Harmonic Bat Pattern

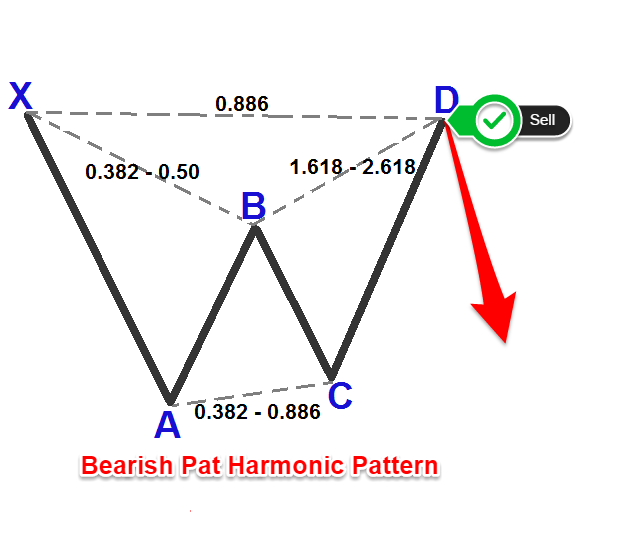

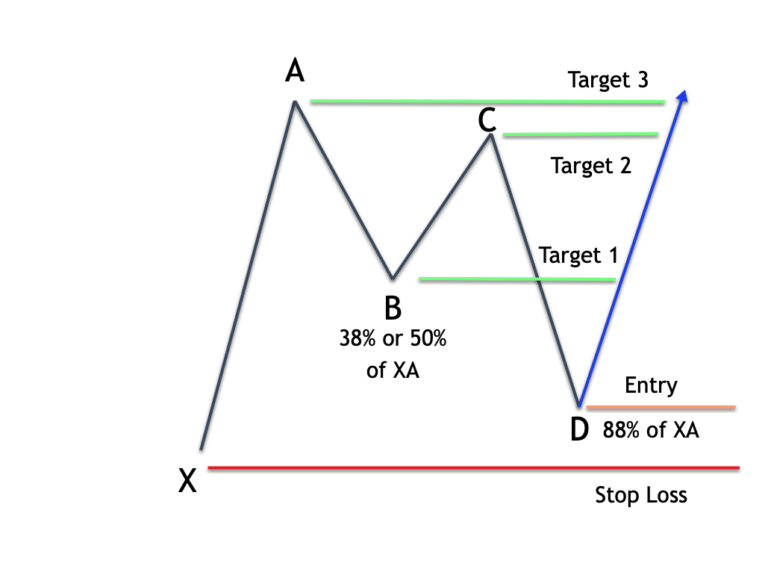

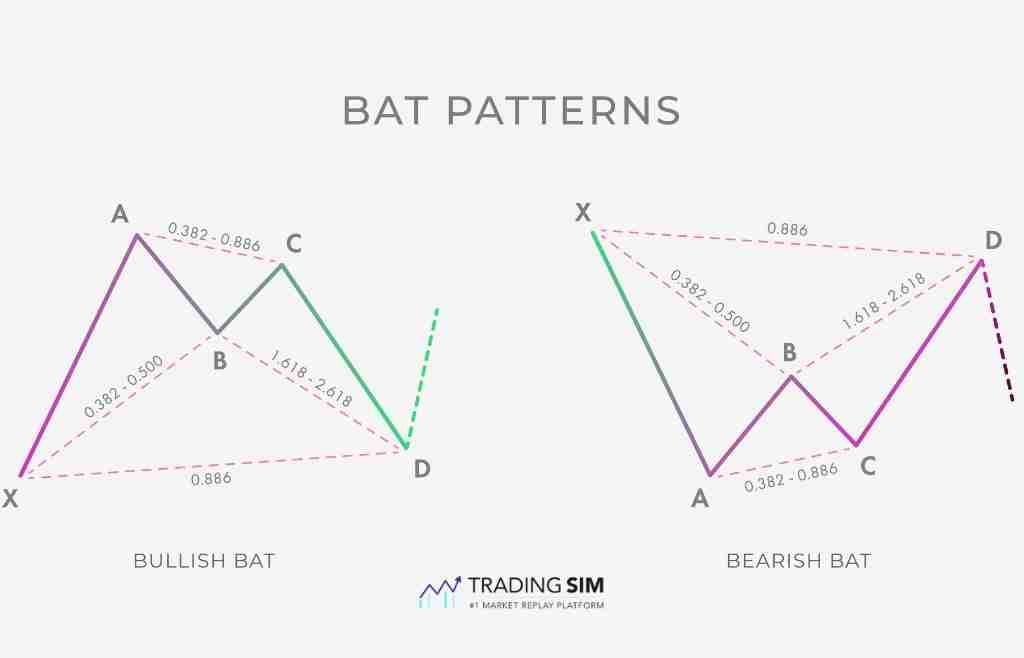

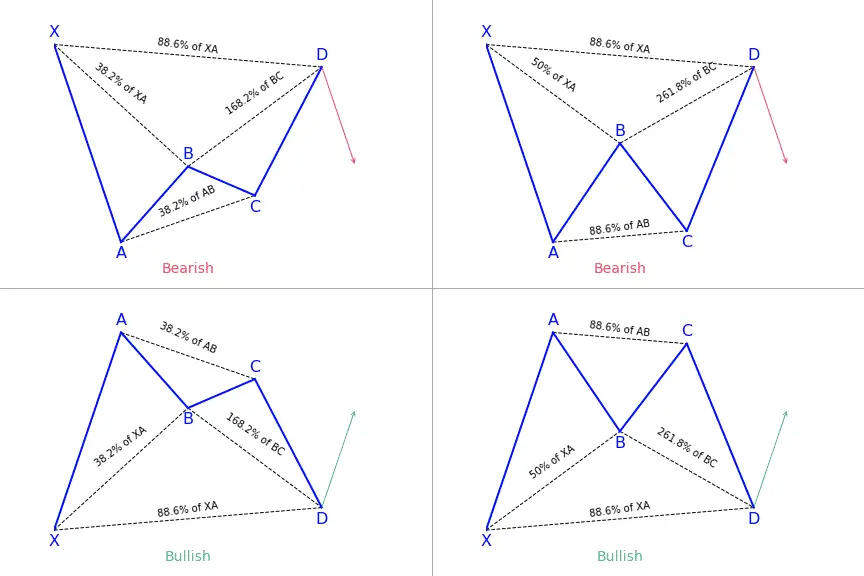

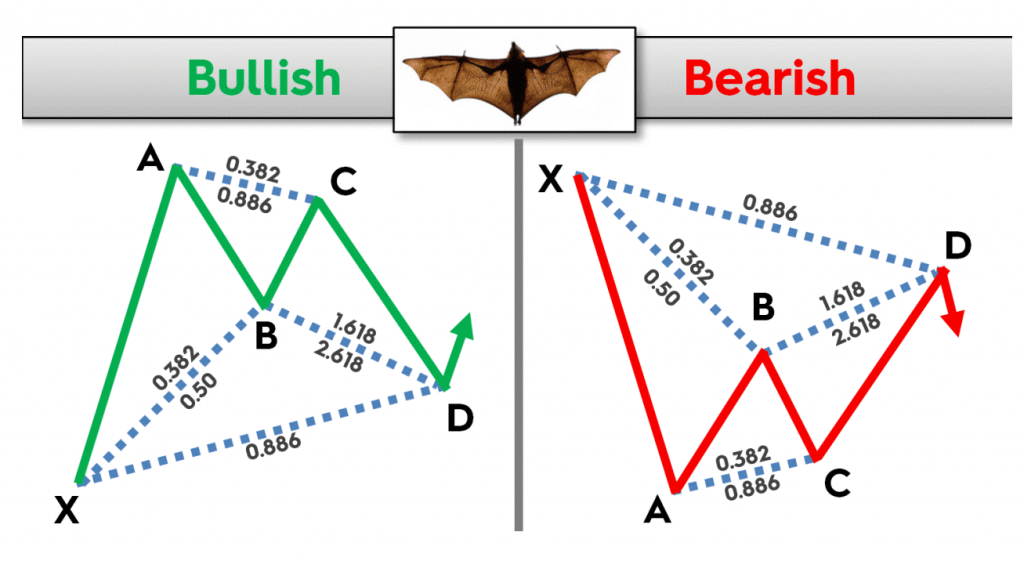

Harmonic Bat Pattern - It has a high reward/risk ratio, and scott believed that it is one of the most accurate of all the harmonic patterns. One of the key ways to differentiate a bat structure from a cypher pattern is the b point which, if it doesn’t go beyond the 50% fibonacci retracement of the xa leg then it’s a bat, otherwise it can turn into a cypher structure. In a bullish bat, c can retrace up to 88% of ab, but it shouldn’t break higher than point a. The xa wave is a normal price swing in the upward or downward direction. Identified by scott carney in 2001, the bat pattern is made up of precise elements that identify przs. One of the major ways to differentiate it from a cypher pattern is the b point which, if it doesn’t go above the 50. Web the harmonic bat pattern wasn’t introduced until much later in the early 2000s, by scott m. The crab pattern was explained by scott carney in the year 2000. Web this methodology assumes that harmonic patterns or cycles, like many patterns and cycles in life, continually repeat. Scott carney, who first recognized the bat pattern, suggests that a 50% retracement at b is the best signal. Carney in the book harmonic trading; This is the longest leg of the pattern. The b point retracement must be less than a 0.618, preferably a 0.50 or 0.382 of the xa leg. It has a high reward/risk ratio, and scott believed that it is one of the most accurate of all the harmonic patterns. It was discovered by scott. Below is a list of commonly used harmonic patterns: The b point retracement must be less than a 0.618, preferably a 0.50 or 0.382 of the xa leg. Web the harmonic bat pattern wasn’t introduced until much later in the early 2000s, by scott m. Developed by scott carney in 2001, the bat is considered one of the most accurate. The bat utilizes a minimum 1.618bc projection. At its core, this strategy involves an acute analysis of market swing points and retracements, aligning traders with the most opportune entry and exit points. For a valid bat, b should retrace between 38% and 50% of the first move from x to a. It has a high reward/risk ratio, and scott believed. In the bat pattern, as a trader, you’ll. Web harmonic patterns are used by traders to help predict future market movements. The ab leg should end between 38.2% and 50%, signaling a strong initial trend. Carney called the bat pattern “a precise harmonic pattern “ and “probably the most accurate pattern in the entire harmonic trading arsenal. Like the rest,. Bullish harmonic patterns indicate a possible upturn in the market. The xa wave is a normal price swing in the upward or downward direction. You can trade using harmonic patterns by opening a trading account with us. The b point retracement of the primary xa leg. The pattern has five pivot points (x, a, b, c, and d) and four. Carney in 2001, and according to carney, it is the most accurate of them all. The xa wave is a normal price swing in the upward or downward direction. Web the harmonic bat pattern is a type of gartley pattern that signals a potential reversal. The bat pattern is known as the most accurate of all harmonic chart patterns; Carney. Web harmonic patterns are used by traders to help predict future market movements. Web the bullish bat pattern is similar to the cypher harmonic pattern but it follows different fibonacci ratios. The criteria for identifying the bat pattern are as follows: It has a high reward/risk ratio, and scott believed that it is one of the most accurate of all. You can trade using harmonic patterns by opening a trading account with us. Carney called the bat pattern “a precise harmonic pattern “ and “probably the most accurate pattern in the entire harmonic trading arsenal. In the bat pattern, as a trader, you’ll. Web harmonic bat pattern trading rules. In its bullish version, the first leg appears when the price. The criteria for identifying the bat pattern are as follows: The crab pattern was explained by scott carney in the year 2000. In this case, the formation of a bat pattern on gold suggests a possible reversal to the downside. Web this methodology assumes that harmonic patterns or cycles, like many patterns and cycles in life, continually repeat. Carney in. One of the major ways to differentiate it from a cypher pattern is the b point which, if it doesn’t go above the 50. The bat pattern is a harmonic pattern that often indicates a potential reversal in the market. Below is a list of commonly used harmonic patterns: As mentioned earlier, the bat harmonic pattern looks very similar to. The bat utilizes a minimum 1.618bc projection. The xa wave is a normal price swing in the upward or downward direction. The bat pattern is a harmonic pattern that often indicates a potential reversal in the market. Scott carney, who first recognized the bat pattern, suggests that a 50% retracement at b is the best signal. It was first discovered by scott m. At the root of the methodology is the primary ratio, or. In the bat pattern, as a trader, you’ll. The bat harmonic pattern follows different fibonacci ratios. This is the longest leg of the pattern. Developed by scott carney in 2001, the bat is considered one of the most accurate harmonic patterns by some traders. It is the “distinct elements” of the trading pattern. One of the key ways to differentiate a bat structure from a cypher pattern is the b point which, if it doesn’t go beyond the 50% fibonacci retracement of the xa leg then it’s a bat, otherwise it can turn into a cypher structure. The bc wave can be either a 38.2% or 88.6% retracement of the ab wave. Web the harmonic bat pattern is a type of gartley pattern that signals a potential reversal. One of the major ways to differentiate it from a cypher pattern is the b point which, if it doesn’t go above the 50. Web the bat pattern™, is a precise harmonic pattern™ discovered by scott carney in 2001.

How to Trad The Harmonic Bat Pattern Forex Chart Strategy Forex Pops

Tips For Trading The Harmonic Bat Pattern Forex Training Group

Bat Pattern Bat Harmonic Pattern Trading Strategy Bat Harmonic

Harmonic Patterns in Stock Trading for Beginners TradingSim

Different Types of Harmonic Patterns Advanced Forex Strategies

Tips For Trading The Harmonic Bat Pattern Forex Training Group

Harmonic Bat Pattern Harmonic Bat Pattern Rules Harmonic Pattern

How to Trade the Bat Harmonic Pattern (Trading Strategy)

Bat Harmonic Pattern How to trade it? PatternsWizard

The Forex Harmonic Patterns Guide ForexBoat Trading Academy

Web This Methodology Assumes That Harmonic Patterns Or Cycles, Like Many Patterns And Cycles In Life, Continually Repeat.

At Its Core, This Strategy Involves An Acute Analysis Of Market Swing Points And Retracements, Aligning Traders With The Most Opportune Entry And Exit Points.

The B Point Retracement Of The Primary Xa Leg.

The Pattern Has Five Pivot Points (X, A, B, C, And D) And Four Swings:

Related Post: