Hangman Candle Pattern

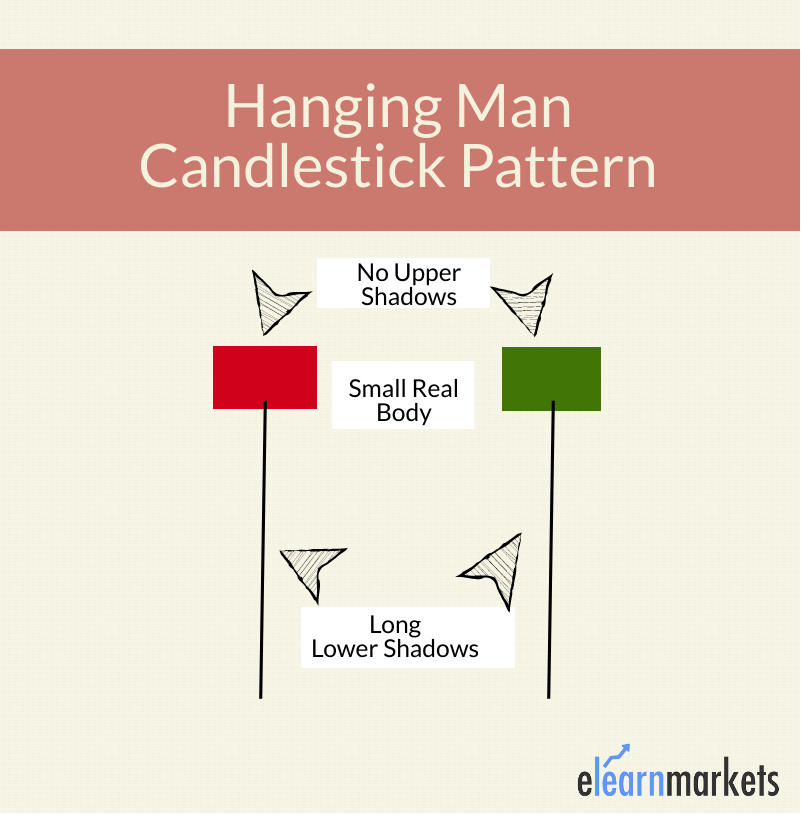

Hangman Candle Pattern - It indicates buyers may be losing control and sellers are starting to enter the market. Web for example, the hanging man candle pattern is a trading signal market participants use to predict upcoming bearish reversals. It’s a bearish reversal pattern. What is the hanging man candlestick? The hanging man is one of the best crypto and forex candlestick patterns. Hanging man candlestick pattern is a single candlestick pattern that if formed at an end of an uptrend. Web a hanging man is a bearish reversal candlestick pattern that occurs after a price advance. This guide will explain what the hanging man candle is, what it looks like, and how to benefit from them. This also indicates that the bulls have lost their strength in moving the prices up, and bears are back in the market. Little to no upper shadow or wick. Web the hanging man candlestick pattern is a bearish reversal candlestick pattern that converts an uptrend to a do.more. Web the hanging man pattern is a single candle formation that is easily recognizable by its distinctive shape. The hanging man is a single candlestick pattern that appears after an uptrend. It also signals the trend reversal of the market as. The following features characterize it: Here is an image showing a hanging man with a red body, and another with a green body. What is the hanging man? Here are the key characteristics of the hanging man pattern: What is the hanging man candlestick? Web the hanging man pattern is a single candle formation that is easily recognizable by its distinctive shape. Web the hanging man is a notable candlestick pattern in trading, signaling a possible shift from bullish to bearish market trends. This pattern is popular amongst traders as it is considered a reliable tool for predicting changes in the trend direction. The. Hanging man candlestick pattern is a single candlestick pattern that if formed at an end of an uptrend. Perhaps this is a consequence of the impressive name referring to the shape of the candle resembling a hanged man. What is the hanging man? The following features characterize it: Web what is the hanging man candlestick pattern? What is the hanging man? What is the hanging man candle? It indicates buyers may be losing control and sellers are starting to enter the market. The hanging man is a single candlestick pattern that appears after an uptrend. Web the hanging man candlestick pattern is a bearish reversal candlestick pattern that converts an uptrend to a do.more. A hanging man candle (aptly named) is a candlestick formation that reveals a sharp increase in. The following features characterize it: Web a long lower shadow or wick a small real body at the top of the candlestick range. Web the hanging man is a japanese candlestick pattern. Web the hanging man pattern is a single candle formation that is. Web hanging man is a pattern that is very popular among analysts similarly as the opposite hammer pattern. The hanging man pattern is a type of candlestick pattern that typically signals a potential reversal in an uptrend. The color of the main body of a hanging man candle can be red or green. Web the bottom line. Web what is. Web the hanging man is a japanese candlestick pattern that signals the reversal of an uptrend. The following features characterize it: This pattern occurs mainly at the top of uptrends and can act as a warning of a potential reversal downward. It has a long lower shadow and a small body at the top. The hanging man pattern is a. If the candlestick is green or. The hanging man is a single candlestick pattern that appears after an uptrend. It’s recognized for indicating a potential reversal in a bullish market, suggesting that the ongoing uptrend might be weakening. In the past few weeks, we have looked at several candlestick patterns like the hammer and the morning star. Trading up blog. In the past few weeks, we have looked at several candlestick patterns like the hammer and the morning star. What is the hanging man candle? Web hanging man is a single bearish reversal candlestick pattern. Here are the key characteristics of the hanging man pattern: The pattern is formed when the market opens near its high but then sells off. The advance can be small or large, but should be composed of at least a few price bars moving. The following features characterize it: This article will cover identifying, interpreting, and trading the hanging man. How to identify and use the hanging man candlestick? In the past few weeks, we have looked at several candlestick patterns like the hammer and the morning star. It forms at the top of an uptrend and has a small real body, a long lower shadow, and little to no upper shadow. Candlestick patterns are essential in determining the direction of a financial asset. The hanging man pattern is a type of candlestick pattern that typically signals a potential reversal in an uptrend. What is the hanging man candle? This also indicates that the bulls have lost their strength in moving the prices up, and bears are back in the market. Web for example, the hanging man candle pattern is a trading signal market participants use to predict upcoming bearish reversals. The hanging man is a single candlestick pattern that appears after an uptrend. Web the hanging man is a notable candlestick pattern in trading, signaling a possible shift from bullish to bearish market trends. Web the hanging man is a bearish candlestick pattern that typically occurs at the end of an uptrend. Web a hanging man candlestick is a technical analysis bearish reversal pattern that indicates a potential trend reversal from an uptrend to a downtrend. Web what is a hanging man candlestick pattern?

Hammer Inverted Hammer Hanging Man Candlestick Chart Patterns My XXX

Hanging Man Candlestick Pattern Trading Strategy

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

:max_bytes(150000):strip_icc()/UnderstandingtheHangingManCandlestickPattern1-bcd8e15ed4d2423993f321ee99ec0152.png)

Understanding the 'Hanging Man' Candlestick Pattern

Hanging man candlestick chart pattern. Trading signal Japanese

What Is Hanging Man Candlestick Pattern With Examples ELM

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal

![Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube](https://i.ytimg.com/vi/IgS8pO3g71U/maxresdefault.jpg)

Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube

It Also Signals The Trend Reversal Of The Market As Soon As The Bull Appears To Lose Its Momentum.

Perhaps This Is A Consequence Of The Impressive Name Referring To The Shape Of The Candle Resembling A Hanged Man.

Traders Utilize This Pattern In The Trend Direction Of Pattern Changes.

Trading Up Blog > How To Spot & Trade With The Hanging Man Candlestick Pattern.

Related Post: