Harami Candlestick Pattern

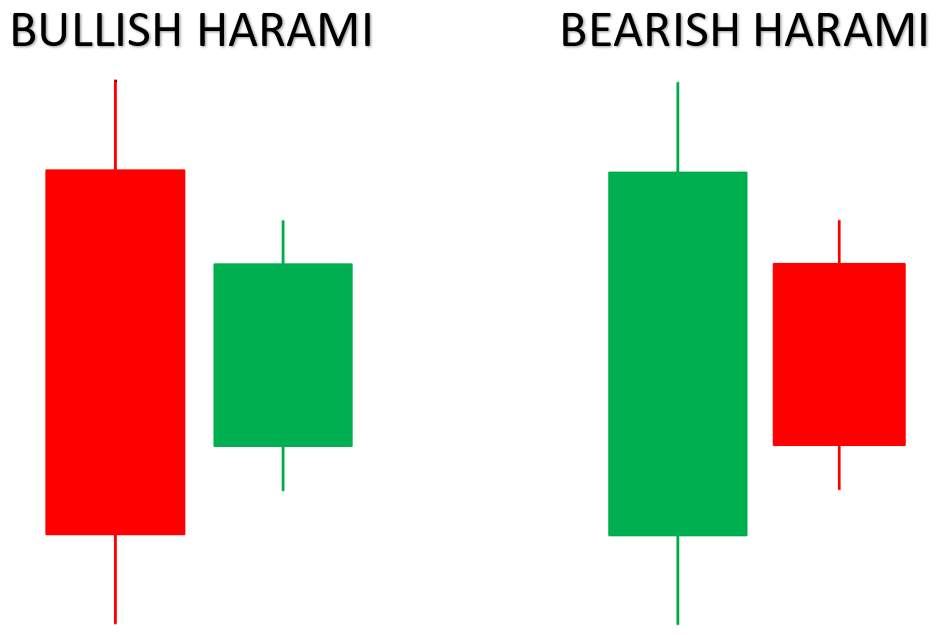

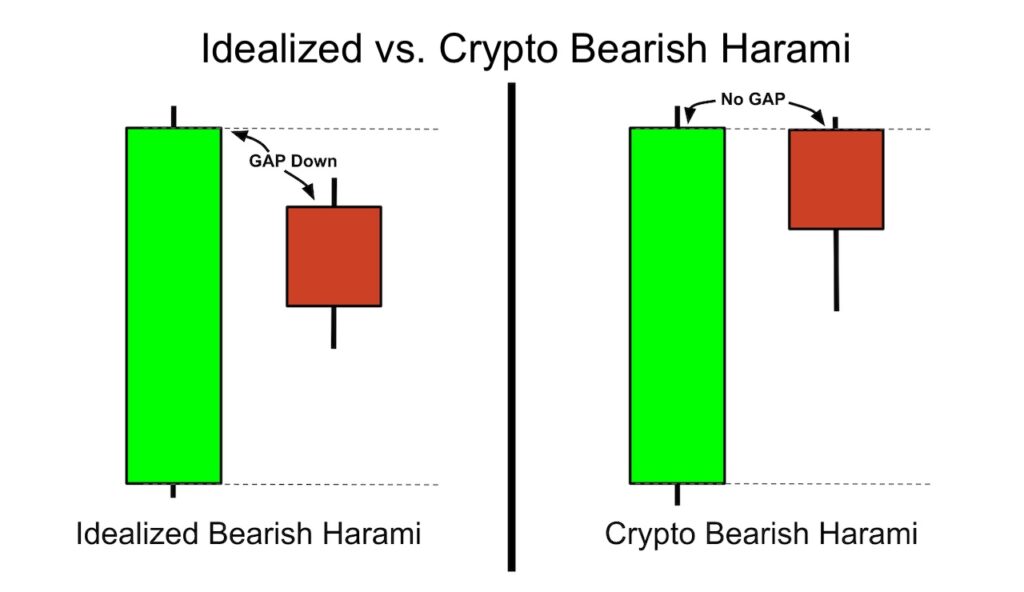

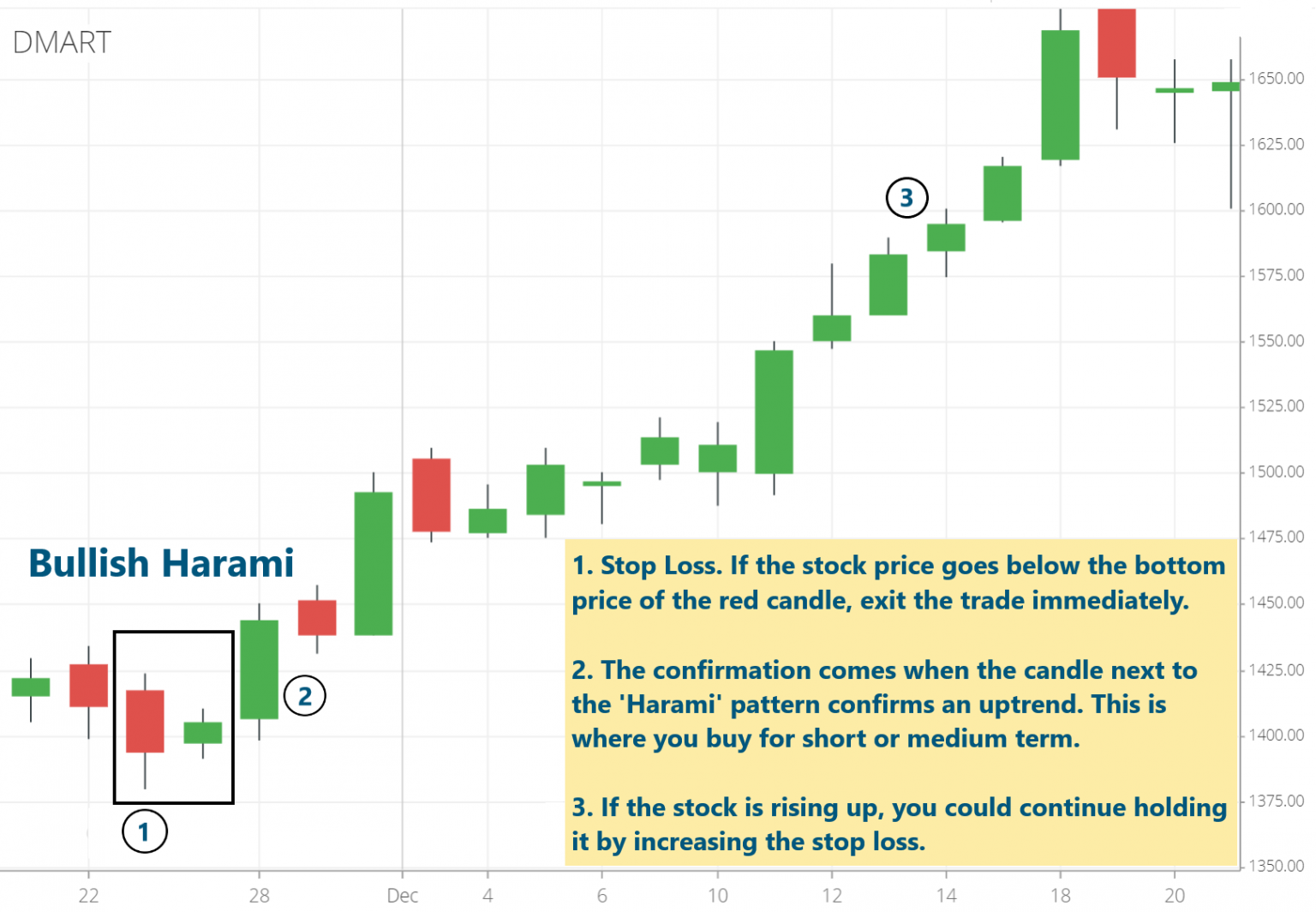

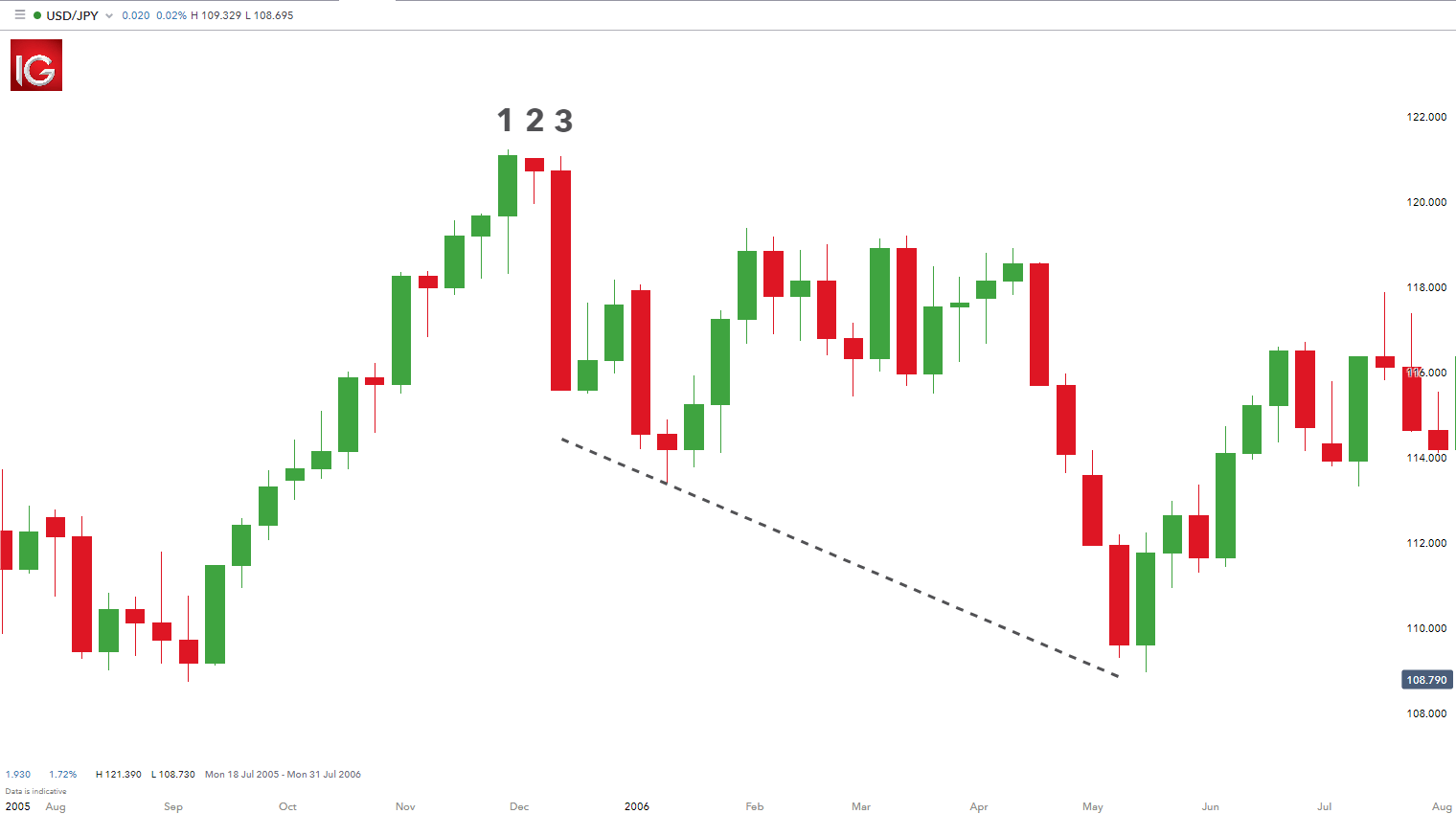

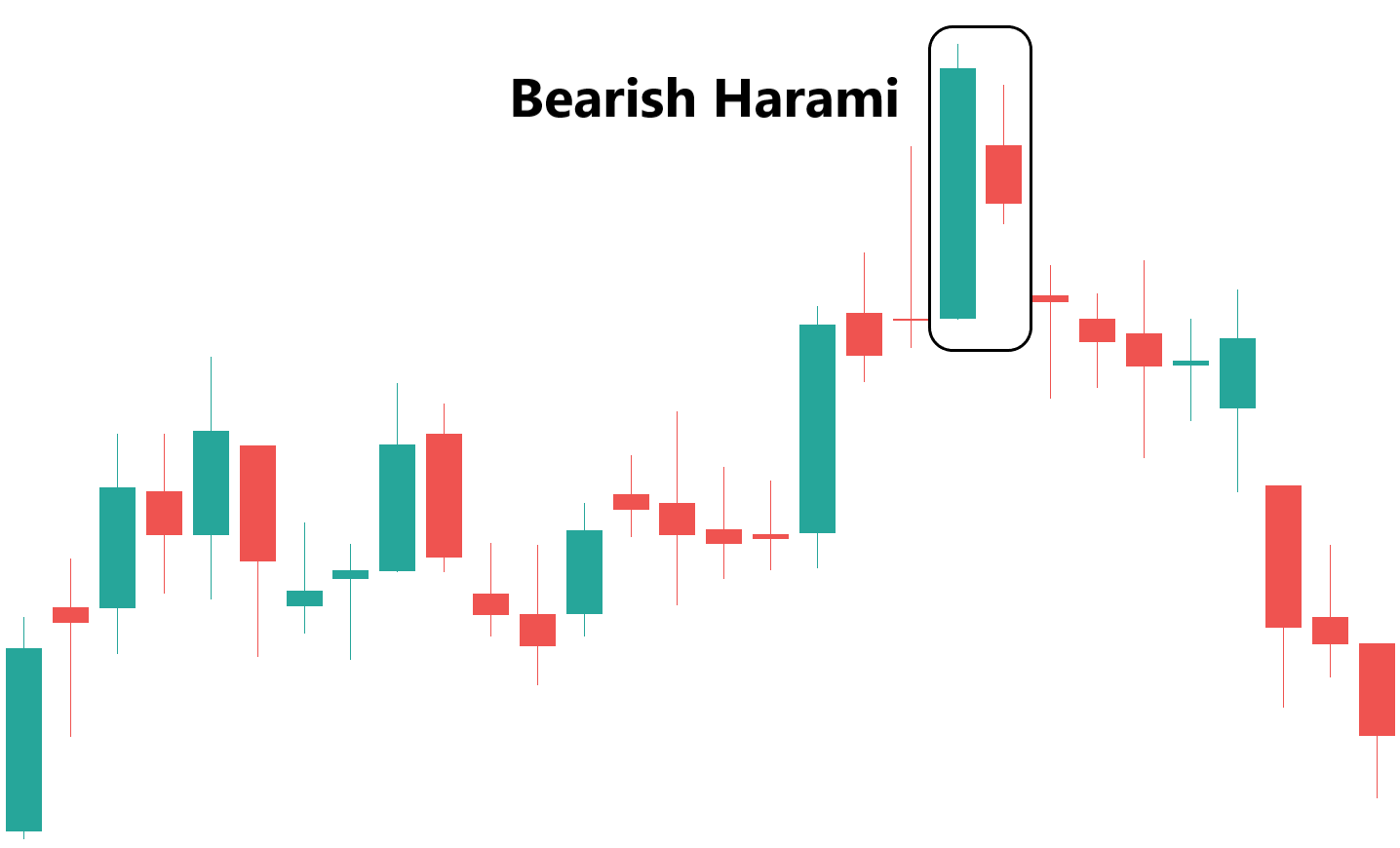

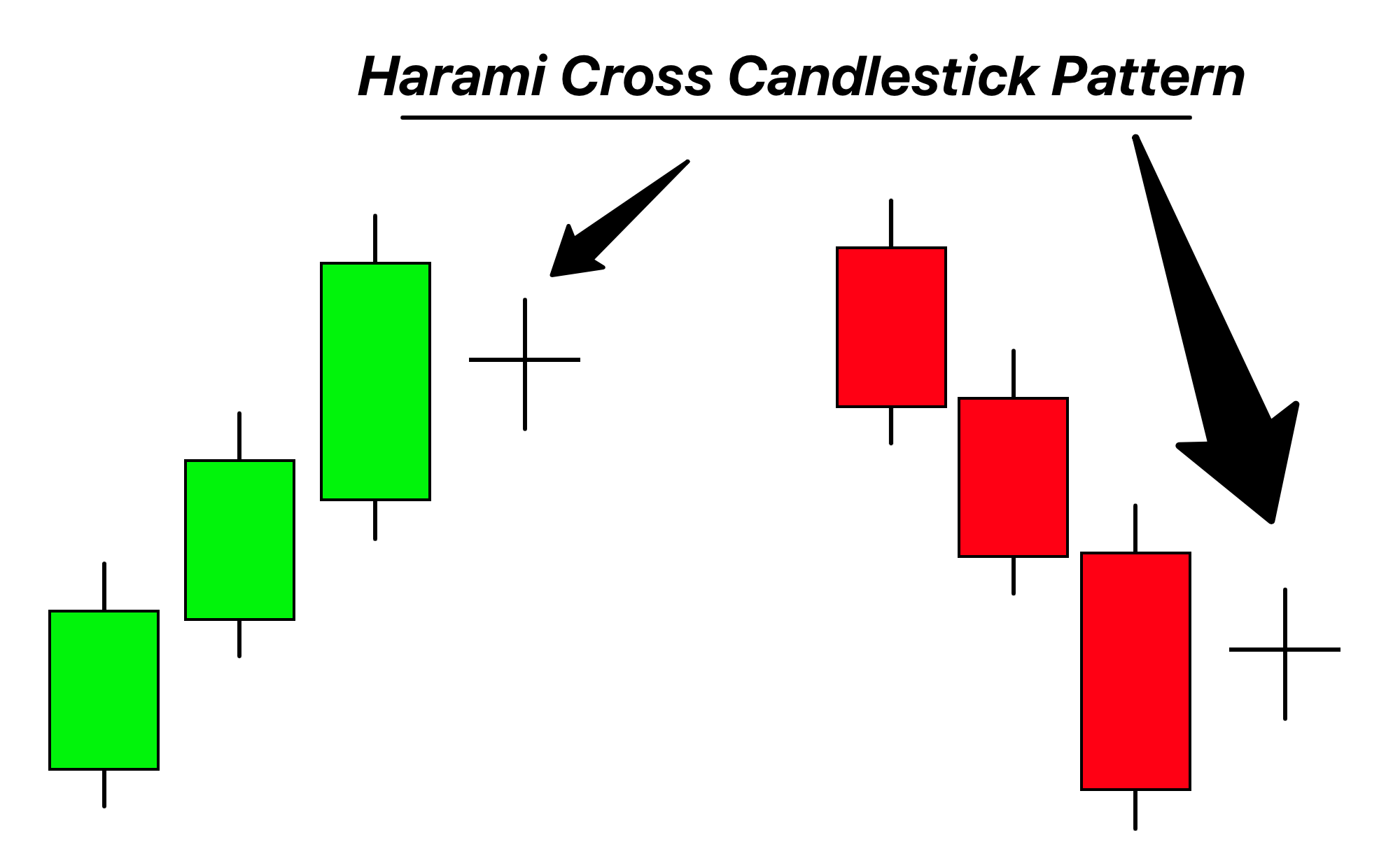

Harami Candlestick Pattern - Among them, the harami candlestick is a relatively popular pattern that. Web a harami cross is a japanese candlestick pattern that consists of a large candlestick that moves in the direction of the trend, followed by a small doji candlestick. Its name derives from the japanese word that means “pregnant” because the graphic that shows resembles a pregnant woman. Web the harami candlestick pattern like the inverted hammer candlestick pattern is a visual pattern that can be easily spotted by the traders and analyzed. It comes in two different varieties: Web the aspects of a candlestick pattern. This article will focus on the other six patterns. Web harami is a trend reversal candlestick pattern consisting of two candles. Candlesticks are graphical representations of price movements for a given period of time. Stay updated with the latest trends and insights in the finance world. As the name suggests, the bullish harami is a bullish pattern appearing at the bottom end of the chart. Learn to identify over 50 candlestick chart patterns. In either case, you might need to learn about the harami candlestick pattern. The bearish reversal pattern (which occurs after an uptrend) and the bullish reversal pattern (which occurs after a downtrend). Web. Trading up blog > harami candlestick pattern: Web a harami cross is a japanese candlestick pattern that consists of a large candlestick that moves in the direction of the trend, followed by a small doji candlestick. Web what is a bullish harami pattern in candlestick analysis? Web the aspects of a candlestick pattern. Candlesticks are by far the most used. However, traders wait for the confirmation of the. Web what is a bullish harami pattern in candlestick analysis? Web in this guide to understanding the harami candlestick pattern, we’ll show you what this chart looks like, explain its components and teach you how to interpret it with an example. Web harami is a type of japanese candlestick pattern represented by. The second harami pattern candlestick directly following it opens at (or higher than) the red candle’s closing price, but by the time this candle closes, it has a small body that is contained within the body of the first. The bearish reversal pattern (which occurs after an uptrend) and the bullish reversal pattern (which occurs after a downtrend). Web a. Derived from a japanese word meaning ‘pregnant’, it symbolizes the potential birth of a new trend. Web inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. Candlestick patterns deserve to be studied thoroughly and even though a strategy relying solely on them will be unstable and. However, traders wait for the confirmation of the. Web inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. Web this pattern is also known as a bullish harami pattern, which is also considered as a bullish reversal pattern. The first candle is bearish, followed by a. The bearish reversal pattern (which occurs after an uptrend) and the bullish reversal pattern (which occurs after a downtrend). Web the bullish harami candle pattern is a reversal pattern appearing at the bottom of a downtrend. Web harami candlestick patterns can provide crucial insights into the future direction of a trend. Candlesticks are graphical representations of price movements for a. In either case, you might need to learn about the harami candlestick pattern. Web looking for a bull? They are commonly formed by the opening, high,. Candlesticks are graphical representations of price movements for a given period of time. Web harami is a type of japanese candlestick pattern represented by two bodies, the first of them, larger, with black or. Web the bullish harami candle pattern is a reversal pattern appearing at the bottom of a downtrend. The pattern consists of a long white candle followed by a small black. Web a bullish harami pattern starts with a red candlestick that forms after a price decline, and has a relatively large red body. The first candle is bearish, followed by. Candlestick patterns deserve to be studied thoroughly and even though a strategy relying solely on them will be unstable and unprofitable, they can be a valuable addition into a. Learn how to quickly spot the bearish harami on chart and how to trade it. Web harami is a type of japanese candlestick pattern represented by two bodies, the first of. Candlesticks are by far the most used chart type in the trading world. Among them, the harami candlestick is a relatively popular pattern that. Web harami candlestick patterns can provide crucial insights into the future direction of a trend. Understand the significance of each pattern in market analysis. Web the harami, which means “pregnant” in japanese, is a multiple candlestick pattern that is considered a reversal pattern. The first candle is bearish, followed by a small bullish candle that’s contained within the real body of the previous bearish candle. The bullish harami pattern evolves over a two day period, similar to the engulfing pattern. Web harami is a type of japanese candlestick pattern represented by two bodies, the first of them, larger, with black or red body and the second one, white or green. Web harami candlestick patterns are a type of reversal pattern, where there are bullish and bearish equivalents. Web the bullish harami candle pattern is a reversal pattern appearing at the bottom of a downtrend. Web the harami candlestick is a japanese candlestick pattern that comprises of two candles which indicates a potential reversal or continuation in the market. However, traders wait for the confirmation of the. The bearish harami reversal is recognized if: Candlestick patterns deserve to be studied thoroughly and even though a strategy relying solely on them will be unstable and unprofitable, they can be a valuable addition into a. The pattern consists of a long white candle followed by a small black. Web the aspects of a candlestick pattern.

What Is A Bullish Harami Candlestick Pattern? Meaning And How To Trade

HARAMI CANDLESTICK PATTERN PERFECT WAY TO USE CANDLESTICK PATTERN

Understanding The Bullish Harami Candlestick Pattern InvestoPower

Harami Candlestick Patterns A Trader’s Guide

How to Use Bullish and Bearish Harami Candles to Find Trend Reversals

Bullish Harami Candle Stick Pattern

Harami Candlestick Patterns A Trader’s Guide Currency Trader

What Is A Bullish Harami Candlestick Pattern? Meaning And How To Trade

Bearish Harami Candle Stick Pattern

Harami Cross Candlestick PDF Guide Trading PDF

Web A Harami Cross Is A Japanese Candlestick Pattern That Consists Of A Large Candlestick That Moves In The Direction Of The Trend, Followed By A Small Doji Candlestick.

Candlesticks Are Graphical Representations Of Price Movements For A Given Period Of Time.

Trading Up Blog > Harami Candlestick Pattern:

In Either Case, You Might Need To Learn About The Harami Candlestick Pattern.

Related Post: