Hard Inquiry Removal Letter Template

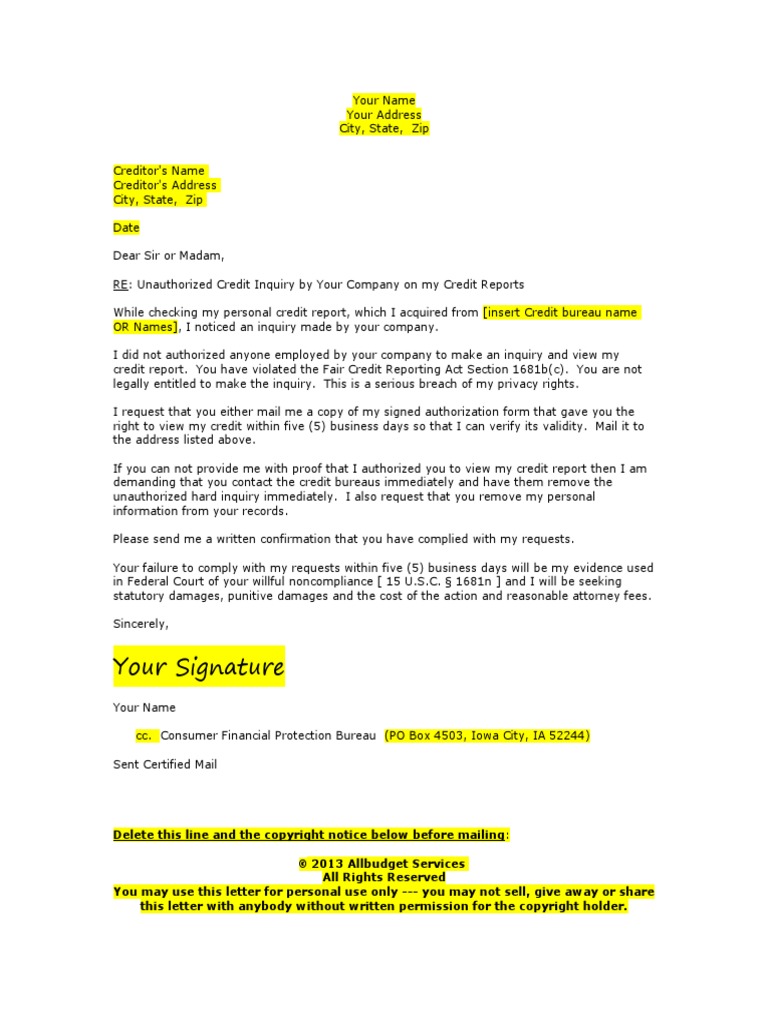

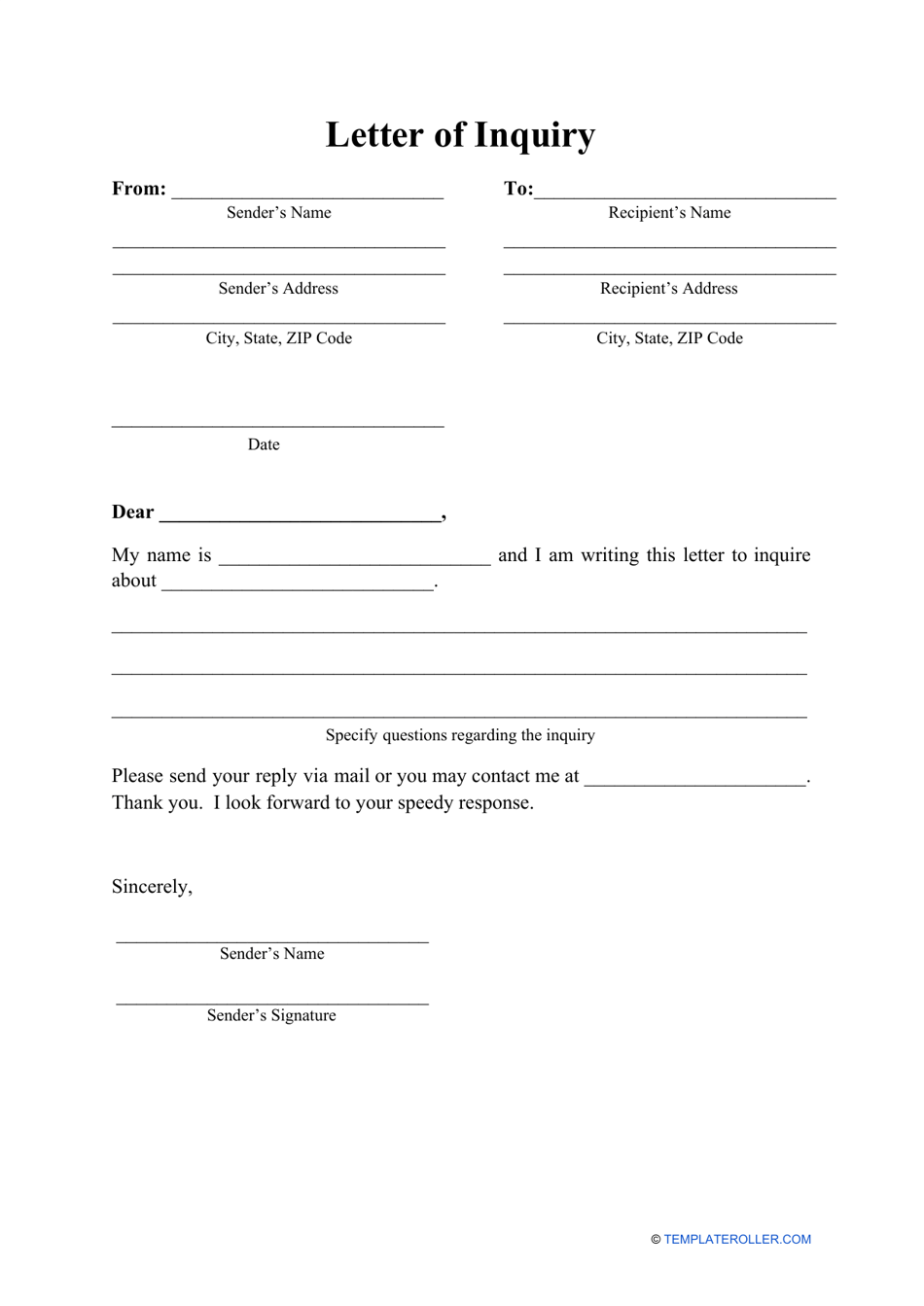

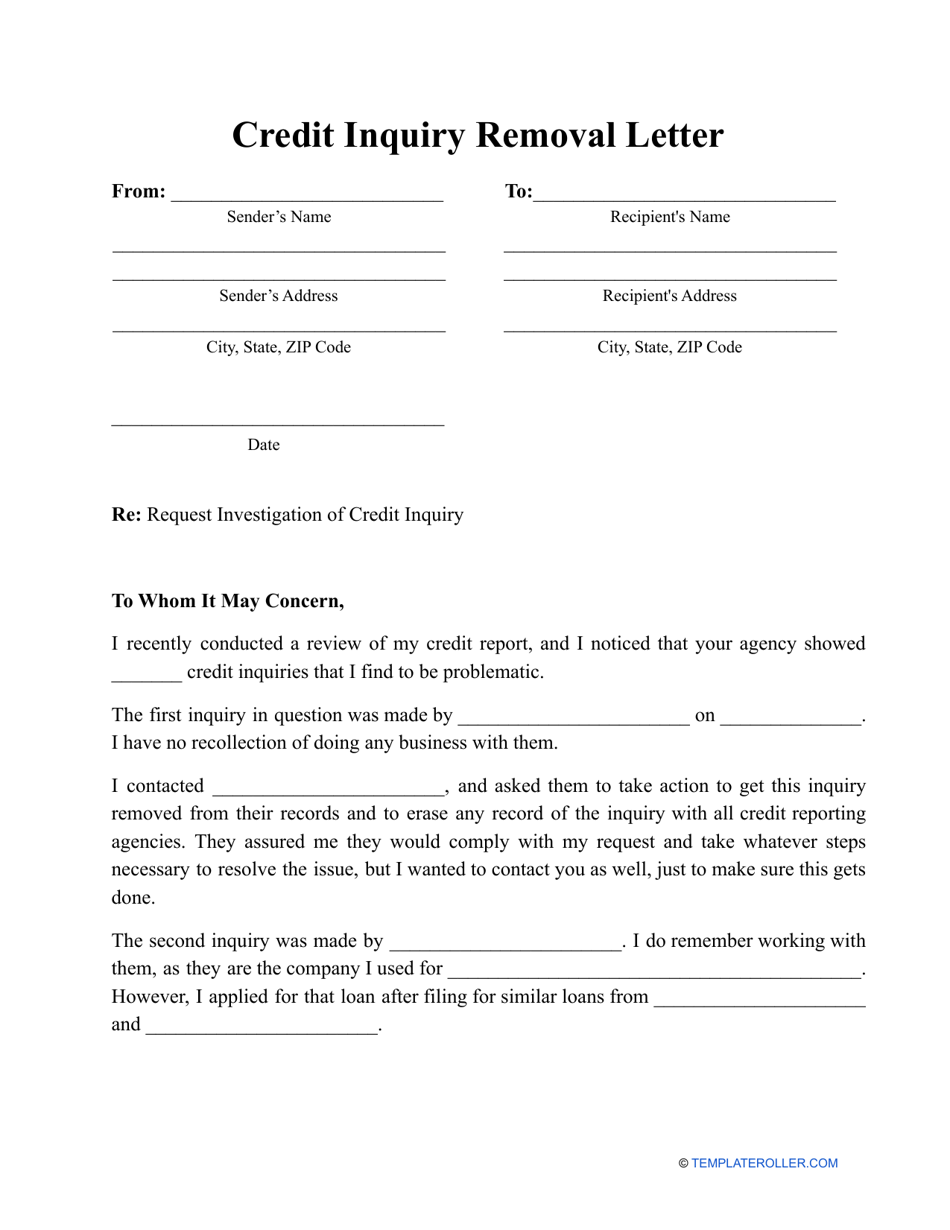

Hard Inquiry Removal Letter Template - All inquiries that you have authorized will remain on the record and unauthorized or false inquiries can be wiped off. I noticed the unauthorized inquiries listed below after receiving a copy of my credit report from your bureau on [insert date]. Web in a nutshell. You may consider “return receipt requested,” for proof that the credit reporting company received it. I had to use one when i noticed some inquiries on my report that i didn’t recognize. Credit inquiry removal letter template. In order to remove hard inquiries from your credit report, you will have to write a dispute letter to all three major credit bureaus. For disputing other issues on. From my experience, an inquiry removal letter is a formal request sent to credit bureaus to remove unauthorized or incorrect hard inquiries from your credit report. The removal letter follows a specific format and should be typed, not handwritten. This letter typically includes your personal. A credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid, falsely listed, or if the debt is more than seven years old. It’s called a “credit inquiry removal letter” or a “credit inquiry dispute letter.”. I request that these inquiries be investigated and. Web in those cases, there is a way to remove the hard inquiry and improve your credit scores as a result. Web once you submit the request, you can track your progress through the dispute center. Credit inquiry removal letter template. Web i have highlighted these inquiries below and attached any relevant documentation to support my claim. Be sure to. From my experience, an inquiry removal letter is a formal request sent to credit bureaus to remove unauthorized or incorrect hard inquiries from your credit report. Web look for sample credit dispute letters online, like the one available from the federal trade commission, to help you draft your dispute letter. If you send any information with the letter, send copies. Web follow cole on twitter: It’s named after section 609 of the fair credit reporting act (fcra), a federal law that protects consumers from unfair credit and collection practices. Web when you write a credit inquiry removal letter, there is some key information that you’ll need to include. A credit inquiry removal letter is a document that individuals can use. You may dispute information on your credit report by submitting a dispute form, or write your own letter that details your issues. Download our sample letter and instructions to submit a dispute. You can only submit a removal letter for false or unauthorized inquiries—any inquiry you did authorize will stay on your record. If you send any information with the. Web once you submit the request, you can track your progress through the dispute center. Web experian provides an easy process for filing a dispute by mail. If the credit bureau in question investigates and finds that the inquiry wasn’t authorized, it should remove the inquiry from your corresponding credit report. I request that these inquiries be investigated and removed. You can file a dispute with a credit bureau or a furnisher. Below is a sample credit inquiry removal letter to help you get. From my experience, an inquiry removal letter is a formal request sent to credit bureaus to remove unauthorized or incorrect hard inquiries from your credit report. What exactly is an inquiry removal letter? If the credit. The removal letter follows a specific format and should be typed, not handwritten. Include a copy of your credit report. What exactly is an inquiry removal letter? You may consider “return receipt requested,” for proof that the credit reporting company received it. Web a removal letter is a formal request to the credit bureaus to have an inquiry wiped from. Web experian provides an easy process for filing a dispute by mail. If this explicit consent was not given, the inquiry is unauthorized and can be removed by mailing a filled out copy of the above template to. Web follow cole on twitter: Web once you submit the request, you can track your progress through the dispute center. You may. Web section 604 refers to the fair credit reporting act which says a hard inquiry can only be performed with a permissible purpose. Web follow cole on twitter: You can only submit a removal letter for false or unauthorized inquiries—any inquiry you did authorize will stay on your record. Make sure to send the credit inquiry removal letter via certified. Web updated september 22, 2023. Web when you write a credit inquiry removal letter, there is some key information that you’ll need to include. The first step is to get your credit reports from each of the three credit. A 609 letter (also called a credit dispute letter) is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. In order to remove hard inquiries from your credit report, you will have to write a dispute letter to all three major credit bureaus. What exactly is an inquiry removal letter? You can only submit a removal letter for false or unauthorized inquiries—any inquiry you did authorize will stay on your record. The removal letter follows a specific format and should be typed, not handwritten. Web when submitting a dispute for an inquiry on your credit report, you’ll need to include some specific information. A credit report dispute letter is used to remove an invalid collection from a person’s credit history that was either paid, falsely listed, or if the debt is more than seven years old. Include a copy of your credit report. Web all hard inquiries should disappear from your credit report after two years. A credit inquiry removal letter is a document that individuals can use when they would like to remove a credit inquiry from their credit report. Web mail the dispute form with your letter to: There is a certain format you need to follow in the letter and it needs to be typed and not handwritten. Make sure to send the credit inquiry removal letter via certified mail.

Free Hard Inquiry Dispute Letter Template Resume Example Gallery

Fillable Online Hard Inquiry Removal Letter PDF Form Fill Out and

Hard Inquiry Removal Letter Template

Letter of Inquiry Template Download Printable PDF Templateroller

Hard Inquiry Removal Dispute Letter Template Inquiries Etsy

Credit Inquiry Removal Letter Template Download Printable PDF

Experian Inquiry Removal Letter Business

Hard Credit Inquiry Removal Letter Draft Destiny

Hard Inquiry Removal Letter Printable

Hard Inquiry Removal Letter Printable

Web Here’s How You Can Dispute Inaccurate Inquiries And Iron Out Your Credit.

Send Your Dispute Letter Via Certified Mail, Return Receipt Requested, So That You Have Document That The Inquirers Received Your Correspondence.

However, If The Investigation Shows The Inquiry Was A Result Of Identity Theft, It Will Be Removed From Your.

This Form Of Mail Will Give You Proof That The Credit Issuer Or Lender Received The Appropriate First Notification To Remove The Hard Inquiry.

Related Post: