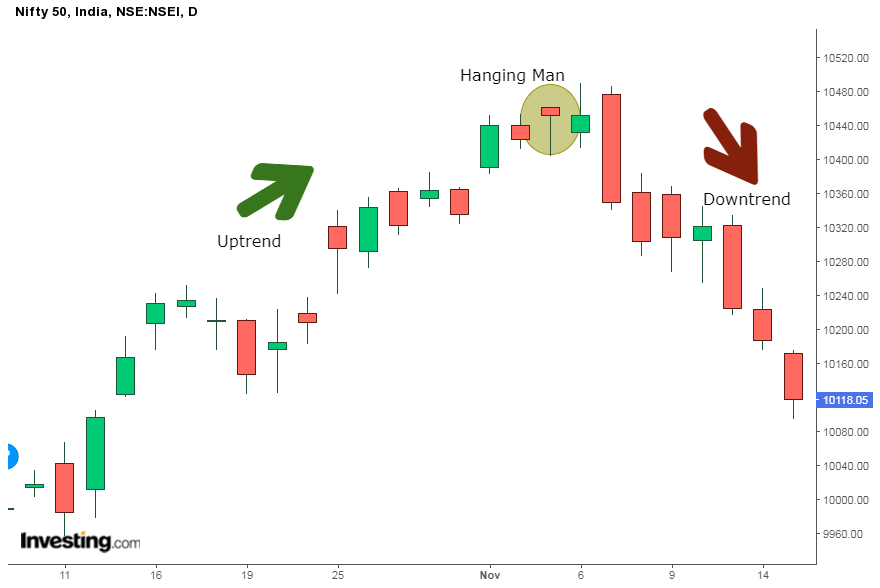

Hangman Candlestick Pattern

Hangman Candlestick Pattern - It is a bearish reversal pattern that signals that the uptrend is going to end. In theory, it is supposed to be a bearish reversal but it actually is a bullish continuation pattern 59% of the time. Web the hanging man pattern is a type of candlestick pattern that typically signals a potential reversal in an uptrend. A long lower shadow or ‘wick’, at least two or three times the length of the real body. Each individual candlestick is constructed from four data points. Hanging man candlestick pattern is a single candlestick pattern that if formed at an end of an uptrend. Traders utilize this pattern in the trend direction of pattern changes. Web the hanging man is a type of candlestick pattern. Web what is the hanging man candlestick pattern. Web you do not want to place a trade in the opposite direction of the long term trend. This pattern occurs mainly at the top of uptrends and can act as a warning of a potential reversal downward. As a bearish reversal pattern, the hanging man pattern forms during an upward price trend. Web the bottom line. Candlesticks displays the high, low, opening and closing prices for a security for a specific time frame. It’s a reversal pattern,. Web the bottom line. A candlestick is a type of price chart used to display information about a security’s price movement. Traders utilize this pattern in the trend direction of pattern changes. The open, close, high, and low are them. A small real body (the difference between the open and close prices) at the upper end of the. It’s a reversal pattern, which means that it’s believed to precede a market downturn. For instance, if followed by a gap down and a bearish candle, it forms part of an evening star pattern, a powerful bearish reversal signal. Web the hanging man candlestick pattern shows that the selling interest is starting to increase. It shows that the sellers are. A candlestick is a type of price chart used to display information about a security’s price movement. The hanging man candlestick is a popular one, but one that shows lousy performance. This pattern occurs mainly at the top of uptrends and can act as a warning of a potential reversal downward. Traders utilize this pattern in the trend direction of. A small real body (the difference between the open and close prices) at the upper end of the. Specifically, the hanging man candle has: It also signals the trend reversal of the market as soon as the bull appears to lose its momentum. This pattern, often seen at the peak of an upward trend in the market, is a single. As a bearish reversal pattern, the hanging man pattern forms during an upward price trend. A small real body (the difference between the open and close prices) at the upper end of the. In technical analysis, the hanging man patterns are a single candlestick patterns that forms primarily at the top of an uptrend. All one needs to do is. Its formation and subsequent market reactions are key to understanding this pattern. Web hanging man candlestick: Web the “hanging man” is a candlestick pattern that represents a potential reversal in an uptrend. In theory, it is supposed to be a bearish reversal but it actually is a bullish continuation pattern 59% of the time. In this comprehensive guide, we will. Statistical validity of hanging man as a trend reversal indicator Hanging man candlestick pattern is a single candlestick pattern that if formed at an end of an uptrend. A long lower shadow or ‘wick’, at least two or three times the length of the real body. Web the hanging man candlestick pattern is a bearish reversal that forms in an. Web what is the hanging man candlestick pattern. Typically emerging at the peak of an uptrend, the hanging man’s small body and long lower shadow narrate a compelling. It shows that the sellers are gaining momentum against the buyers and might. The hanging man candlestick is a popular one, but one that shows lousy performance. Its formation and subsequent market. A hanging man is considered a bearish candlestick pattern that issues a warning that the market may reverse soon as the bulls appear to be. It aims to indicate a potential bearish. Typically emerging at the peak of an uptrend, the hanging man’s small body and long lower shadow narrate a compelling. It shows that the sellers are gaining momentum. Web one such candlestick pattern is called “hanging man”, and that’s the topic for this article. Web trading the hanging man candlestick pattern is easy once a bullish trend is identified and a hanging man candle formation appears. Web the hanging man candlestick pattern is a bearish reversal that forms in an upward price swing. Web the hanging man candlestick pattern shows that the selling interest is starting to increase. It is characterized by a long lower shadow and a small real body at the top of the candlestick. Hanging man candlestick pattern is a single candlestick pattern that if formed at an end of an uptrend. Spotting your ideal entry point. In theory, it is supposed to be a bearish reversal but it actually is a bullish continuation pattern 59% of the time. Web the hanging man candlestick pattern is a fascinating concept in the world of financial trading. Web the hangman pattern is a single candlestick pattern that typically appears at the top of an uptrend. The hanging man candlestick pattern only occurs if it includes a small real body, long lower shadow, and the asset’s been in an uptrend. Traders utilize this pattern in the trend direction of pattern changes. Web the hanging man candlestick pattern, as one could predict from the name, is viewed as a bearish reversal pattern. This pattern, often seen at the peak of an upward trend in the market, is a single candlestick pattern that suggests a potential reversal in the price direction. Candlesticks displays the high, low, opening and closing prices for a security for a specific time frame. The hanging man is one of the best crypto and forex candlestick patterns.

How to Trade the Hanging Man Candlestick ForexBoat Trading Academy

What Is Hanging Man Candlestick Pattern With Examples ELM

Hanging Man Candle Pattern

How to Identify Perfect Hanging Man Hanging Man Candlestick Pattern

Hanging Man Candlestick Pattern Trading Strategy

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

:max_bytes(150000):strip_icc()/UnderstandingtheHangingManCandlestickPattern1-bcd8e15ed4d2423993f321ee99ec0152.png)

Hanging Man' Candlestick Pattern Explained

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

![Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube](https://i.ytimg.com/vi/IgS8pO3g71U/maxresdefault.jpg)

Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube

Each Individual Candlestick Is Constructed From Four Data Points.

Web The Hanging Man Is A Type Of Candlestick Pattern.

For Instance, If Followed By A Gap Down And A Bearish Candle, It Forms Part Of An Evening Star Pattern, A Powerful Bearish Reversal Signal.

Candlesticks Display A Security's High, Low.

Related Post: