based on geometric price action and fibonacci levels. We can distinguish six basic forex harmonic patterns: This is how harmonic trading patterns were born. The cypher harmonic pattern is a technical analysis indicator used by traders to identify valuable support and resistance levels based on the. What is the cypher harmonic candlestick pattern? Harmonic patterns are a type of complex patterns that occur naturally in financial charts based on geometric price action and fibonacci levels. Each pattern has specific criteria that need to be met for it to be valid. Depending on the pattern, they are composed of 3 to 5 legs (created by 4 to 6 points). Locate a potential harmonic price pattern. These patterns are named after various animals or shapes, such as the butterfly, bat, crab, gartley, and more. I plotted the pattern using the exact required measurement for xb leg at 0.724 max and 0.886xd max. The similarity between harmonic and basic chart patterns is that, for each of them, the shape and structure are key factors to recognizing and validating a specific pattern. Web harmonic trading combines patterns and math into a trading method that is precise and based on the premise that patterns repeat themselves. Web option swing trading is easy to learn and when done properly, has the potential to make you wealthy. A few of the most popular are the gartley pattern, butterfly pattern, bat pattern, and crab pattern. The four main harmonic patterns that can have bullish or bearish versions receive the following. Here, in this article, we explain how the cypher harmonic pattern works, identify it, and trade it. This article will provide traders with a detailed explanation of what harmonic trading patterns are, how harmonic trading patterns are used in currency markets, as well as, exploring market harmonics, harmonic ratios, and much more! How do harmonic patterns work? Measure the potential harmonic price pattern.![Harmonic Patterns Cheat Sheet [FREE Download] HowToTrade](https://howtotrade.com/wp-content/uploads/2023/02/harmonic-patterns-cheat-sheet-768x543.png)

Harmonic Patterns Cheat Sheet [FREE Download] HowToTrade

Harmonic Patterns The Ultimate Trading Guide Pro Trading School

Harmonic Patterns ForexBoat Trading Academy

Harmonic Patterns FX & VIX Traders Blog

Harmonic patterns cheatsheet Everything you need to know

Accurately Identify Harmonic Patterns

Harmonic Patterns Explained For Beginners

The Forex Harmonic Patterns Guide ForexBoat Trading Academy

What are Harmonic Patterns Predicting Price Actions Phemex Academy

Harmonic Pattern Trading Strategy Explained With PDF Cheat Sheet

Traders Often Use Tools Such As Fibonacci Retracement And Extension Levels To Validate The Pattern’s Formation.

This Is How Harmonic Trading Patterns Were Born.

The Similarity Between Harmonic And Basic Chart Patterns Is That, For Each Of Them, The Shape And Structure Are Key Factors To Recognizing And Validating A Specific Pattern.

Web Harmonic Trading Patterns In Trading.

Related Post: